Pennsylvania Partial Release of Property From Mortgage by Individual Holder

Description

Key Concepts & Definitions

Partial Release of Property from Mortgage: This process allows a borrower to remove a part of the collateral (property) that is securing a mortgage, subject to the lenders agreement. Real Property: Involves land and anything permanently affixed to the land, like buildings. Mortgage Loan: A loan secured by the collateral of some specified real estate property that the borrower is obliged to pay back with a predetermined set of payments.

Step-by-Step Guide for Requesting a Partial Release

- Evaluating Request: Review your mortgage agreement to understand if partial releases are permitted and under what conditions.

- Contact Your Lender: Reach out to your mortgage lender to discuss the possibility of a partial release. Provide necessary documents such as reasons for the release, the section of the property you wish to release, and any new appraisals.

- Appraisal: Most lenders will require a professional appraisal to determine the value property that is requested for release.

- Approval Process: The lender will evaluate the impact of the partial release on the security of the mortgage loan. Entities like Fannie Mae have specific guidelines that need to be followed.

- Legal Modifying: If the release is approved, legal documents have to be drafted to modify the existing mortgage document reflecting the partial release.

- Finalization: Sign the modified agreement and ensure the property records are updated to reflect the change.

Risk Analysis of Partial Release from Mortgage

- Financial Risk: There could be changes in the mortgage terms, including interest rates or payment terms, following a partial release.

- Legal Risks: Inadequate documentation or failure to comply with local laws can lead to legal complications.

- Property Value Risk: Removing part of the property from the mortgage can potentially affect the overall market value of the property.

Best Practices in Requesting a Partial Release

- Ensure that you understand all the implications and changes to your mortgage that may arise due to the partial release.

- Always consult with a legal professional or a financial advisor specialized in real estate before proceeding.

- Keep thorough records of all communications and documentations exchanged with your lender during this process.

Common Mistakes & How to Avoid Them

- Lack of Preparation: Not having adequate information or necessary documentation ready can delay or halt the process. Prepare all documents and understand the terms thoroughly before reaching out to your lender.

- Ignoring Legal Requirements: Every state has different legal requirements and conditions for partial releases. Neglecting this aspect can bring about legal challenges.

- Not Evaluating Financial Impact: Consider consulting with a financial advisor to understand how this alteration in your mortgage could affect you financially in the long term.

