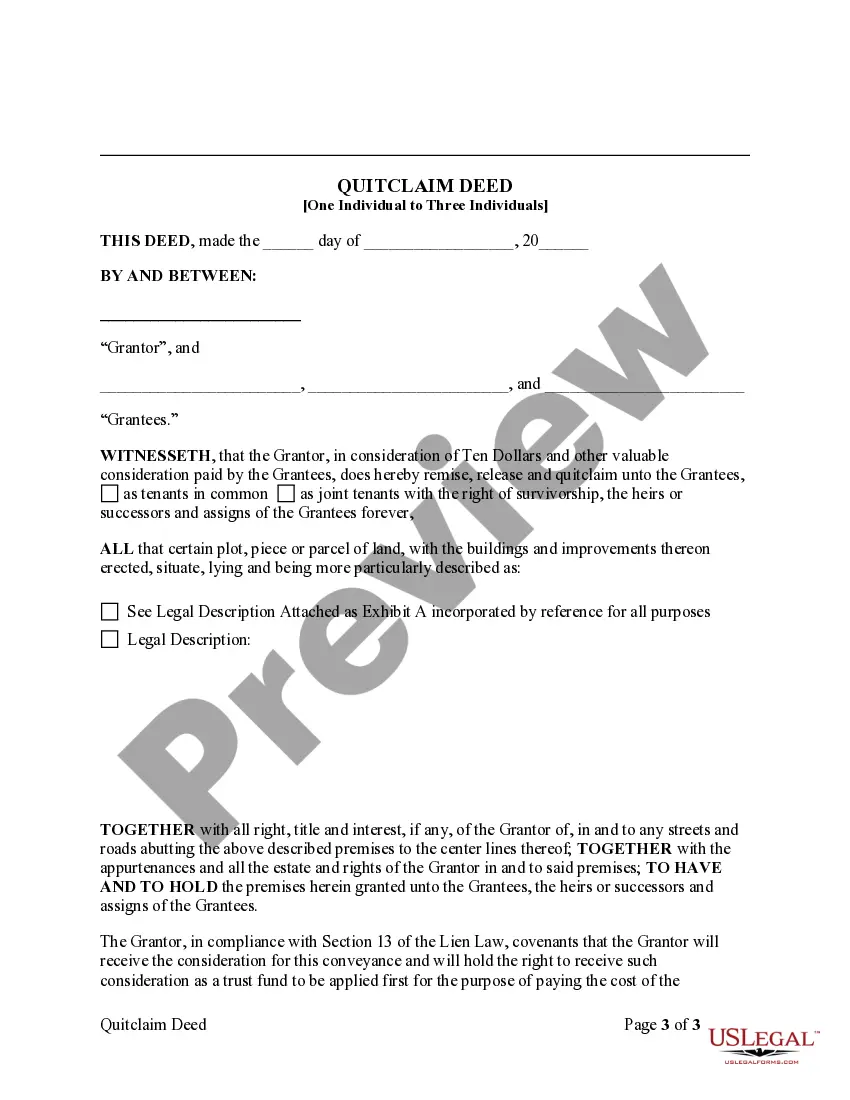

This form is a Quitclaim Deed where the grantor is an individual and the grantees are three individuals. Grantor conveys and quitclaims the described property to grantees. This deed complies with all state statutory laws.

New York Quitclaim Deed - One Individual to Three Individuals

Description

How to fill out New York Quitclaim Deed - One Individual To Three Individuals?

US Legal Forms is actually a special system to find any legal or tax document for filling out, such as New York Quitclaim Deed - One Individual to Three Individuals. If you’re tired with wasting time searching for perfect examples and spending money on papers preparation/legal professional fees, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s benefits, you don't have to download any software but simply choose a subscription plan and sign up your account. If you already have one, just log in and get an appropriate template, save it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need to have New York Quitclaim Deed - One Individual to Three Individuals, check out the instructions listed below:

- Double-check that the form you’re considering is valid in the state you need it in.

