North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors

Description

Key Concepts & Definitions

Warranty Deed: A legal document used to transfer ownership of real property that guarantees the grantor owns the property free from any claims.

Life Estate: A type of estate in real estate that grants an individual (the life tenant) the right to occupy or benefit from a property for their lifetime. Upon their death, the property passes to the remainderman designated in the deed.

Remainderman: The person who receives ownership of the property after the death of the life tenant.

Probate: A legal process where a deceased person's will is validated, and their property is distributed according to the will or state law.

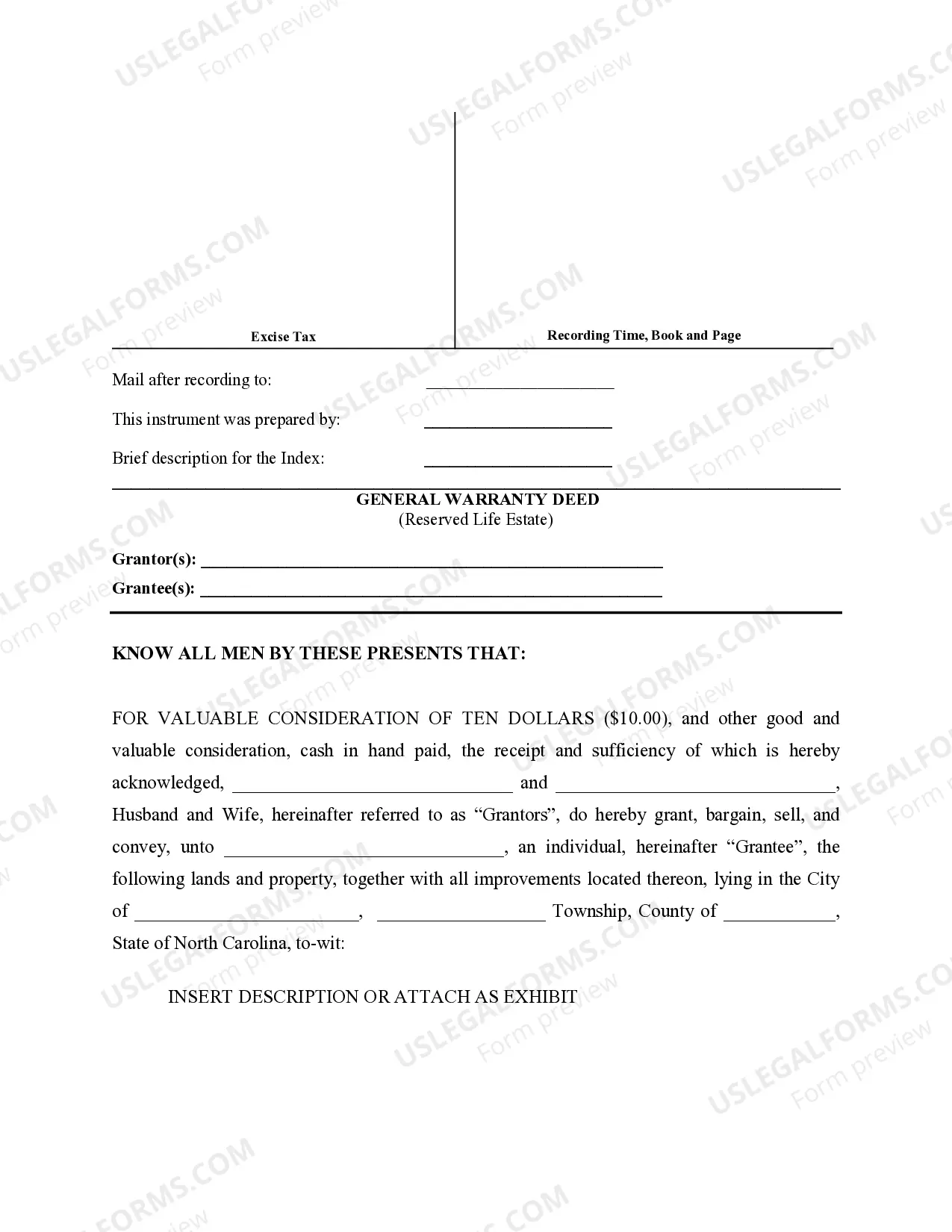

Step-by-Step Guide to Creating a Warranty Deed to Child Reserving a Life Estate

- Consult with an Estate Planning Attorney: To ensure compliance with local laws and correct wording.

- Identify the Property: Clearly describe the real estate being transferred.

- Determine the Parties: Identify the grantor, life tenant, and remainderman in the deed.

- Draft the Deed: Include necessary legal terms and conditions stipulating the life estate and remainderman rights.

