This form is a Seller's Disclosure Statement for use in a residential sales transaction in Ohio. This disclosure statement concerns the condition of property and is completed by the Seller.

- US Legal Forms

-

Ohio Residential Real Estate Sales Disclosure Statement

Ohio Residential Real Estate Sales Disclosure Statement

Description

Related forms

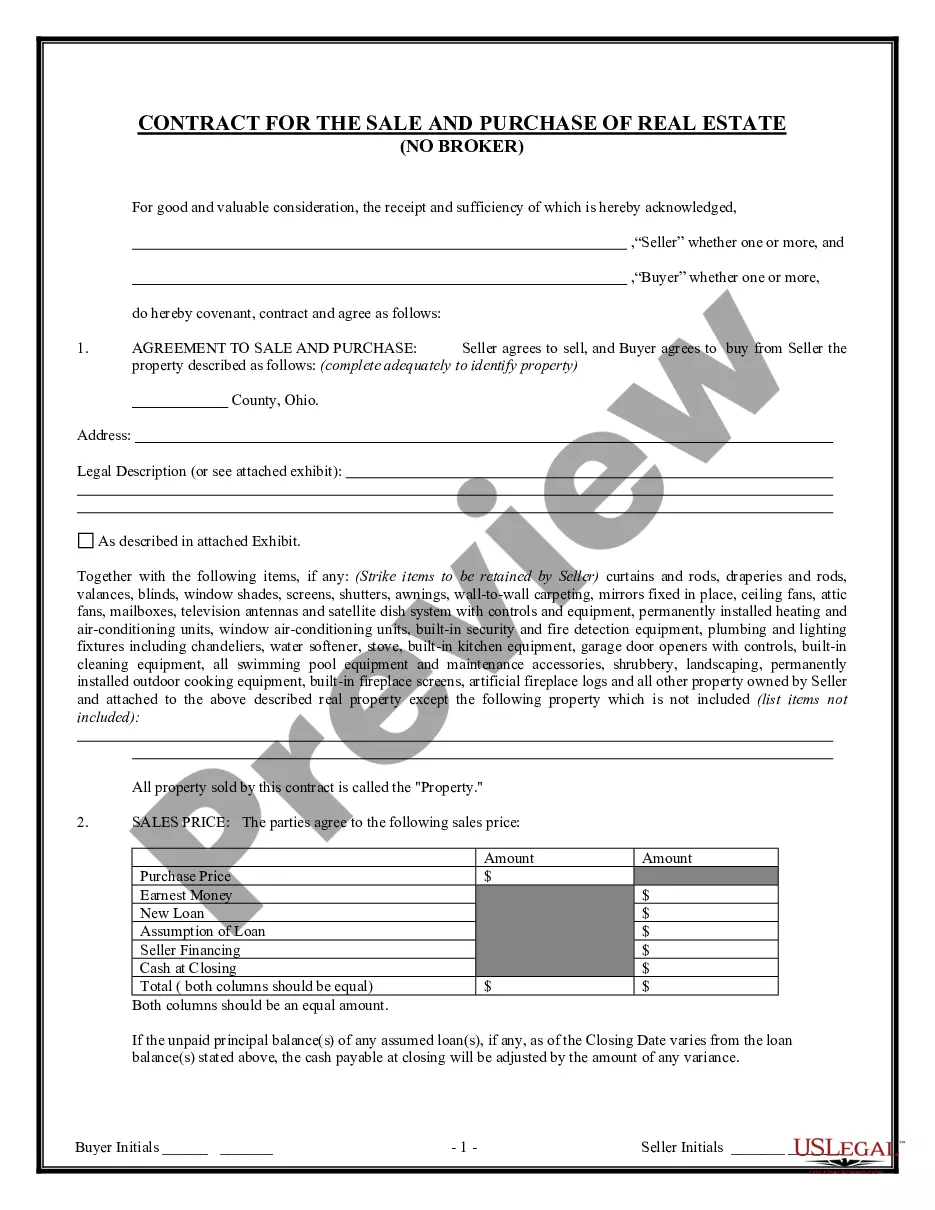

View Contract for Sale and Purchase of Real Estate with No Broker for Residential Home Sale Agreement

