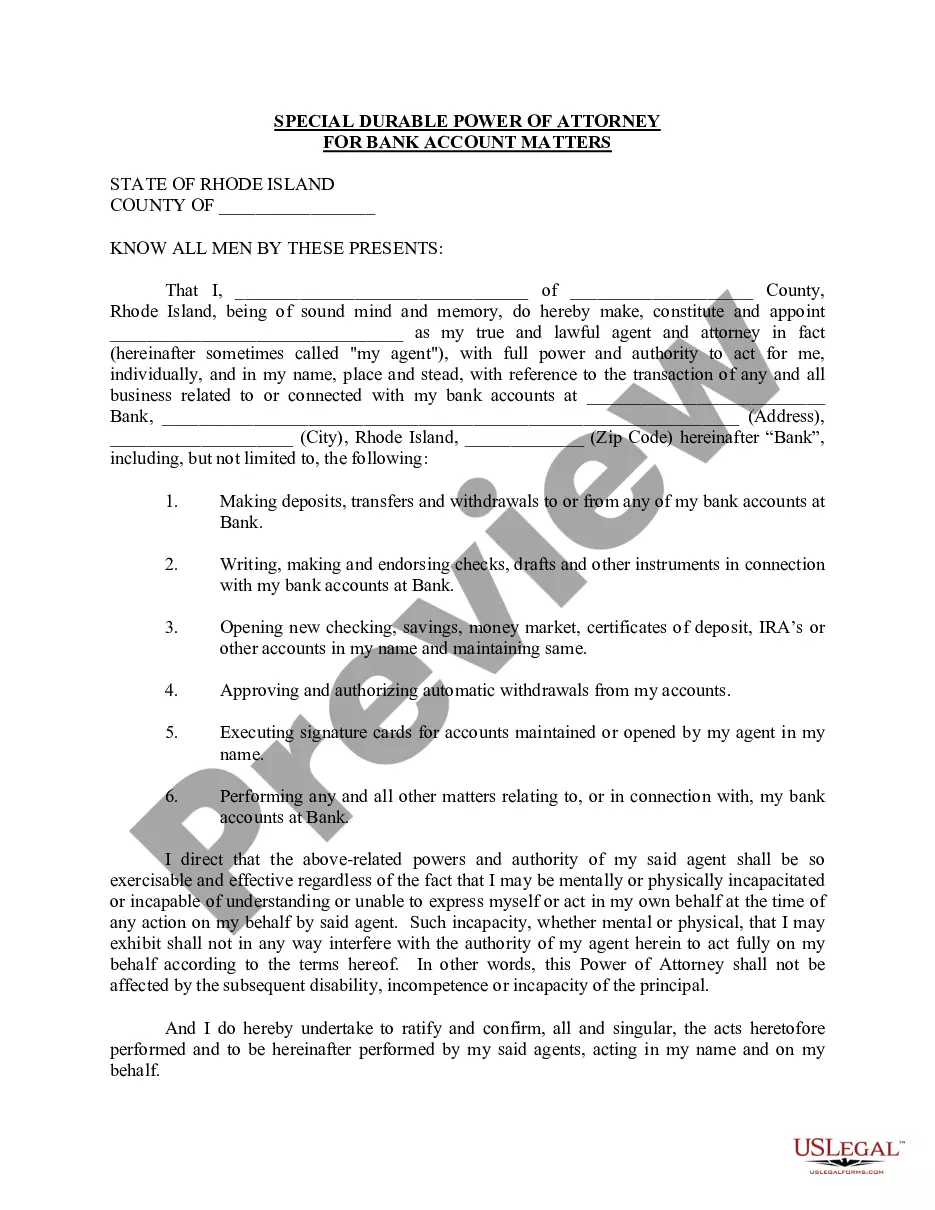

Rhode Island Special Durable Power of Attorney for Bank Account Matters

About this form

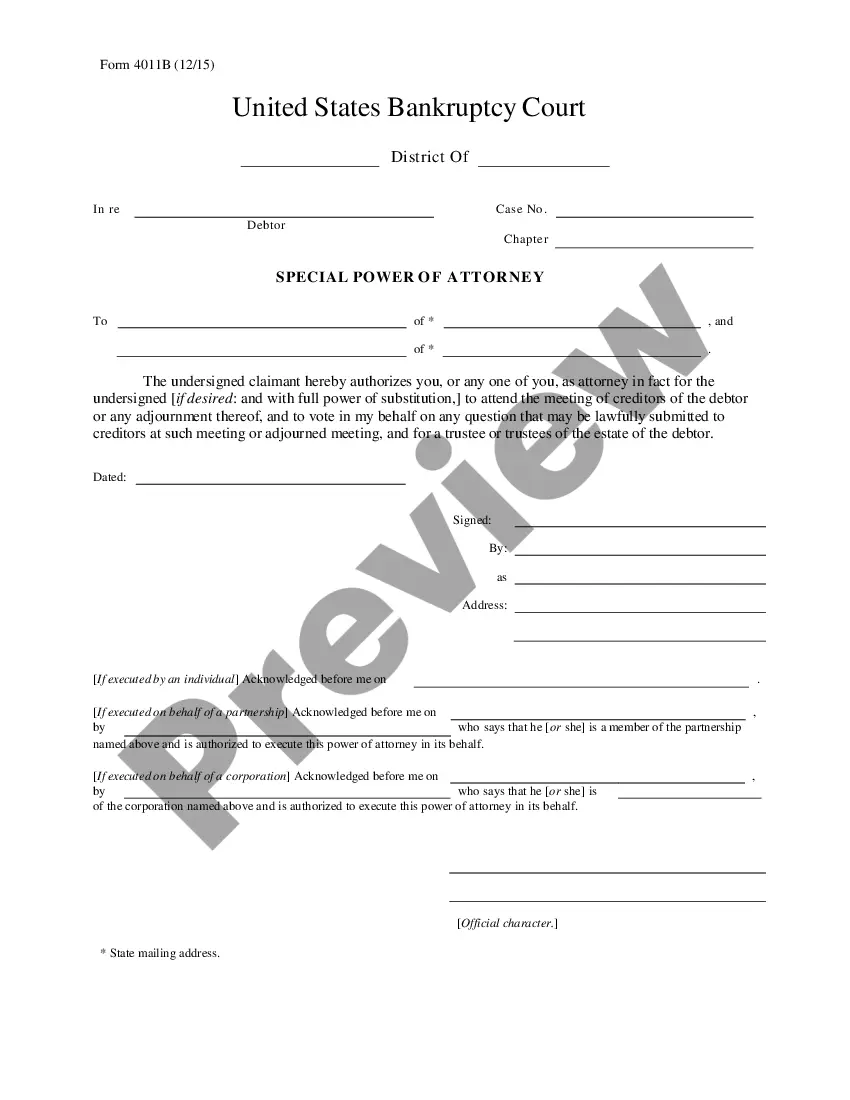

The Special Durable Power of Attorney for Bank Account Matters empowers an agent to manage specific banking tasks on your behalf. Unlike a general power of attorney, this form limits the agent's authority to banking-related activities, such as making deposits, withdrawals, and managing accounts. This type of power of attorney remains effective even if you become mentally or physically incapacitated, ensuring your banking needs are continuously addressed.

