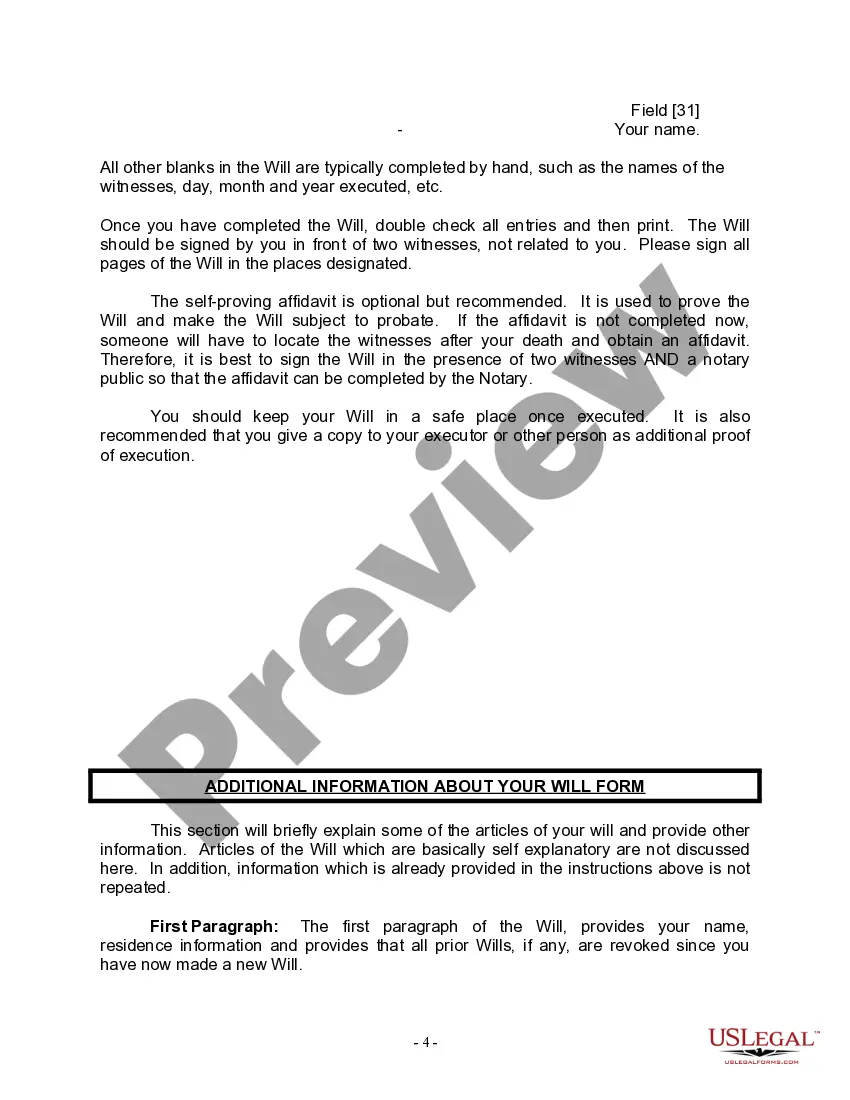

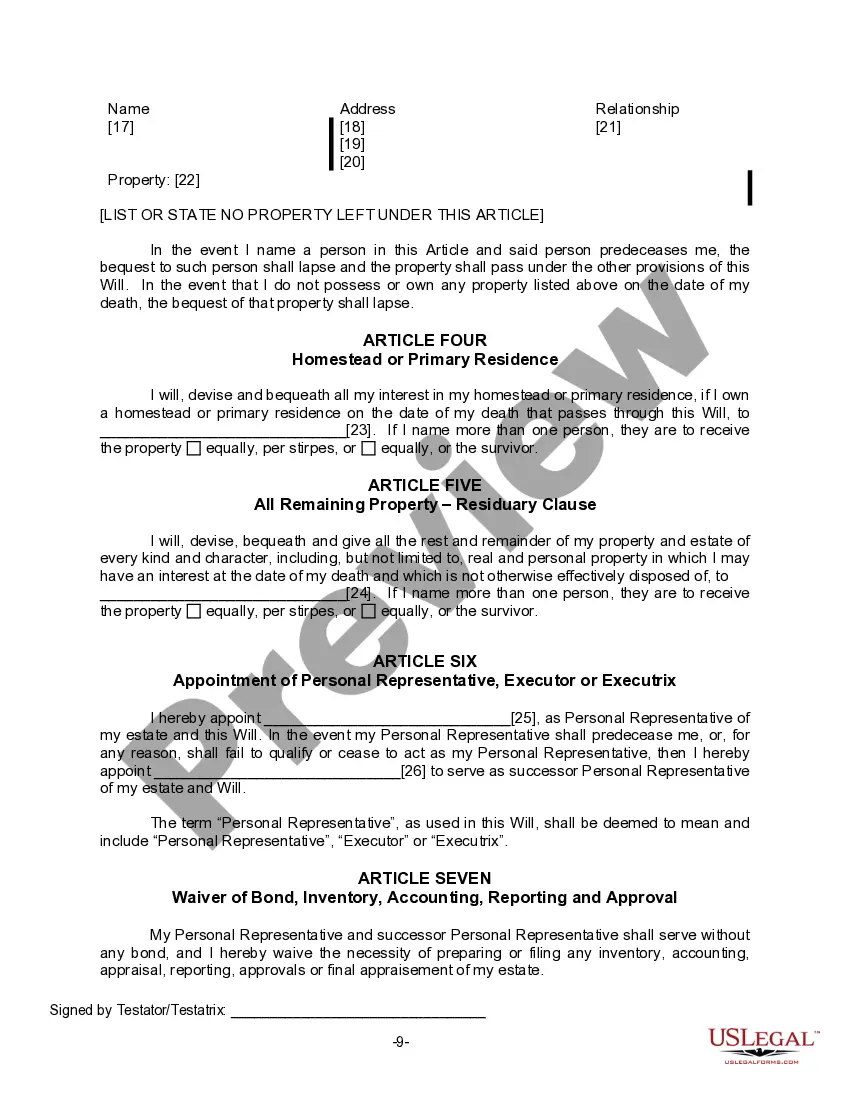

