New York Closing Statement

Understanding this form

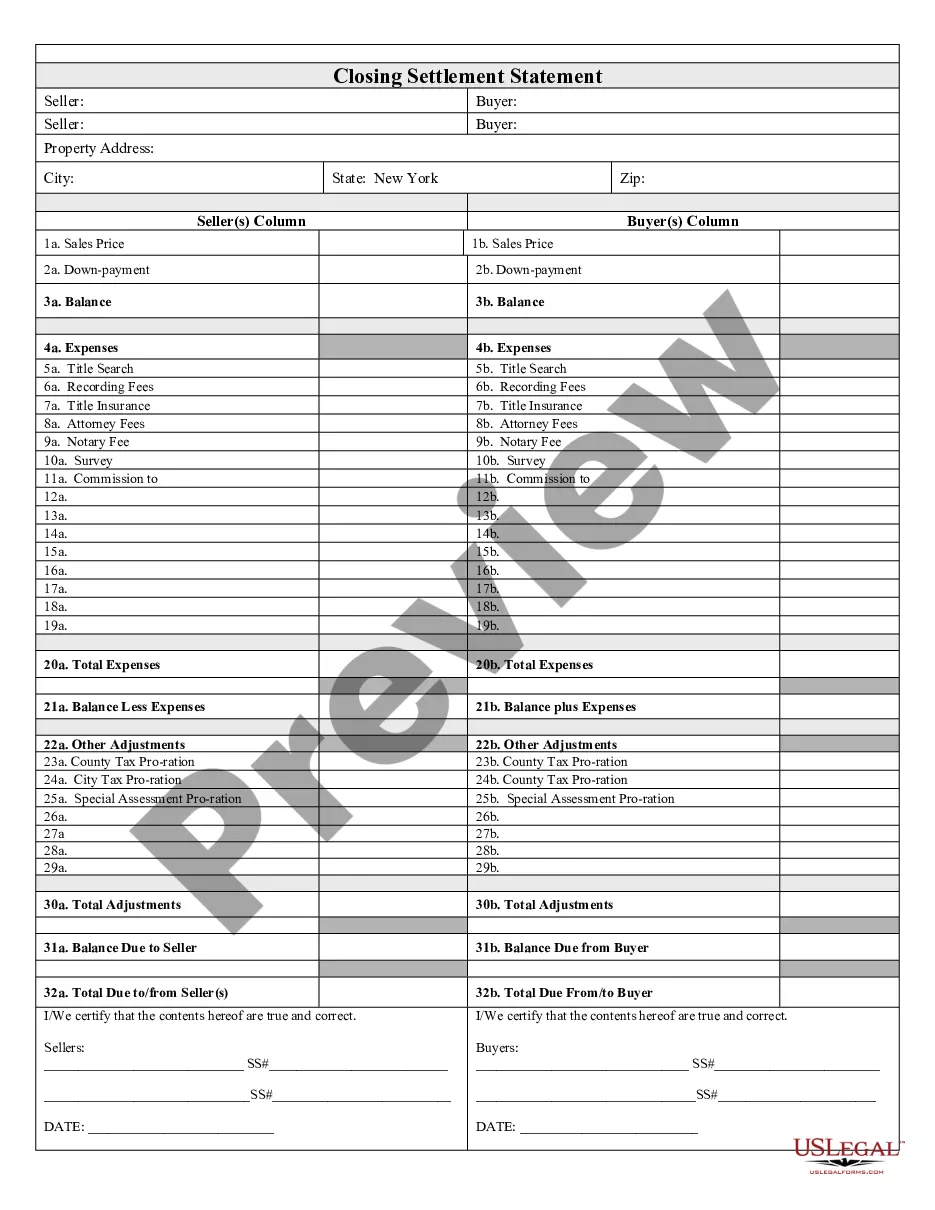

The Closing Statement is a crucial document in real estate transactions that represents the final accounting of the sale. It is used for cash sales or transactions involving owner financing. This legally binding document outlines all financial aspects of the sale, including expenses and balances due, verified and signed by both the buyer and seller. Unlike other real estate forms, the Closing Statement provides a detailed summary of all costs and payments involved in the transaction.

What’s included in this form

- Balance: Final adjusted amounts for both buyer and seller.

- Expenses: A breakdown of all costs incurred during the transaction.

- Title Search: Verification of property ownership and title history.

- Recording Fees: Costs associated with registering the real estate transaction.

- Title Insurance: Details of insurance protecting against title defects.

- Attorney Fees: Charges for legal services rendered during the transaction.

- Commission: Payments to real estate agents involved in the sale.

- Notary Fee: Costs for notarizing the document.

- Adjustments: Adjustments for taxes or special assessments related to the property.

When to use this document

This form is necessary when finalizing a real estate transaction, particularly in cash sales or when owner financing is involved. Use the Closing Statement to ensure all parties understand the financial aspects of the deal, including total expenses and net proceeds for both the buyer and seller. It protects the interests of both parties by providing a transparent accounting of all costs associated with the transaction.

Who this form is for

This form is suitable for:

- Homebuyers and sellers involved in real estate transactions.

- Real estate agents facilitating cash sales or owner-financed deals.

- Attorneys representing either party in a real estate transaction.

How to complete this form

- Identify the parties involved in the transaction: seller and buyer.

- Specify the property details, including the address and legal description.

- List all expenses under the appropriate sections, including title search and insurance.

- Calculate total expenses and settle the amounts due to/from both parties.

- Both seller and buyer must sign and date the form to validate it.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Typical mistakes to avoid

- Failing to include all relevant expenses.

- Incomplete or incorrect signatures from involved parties.

- Not updating adjustments for taxes or additional fees.

Why complete this form online

- Convenience of easy access and downloadable format.

- Editability allows customization to fit specific transaction details.

- Reliability due to attorney-drafted templates ensuring legal compliance.

Key takeaways

- The Closing Statement is essential for documenting financial transactions in real estate sales.

- It must be completed accurately to avoid misunderstandings between parties.

- Proper signatures and dates are crucial for the legal validity of the form.

Form popularity

FAQ

Credits and debits appear on the closing statement. Which of the following will appear as a buyer debit and seller credit at closing?

New York Style Closing (Real Estate Glossary) Summary. A real estate transaction closing in which the transaction parties, their counsel, a representative of the title insurance company, and any other necessary parties convene in person to execute and exchange the closing documents and transfer closing funds.

The Closing Disclosure form is issued at least three days before you sign the mortgage documents. It is a final accounting of your loan's interest rate and fees, mortgage closing costs, your monthly mortgage payment and the grand total of all payments and finance charges.

At closing, the seller will sign documents that transfer the property ownership to you. You will receive documents pertaining to your mortgage agreement and property ownership. You'll also have to pay closing costs and make escrow payments.A deed, which transfers the property from seller to buyer.

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

Average closing costs in New York Across the state, the average home sale price is between $400,000 and $500,000. If you buy a home in that price range, the average closing costs before taxes are $5,612. These fees pay for processing, appraisal and recording fees, plus title insurance, municipal searches and more.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

How will it be shown on the closing statement? this amount will be included in the seller's expenses later under disbursements in the broker's Statement section of the closing statement.

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New