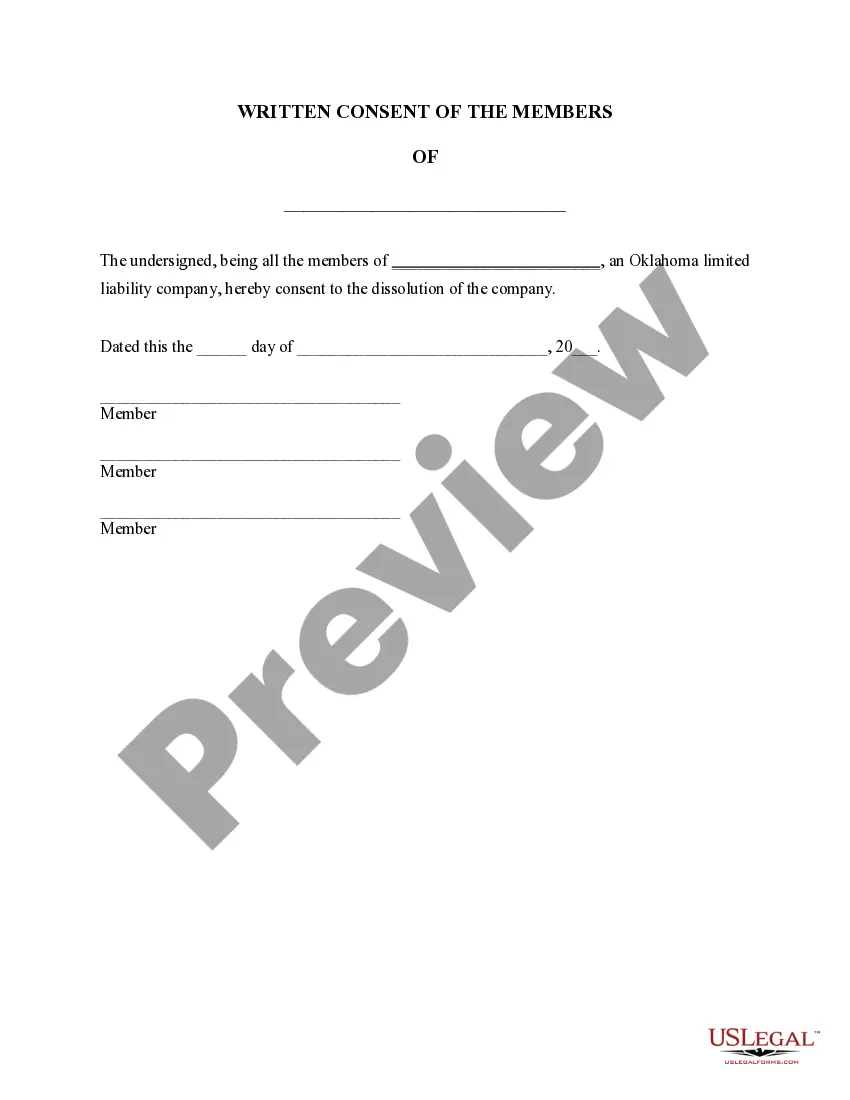

Oklahoma Dissolution Package to Dissolve Limited Liability Company LLC

Description Dissolution Of Llc Oklahoma

How to fill out Oklahoma Dissolution Package To Dissolve Limited Liability Company LLC?

In terms of submitting Oklahoma Dissolution Package to Dissolve Limited Liability Company LLC, you most likely visualize an extensive procedure that involves getting a ideal sample among numerous very similar ones and after that being forced to pay out an attorney to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific document in just clicks.

In case you have a subscription, just log in and click Download to have the Oklahoma Dissolution Package to Dissolve Limited Liability Company LLC form.

If you don’t have an account yet but want one, keep to the point-by-point manual listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and by clicking on the Preview function (if readily available) to see the form’s information.

- Click on Buy Now button.

- Find the appropriate plan for your budget.

- Join an account and select how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional legal professionals work on creating our samples so that after saving, you don't need to worry about editing and enhancing content material outside of your individual details or your business’s info. Join US Legal Forms and get your Oklahoma Dissolution Package to Dissolve Limited Liability Company LLC sample now.

Oklahoma Articles Of Dissolution Form popularity

Oklahoma Limited Liability Company Act Other Form Names

FAQ

Written Resolution. Pay creditors. Distribute to Members. Complete Articles of Dissolution. File with Secretary of State. File with Oklahoma Tax Commission. File with IRS. Unemployment Authority.