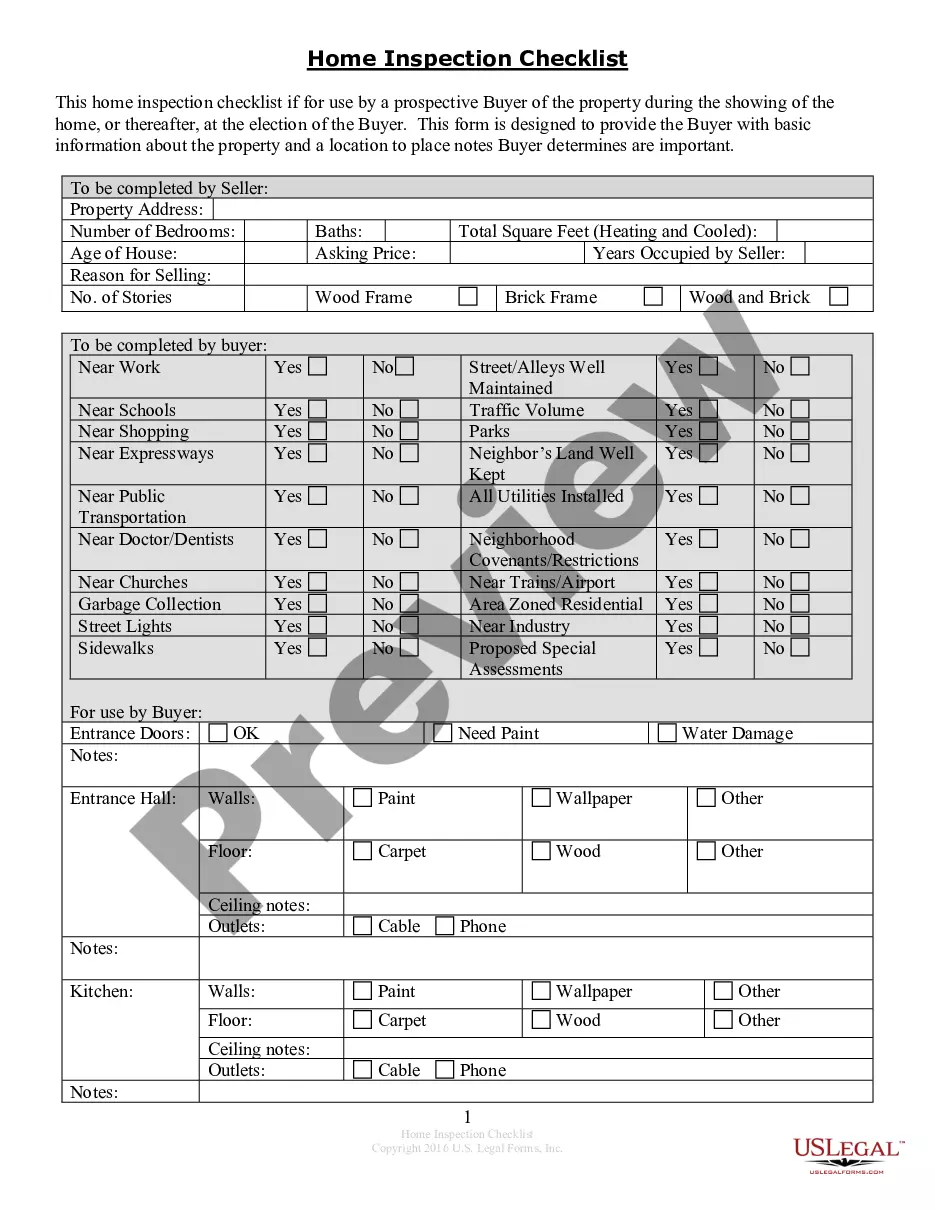

View Buyer's Home Inspection Checklist

View LegalLife Multistate Guide and Handbook for Selling or Buying Real Estate

View Ohio Real Estate Home Sales Package with Offer to Purchase, Contract of Sale, Disclosure Statements and more for Residential House

