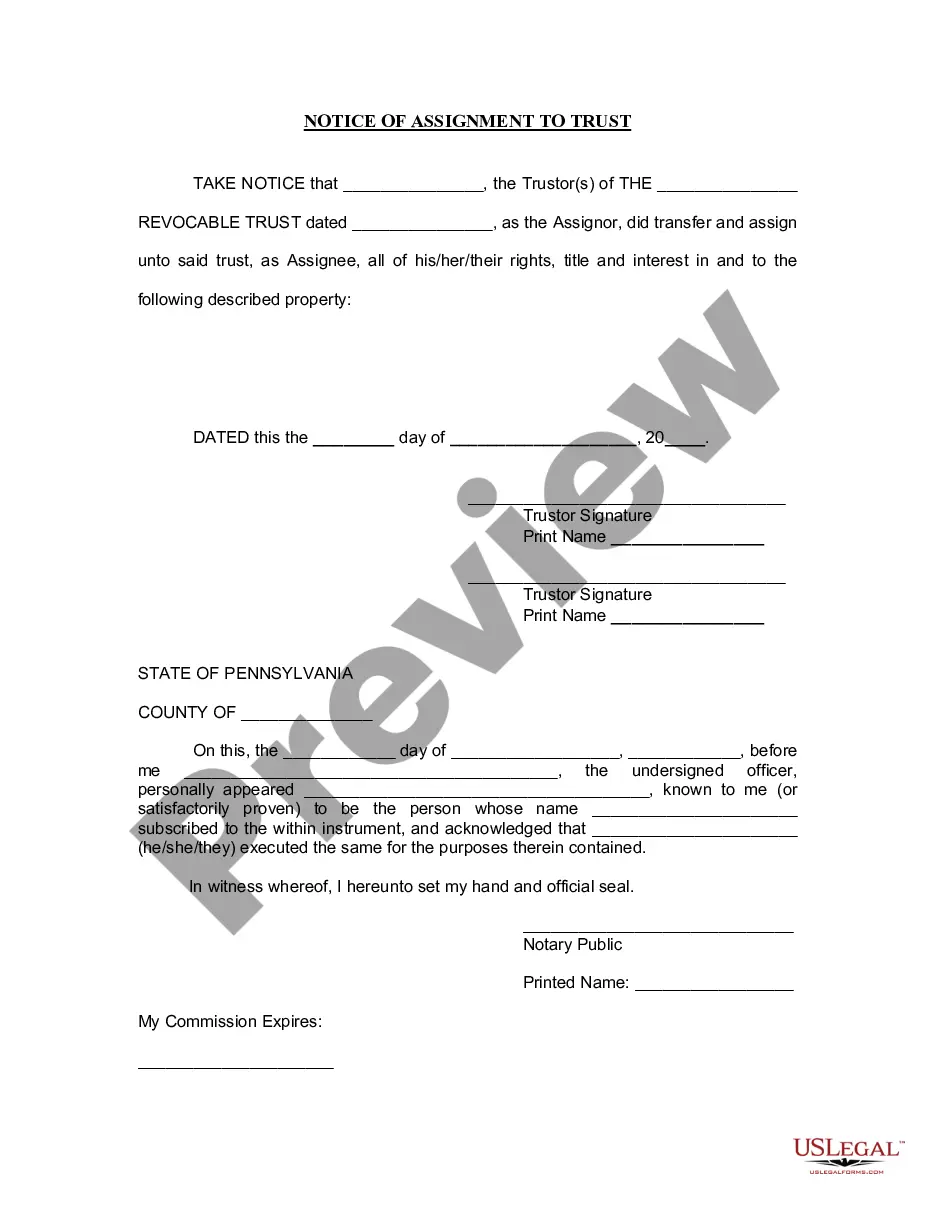

Pennsylvania Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Pennsylvania Notice Of Assignment To Living Trust?

