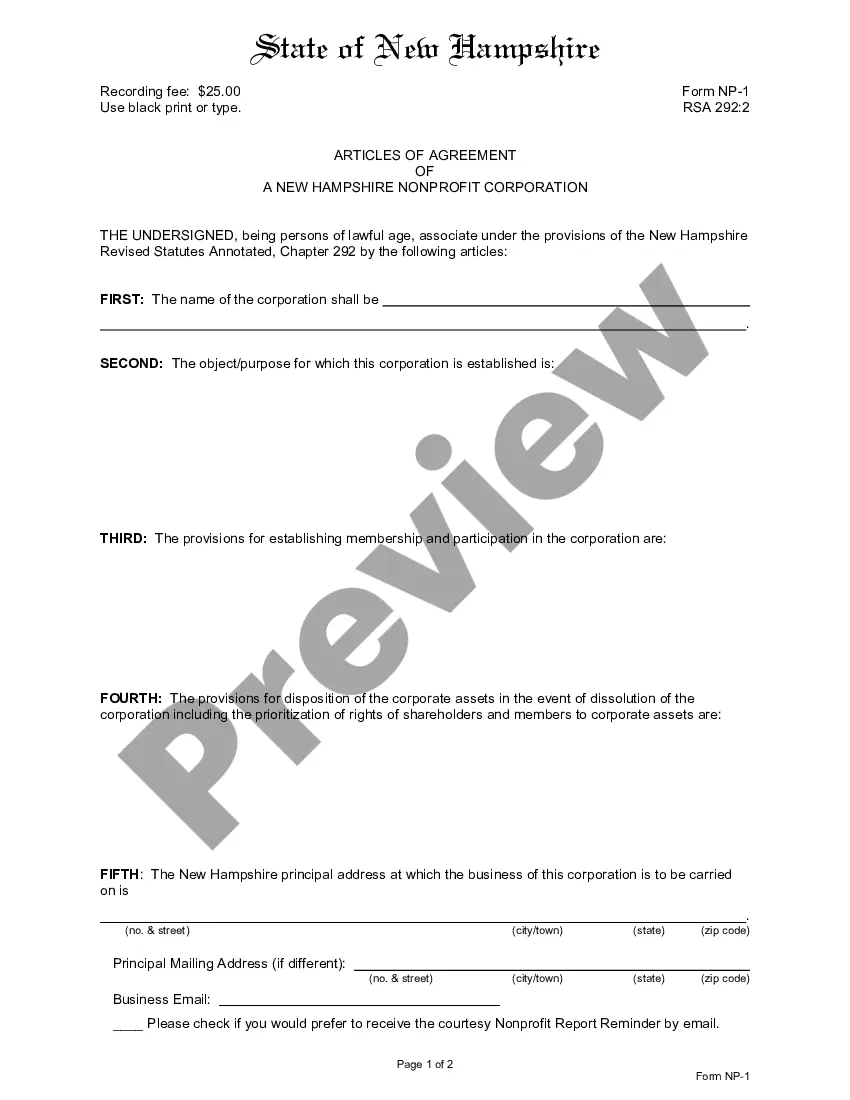

New Hampshire Articles of Agreement for Domestic Nonprofit Corporation

Description

How to fill out New Hampshire Articles Of Agreement For Domestic Nonprofit Corporation?

Avoid pricey attorneys and find the New Hampshire Articles of Agreement for Domestic Nonprofit Corporation you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to search for and obtain legal and tax documents. Go through their descriptions and preview them before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and complete each form.

US Legal Forms customers simply have to log in and get the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the guidelines listed below:

- Ensure the New Hampshire Articles of Agreement for Domestic Nonprofit Corporation is eligible for use in your state.

- If available, look through the description and use the Preview option prior to downloading the templates.

- If you’re sure the document fits your needs, click Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you are able to complete the New Hampshire Articles of Agreement for Domestic Nonprofit Corporation manually or with the help of an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