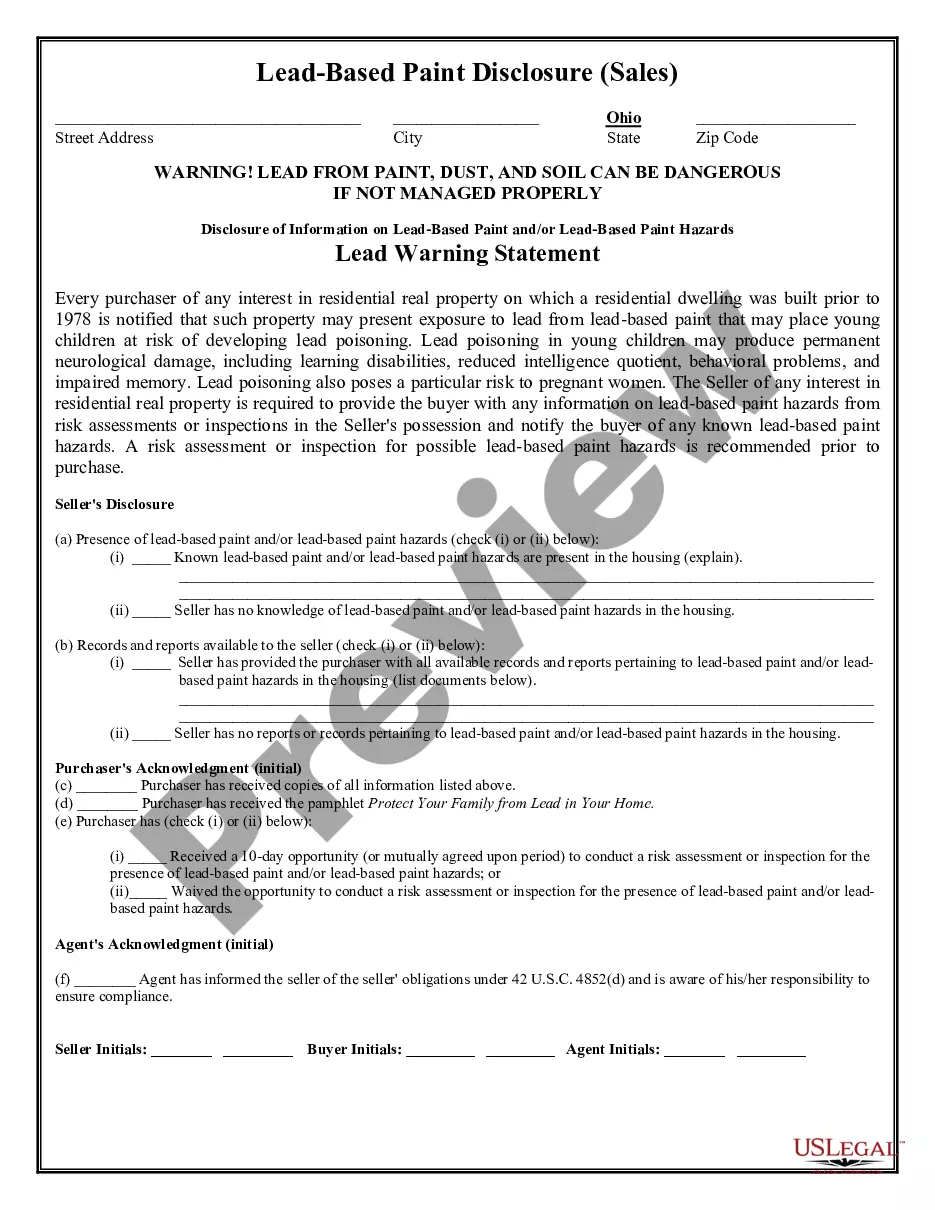

View Lead Based Paint Disclosure for Sales Transaction

View Counterproposal to Contract for the Sale and Purchase of Real Estate

View Agreement to Extend or Amend Contract for the Sale and Purchase of Real Estate

Related legal definitions

How to fill out Ohio Residential Real Estate Sales Disclosure Statement?

In terms of submitting Ohio Residential Real Estate Sales Disclosure Statement, you probably imagine an extensive process that involves choosing a ideal form among a huge selection of similar ones and after that being forced to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific template in a matter of clicks.

For those who have a subscription, just log in and click on Download button to find the Ohio Residential Real Estate Sales Disclosure Statement form.

In the event you don’t have an account yet but need one, follow the point-by-point manual below:

- Be sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and through clicking the Preview option (if offered) to find out the form’s content.

- Click Buy Now.

- Find the appropriate plan for your budget.

- Sign up to an account and select how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Skilled attorneys work on drawing up our samples so that after downloading, you don't need to bother about modifying content outside of your individual information or your business’s info. Be a part of US Legal Forms and receive your Ohio Residential Real Estate Sales Disclosure Statement example now.

Form Rating

Form popularity

FAQ

Ohio disclosure law requires sellers to disclose only those items they actually know about. This means that you aren't required to get an independent inspection to complete the form, only to list what you actually have learned and observed about the house through having lived there and taken care of it.

California's Especially Stringent Disclosure Requirements Sellers must fill out and give the buyers a disclosure form listing a broad range of defects, such as a leaky roof, deaths that occurred within three years on the property, neighborhood nuisances such as a dog that barks every night, and more.

If a seller fails to disclose, or actively conceals, problems that affect the value of the property; they are violating the law, and may be subject to a lawsuit for recovery of damages based on claims of fraud and deceit, misrepresentation and/or breach of contract.

As a general rule, Ohio follows the doctrine of caveat emptor in all real estate transactions, which precludes a purchaser from recovering for a structural defect if: (1) the condition complained of is open to observation or discoverable upon reasonable inspection; (2) the purchaser had the unimpeded opportunity to

In general, as long as any dispute does not affect anything material about the house or property on which it stands, and you're not being asked to disclose information in writing, you shouldn't feel obliged to give a 'warts and all' account of all the problems you've had with a neighbour.