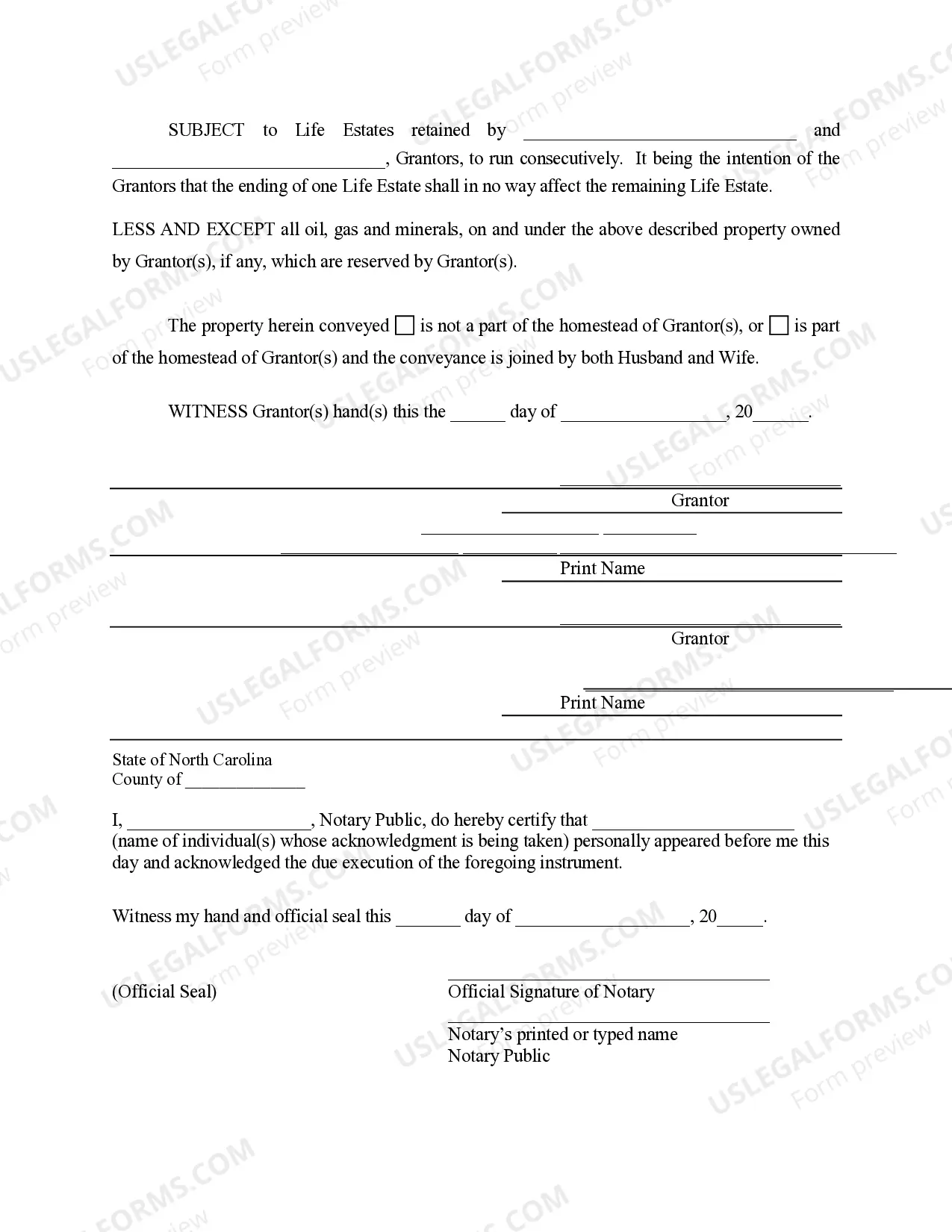

- Sign and Notarize the Deed: The grantor should sign the deed in front of a notary to validate it.

