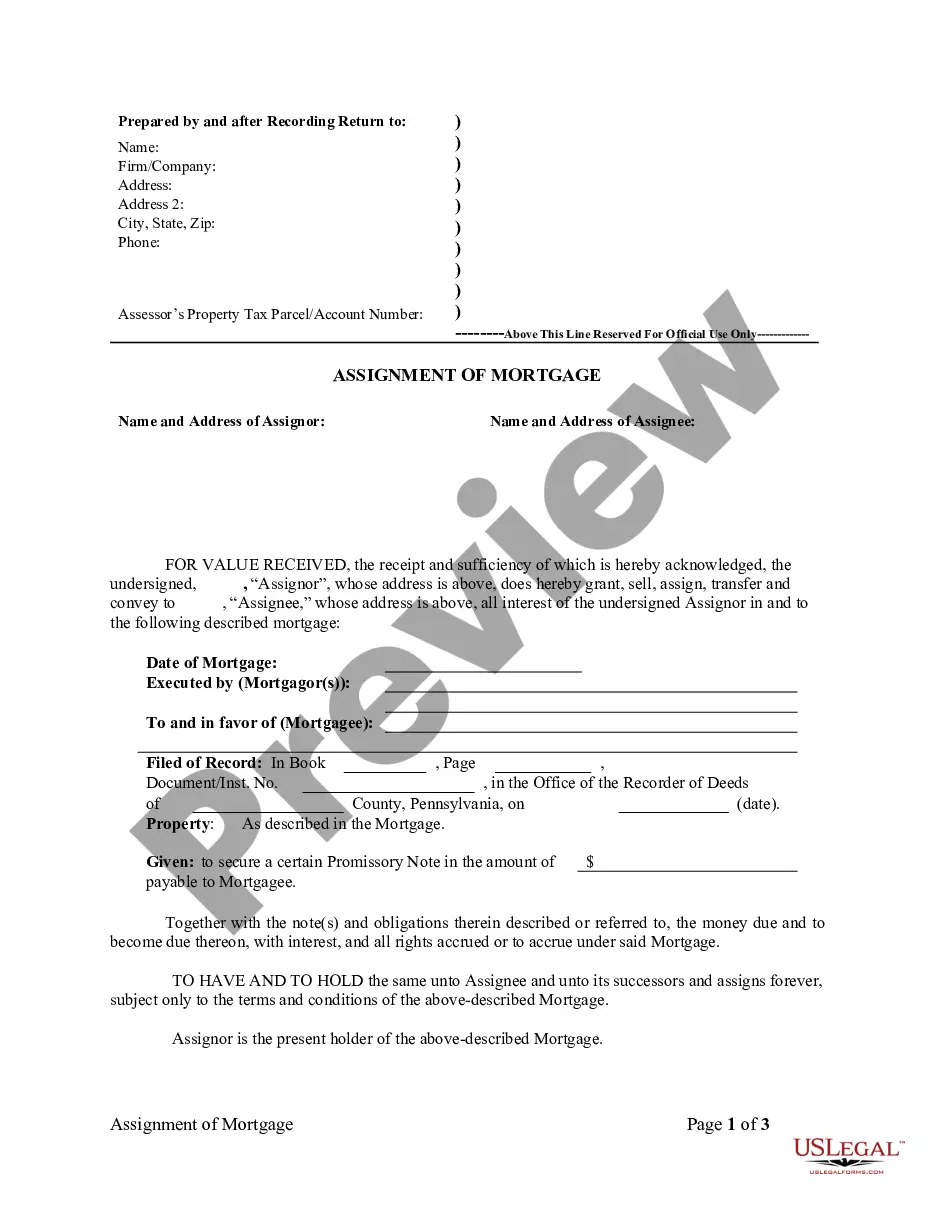

Assignment of Mortgage by Corporate Mortgage Holder

Assignment and Satisfaction of Mortgages

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage

or deed of trust of record to show that the mortgage or deed of trust is

no longer a lien on the property. The general rule is that the satisfaction

must be in proper written format and recorded to provide notice of the

satisfaction. If the lender fails to record a satisfaction within

set time limits, the lender may be responsible for damages set by statute

for failure to timely cancel the lien. Depending on your state, a satisfaction

may be called a Satisfaction, Cancellation, or Reconveyance. Some

states still recognize marginal satisfaction but this is slowly being phased

out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

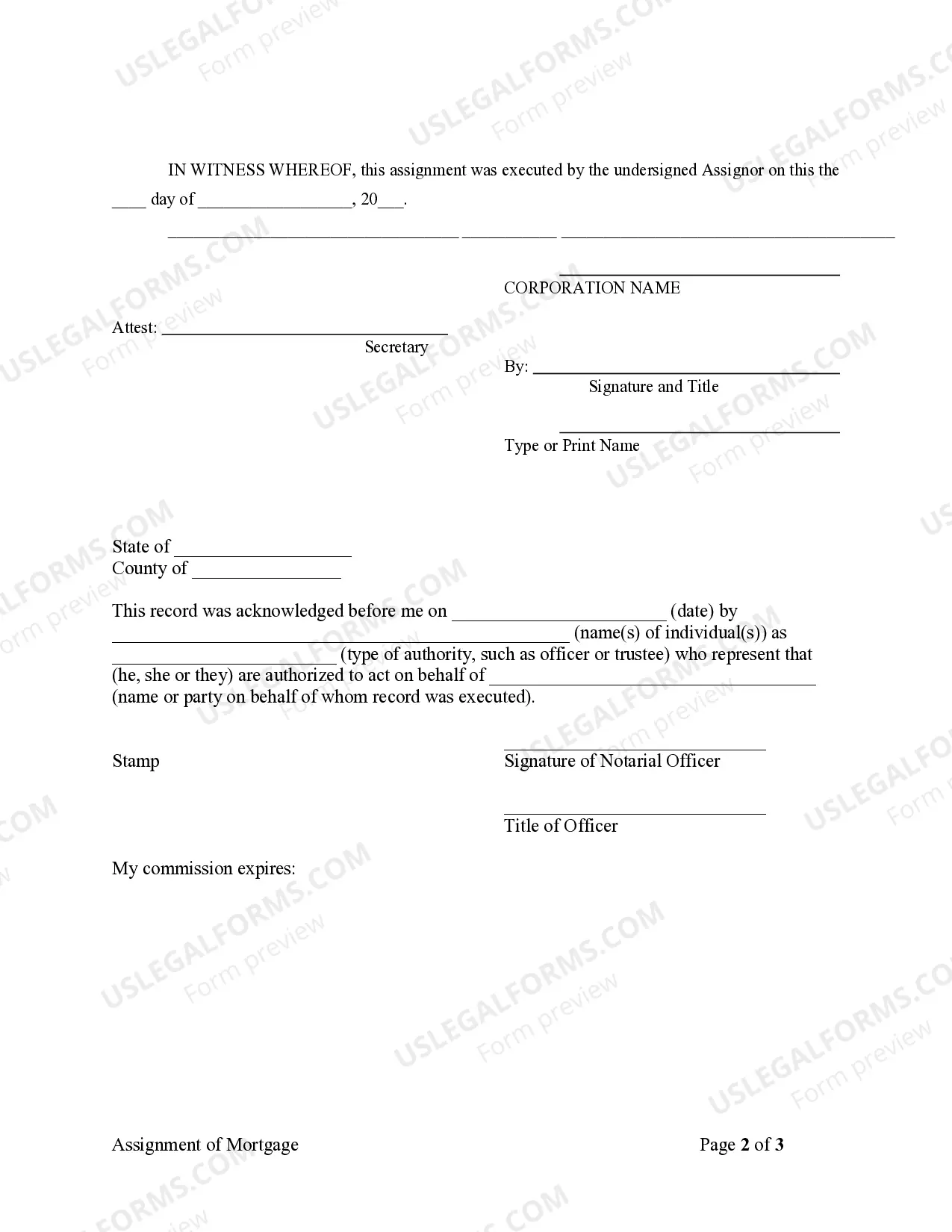

Pennsylvania Statutes

21 P. S. § 623. Assignments and Letters of Attorney.

All assignments of mortgages and letters of attorney authorizing

the satisfaction of mortgages, duly executed and acknowledged, in the

manner provided by law for the acknowledgment of deeds, may be recorded

in the office for recording of deeds, in the county in which the mortgage

assigned or authorized to be satisfied may be or shall have been recorded;

and the record of such instrument, or a duly certified copy thereof, shall

be as good evidence as the original assignment or letter of attorney, when

duly proved in any court of justice.

21 P. S. § 623-1. Assignments to be in writing

Hereafter no assignment of any mortgage shall be entered of record

in any county of the second class, unless such assignment shall be in writing,

and acknowledged by the assignor or assignors before an officer or person

duly authorized to take such acknowledgments.

21 P. S. § 624. Assignments to be entered on margin of record

of mortgage

From and after the passage of this act, it shall be the duty of

the recorders of deeds, of the several counties of this commonwealth, to

enter upon the margin of the record of any mortgages, the book and page

wherein any assignment or assignments of the same are recorded, together

with the date of such assignment, for which service the recorders aforesaid

shall charge and be entitled to receive such fee as is provided by law

unless the recorder of deeds microfilms the mortgages in which case the

assignment shall be recorded without a marginal notation.