Under Ohio law, in fact, sellers must disclose any material defect about which they are aware before the sale is complete. If you discover a significant defect with your home following the closing, you might be able to seek recovery from the seller in court.

As a seller in California, you must also complete an additional disclosure form, the Natural Hazard Disclosure Report/Statement, prior to any home sale.You will need to include information about all appliances in the home, including which are included in the sale as well as whether they are operational.

Your state and local law will also have additional disclosure requirements. You can also ask a real estate agent or an attorney for a copy of the disclosure law. Your state's Department of Real Estate might also have information about what disclosures are required in your state.

One question all sellers are required by law to answer on the Real Estate Transfer Disclosure Statement is whether there are any neighborhood noise problems or other nuisances. If the answer is yes, the seller must explain that answer in detail.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Ohio

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Ohio Revised Code § 5302.30

(A) As used in this section:

(1) "Good faith" means honesty in fact in a transaction

involving the transfer of residential real property.

(2) "Land installment contract" has the same meaning

as in section 5313.01 of the Revised Code.

(3) "Political subdivision" and "state" have the

same meanings as in section 2744.01 of the Revised Code.

(4) "Residential real property" means real property

that is improved by a building or other structure that has one to four

dwelling units.

(B)

(1) Except as provided in division (B)(2) of this

section, this section applies to any transfer of residential real property

that occurs on or after July 1, 1993, by sale, land installment contract,

lease with option to purchase, exchange, or lease for a term of ninety-nine

years and renewable forever. For purposes of this section, a transfer occurs

when the initial contract for transfer is executed, regardless of when

legal title is transferred, and references in this section to transfer

offers and transfer agreements refer to offers and agreements in respect

of the initial contract for transfer.

(2) This section does not apply to any transfer

of residential real property that is any of the following:

(a) A transfer pursuant

to court order, including, but not limited to, a transfer ordered by a

probate court during the administration of a decedent's estate, a transfer

pursuant to a writ of execution, a transfer by a trustee in bankruptcy,

a transfer as a result of the exercise of the power of eminent domain,

and a transfer that results from a decree for specific performance of a

contract or other agreement between persons;

(b) A transfer to a mortgagee

by a mortgagor by deed in lieu of foreclosure or in satisfaction of the

mortgage debt;

(c) A transfer to a beneficiary

of a deed of trust by a trustor in default;

(d) A transfer by a foreclosure

sale that follows a default in the satisfaction of an obligation secured

by a mortgage;

(e) A transfer by a sale

under a power of sale following a default in the satisfaction of an obligation

that is secured by a deed of trust or another instrument containing a power

of sale;

(f) A transfer by a mortgagee,

or a beneficiary under a deed of trust, who has acquired the residential

real property at a sale conducted pursuant to a power of sale under a mortgage

or a deed of trust or who has acquired the residential real property by

a deed in lieu of foreclosure;

(g) A transfer by a fiduciary

in the course of the administration of a decedent's estate, a guardianship,

a conservatorship, or a trust;

(h) A transfer from one

co-owner to one or more other co-owners;

(i) A transfer made to the

transferor's spouse or to one or more persons in the lineal line of consanguinity

of one or more of the transferors;

(j) A transfer between spouses

or former spouses as a result of a decree of divorce, dissolution of marriage,

annulment, or legal separation or as a result of a property settlement

agreement incidental to a decree of divorce, dissolution of marriage, annulment,

or legal separation;

(k) A transfer to or from

the state, a political subdivision of the state, or another governmental

entity;

(l) A transfer that involves

newly constructed residential real property that previously has not been

inhabited;

(m) A transfer to a transferee

who has occupied the property as a personal residence for one or more years

immediately prior to the transfer;

(n) A transfer from a transferor

who both has not occupied the property as a personal residence within one

year immediately prior to the transfer and has acquired the property through

inheritance or devise.

(C)

Except as provided in division (B)(2) of this section and subject to divisions (E) and (F) of this section, every person who intends to transfer any residential real property on or after July 1, 1993, by sale, land installment contract, lease with option to purchase, exchange, or lease for a term of ninety-nine years and renewable forever shall complete all applicable items in a property disclosure form prescribed under division (D) of this section and shall deliver in accordance with division (I) of this section a signed and dated copy of the completed form to each prospective transferee or his agent as soon as is practicable.