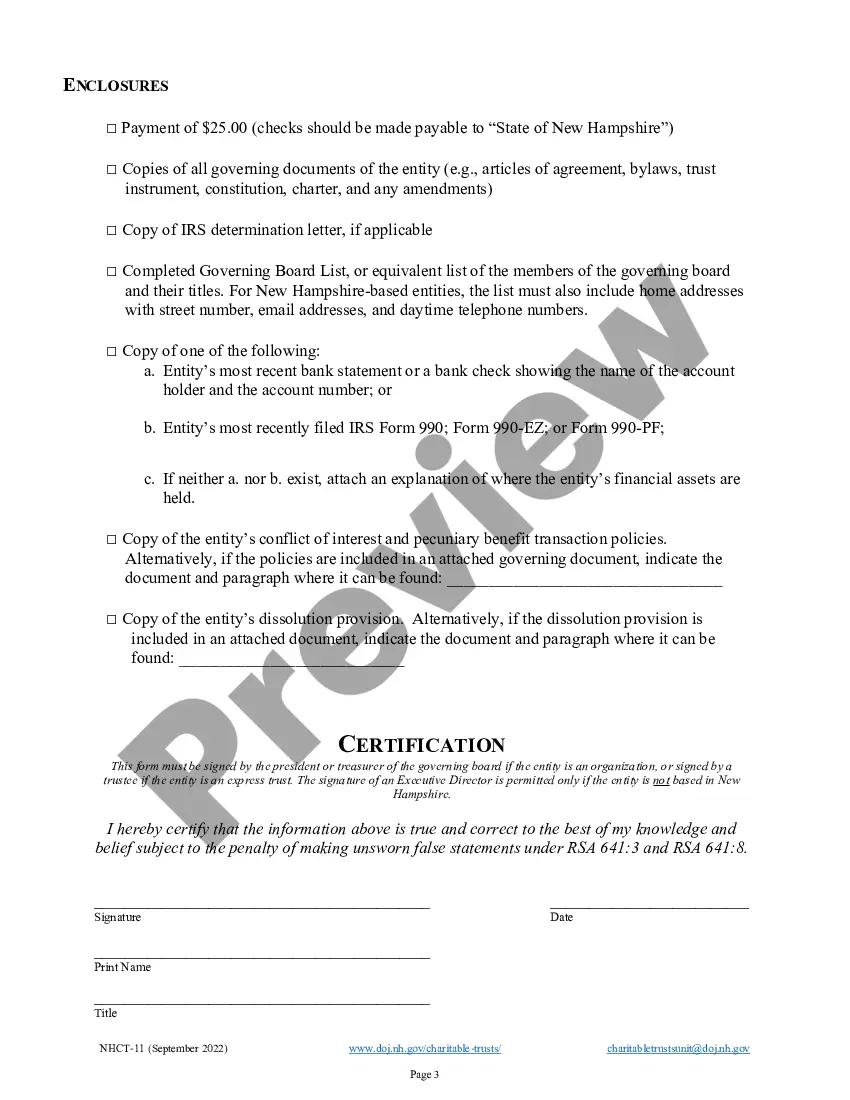

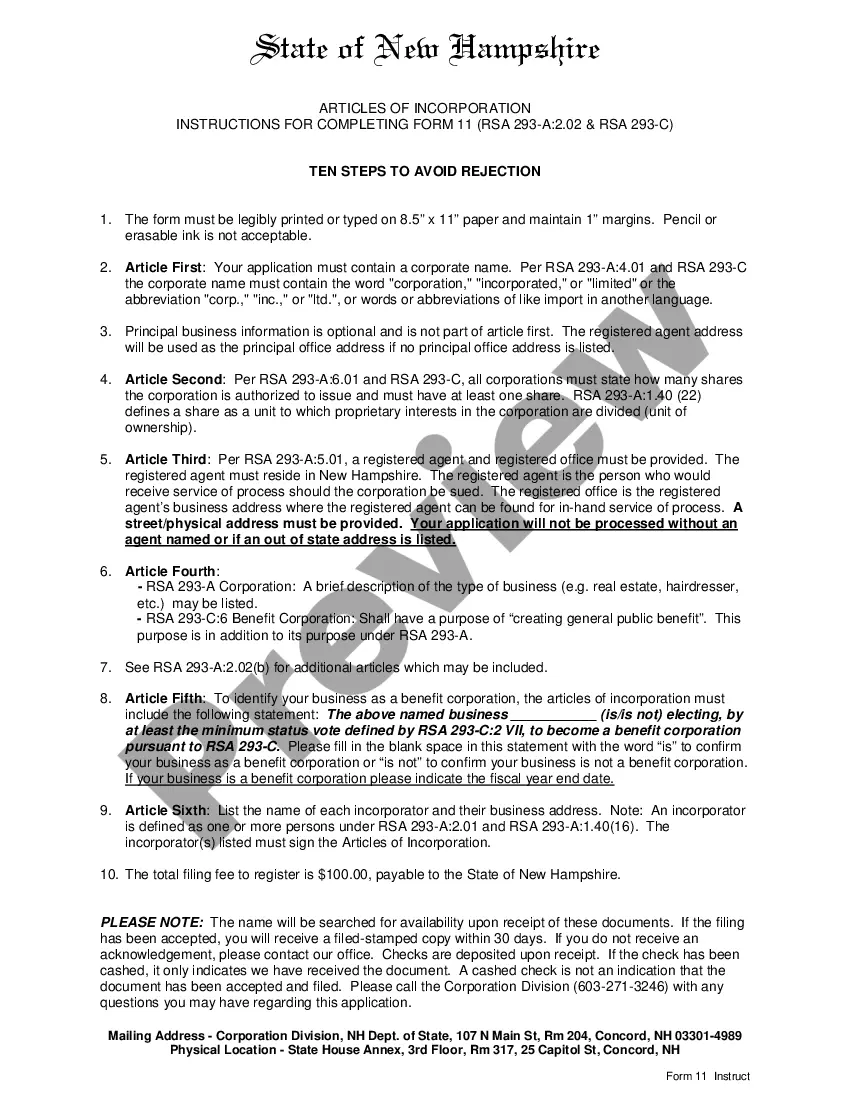

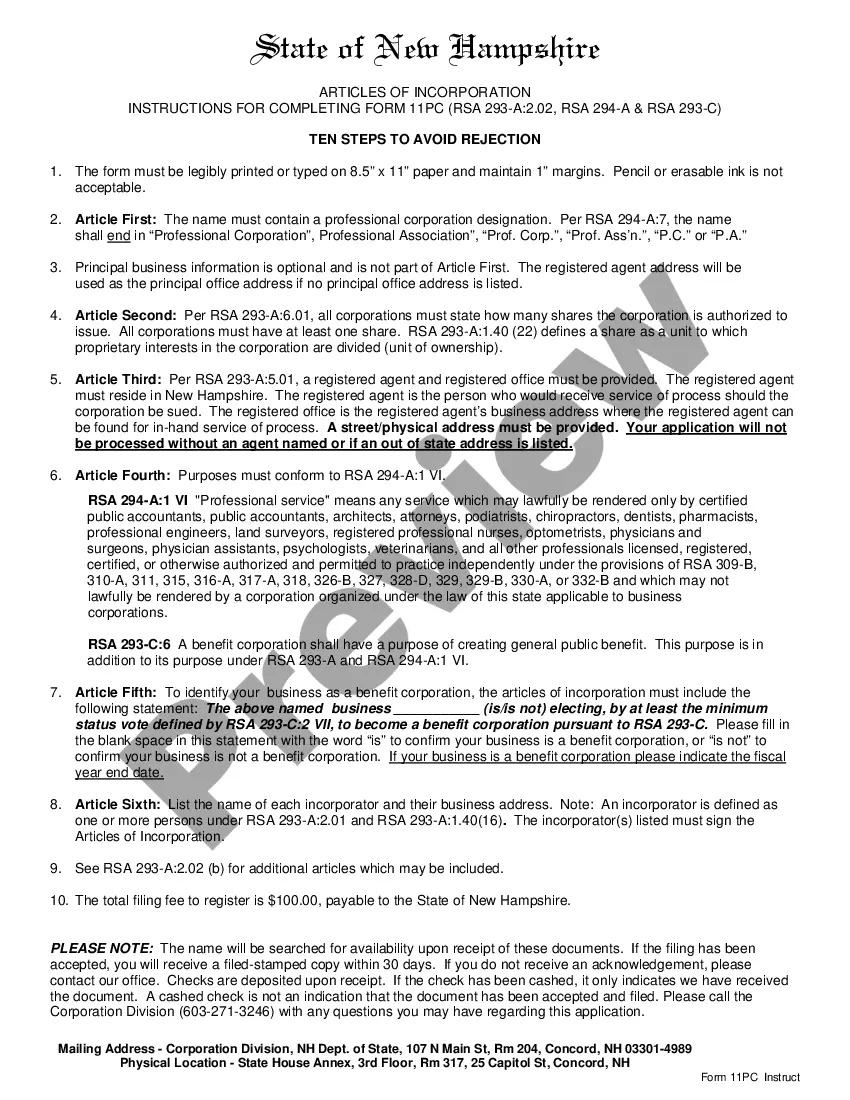

