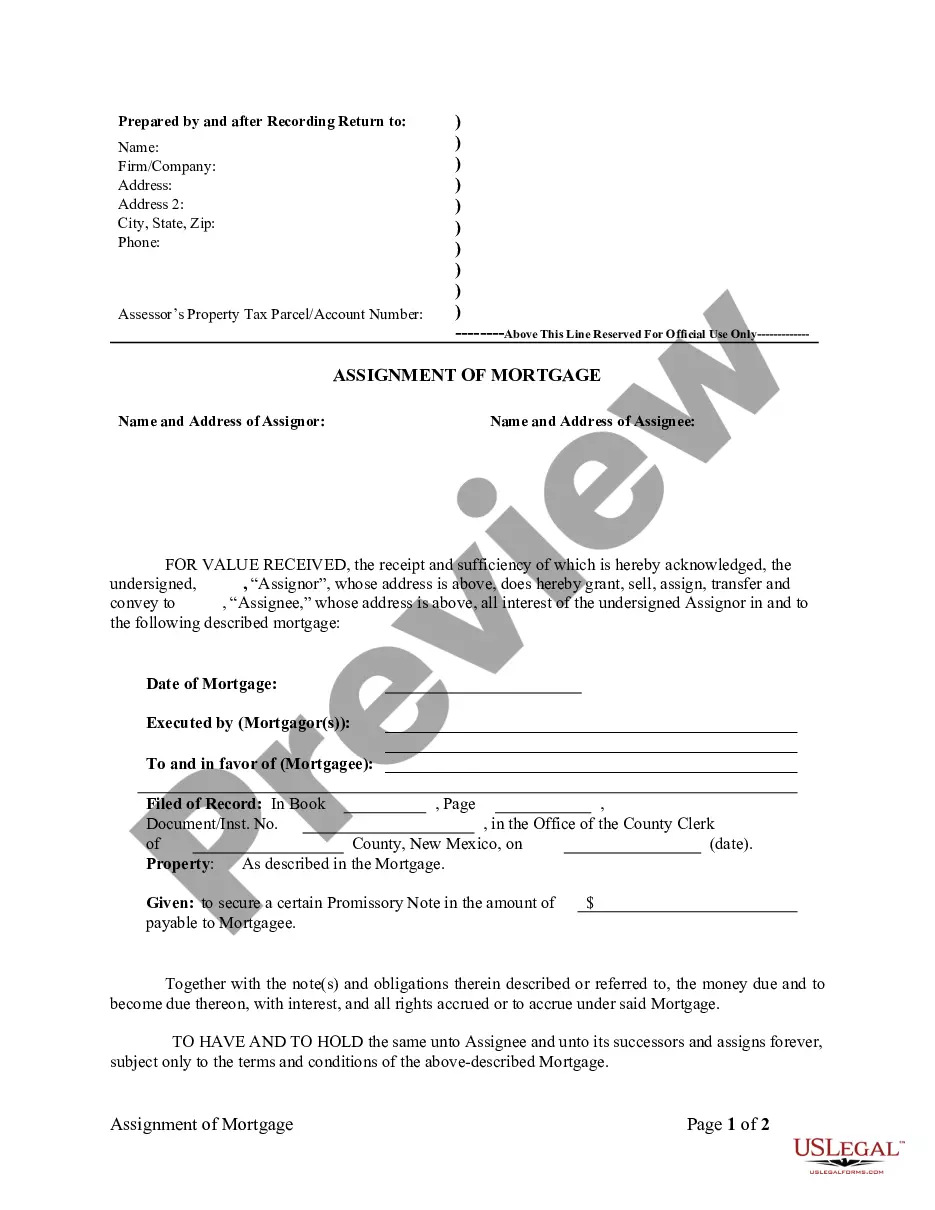

Assignment of Mortgage by Corporate Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

New Mexico Law

Assignment: If an assignment of mortgage

appears upon the proper record of such county clerk, then payment may be

made to the last assignee whose assignment is so recorded, and such [full]

payment shall be effectual to extinguish all claims against such mortgagor.

Demand to Satisfy: None required.

Recording Satisfaction: It is the duty

of the mortgagee, trustee or the assignee of the debt or evidence

of debt, as the case may be, to cause the full satisfaction of it

to be entered of record in the office of the county clerk of the county

where the mortgage or deed of trust is recorded.

Penalty: Failure to satisfy of record results

in a fine of between $10 and $25, and liability for other recoverable costs.