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

New York Last Will for a Widow or Widower with no Children

Description

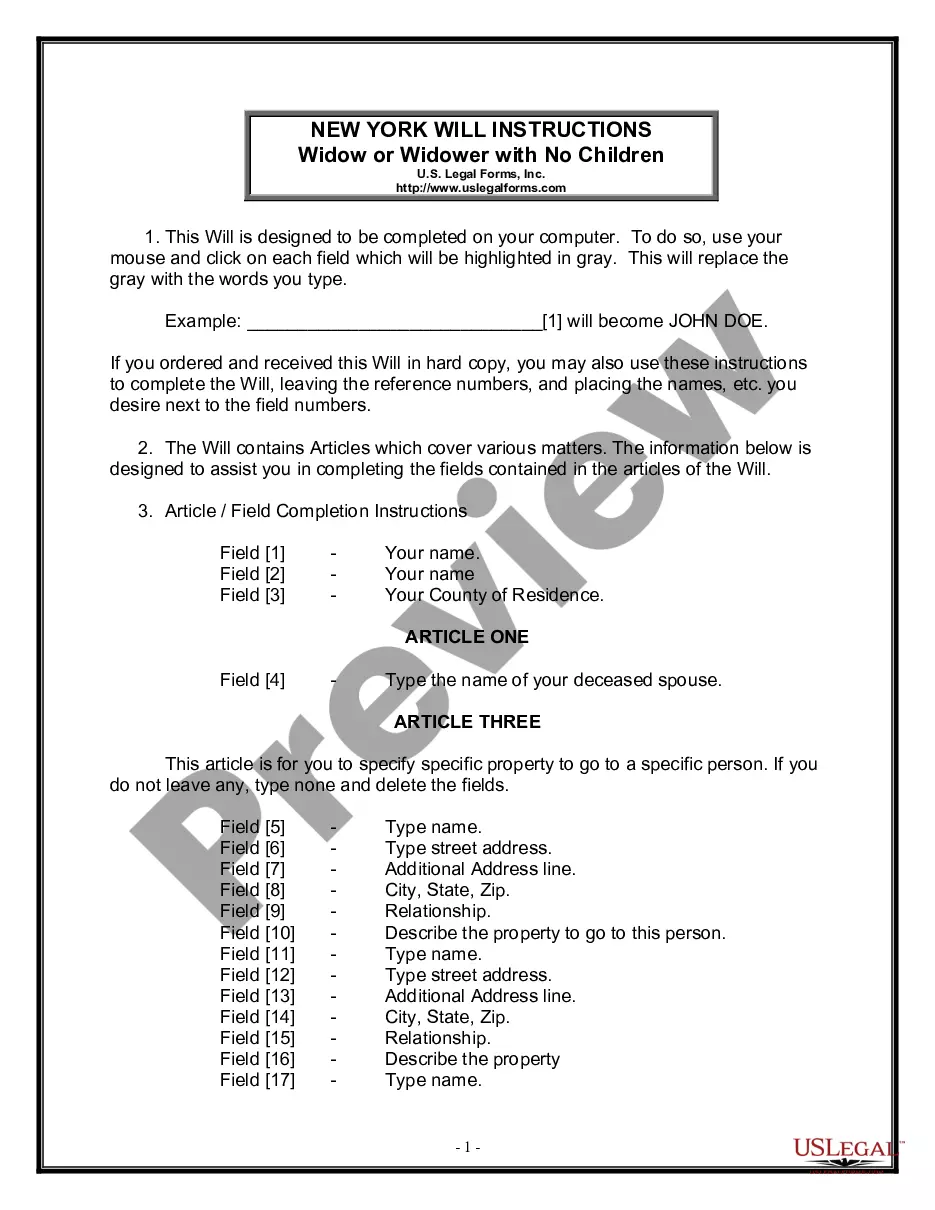

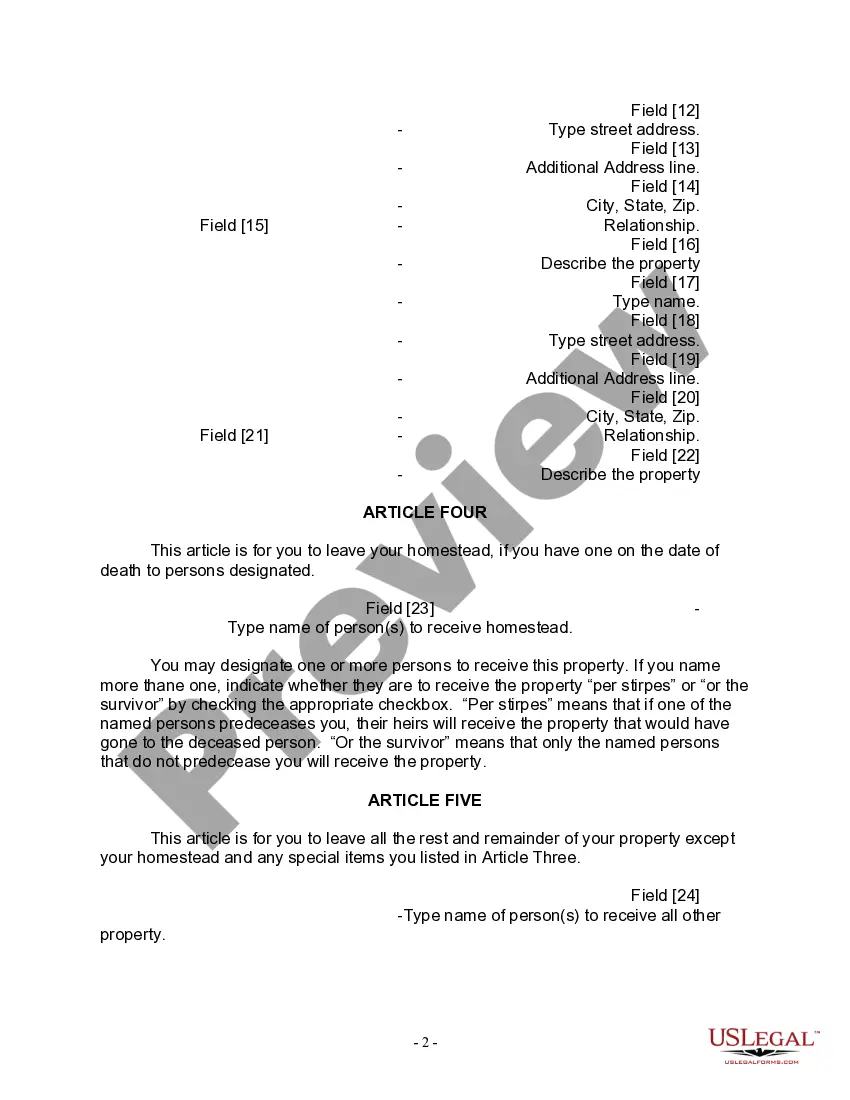