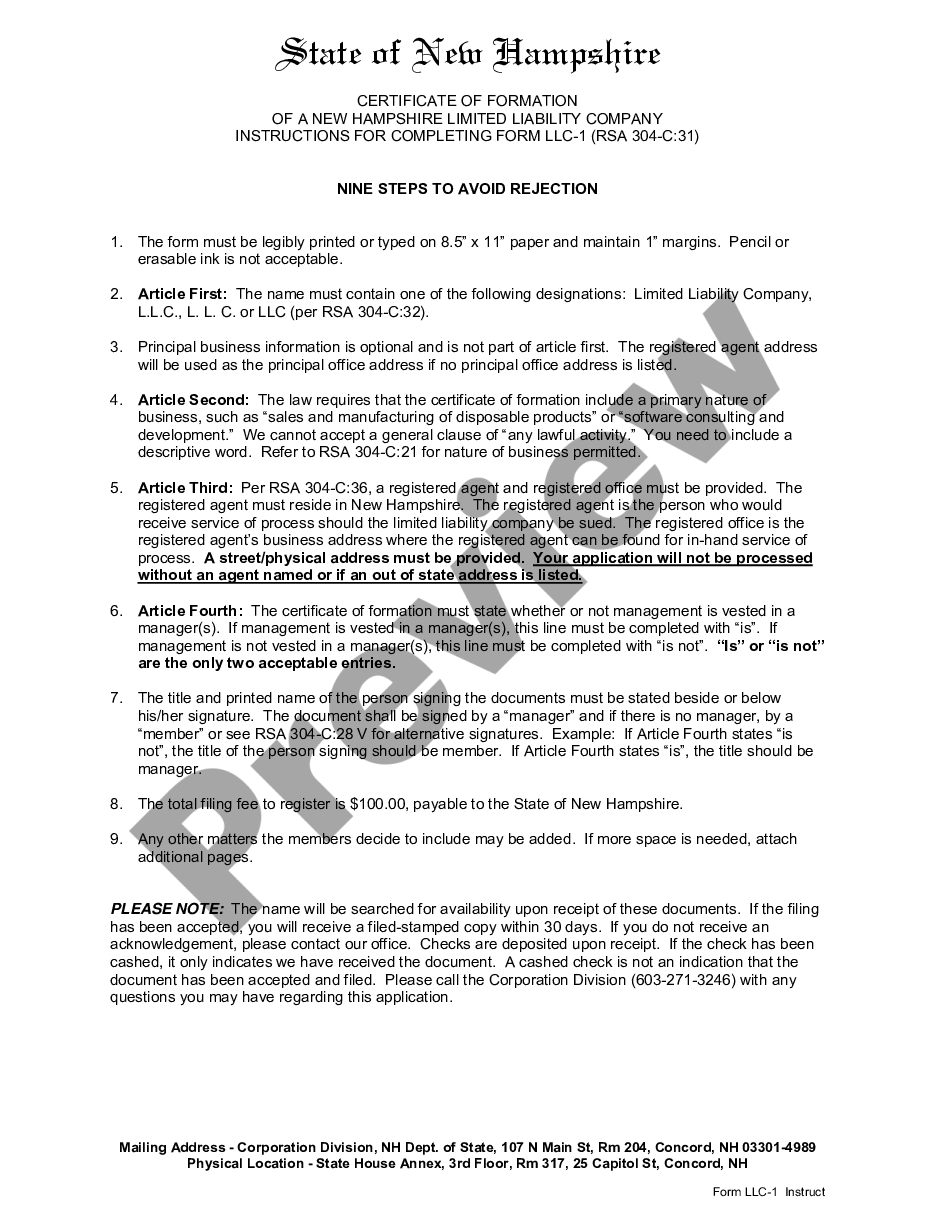

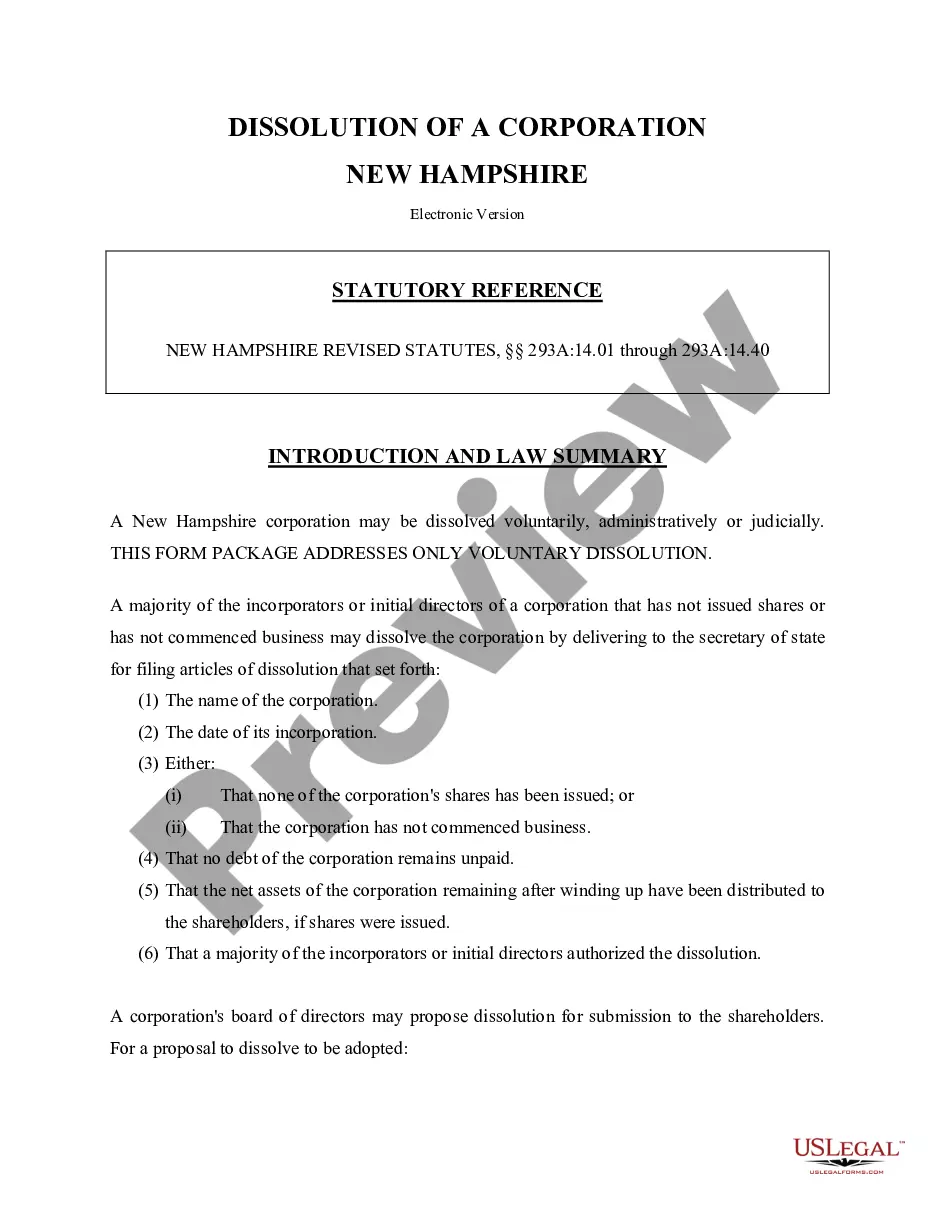

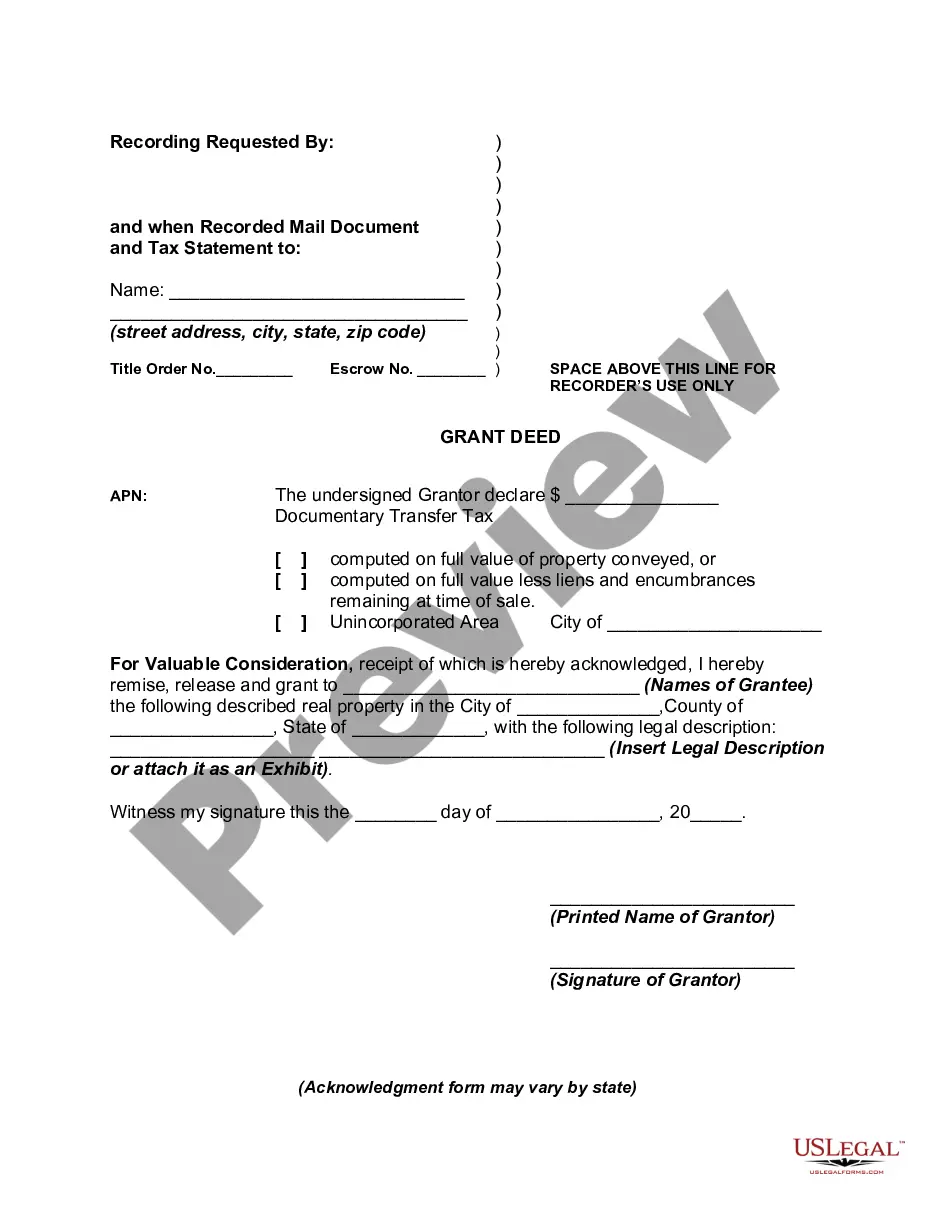