Creating documents isn't the most uncomplicated task, especially for those who almost never deal with legal paperwork. That's why we advise utilizing accurate Pennsylvania Notice of Assignment to Living Trust templates made by skilled lawyers. It allows you to stay away from problems when in court or handling formal institutions. Find the templates you need on our website for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template web page. After downloading the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily create an account. Utilize this short step-by-step guide to get your Pennsylvania Notice of Assignment to Living Trust:

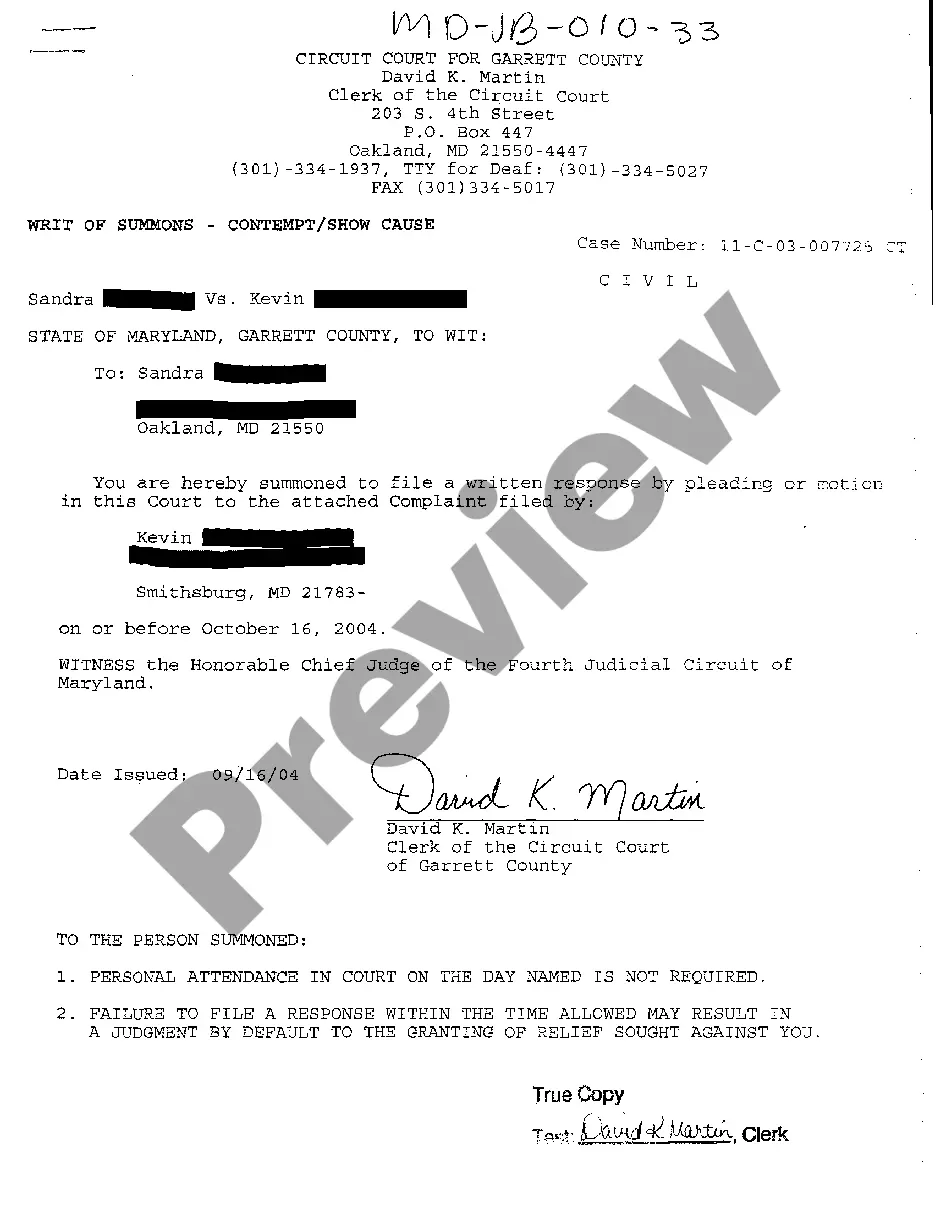

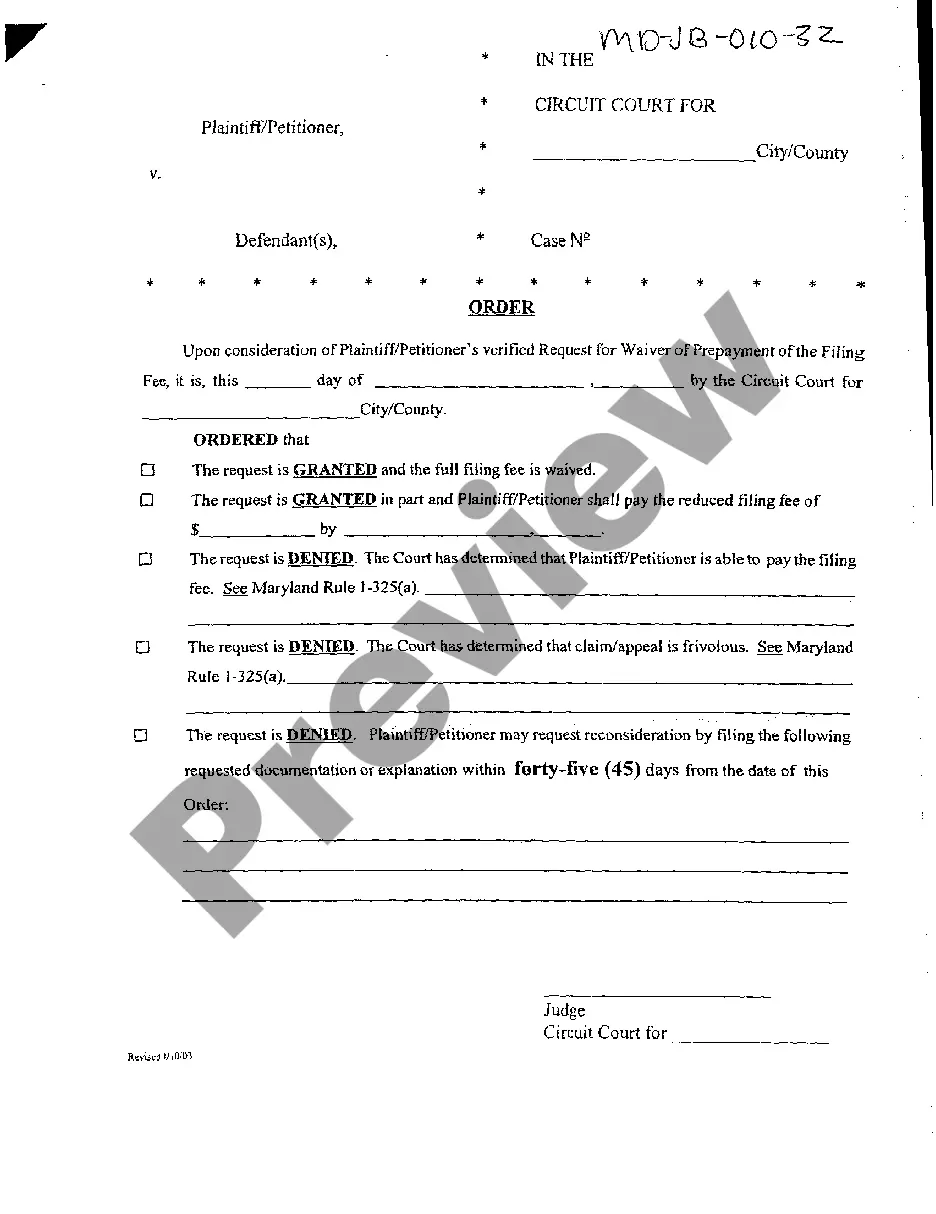

- Make sure that the form you found is eligible for use in the state it’s needed in.

- Verify the file. Make use of the Preview option or read its description (if readily available).

- Click Buy Now if this form is the thing you need or return to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After completing these simple actions, you are able to fill out the form in your favorite editor. Recheck filled in info and consider requesting a lawyer to review your Pennsylvania Notice of Assignment to Living Trust for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

Select the trust that best fits your financial situation. Determine which property and assets you want to include in the trust. Select a trustee to manage your living trust. Create the trust document. Sign the trust while a notary public is present. Fund the trust by transferring property into it.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Most people can create a living trust without an attorney using software or an online service.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.