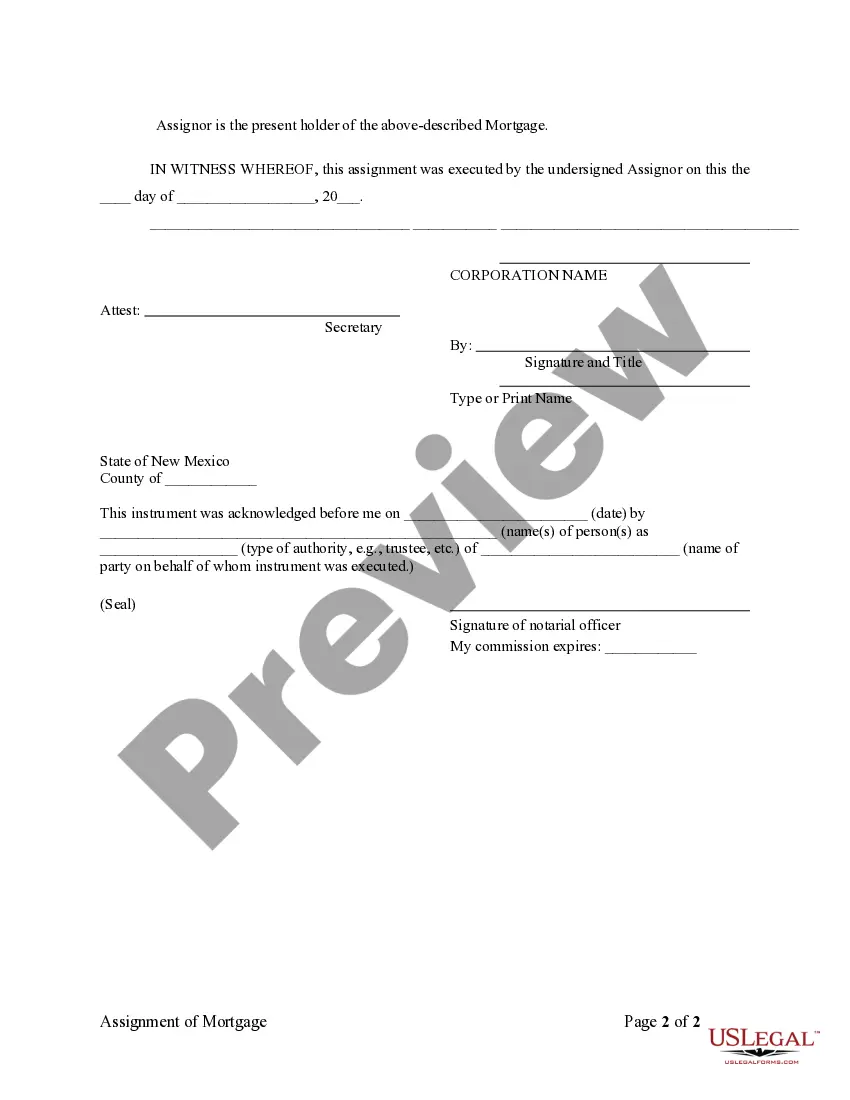

Acknowledgment: An assignment or satisfaction

must contain a proper New Mexico acknowledgment, or other acknowledgment

approved by Statute.

New Mexico Statutes

48-7-2. [Assignments of mortgages; recording; person entitled

to payment; effect of

failure to record; assignee's action against assignor.]

In cases where assignments of real estate mortgages are made subsequent

to the date this act takes effect, and such assignments are not recorded

in the office of the county clerk of the proper county, the mortgagor,

his heirs, personal representatives or assigns may pay the principal debt

secured by such mortgage or accrued interest thereon, prior to the recording

of such assignment, to the mortgagee; but if an assignment of such mortgage

appears upon the proper record of such county clerk, then such payment

may be made to the last assignee whose assignment is so recorded, and such

payment shall be effectual to extinguish all claims against such mortgagor,

his heirs, personal representatives or assigns, for or on account of such

interest or such principal indebtedness. No transfer of any note, bond

or other evidence of indebtedness, by endorsement or otherwise, where such

indebtedness is secured by

mortgage on real estate within this state, shall prevent or operate

to defeat the defense of payment of such interest or principal by the mortgagor,

his heirs, personal representatives or assigns, where such payment has

been made to the mortgagee whose mortgage is duly recorded or to the assignee

whose assignment appears last of record in accordance with the provisions

of this act [48-7-2, 48-7-3 NMSA 1978]; provided, however, that the assignee

who may hold an unrecorded assignment of a real estate mortgage which is

immediately subsequent to such recorded mortgage or to the last recorded

assignment shall have a right of action against his assignor to recover

the amount of any such payment of interest or principal made to such assignor,

as upon an account for money had and received for the use of such assignee.

48-7-4. Release on record upon satisfaction of mortgage.

A. When any debt or evidence of debt secured by a mortgage

or deed of trust upon any real estate in the state has been fully satisfied,

it

is the duty of the mortgagee, trustee or the assignee of the debt or evidence

of debt, as the case may be, to cause the full satisfaction of it to be

entered of record in the office of the county clerk of the county where

the mortgage or deed of trust is recorded.

B. The debt or evidence of debt secured by a mortgage or deed

of trust shall not have been fully satisfied for purposes of Subsection

A of this section, even if all sums due thereunder have been paid in full,

if the written agreement between the mortgagor or trustor and the mortgagee

or beneficiary provides for the securing of a series of loans or a line

of credit by a mortgage or deed of trust and the notation "Line of credit

mortgage" is prominently placed on the mortgage or deed of trust that is

filed with the county clerk in the county or counties in which the property

is located.

C. If, at any time the obligation secured by the mortgage

or deed of trust described in Subsection B of this section is fulfilled,

and the balance is zero, the mortgagee or beneficiary shall cause the mortgage

or deed of trust to be released of record upon written demand of the mortgagor,

trustor or the successor or assignee thereof. In the event of the

death or incompetence of the mortgagor or trustor, the heirs, personal

representative, conservator or guardian of the mortgagor or trustor as

appropriate may make the demand for release described in this subsection.

48-7-5. [Failure to release; penalty; civil liability.]

Any person who shall be guilty of violating the preceding section

[48-7-4 NMSA 1978], upon conviction before any justice of the peace [magistrate]

or district court having jurisdiction of the same shall be punished by

a fine of not less than ten [($10.00)] nor more than twenty-five dollars

[($25.00)], and shall be liable in a civil action to the owner of such

real estate for all costs of clearing the title to said property including

a reasonable attorney's fee.