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

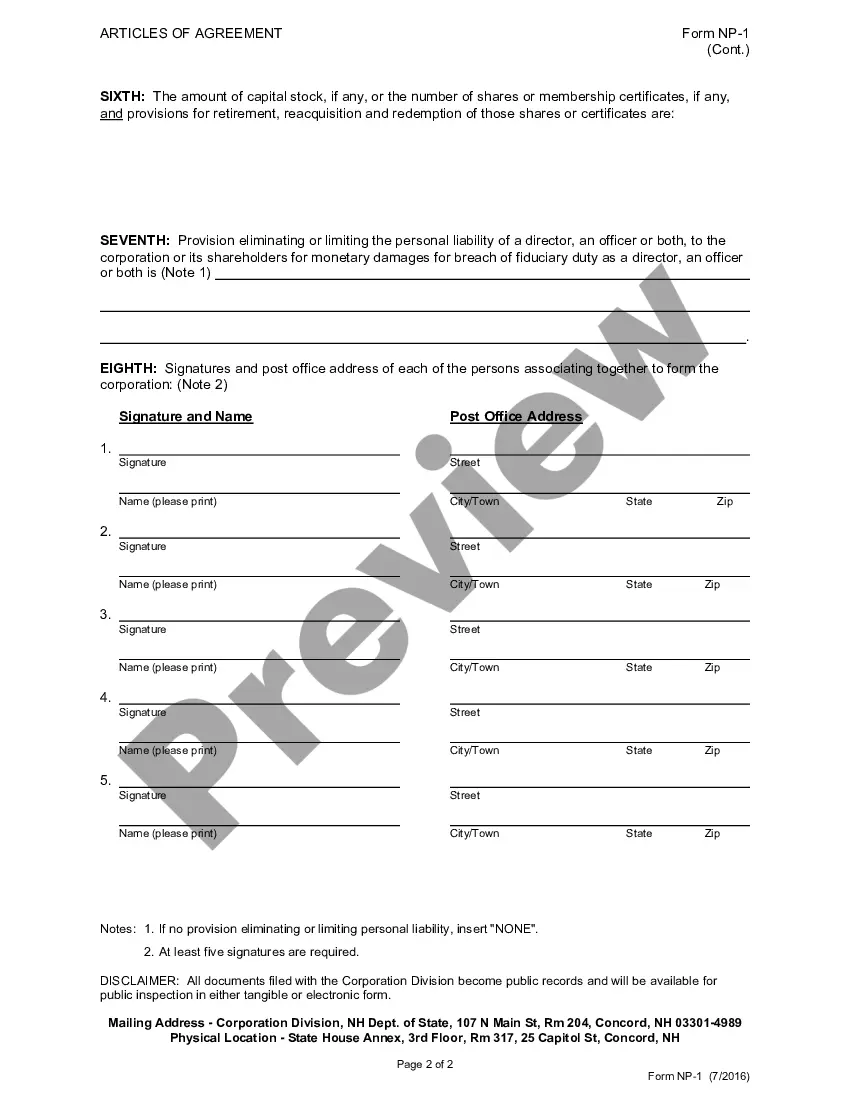

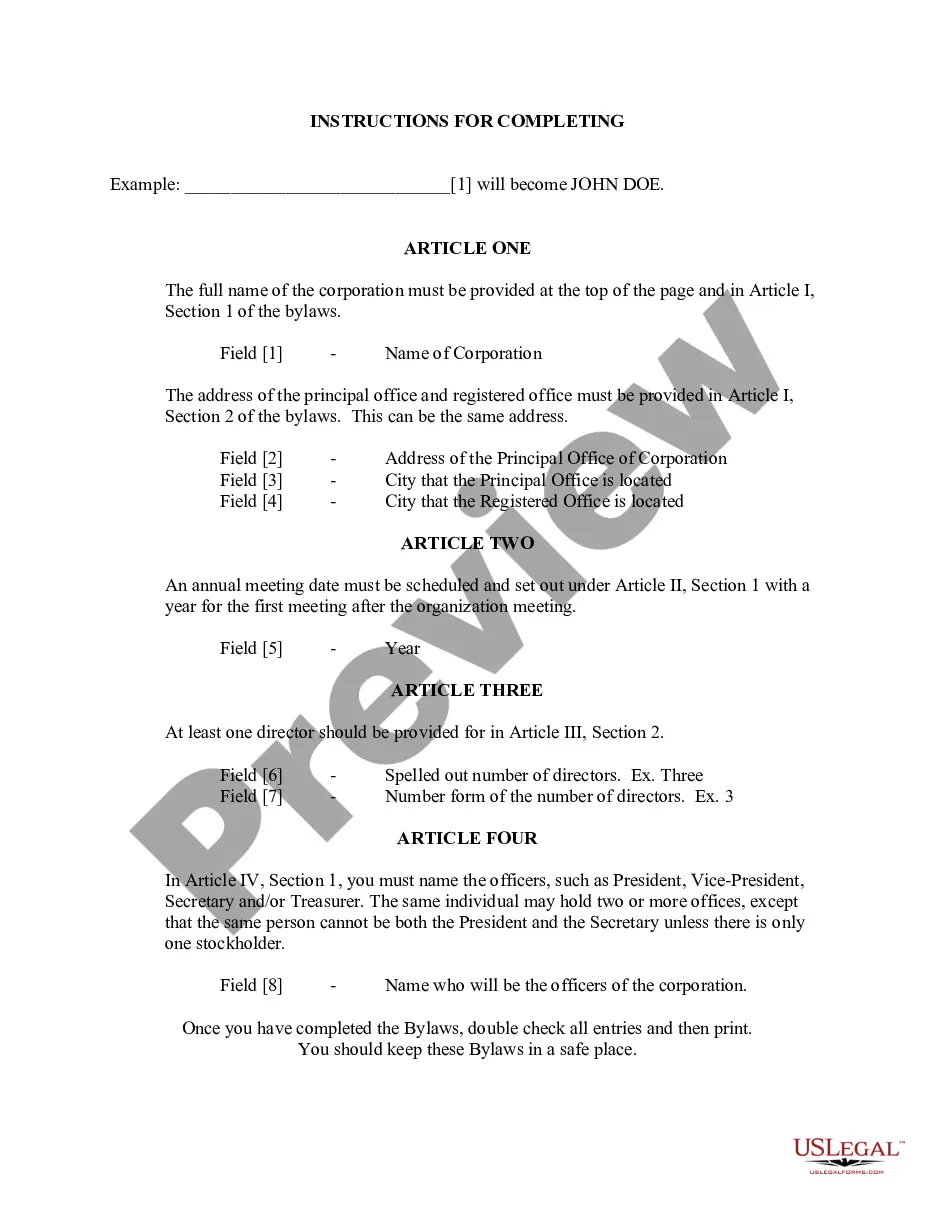

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Nonprofit incorporation usually involves these steps: Choose a business name that is legally available in your state and file for an EIN (Employment Identification Number) Prepare and file your articles of incorporation with your state's corporate filing office, and pay a filing fee.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

