New Jersey Quitclaim Deed by Two Individuals to Husband and Wife

What is this form?

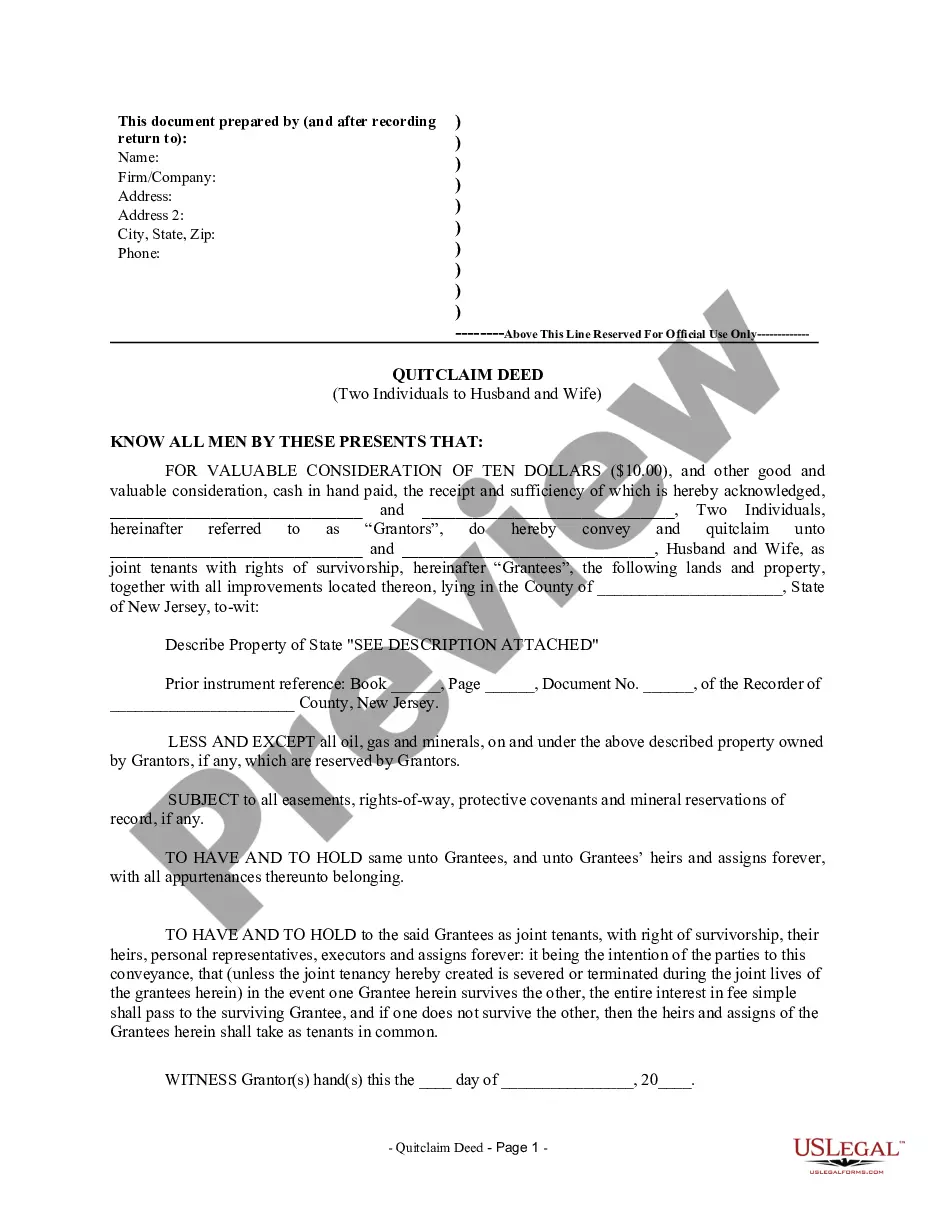

The Quitclaim Deed by Two Individuals to Husband and Wife is a legal document that transfers the ownership of property from two individuals (the Grantors) to a married couple (the Grantees). Unlike a warranty deed, a quitclaim deed offers no warranties on the title, meaning the Grantors are relinquishing any claim they may have to the property without guaranteeing any rights to it. This form is specifically designed for use by couples wishing to secure their joint ownership of real estate while reserving certain mineral rights as specified.

Main sections of this form

- Description of the Property: Identifies the property being transferred, including the legal description.

- Prior Instrument Reference: Details previous documents related to the property transfer.

- Reservation of Rights: Specifies any reserved rights to oil, gas, and minerals by the Grantors.

- Joint Tenancy Declaration: Indicates the intent for joint ownership with rights of survivorship.

