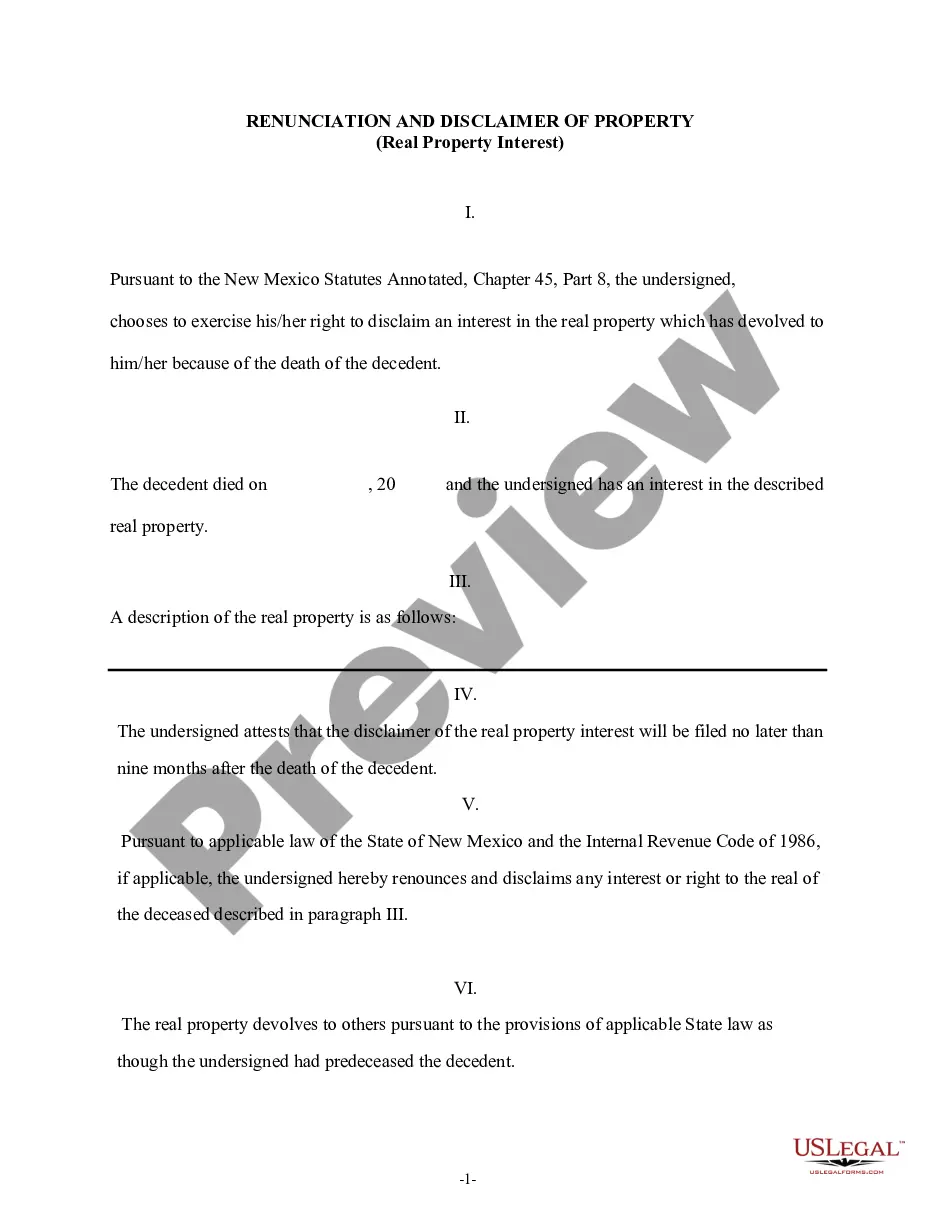

Disclaimer Real Property

Description Property Interest

How to fill out Disclaimer Of Interest Form?

- If you are a returning user, log in to your account and navigate to the desired form. Ensure your subscription is current; renew it if necessary.

- For first-time users, browse through the library, checking the Preview mode and descriptions to find the New Mexico Renunciation and Disclaimer of Real Property Interest form that meets your criteria.

- If you need a different template, utilize the Search tab to find the right form. Confirm it meets your local jurisdiction's standards before proceeding.

- Once your form is selected, click the Buy Now button. Choose a subscription plan that fits your needs and create an account to gain access.

- Complete your purchase by entering your payment method details, either through credit card or PayPal.

- After payment, download the template directly to your device. You can access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms empowers users with a vast collection of over 85,000 customizable legal templates, ensuring precise documentation. With unmatched benefits like expert assistance and a user-friendly interface, you can confidently handle legal processes.

Ready to streamline your legal documentation? Visit US Legal Forms today to begin your journey.