(D)

Prior to July 1, 1993, the director of commerce, by rule adopted in accordance with Chapter 119. of the Revised Code, shall prescribe the disclosure form to be completed by transferors. The form prescribed by the director shall be designed to permit the transferor to disclose material matters relating to the physical condition of the property to be transferred, including, but not limited to, the source of water supply to the property the nature of the sewer system serving the property; the condition of the structure of the property, including the roof, foundation, walls, and floors; the presence of hazardous materials or substances, including lead-based paint, asbestos, urea-formaldehyde foam insulation, and radon gas; and any material defects in the property that are within the actual knowledge of the transferor. The form also shall set forth a statement of the purpose of the form, including statements substantially similar to the following: that the form constitutes a statement of the conditions of the property and of information concerning the property actually known by the transferor; that, unless the transferee is otherwise advised in writing, the transferor, other than having lived at or owning the property, possesses no greater knowledge than that which could be obtained by a careful inspection of the property by a potential transferee; that the statement is not a warranty of any kind by the transferor or by any agent or subagent representing the transferor in this transaction; that the statement is not a substitute for any inspections; that the transferee is encouraged to obtain his/her own professional inspection; that the representations are made by the transferor and are not the representations of the transferor's agent or subagent; and that the form and the representations contained therein are provided by the transferor exclusively to potential transferees in a transfer made by the transferor, and are not made to transferees in any subsequent transfers. The form shall include instructions to the transferor for completing the form, space in which the transferor or transferors shall sign and date the form, and space in which the transferee or transferees shall sign and date the form acknowledging receipt of a copy of the form and stating that the transferee or transferees understand the purpose of the form as stated thereon.

(E)

(1) Each disclosure of an item of information that

is required to be made in the property disclosure form prescribed under

division (D) of this section in connection with particular residential

real property and each act that may be performed in making any disclosure

of an item of information shall be made or performed in good faith.

(2) If an item of information is unknown to the transferor

of residential real property at the time the item is required to be disclosed

in the property disclosure form and if the approximation is not used for

the purpose of circumventing or otherwise evading divisions (C) and (D)

of this section, the transferor may make a good faith approximation of

the item of information.

(F)

(1) A transferor of residential real property is

not liable in damages in a civil action for injury, death, or loss to person

or property that allegedly arises from any error in, inaccuracy of, or

omission of any item of information required to be disclosed in the property

disclosure form if the error, inaccuracy, or omission was not within the

transferor's actual knowledge.

(2) If any item of information that is disclosed

in the property disclosure form is rendered inaccurate after the delivery

of the form to the transferee of residential real property or his agent

as a result of any act, occurrence, or agreement, the subsequent inaccuracy

does not cause, and shall not be construed as causing, the transferor of

the residential real property to be in non-compliance with the requirements

of divisions (C) and (D) of this section.

(G)

Any disclosure of an item of information in the property disclosure form prescribed under division (D) of this section may be amended in writing by the transferor of residential real property at any time following the delivery of the form in accordance with divisions (C) and (I) of this section. The amendment shall be subject to the provisions of this section.

(H)

Except as provided in division (B)(2) of this section, every prospective transferee of residential real property who receives in accordance with division (C) of this section a signed and dated copy of a completed property disclosure form as prescribed under division (D) of this section shall acknowledge his receipt of the form by doing both of the following:

(1) Signing and dating a copy of the form;

(2) Delivering a signed and dated copy of the form

to the transferor or his agent or subagent.

(I)

The transferor's delivery under division (C) of this section of a property disclosure form as prescribed under division (D) of this section and the prospective transferee's delivery under division (H) of this section of an acknowledgment of his receipt of that form shall be made by personal delivery to the other party or his agent or subagent, by ordinary mail or certified mail, return receipt requested, or by facsimile transmission. For the purposes of the delivery requirements of this section, the delivery of a property disclosure form to a prospective co-transferee of residential real property or his agent shall be considered delivery to the other prospective transferees unless otherwise provided by contract.

(J)

The specification of items of information that must be disclosed in the property disclosure form as prescribed under division (D) of this section does not limit or abridge, and shall not be construed as limiting or abridging, any obligation to disclose an item of information that is created by any other provision of the Revised Code or the common law of this state or that may exist in order to preclude fraud, either by misrepresentation, concealment, or nondisclosure in a transaction involving the transfer of residential real property. The disclosure requirements of this section do not bar, and shall not be construed as barring, the application of any legal or equitable defense that a transferor of residential real property may assert in a civil action commenced against the transferor by a prospective or actual transferee of that property.

(K)

(1) Except as provided in division (K)(2) of this

section but subject to divisions (J) and (L) of this section, a transfer

of residential real property that is subject to this section shall not

be invalidated because of the failure of the transferor to provide to the

transferee in accordance with division (C) of this section a completed

property disclosure form as prescribed under division (D) of this section.