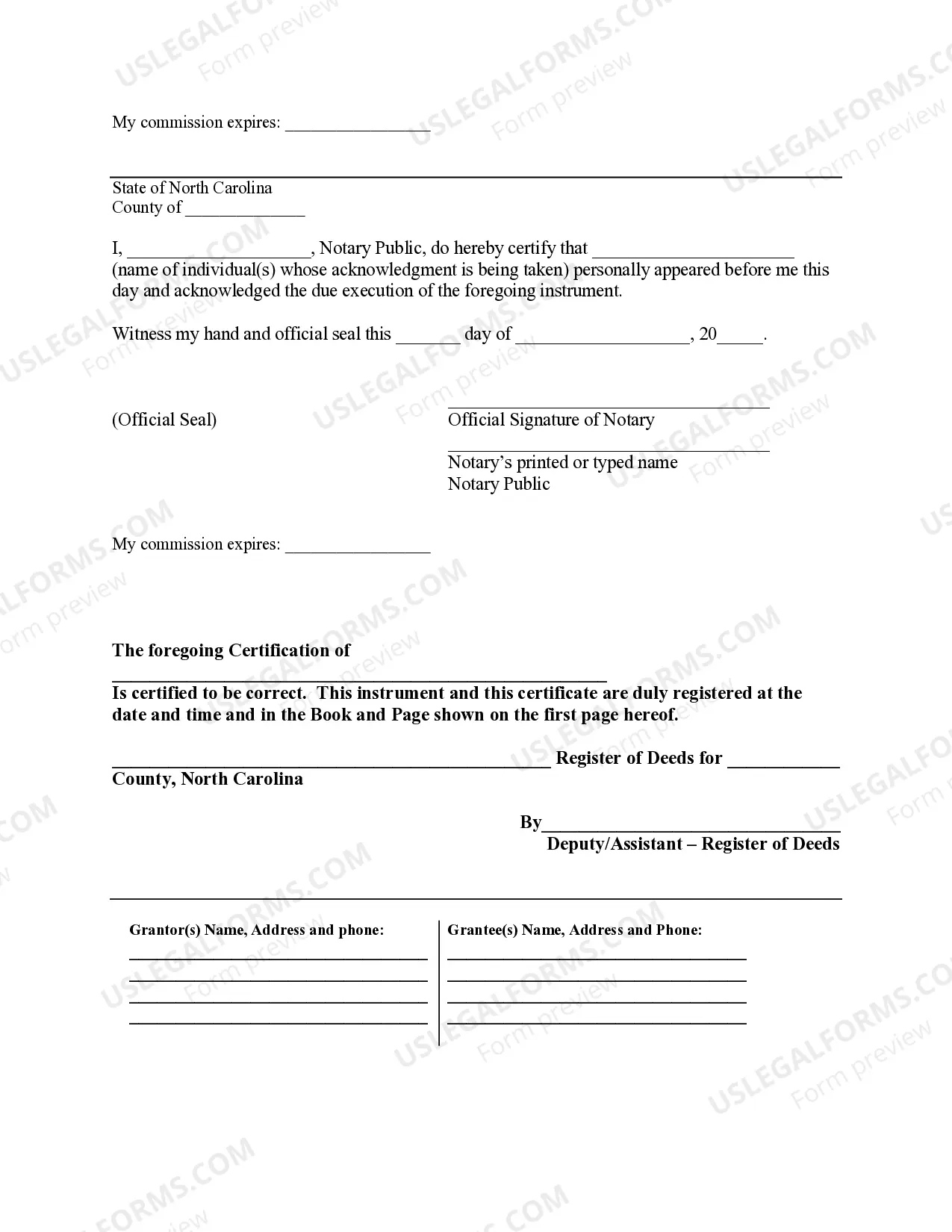

- Record the Deed: File the deed at the local county recorders office to make it legally binding and enforceable.

Risk Analysis

Transferring property using a warranty deed to child reserving a life estate can lead to several risks including

- Potential disagreements or misunderstandings between the life tenant and remainderman regarding property rights.

- Financial implications regarding maintenance, taxes, and insurance which the life tenant is typically responsible for.

- Legal challenges if the deed is not properly executed or recorded, leading to probate issues.

How to fill out North Carolina Warranty Deed To Child Reserving A Life Estate In The Parents - Husband And Wife Grantors?

Avoid pricey lawyers and find the North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors you want at a reasonable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax forms. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to obtain and fill out every single form.

US Legal Forms subscribers just must log in and download the particular form they need to their My Forms tab. Those, who have not got a subscription yet must follow the guidelines listed below:

- Make sure the North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors is eligible for use in your state.

- If available, look through the description and use the Preview option prior to downloading the sample.

- If you are sure the template fits your needs, click Buy Now.

- If the template is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, it is possible to complete the North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors manually or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A life estate is a form of joint ownership that gives a person (the life tenant) ownership rights in property during their lifetime. But when the life tenant dies, the remainder interest in the property goes to the beneficiary, also known as the remainderman.

A life estate is the interest in property that is measured by the life of a person. It can be granted to someone for his or her lifetime or for the lifetime of another. The life estate interest gives the holder the right to all the benefits of the property during the lifetime for which it is granted.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A lifetime estate on a deed is a type of property ownership. It gives an individual the right to occupy and use a property during that individual's lifetime.After the death of the occupant, the life estate terminates and transfers to another person, known as the remainderman.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A life estate, when used to gift property, splits ownership between the giver and receiver. Many parents set up a life estate to reduce their assets in order to qualify for Medicaid. Even though the parent still retains some interest in the property, Medicaid does not count it as an asset.