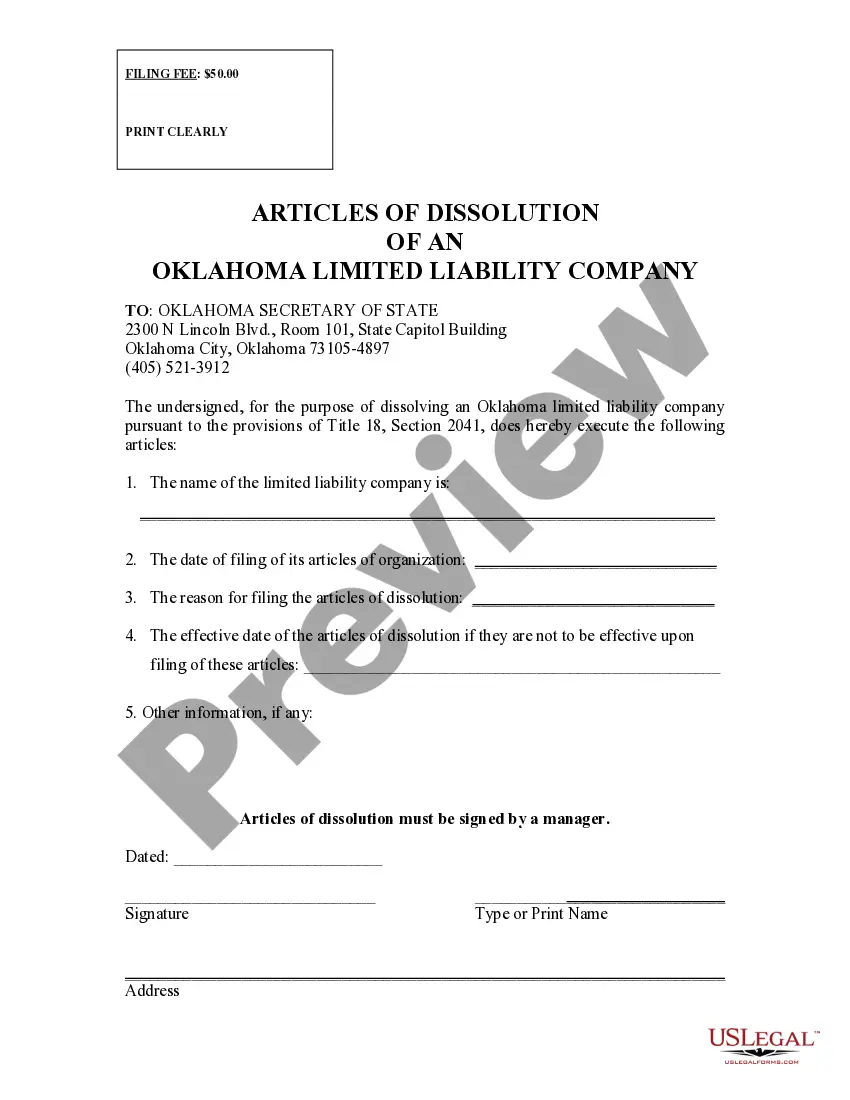

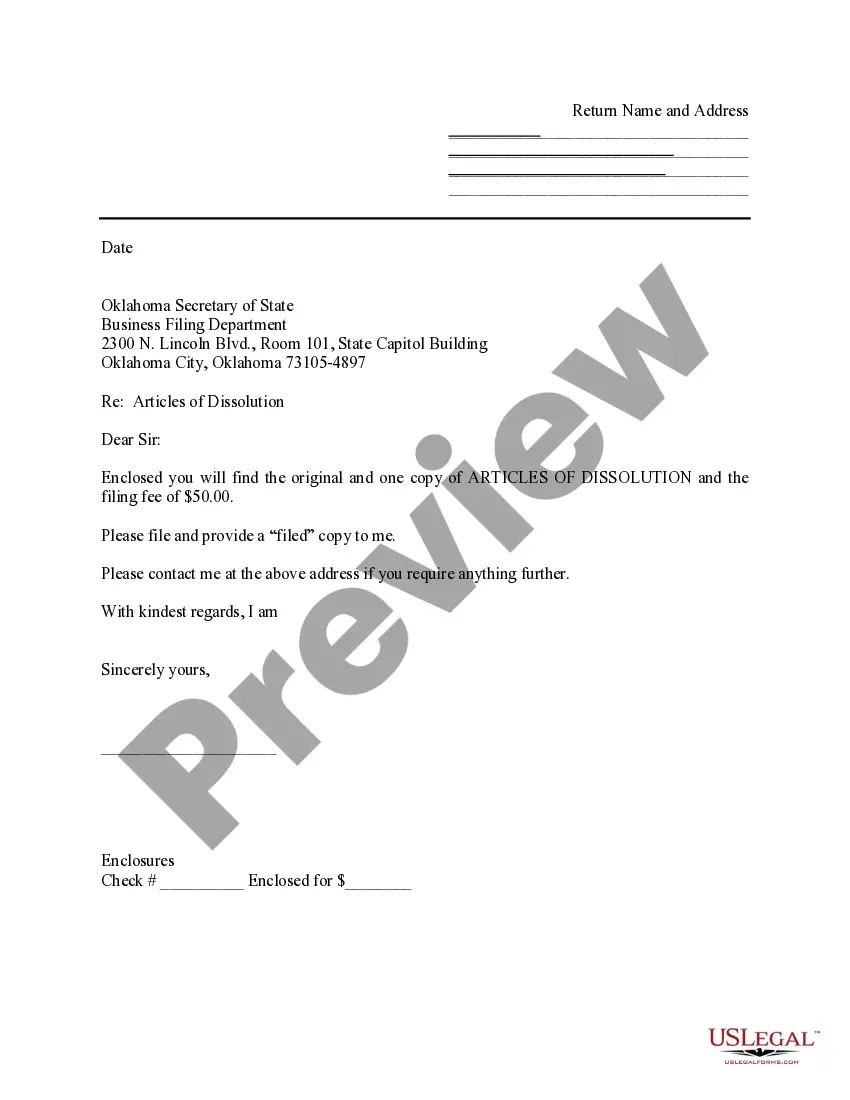

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

Written Resolution. Pay creditors. Distribute to Members. Complete Articles of Dissolution. File with Secretary of State. File with Oklahoma Tax Commission. File with IRS. Unemployment Authority.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.