(2) Subject to division (K)(3)(c) of this section,

if a transferee of residential real property that is subject to this section

receives a property disclosure form or an amendment of that form as described

in division (G) of this section after the transferee has entered into a

transfer agreement with respect to the property, the transferee, after

his receipt of the form or amendment, may rescind the transfer agreement

in a written, signed, and dated document that is delivered to the transferor

or his agent or subagent in accordance with divisions (K)(3)(a) and (b)

of this section, without incurring any legal liability to the transferor

because of the rescission, including, but not limited to, a civil action

for specific performance of the transfer agreement. Upon the rescission

of the transfer agreement, the transferee is entitled to the return of,

and the transferor shall return, any deposits made by the transferee in

connection with the proposed transfer of the residential real property.

(3) (a) Subject to division (K)(3)(b) of this section,

a rescission of a transfer agreement under division (K)(2) of this section

only may occur if the transferee's written, signed, and dated document

of rescission is delivered to the transferor or his agent or subagent within

three business days following the date on which the transferee or his agent

receives the property disclosure form prescribed under division (D) of

this section or the amendment of that form as described in division (G)

of this section.

(b) A transferee may not

rescind a transfer agreement under division (K)(2) of this section unless

he rescinds the transfer agreement by the earlier of the date that is thirty

days after the date upon which the transferor accepted the transferee's

transfer offer or the date of the closing of the transfer of the residential

real property.

(c) A transferee of residential

real property may waive the right of rescission of a transfer agreement

described in division (K)(2) of this section.

(d) A rescission of a transfer

agreement is not permissible under division (K)(2) of this section if a

transferee of residential real property that is subject to this section

receives a property disclosure form as prescribed under division (D) of

this section or an amendment of that form as described in division (G)

of this section prior to the transferee's submission to the transferor

or his agent or subagent of a transfer offer and the transferee's entry

into a transfer agreement with respect to the property.

(4) If a transferee of residential real property subject to this section

does not receive a property disclosure form from the transferor after the

transferee has submitted to the transferor or his agent or subagent a transfer

offer and has entered into a transfer agreement with respect to the property,

the transferee may rescind the transfer agreement in a written, signed,

and dated document that is delivered to the transferor or his agent or

subagent in accordance with this paragraph, without incurring any legal

liability to the transferor because of the rescission, including, but not

limited to, a civil action for specific performance of the transfer agreement.

Upon the rescission of the transfer agreement, the transferee is entitled

to the return of, and the transferor shall return, any deposits made by

the transferee in connection with the proposed transfer of the residential

real property. A transferee may not rescind a transfer agreement under

this paragraph unless he rescinds the transfer agreement by the earlier

of the date that is thirty days after the date upon which the transferor

accepted the transferee's transfer offer or the date of the closing of

the transfer of the residential real property.

(L)

The right of rescission of a transfer agreement described in division (K)(2) of this section or the absence of that right does not affect, and shall not be construed as affecting, any other legal causes of action or other remedies that a transferee or prospective transferee of residential real property may possess against the transferor of that property.

HISTORY: 144 v S 304. Eff 3-19-93.

Ohio Revised Code § 5302.30

(A) As used in this section:

(1) "Good faith" means honesty in fact in a transaction

involving the transfer of residential real property.

(2) "Land installment contract" has the same meaning

as in section 5313.01 of the Revised Code.

(3) "Political subdivision" and "state" have the

same meanings as in section 2744.01 of the Revised Code.

(4) "Residential real property" means real property

that is improved by a building or other structure that has one to four

dwelling units.

(B)

(1) Except as provided in division (B)(2) of this

section, this section applies to any transfer of residential real property

that occurs on or after July 1, 1993, by sale, land installment contract,

lease with option to purchase, exchange, or lease for a term of ninety-nine

years and renewable forever. For purposes of this section, a transfer occurs

when the initial contract for transfer is executed, regardless of when

legal title is transferred, and references in this section to transfer

offers and transfer agreements refer to offers and agreements in respect

of the initial contract for transfer.

(2) This section does not apply to any transfer

of residential real property that is any of the following:

(a) A transfer pursuant

to court order, including, but not limited to, a transfer ordered by a

probate court during the administration of a decedent's estate, a transfer

pursuant to a writ of execution, a transfer by a trustee in bankruptcy,

a transfer as a result of the exercise of the power of eminent domain,

and a transfer that results from a decree for specific performance of a

contract or other agreement between persons;

(b) A transfer to a mortgagee

by a mortgagor by deed in lieu of foreclosure or in satisfaction of the

mortgage debt;

(c) A transfer to a beneficiary

of a deed of trust by a trustor in default;

(d) A transfer by a foreclosure

sale that follows a default in the satisfaction of an obligation secured

by a mortgage;

(e) A transfer by a sale

under a power of sale following a default in the satisfaction of an obligation

that is secured by a deed of trust or another instrument containing a power

of sale;

(f) A transfer by a mortgagee,

or a beneficiary under a deed of trust, who has acquired the residential

real property at a sale conducted pursuant to a power of sale under a mortgage

or a deed of trust or who has acquired the residential real property by

a deed in lieu of foreclosure;