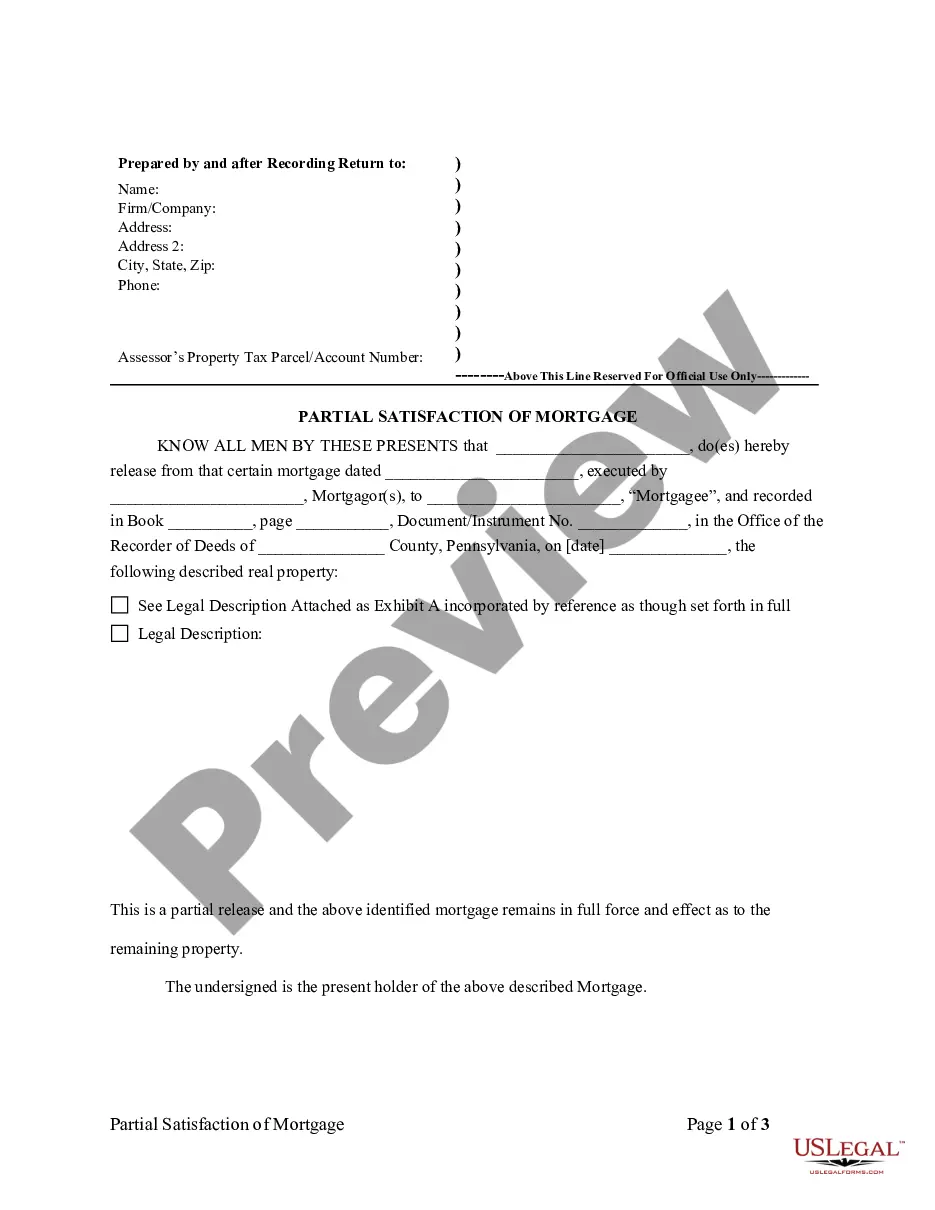

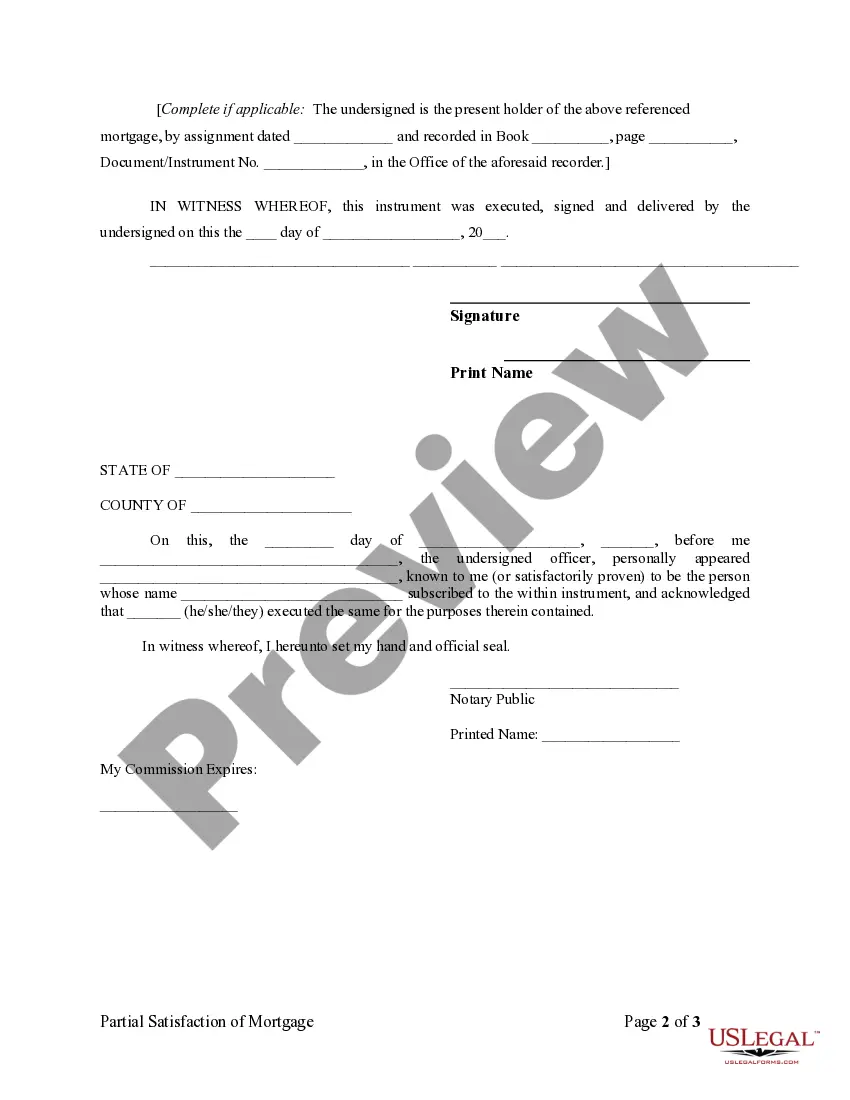

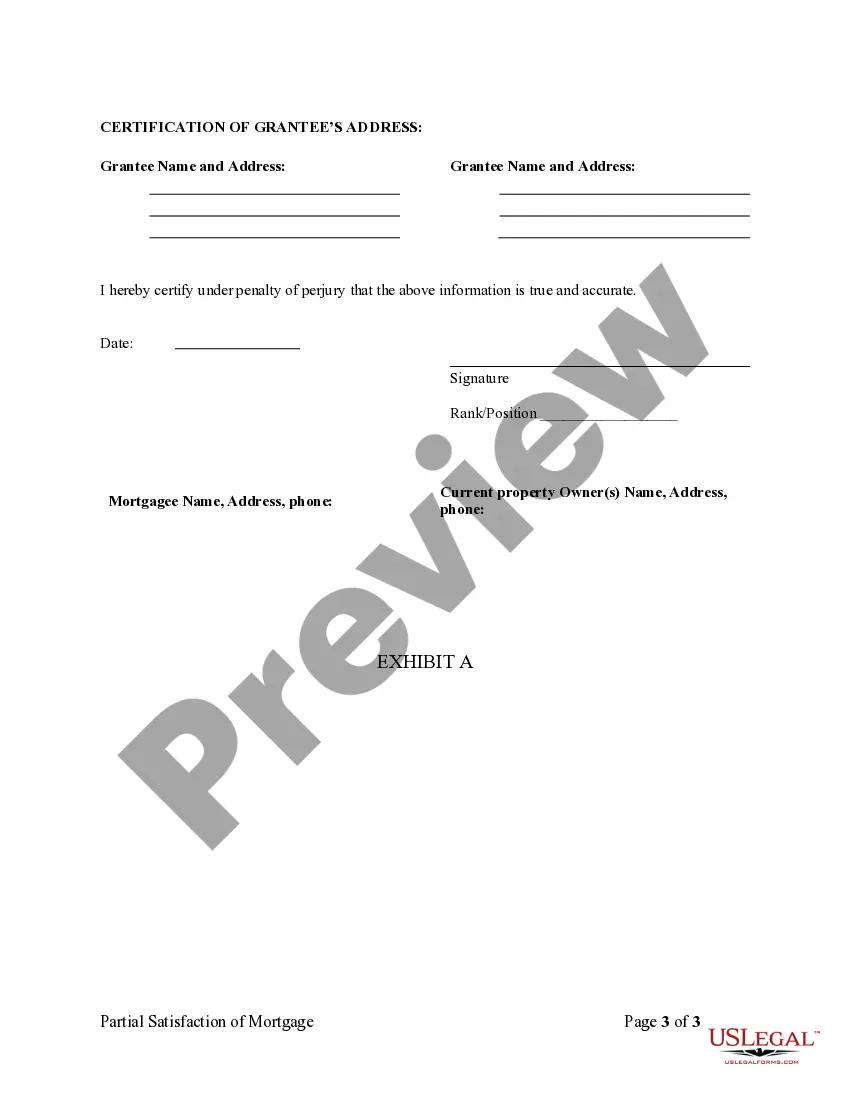

How to fill out Pennsylvania Partial Release Of Property From Mortgage By Individual Holder?

The work with papers isn't the most easy job, especially for people who rarely work with legal paperwork. That's why we recommend utilizing accurate Pennsylvania Partial Release of Property From Mortgage by Individual Holder templates created by professional attorneys. It gives you the ability to avoid troubles when in court or handling official institutions. Find the files you need on our website for high-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the file webpage. After getting the sample, it’ll be saved in the My Forms menu.

Users without a subscription can quickly get an account. Follow this brief step-by-step guide to get your Pennsylvania Partial Release of Property From Mortgage by Individual Holder:

- Ensure that the document you found is eligible for use in the state it is necessary in.

- Confirm the file. Make use of the Preview feature or read its description (if available).

- Buy Now if this sample is the thing you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these straightforward actions, you can fill out the sample in your favorite editor. Double-check completed details and consider requesting a lawyer to review your Pennsylvania Partial Release of Property From Mortgage by Individual Holder for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Day of closing belongs to the seller... What are the consequences for a lender who fails to record a release of lien or satisfaction of mortgage after being paid off? A- Nothing, if the lender records the satisfaction within 120 days after being paid off.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Preliminary Title Report- California case law is clear that a preliminary title report cannot be relied upon as a true and reliable condition of title to real property.No duties or liabilities arise with a preliminary title report. Therefore, there is no liability to a title company if any recorded document is missed.

Lien Release Waiting Period The typical amount of time is 30 to 60 days. Some banks will send the lien release directly to the department of motor vehicles or the county recorder's office on behalf of the borrower, while others send the release to the borrower who then must file it.

In the case of mortgage liens, courts use the date of a recording to determine the priority for which liens should receive payment first.Some states have also passed recording acts, which are statutes that establish how official records are kept.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.