A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

New York Itemized Statement by Corporation

Description

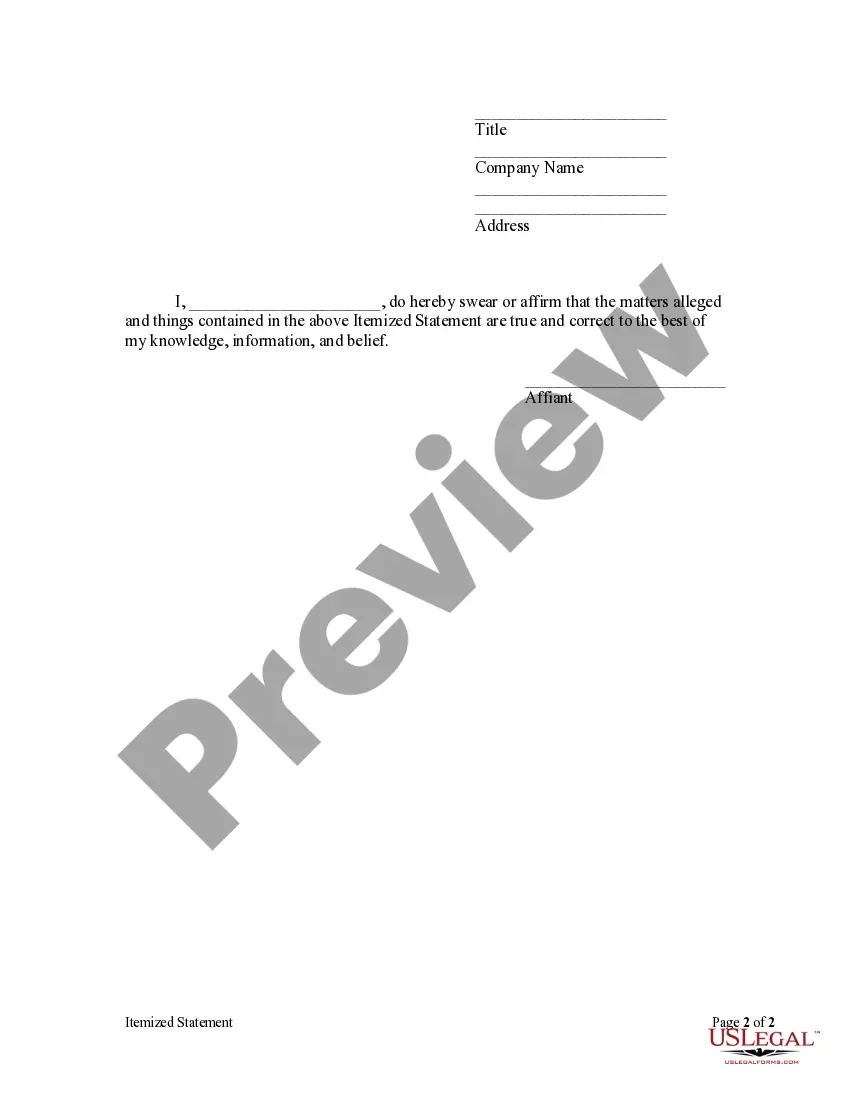

How to fill out New York Itemized Statement By Corporation?

US Legal Forms is a special system where you can find any legal or tax form for submitting, including New York Itemized Statement by Corporation or LLC. If you’re sick and tired of wasting time searching for suitable examples and paying money on record preparation/legal professional charges, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s advantages, you don't need to install any application but just select a subscription plan and create an account. If you already have one, just log in and find an appropriate sample, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have New York Itemized Statement by Corporation or LLC, take a look at the guidelines below:

- check out the form you’re checking out applies in the state you need it in.

- Preview the example and read its description.

- Click Buy Now to reach the register webpage.

- Choose a pricing plan and continue registering by entering some info.

- Decide on a payment method to complete the registration.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain concerning your New York Itemized Statement by Corporation or LLC template, speak to a legal professional to examine it before you send or file it. Get started hassle-free!

Form popularity

FAQ

The Background. Every two years, domestic and foreign corporations are required to file a Biennial Statement with the New York Department of State. This document essentially allows these corporations to maintain their entity status. To file, eligible corporations and Limited Liability Companies (LLCs) must pay a $9 fee

Every NY LLC must have a Registered Agent when it is formed. This is an official position; the Registered Agent is someone who receives official legal and tax correspondence and has responsibility for filing reports with the New York Department of State.

Beginning with tax year 2018, the Tax Law allows you to itemize your deductions for New York State income tax purposes whether or not you itemized your deductions on your federal income tax return.

Yes. Biennial Statements may still be filed online on the Department's website. If the Biennial Statement cannot be filed online, you may request a paper form by contacting the Statement Unit of the Department of State's Division of Corporations. You may contact the Statement Unit by fax at (518) 486-4680 or by E-mail.

Filed with the Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

One of the requirements of maintaining an LLC or corporation in New York is filing a Biennial Statement (sometimes known as a Biennial or Annual Report). The Biennial Statement is used to confirm and update the company's information every other year with the New York Department of State.

Filed with the Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Domestic and foreign business corporations are required by Section 408 of the Business Corporation Law to file a Biennial Statement every two years with the New York Department of State.

In California, a biennial report is a regular filing that your LLC must complete every two years. The report is essentially updating your registered agent address and paying a $20 fee, in addition to a $20 initial statement filing.