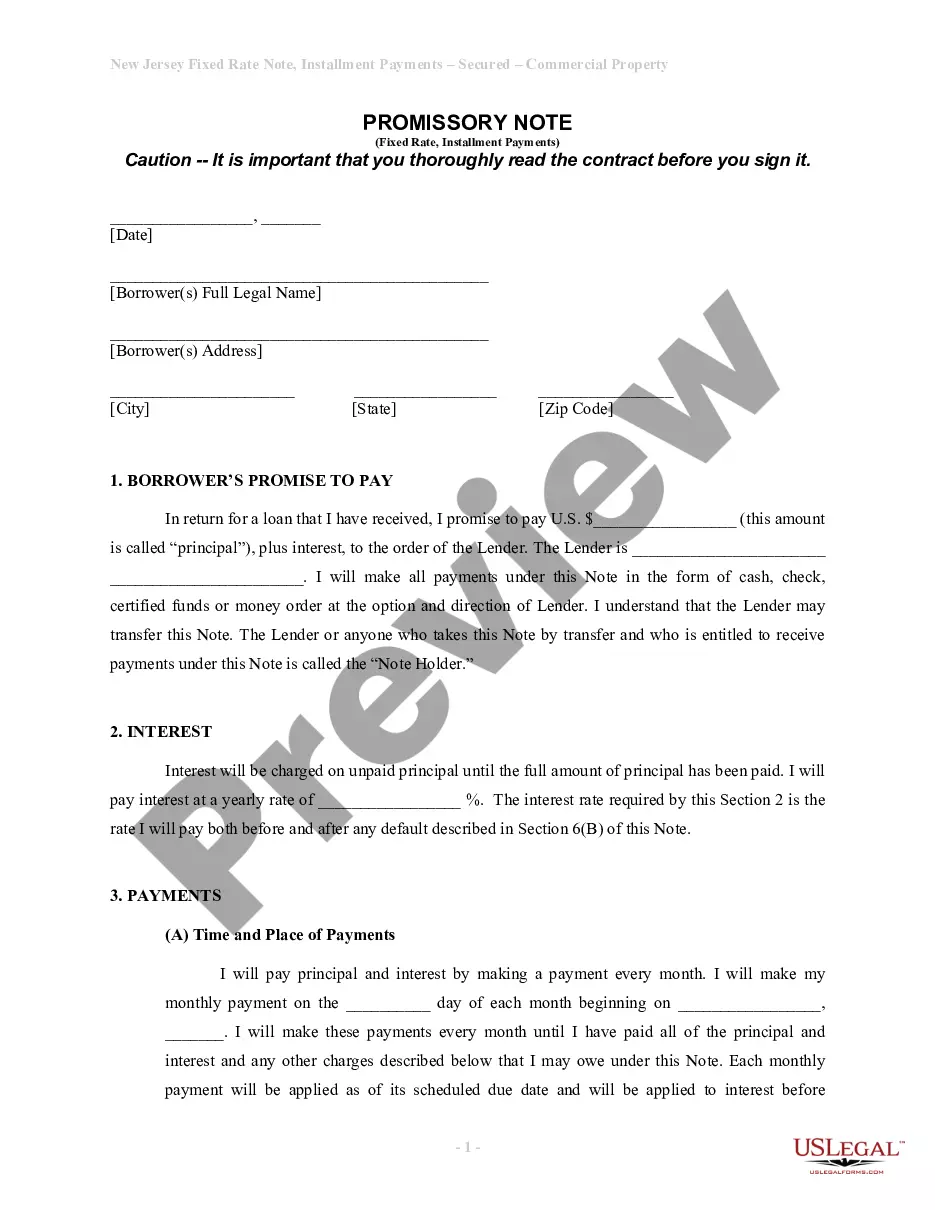

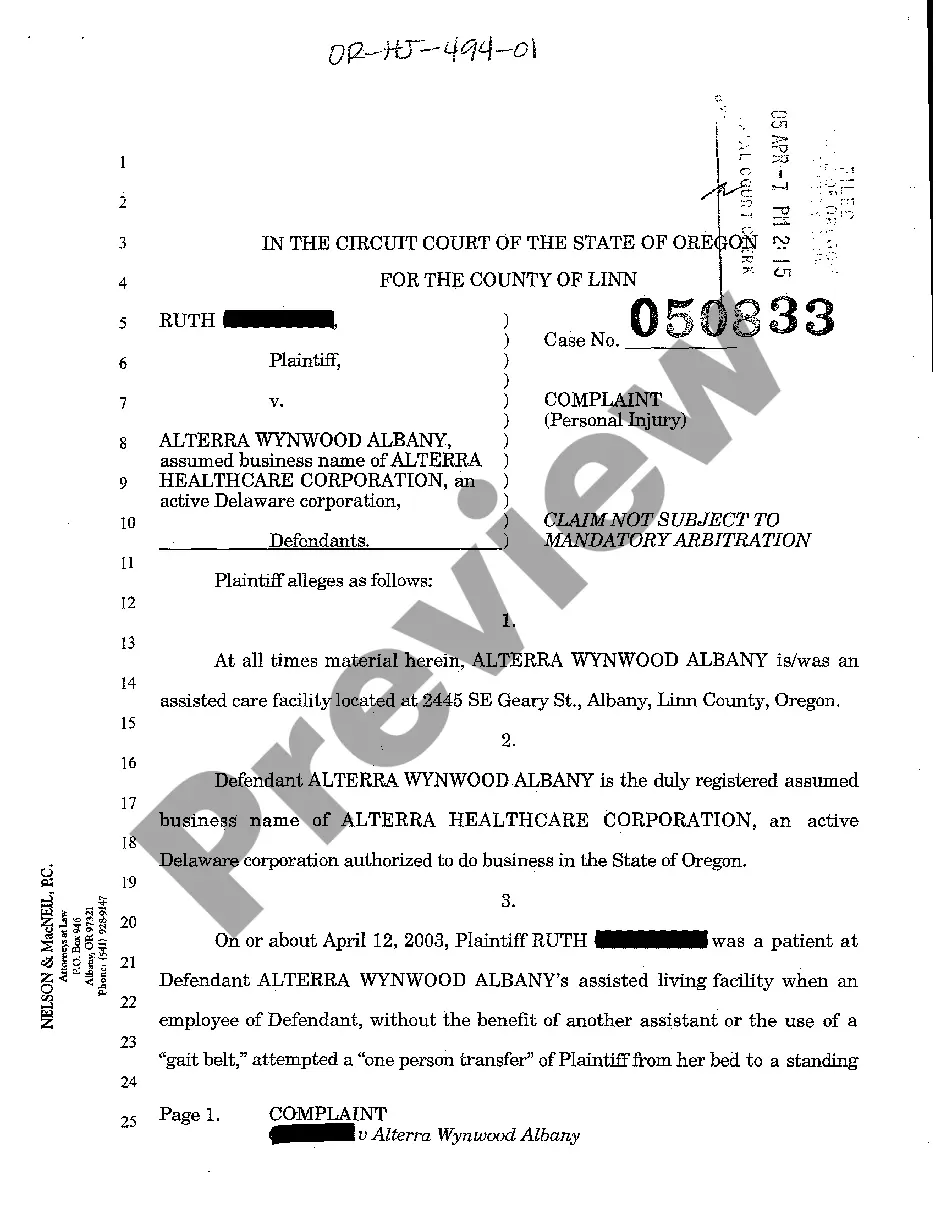

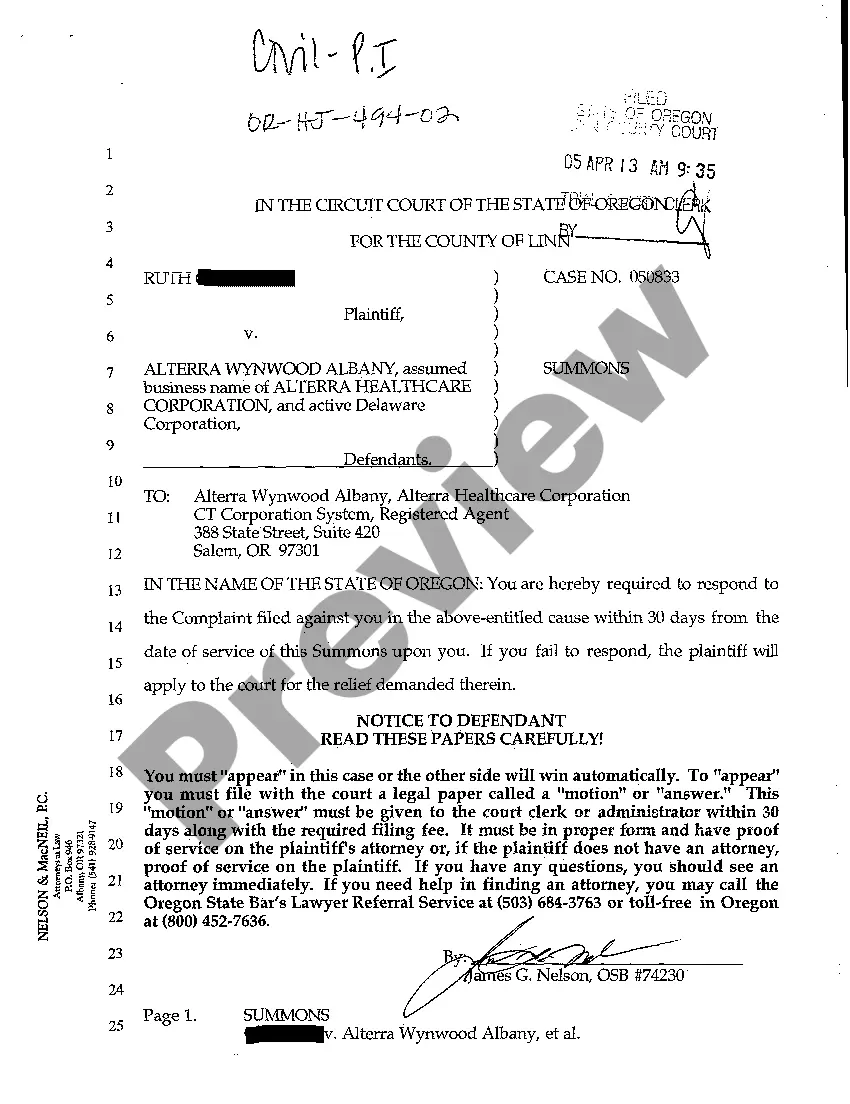

New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

US Legal Forms is actually a unique system where you can find any legal or tax document for completing, including New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If you’re tired with wasting time searching for appropriate examples and paying money on file preparation/lawyer charges, then US Legal Forms is precisely what you’re searching for.

To reap all of the service’s advantages, you don't need to install any application but simply pick a subscription plan and register an account. If you already have one, just log in and get the right sample, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate, check out the recommendations listed below:

- check out the form you’re taking a look at is valid in the state you need it in.

- Preview the example its description.

- Click Buy Now to reach the sign up page.

- Pick a pricing plan and keep on registering by providing some info.

- Pick a payment method to finish the sign up.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure about your New Jersey Installments Fixed Rate Promissory Note Secured by Residential Real Estate form, speak to a attorney to analyze it before you send or file it. Start without hassles!

Form popularity

FAQ

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the maker or issuer) promises in writing to pay a determinate sum of money to the other (the payee), either at a fixed or determinable future time or

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.

Simple Promissory Note. Student Loan Promissory Note. Real Estate Promissory Note. Personal Loan Promissory Notes. Car Promissory Note. Commercial Promissory note. Investment Promissory Note.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

There are four significant types of promissory notes in India. A personal note is the kind of promissory note that an individual should seek when lending money to family members or close relatives. A commercial note is the type of promissory note that is signed between a borrower and a financial institution.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.