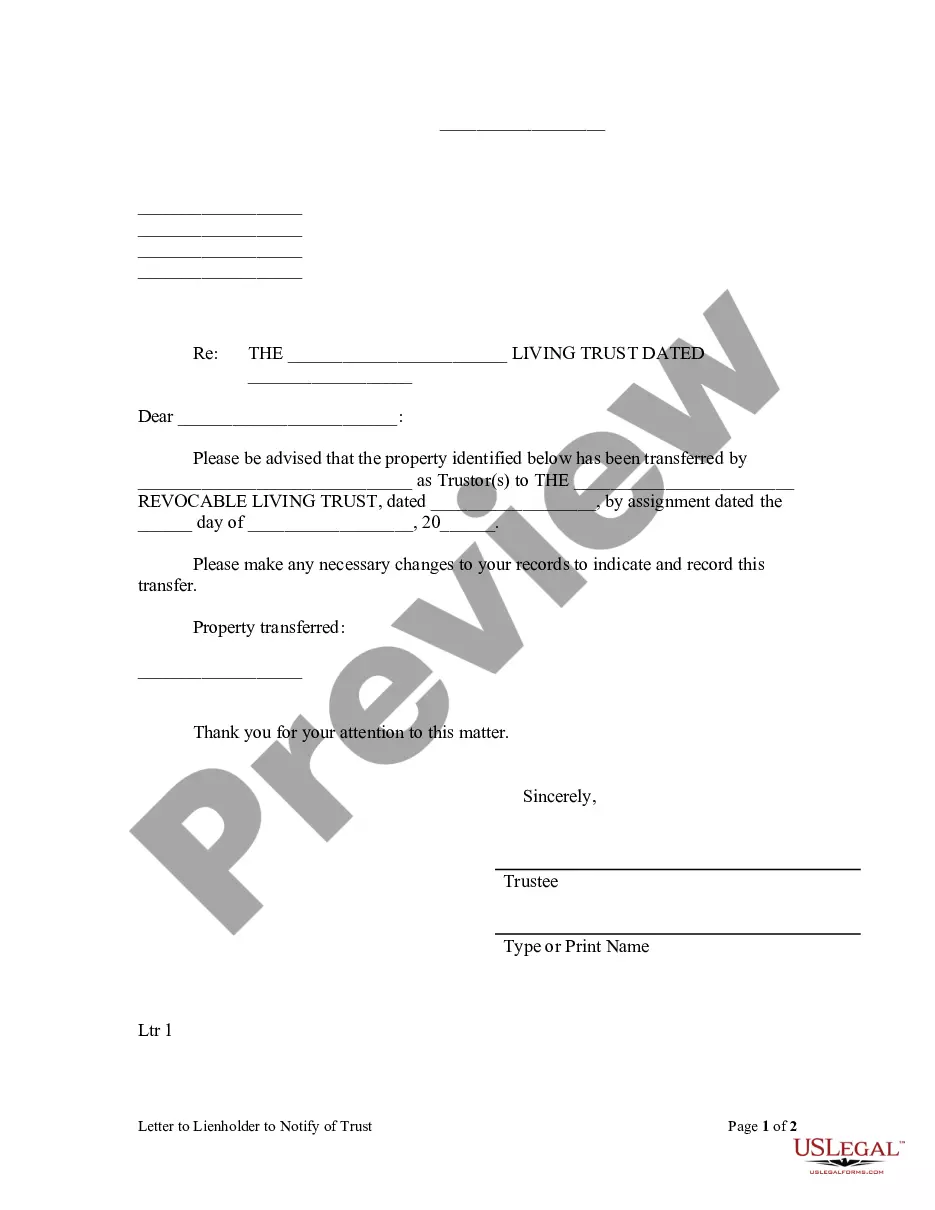

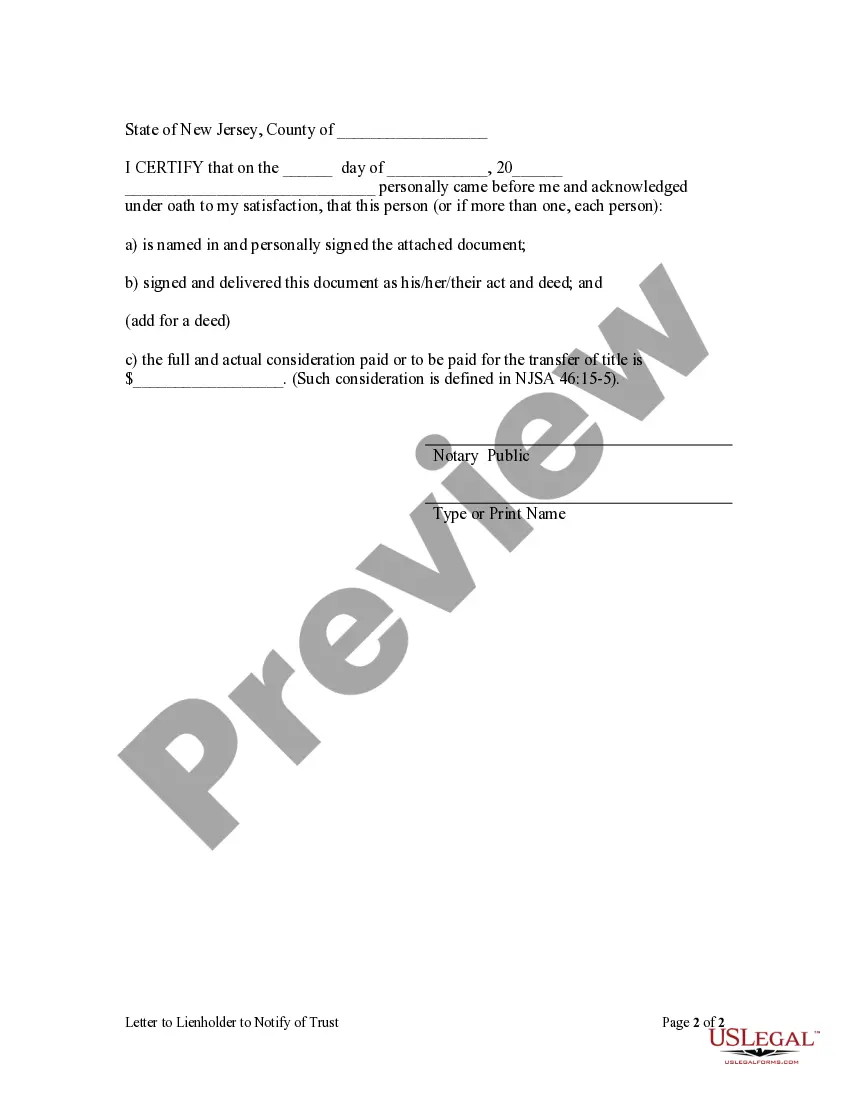

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

New Jersey Letter to Lienholder to Notify of Trust

Description

How to fill out New Jersey Letter To Lienholder To Notify Of Trust?

US Legal Forms is actually a unique platform to find any legal or tax template for completing, such as New Jersey Letter to Lienholder to Notify of Trust. If you’re sick and tired of wasting time looking for ideal examples and spending money on papers preparation/lawyer fees, then US Legal Forms is exactly what you’re looking for.

To experience all of the service’s benefits, you don't need to download any application but just pick a subscription plan and register an account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need to have New Jersey Letter to Lienholder to Notify of Trust, have a look at the guidelines below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the form and read its description.

- Click on Buy Now button to access the sign up page.

- Select a pricing plan and keep on registering by providing some info.

- Select a payment method to complete the registration.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you feel unsure regarding your New Jersey Letter to Lienholder to Notify of Trust sample, contact a attorney to analyze it before you send or file it. Start hassle-free!

Form popularity

FAQ

The car you purchase has a lien on the title until you completely pay off the car. Not only does a lien act as insurance for a lender, but a lien also allows a creditor to repossess your car if you default on your loan. A lien is a right against property or a legal claim, according to The Balance.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

Congratulations on owning your vehicle free and clear. Now that your loan is paid off, you should receive a "letter of lien release" from the bank or financial institution that financed your vehicle.You cannot transfer ownership of a vehicle until the lien is cleared from the title.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Mark S. Katz. You can sell the car and hold the title. The easiest thing to do is to accompany the buyer to the DMV to register the car and prepare any and all paperwork that your DMV may require to register the car to the buyer and list you as a lien-holder...

Note: Ensure both pages 1 and 2 are completed. Make a copy of your driver's license to submit with the form (DO-22). Include a check or money order for $15 payable to the NJMVC. Mail all of the above required documents to:

Lien Holder Authorization Letter A letter from the lien holder, giving permission for the vehicle to be relocated.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.