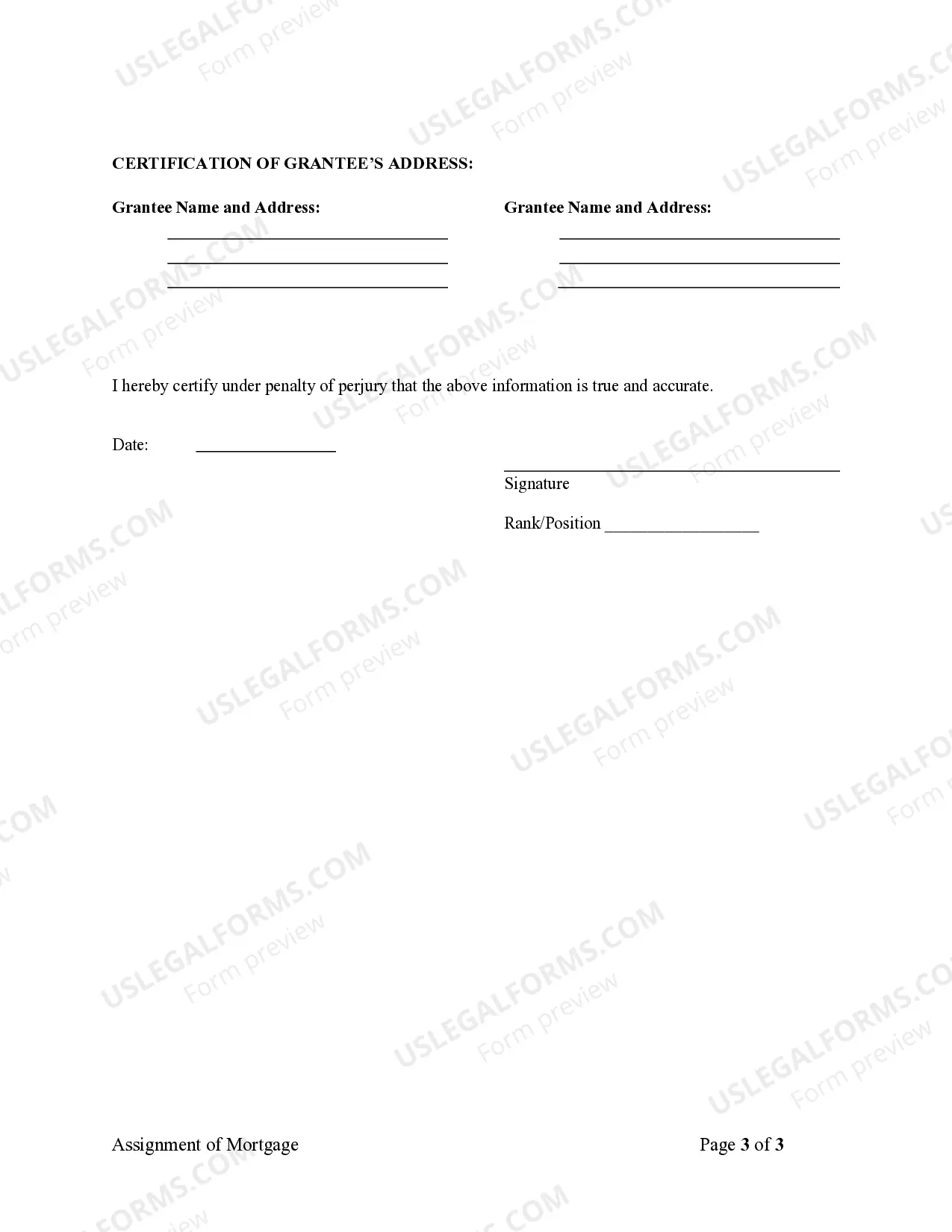

21 P. S. § 625. Certificate of residence of mortgagee or

assignee

For the purpose of obtaining with accuracy the precise residence

of all mortgagees, assignees, and persons to whom interest is payable on

articles of agreement, it shall be the duty of the recorder of deeds in

each county, whenever a mortgage, assignment, or agreement given to secure

the payment of money, shall be presented to him for record, to refuse the

same, unless the said mortgage, assignment, or agreement has attached

thereto, and made part of said mortgage, assignment, or agreement, a certificate

signed by said mortgagee, assignee, or person entitled to interest, or

his, her or their duly authorized attorney or agent, setting forth the

precise residence of such mortgagee, assignee, or person entitled to interest;

said certificate to be recorded with said mortgage, assignment, or agreement;

and therefrom the said recorder shall prepare and deliver, at stated intervals,

to the proper Board of Revision of Taxes, or other officials charged with

the assessment of State tax, a list of said mortgages, assignments, and

agreements, with the names and residences of said mortgagees, assignees,

or persons entitled to interest, with the amount and date of said mortgages,

assignments, and articles of agreement, with the date of recording and

the properties upon which the debts are secured.

21 P. S. § 681. Satisfaction of mortgage on margin of record

or by satisfaction piece

Any mortgagee of any real or personal estates in the Commonwealth,

having received full satisfaction and payment of all such sum and sums

of money as are really due to him by such mortgage, shall, at the request

of the mortgagor, enter satisfaction either upon the margin of the

record of such mortgage recorded in the said office or by means of a satisfaction

piece, which shall forever thereafter discharge, defeat and release

the same; and shall likewise bar all actions brought, or to be brought

thereupon.

21 P. S. § 682. Fine for neglect

And if such mortgagee, by himself or his attorney, shall

not, within forty-five days after request and tender made for

his reasonable charges, return to the said office, and there make such

acknowledgment as aforesaid, he, she or they, neglecting so to do, shall

for every such offence, forfeit and pay, unto the party or parties aggrieved,

any sum not exceeding the mortgage-money, to be recovered in any Court

of Record within this Commonwealth, by bill, complaint or information.

21 P. S. § 705. Notice requirement

A bank, savings bank, savings and loan association or other lending

institution holding a residential mortgage shall send written

notification by first class mail to the mortgagor when the mortgage has

been fully paid. Any moneys remaining in any escrow account established

for the payment of taxes or insurance premiums shall be returned within

30 days to the mortgagor.