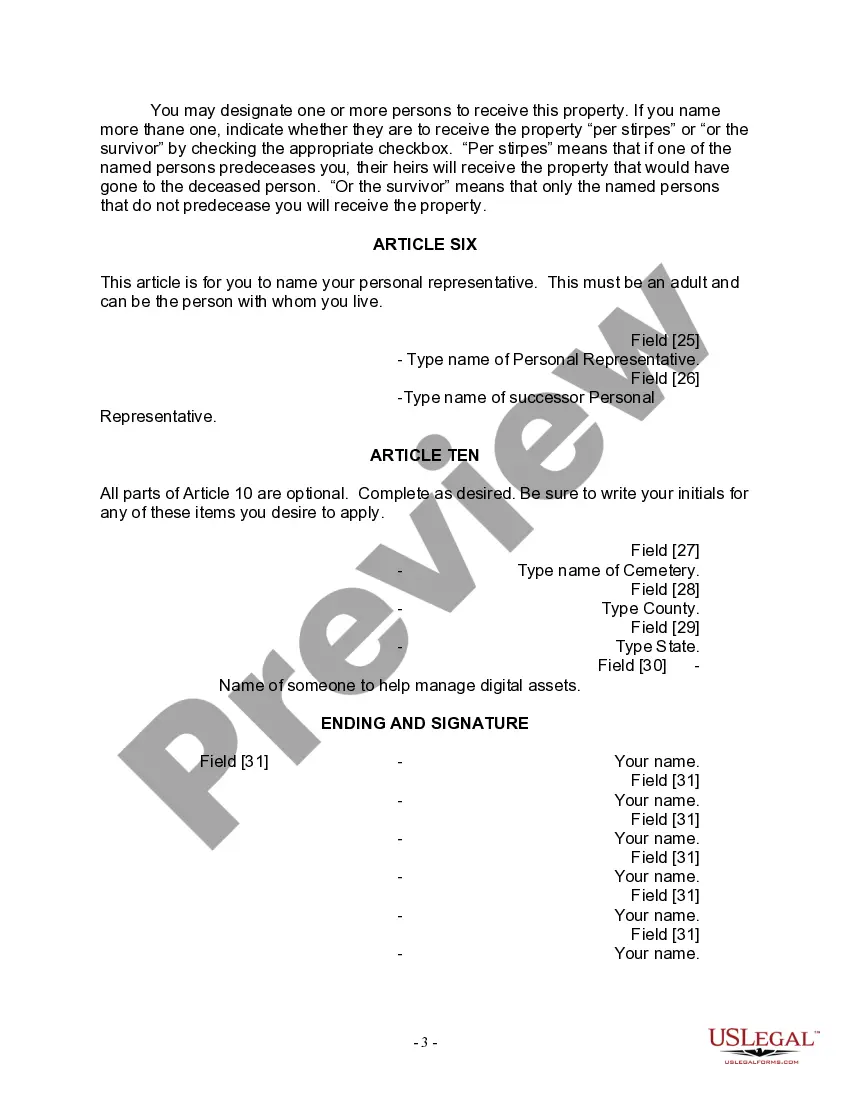

How to fill out New York Last Will For A Widow Or Widower With No Children?

