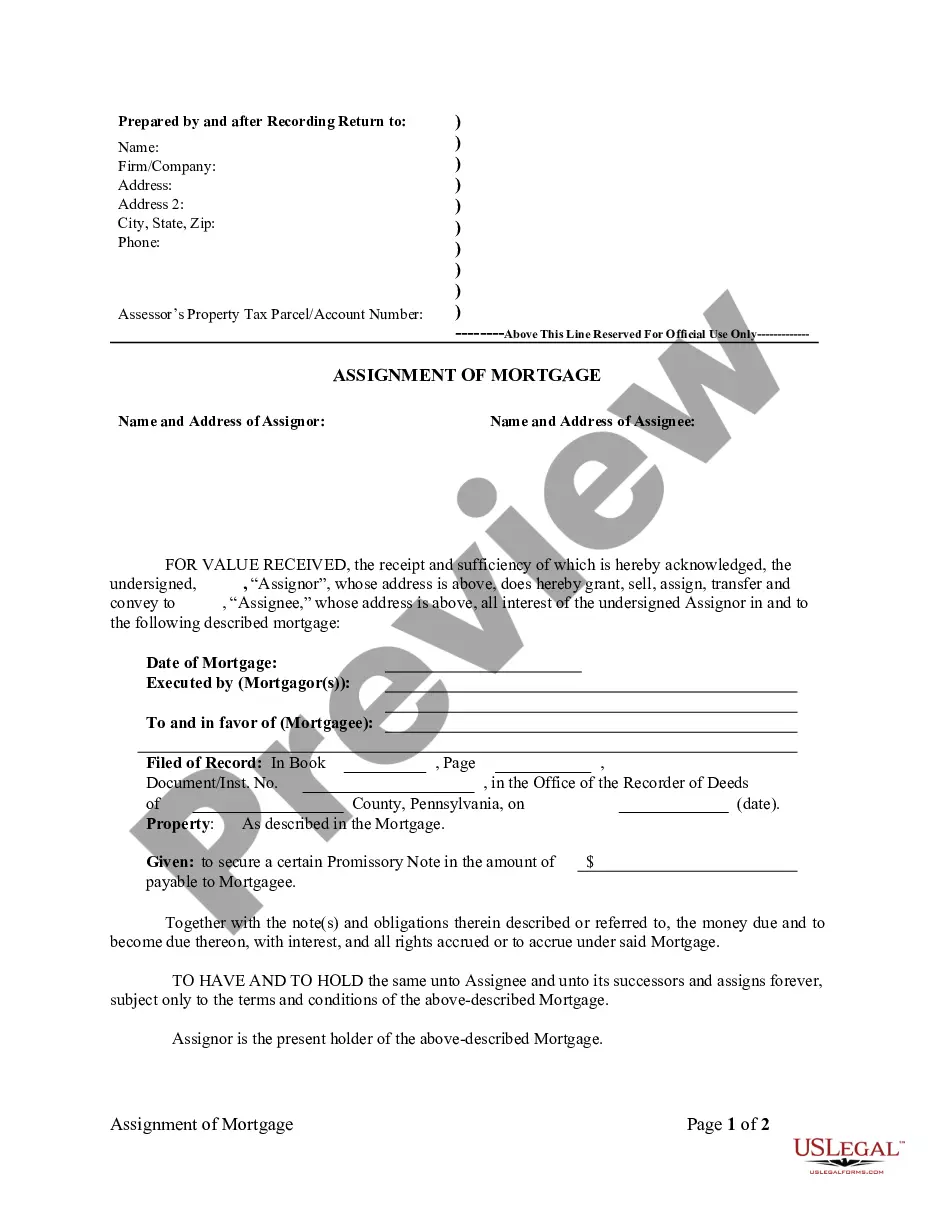

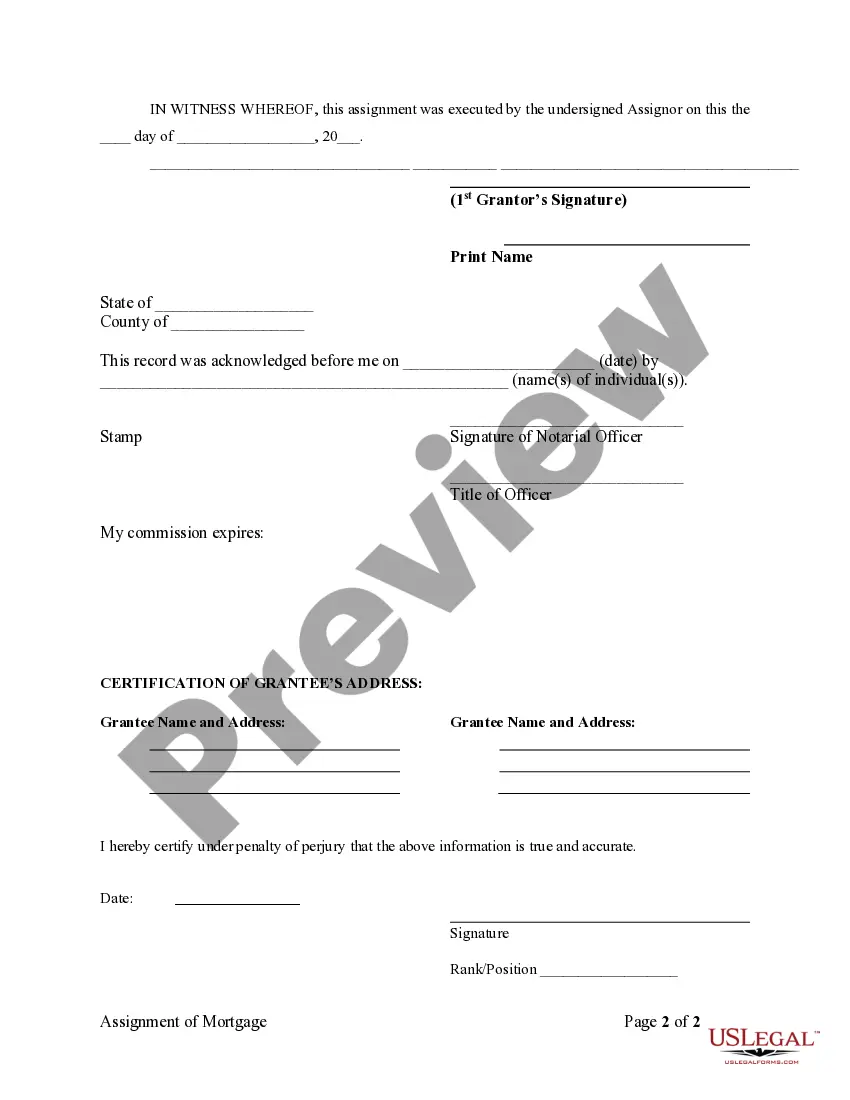

Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder?

The work with papers isn't the most uncomplicated job, especially for those who rarely deal with legal papers. That's why we recommend utilizing correct Pennsylvania Assignment of Mortgage by Individual Mortgage Holder templates made by professional attorneys. It gives you the ability to prevent problems when in court or handling formal institutions. Find the documents you want on our site for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the template webpage. Soon after accessing the sample, it will be stored in the My Forms menu.

Users with no an activated subscription can easily create an account. Look at this short step-by-step guide to get your Pennsylvania Assignment of Mortgage by Individual Mortgage Holder:

- Ensure that the sample you found is eligible for use in the state it is required in.