(g) A transfer by a fiduciary

in the course of the administration of a decedent's estate, a guardianship,

a conservatorship, or a trust;

(h) A transfer from one

co-owner to one or more other co-owners;

(i) A transfer made to the

transferor's spouse or to one or more persons in the lineal line of consanguinity

of one or more of the transferors;

(j) A transfer between spouses

or former spouses as a result of a decree of divorce, dissolution of marriage,

annulment, or legal separation or as a result of a property settlement

agreement incidental to a decree of divorce, dissolution of marriage, annulment,

or legal separation;

(k) A transfer to or from

the state, a political subdivision of the state, or another governmental

entity;

(l) A transfer that involves

newly constructed residential real property that previously has not been

inhabited;

(m) A transfer to a transferee

who has occupied the property as a personal residence for one or more years

immediately prior to the transfer;

(n) A transfer from a transferor

who both has not occupied the property as a personal residence within one

year immediately prior to the transfer and has acquired the property through

inheritance or devise.

(C)

Except as provided in division (B)(2) of this section and subject to divisions (E) and (F) of this section, every person who intends to transfer any residential real property on or after July 1, 1993, by sale, land installment contract, lease with option to purchase, exchange, or lease for a term of ninety-nine years and renewable forever shall complete all applicable items in a property disclosure form prescribed under division (D) of this section and shall deliver in accordance with division (I) of this section a signed and dated copy of the completed form to each prospective transferee or his agent as soon as is practicable.

(D)

Prior to July 1, 1993, the director of commerce, by rule adopted in accordance with Chapter 119. of the Revised Code, shall prescribe the disclosure form to be completed by transferors. The form prescribed by the director shall be designed to permit the transferor to disclose material matters relating to the physical condition of the property to be transferred, including, but not limited to, the source of water supply to the property the nature of the sewer system serving the property; the condition of the structure of the property, including the roof, foundation, walls, and floors; the presence of hazardous materials or substances, including lead-based paint, asbestos, urea-formaldehyde foam insulation, and radon gas; and any material defects in the property that are within the actual knowledge of the transferor. The form also shall set forth a statement of the purpose of the form, including statements substantially similar to the following: that the form constitutes a statement of the conditions of the property and of information concerning the property actually known by the transferor; that, unless the transferee is otherwise advised in writing, the transferor, other than having lived at or owning the property, possesses no greater knowledge than that which could be obtained by a careful inspection of the property by a potential transferee; that the statement is not a warranty of any kind by the transferor or by any agent or subagent representing the transferor in this transaction; that the statement is not a substitute for any inspections; that the transferee is encouraged to obtain his/her own professional inspection; that the representations are made by the transferor and are not the representations of the transferor's agent or subagent; and that the form and the representations contained therein are provided by the transferor exclusively to potential transferees in a transfer made by the transferor, and are not made to transferees in any subsequent transfers. The form shall include instructions to the transferor for completing the form, space in which the transferor or transferors shall sign and date the form, and space in which the transferee or transferees shall sign and date the form acknowledging receipt of a copy of the form and stating that the transferee or transferees understand the purpose of the form as stated thereon.

(E)

(1) Each disclosure of an item of information that

is required to be made in the property disclosure form prescribed under

division (D) of this section in connection with particular residential

real property and each act that may be performed in making any disclosure

of an item of information shall be made or performed in good faith.

(2) If an item of information is unknown to the transferor

of residential real property at the time the item is required to be disclosed

in the property disclosure form and if the approximation is not used for

the purpose of circumventing or otherwise evading divisions (C) and (D)

of this section, the transferor may make a good faith approximation of

the item of information.

(F)

(1) A transferor of residential real property is

not liable in damages in a civil action for injury, death, or loss to person

or property that allegedly arises from any error in, inaccuracy of, or

omission of any item of information required to be disclosed in the property

disclosure form if the error, inaccuracy, or omission was not within the

transferor's actual knowledge.

(2) If any item of information that is disclosed

in the property disclosure form is rendered inaccurate after the delivery

of the form to the transferee of residential real property or his agent

as a result of any act, occurrence, or agreement, the subsequent inaccuracy

does not cause, and shall not be construed as causing, the transferor of

the residential real property to be in non-compliance with the requirements

of divisions (C) and (D) of this section.

(G)

Any disclosure of an item of information in the property disclosure form prescribed under division (D) of this section may be amended in writing by the transferor of residential real property at any time following the delivery of the form in accordance with divisions (C) and (I) of this section. The amendment shall be subject to the provisions of this section.