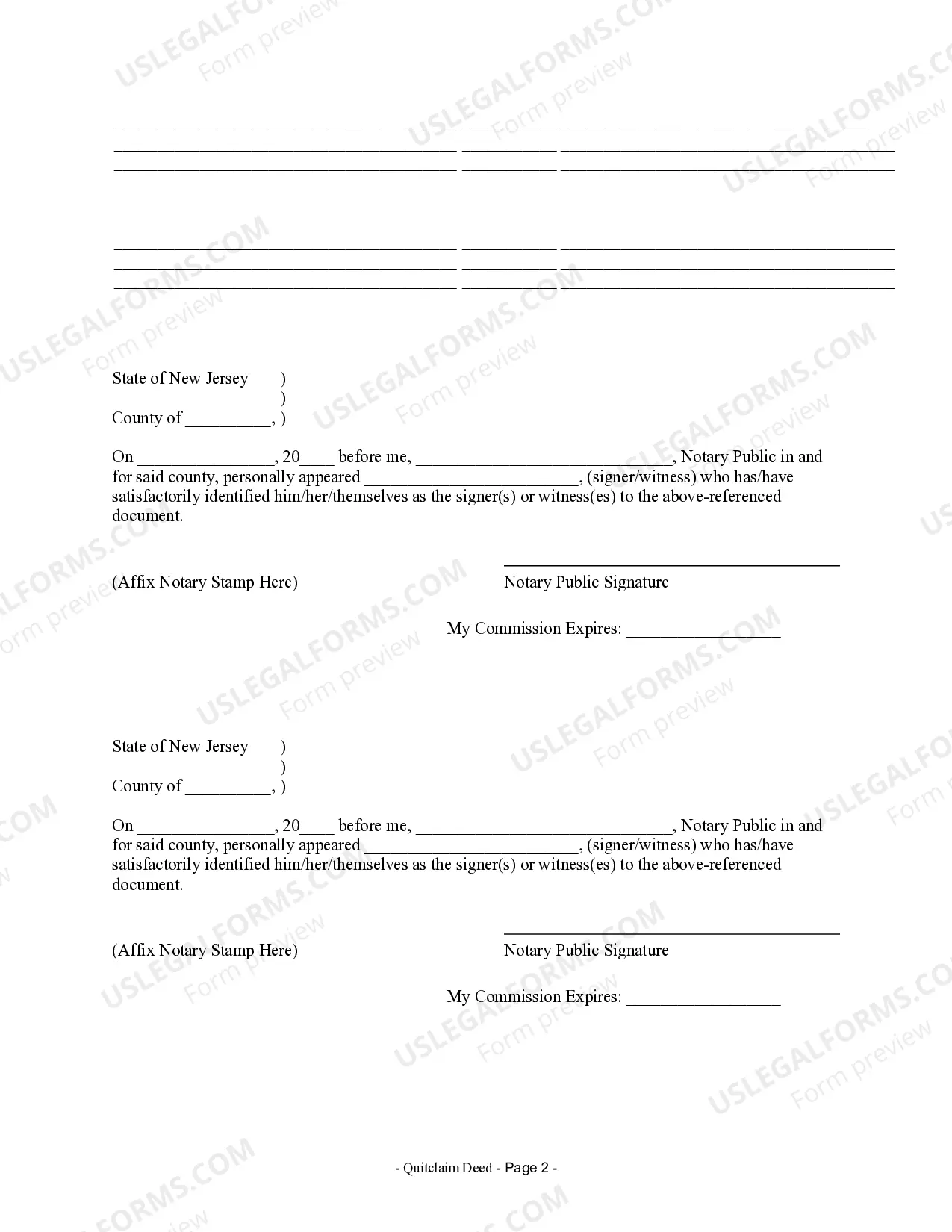

- Signatures and Notarization: Requires signatures from both Grantors and certification by a notary public.

Common use cases

This quitclaim deed form is typically used when two individuals wish to transfer property ownership to a married couple. It is commonly utilized in scenarios such as transferring family property, consolidating ownership among spouses, or when one party is gifting their interest in a property to their spouse. It may also be used to streamline property ownership in anticipation of estate planning decisions.

Intended users of this form

This quitclaim deed is intended for:

- Married couples looking to formalize joint ownership of a property.

- Individuals (Grantors) who currently hold property and wish to transfer their interest to spouses.

- Anyone involved in property transfer who requires a straightforward method of transferring ownership without warranties.

How to complete this form

- Identify the parties involved: Clearly list the names of the Grantors (transferors) and Grantees (recipients).

- Specify the property: Accurately describe the property being conveyed and include any legal descriptions.

- Include prior instrument reference: Document the Book, Page, and Document Number of the original property deed.

- Sign the form: The Grantors must sign the document, along with including the date of signing.

- Notarization: Have the completed form notarized to validate the transfer.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not including the prior instrument reference, which may lead to confusion regarding ownership history.

- Omitting signatures or dates, which can render the deed invalid.

- Neglecting to have the deed notarized, which is essential for legal acceptance in many jurisdictions.

Why use this form online

- Convenience: Access and download the form from anywhere at any time.

- Editability: Fill out the form easily with specific property details and personal information.

- Compliance: The form is drafted by licensed attorneys to meet all legal requirements.

Form popularity

FAQ

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Signing - According to New Jersey law, the quit claim deed must be signed by the seller of the property in the presence of a Notary Public. Recording - All quit claim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.