- Preview the example and read its description.

- Click on Buy Now button to access the sign up webpage.

- Choose a pricing plan and continue registering by entering some information.

- Pick a payment method to finish the registration.

- Download the file by choosing your preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you are uncertain regarding your New York Quitclaim Deed - One Individual to Three Individuals form, contact a attorney to check it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Six people can be on title. It can cause a lot of problems when it comes time to sell though. If even one of the six won't sign, you have a problem. They can sign at different times and from different locations depending on the closing attorney or escrow company.

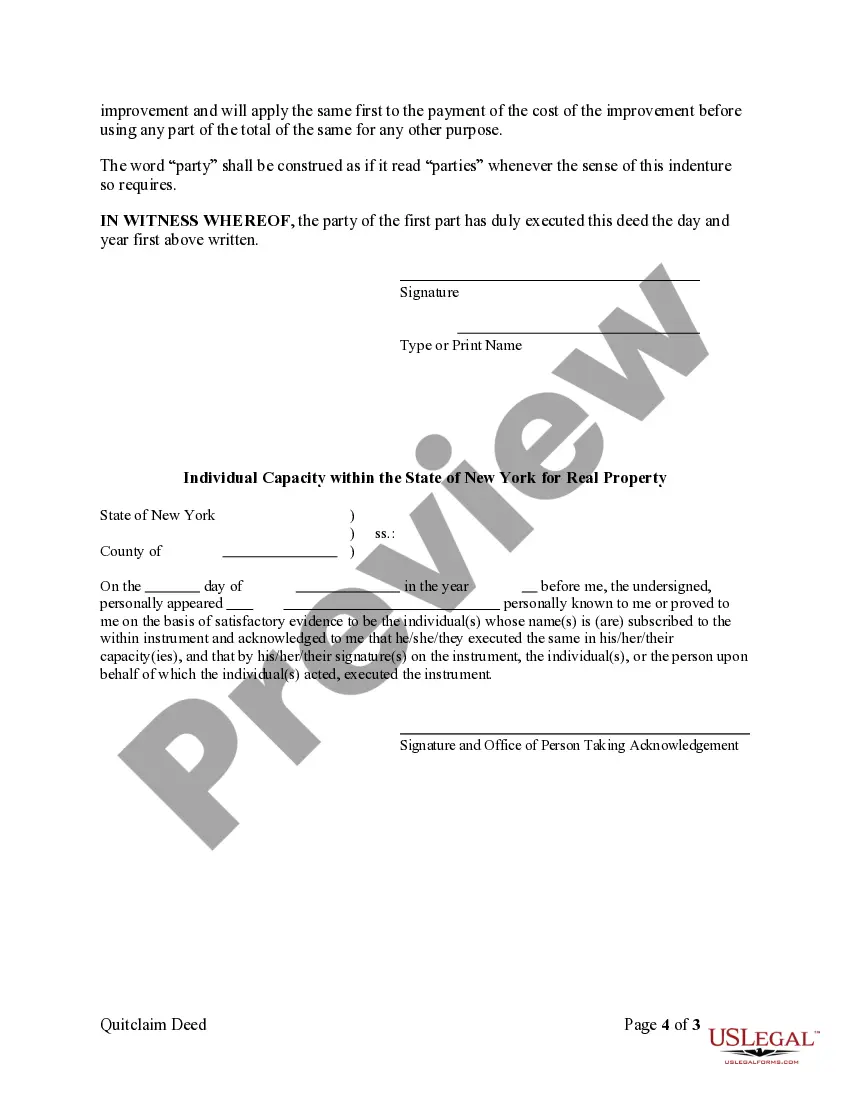

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

For a quitclaim deed to be valid, it has to be recorded at the county recorder's office in the county where the property is located. If you're using an attorney, paralegal or title company to handle the transaction for you, they will take care of this.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.