(H)

Except as provided in division (B)(2) of this section, every prospective transferee of residential real property who receives in accordance with division (C) of this section a signed and dated copy of a completed property disclosure form as prescribed under division (D) of this section shall acknowledge his receipt of the form by doing both of the following:

(1) Signing and dating a copy of the form;

(2) Delivering a signed and dated copy of the form

to the transferor or his agent or subagent.

(I)

The transferor's delivery under division (C) of this section of a property disclosure form as prescribed under division (D) of this section and the prospective transferee's delivery under division (H) of this section of an acknowledgment of his receipt of that form shall be made by personal delivery to the other party or his agent or subagent, by ordinary mail or certified mail, return receipt requested, or by facsimile transmission. For the purposes of the delivery requirements of this section, the delivery of a property disclosure form to a prospective co-transferee of residential real property or his agent shall be considered delivery to the other prospective transferees unless otherwise provided by contract.

(J)

The specification of items of information that must be disclosed in the property disclosure form as prescribed under division (D) of this section does not limit or abridge, and shall not be construed as limiting or abridging, any obligation to disclose an item of information that is created by any other provision of the Revised Code or the common law of this state or that may exist in order to preclude fraud, either by misrepresentation, concealment, or nondisclosure in a transaction involving the transfer of residential real property. The disclosure requirements of this section do not bar, and shall not be construed as barring, the application of any legal or equitable defense that a transferor of residential real property may assert in a civil action commenced against the transferor by a prospective or actual transferee of that property.

(K)

(1) Except as provided in division (K)(2) of this

section but subject to divisions (J) and (L) of this section, a transfer

of residential real property that is subject to this section shall not

be invalidated because of the failure of the transferor to provide to the

transferee in accordance with division (C) of this section a completed

property disclosure form as prescribed under division (D) of this section.

(2) Subject to division (K)(3)(c) of this section,

if a transferee of residential real property that is subject to this section

receives a property disclosure form or an amendment of that form as described

in division (G) of this section after the transferee has entered into a

transfer agreement with respect to the property, the transferee, after

his receipt of the form or amendment, may rescind the transfer agreement

in a written, signed, and dated document that is delivered to the transferor

or his agent or subagent in accordance with divisions (K)(3)(a) and (b)

of this section, without incurring any legal liability to the transferor

because of the rescission, including, but not limited to, a civil action

for specific performance of the transfer agreement. Upon the rescission

of the transfer agreement, the transferee is entitled to the return of,

and the transferor shall return, any deposits made by the transferee in

connection with the proposed transfer of the residential real property.

(3) (a) Subject to division (K)(3)(b) of this section,

a rescission of a transfer agreement under division (K)(2) of this section

only may occur if the transferee's written, signed, and dated document

of rescission is delivered to the transferor or his agent or subagent within

three business days following the date on which the transferee or his agent

receives the property disclosure form prescribed under division (D) of

this section or the amendment of that form as described in division (G)

of this section.

(b) A transferee may not

rescind a transfer agreement under division (K)(2) of this section unless

he rescinds the transfer agreement by the earlier of the date that is thirty

days after the date upon which the transferor accepted the transferee's

transfer offer or the date of the closing of the transfer of the residential

real property.

(c) A transferee of residential

real property may waive the right of rescission of a transfer agreement

described in division (K)(2) of this section.

(d) A rescission of a transfer

agreement is not permissible under division (K)(2) of this section if a

transferee of residential real property that is subject to this section

receives a property disclosure form as prescribed under division (D) of

this section or an amendment of that form as described in division (G)

of this section prior to the transferee's submission to the transferor

or his agent or subagent of a transfer offer and the transferee's entry

into a transfer agreement with respect to the property.

(4) If a transferee of residential real property subject to this section

does not receive a property disclosure form from the transferor after the

transferee has submitted to the transferor or his agent or subagent a transfer

offer and has entered into a transfer agreement with respect to the property,

the transferee may rescind the transfer agreement in a written, signed,

and dated document that is delivered to the transferor or his agent or

subagent in accordance with this paragraph, without incurring any legal

liability to the transferor because of the rescission, including, but not

limited to, a civil action for specific performance of the transfer agreement.

Upon the rescission of the transfer agreement, the transferee is entitled

to the return of, and the transferor shall return, any deposits made by

the transferee in connection with the proposed transfer of the residential

real property. A transferee may not rescind a transfer agreement under

this paragraph unless he rescinds the transfer agreement by the earlier

of the date that is thirty days after the date upon which the transferor

accepted the transferee's transfer offer or the date of the closing of

the transfer of the residential real property.

(L)

The right of rescission of a transfer agreement described in division (K)(2) of this section or the absence of that right does not affect, and shall not be construed as affecting, any other legal causes of action or other remedies that a transferee or prospective transferee of residential real property may possess against the transferor of that property.

HISTORY: 144 v S 304. Eff 3-19-93.