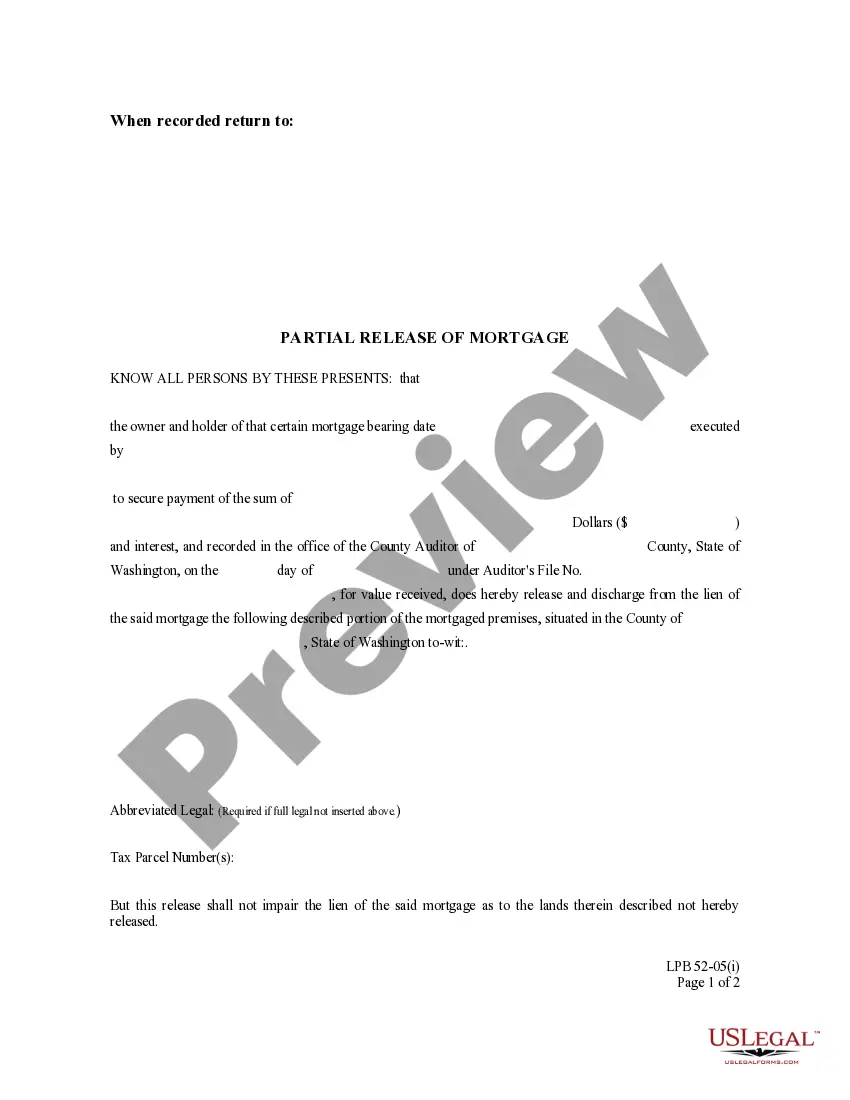

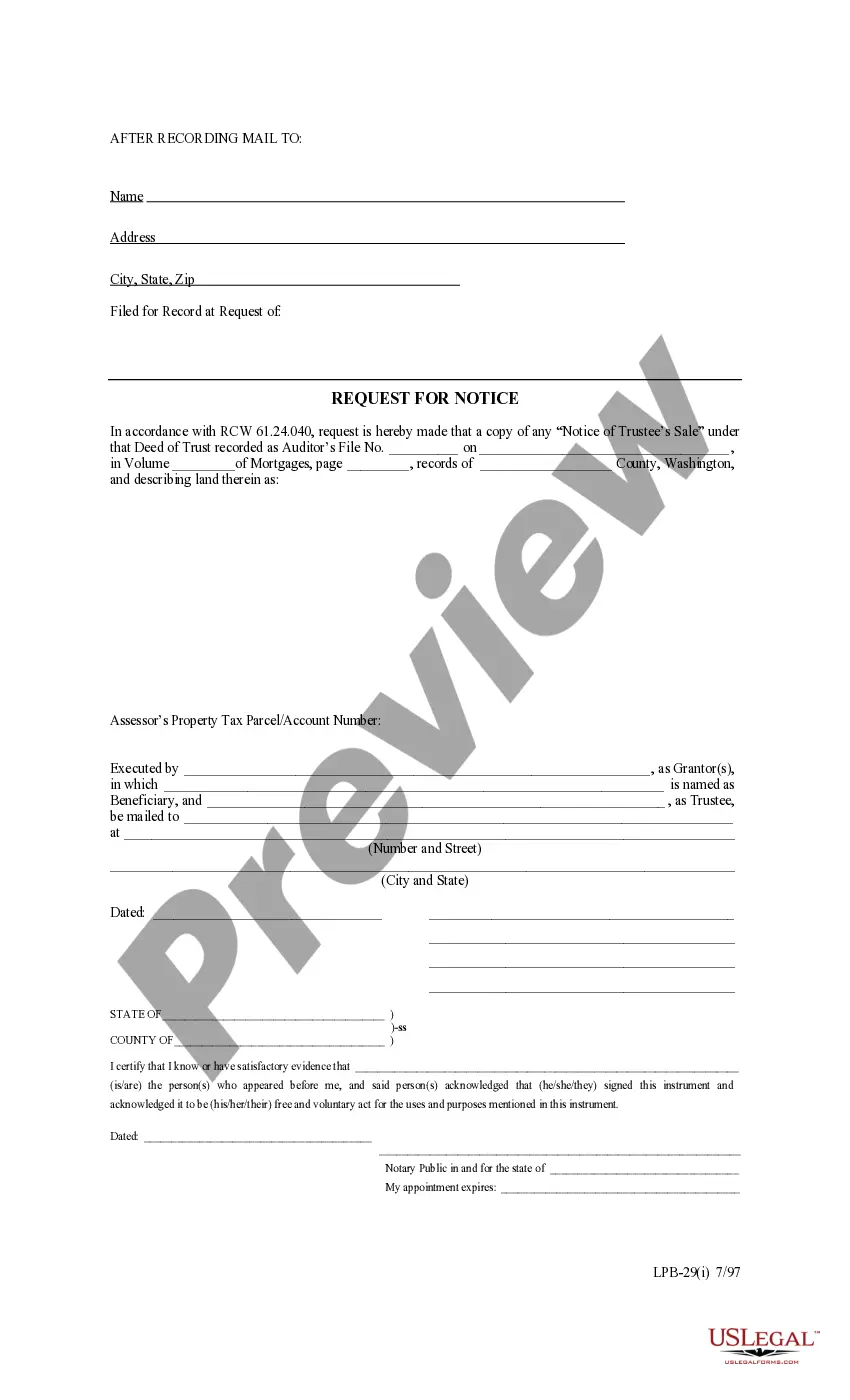

In terms of submitting New York Legal Last Will Form for a Widow or Widower with no Children, you probably visualize a long procedure that involves getting a ideal sample among hundreds of similar ones after which having to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template within clicks.

For those who have a subscription, just log in and click on Download button to get the New York Legal Last Will Form for a Widow or Widower with no Children sample.

In the event you don’t have an account yet but want one, keep to the point-by-point manual listed below:

- Make sure the file you’re downloading is valid in your state (or the state it’s needed in).

- Do this by looking at the form’s description and through clicking on the Preview option (if offered) to find out the form’s content.

- Simply click Buy Now.

- Choose the appropriate plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Professional attorneys draw up our templates to ensure after downloading, you don't have to worry about editing and enhancing content material outside of your personal info or your business’s information. Sign up for US Legal Forms and receive your New York Legal Last Will Form for a Widow or Widower with no Children example now.

Form popularity

FAQ

A qualified widow or widower is a tax filing status that allows a surviving spouse to use the married filing jointly tax rates on an individual return for up to two years following the death of the spouse.

Qualifying widow/widower filing status applies to surviving spouses with dependents. This allows the surviving spouse to file taxes jointly with the deceased spouse. The qualifying widow/widower status applies the standard deduction for a married couple filing jointly.

If you are the widow or widower of a person who worked long enough under Social Security, you can: Receive full benefits at full retirement age for survivors or reduced benefits as early as age 60.

You qualified for married filing jointly with your spouse for the year he or she died. You didn't remarry before the close of the tax year in which your spouse died. You have a child, stepchild, or adopted child you claim as your dependent. You paid more than half the cost of maintaining your home.