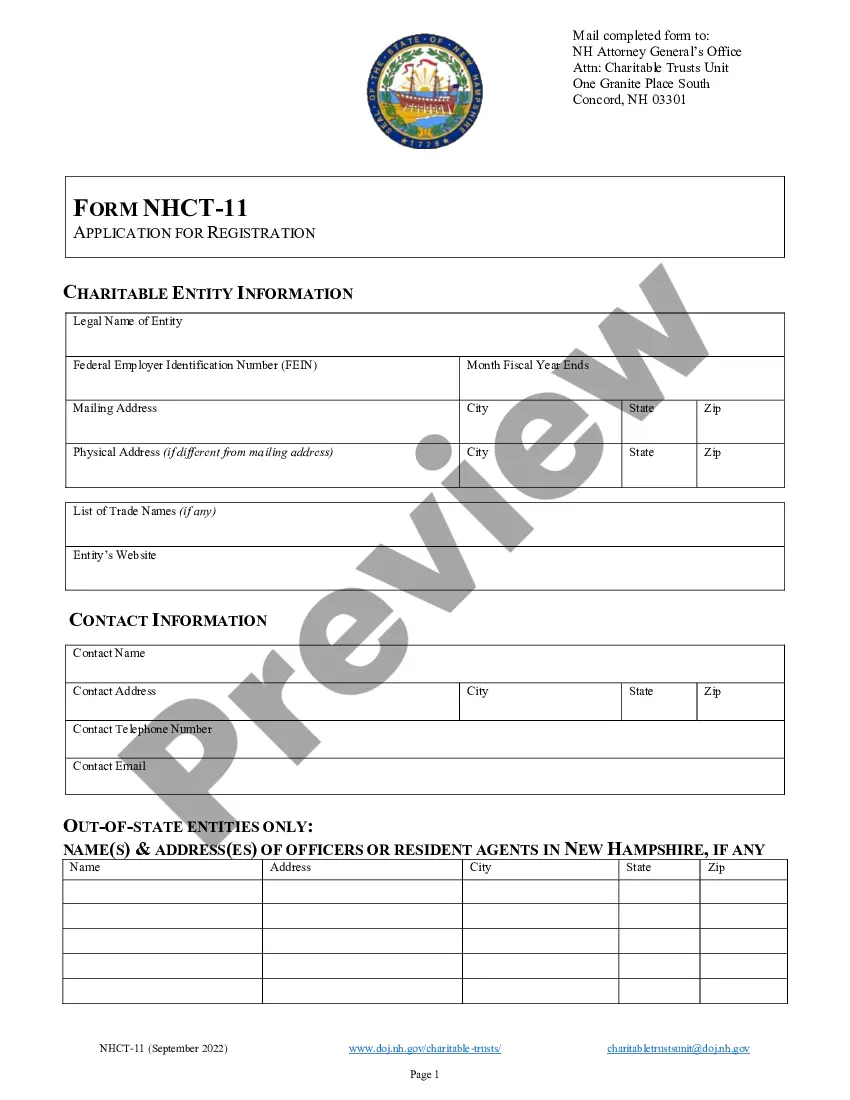

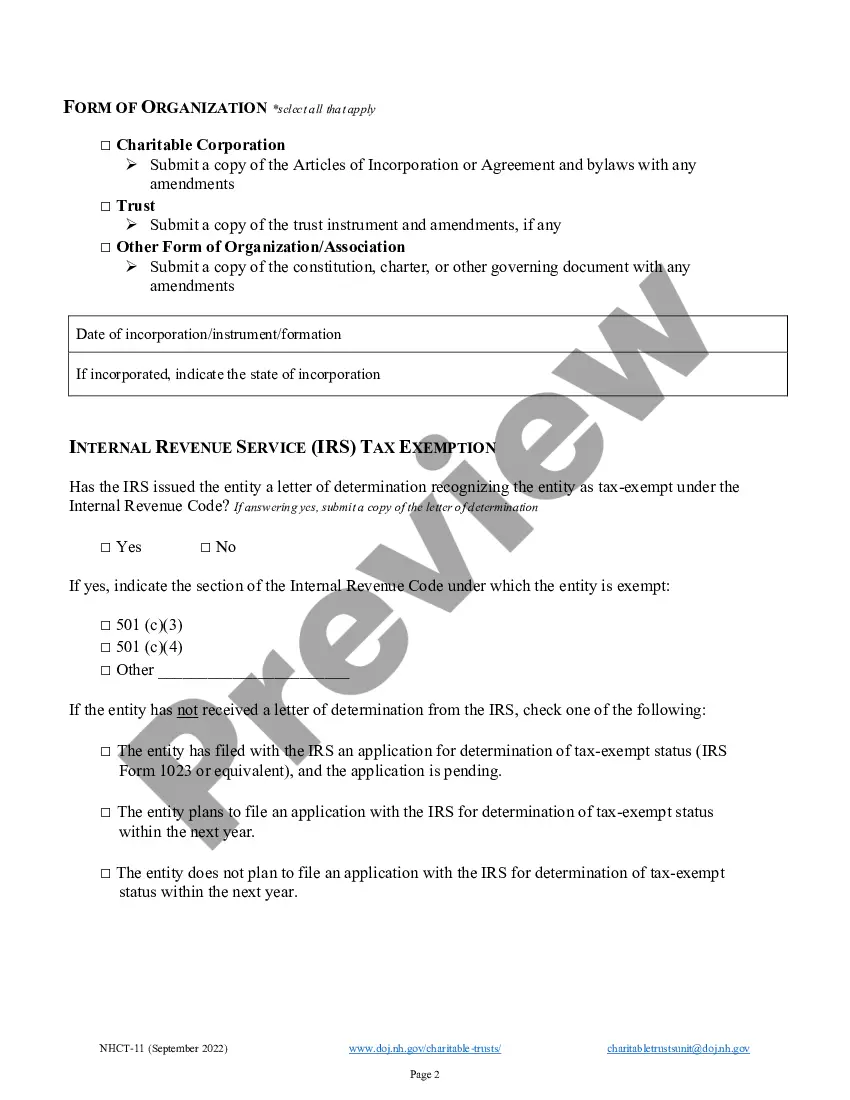

Choose a name. File articles of incorporation. Apply for your IRS tax exemption. Apply for a state tax exemption. Draft bylaws. Appoint directors. Hold a meeting of the board. Obtain licenses and permits.

All states require nonprofit corporations to have a registered agent in the state of formation. The registered agent is responsible for receiving legal and tax documents, must have a physical address (no P.O.Note that supplying the nonprofit's principal office address is optional in many states, but some require it.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Both the IRS and the nonprofit corporation are required to disclose the information they provide on Form 990 to the public. This means that nonprofits must make their records available for public inspection during regular business hours at their principal office.

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.