Renunciation Real Document Form popularity

Renunciation Letter Other Form Names

Disclaimer Property Interest Form FAQ

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

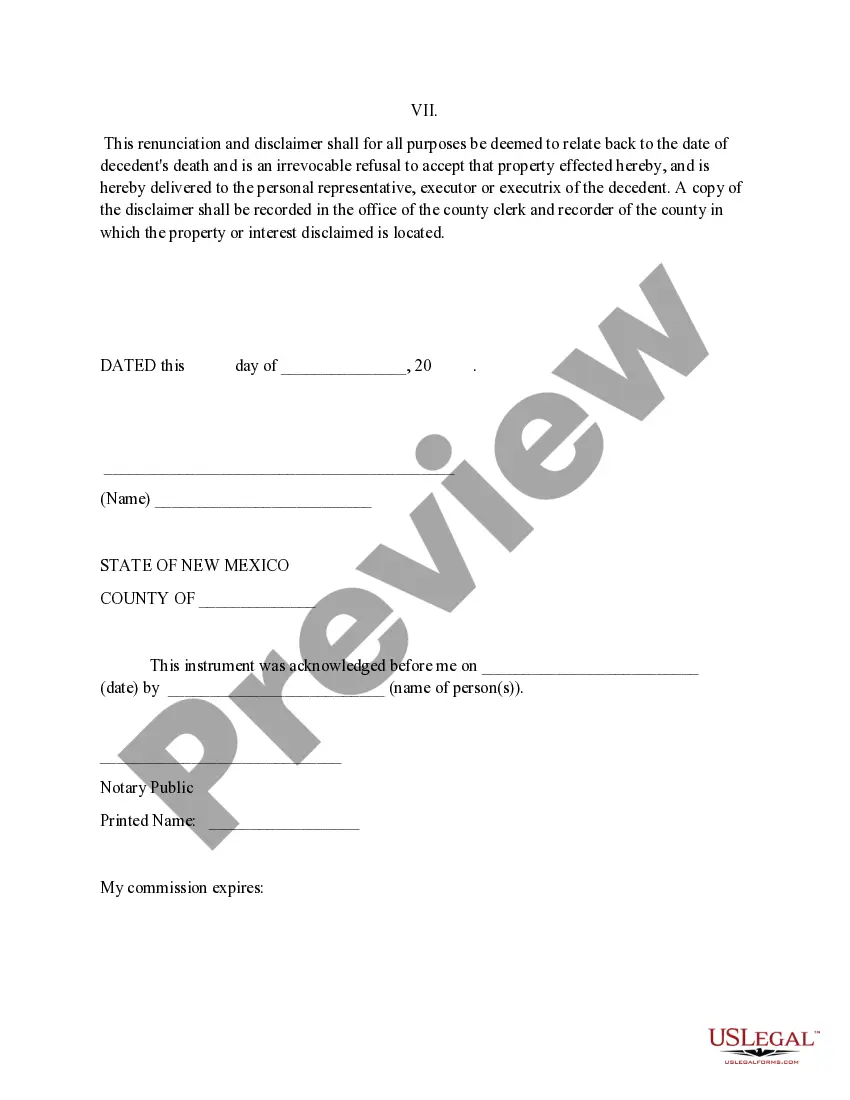

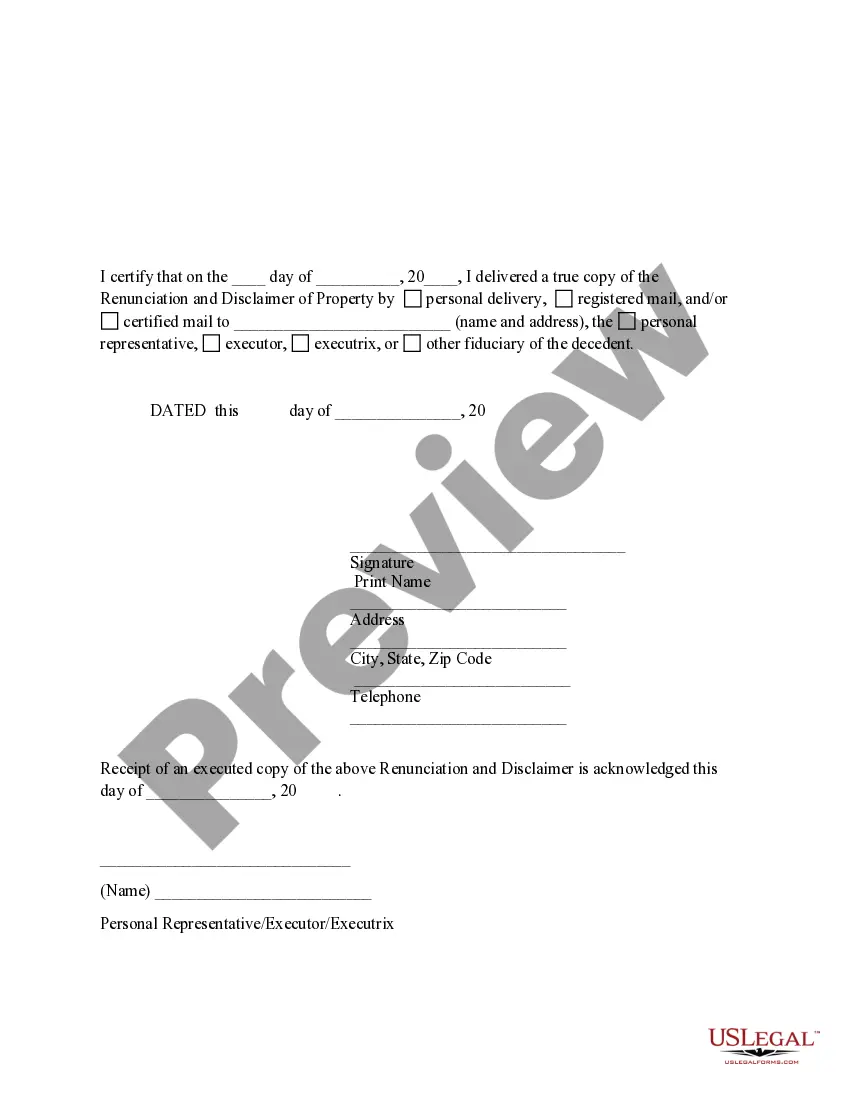

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A marital disclaimer trust has provisions (usually contained in a will) that allow a surviving spouse to put assets in a trust by disclaiming ownership of a portion of the estate that they would have inherited after the death of the first spouse.

By filing a properly drafted petition with the circuit court, which includes the consent of the trustee and the trust beneficiaries, an Order can be obtained directing the collapse of the ILIT and the distribution of its assets in any way the parties agree.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.