- Confirm the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this file is what you need or use the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these straightforward actions, it is possible to fill out the form in an appropriate editor. Check the filled in information and consider asking an attorney to review your Pennsylvania Assignment of Mortgage by Individual Mortgage Holder for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

A corrective assignment corrects or amends a defect or mistake in the original assignment.When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

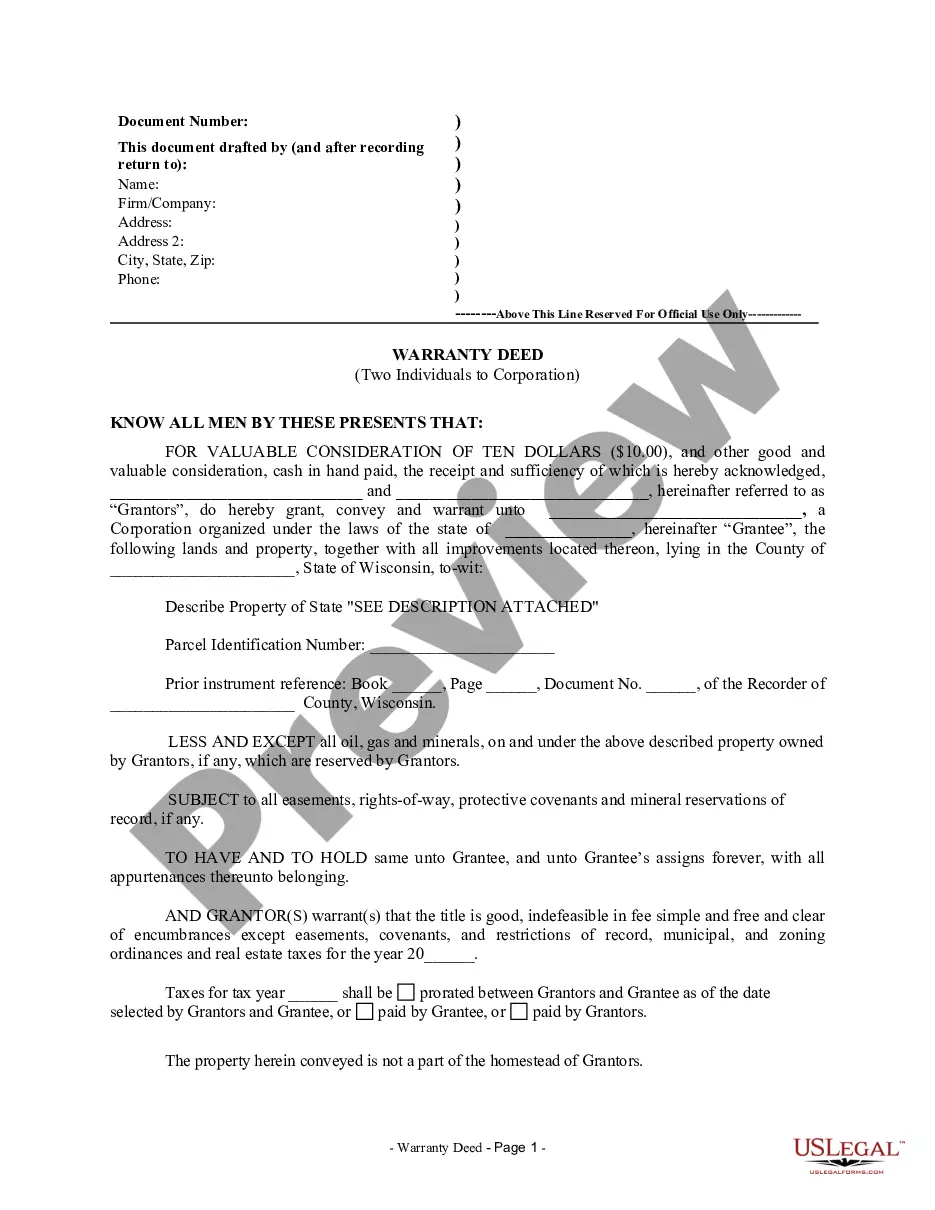

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee).The assignor will still have to perform any obligations it has under the facility agreement.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.