Key components of this form

- Principal: The individual granting authority (you).

- Agent: The designated person who will act on your behalf regarding bank account matters.

- Specific Powers: Detailed listing of actions the agent can take, including making deposits and opening accounts.

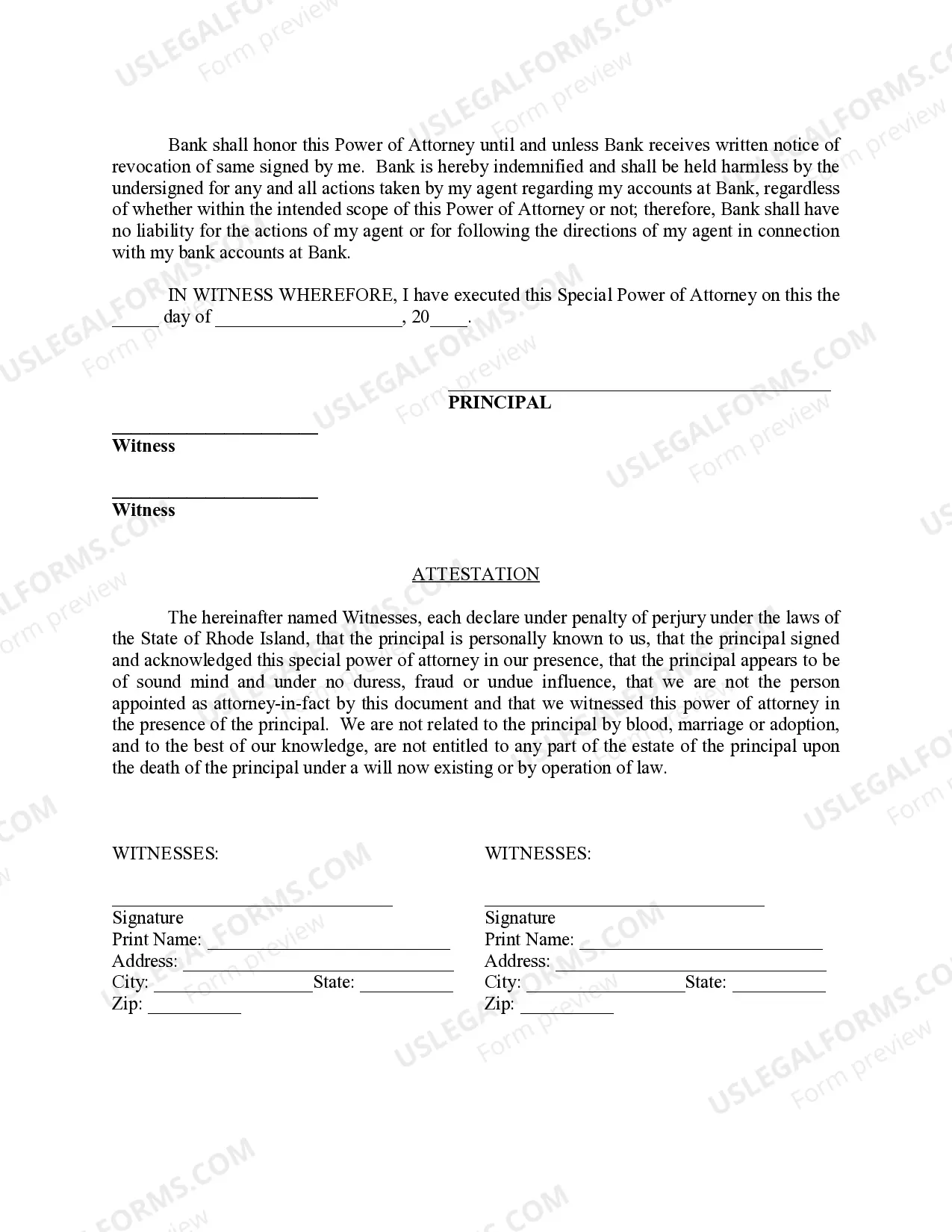

- Indemnification Clause: Protects the bank from liability for actions taken by your agent.

- Witness Requirement: Confirmation by witnesses to the signing of the power of attorney.

When to use this document

This form is useful when you are unable to manage your banking affairs due to absence, travel, illness, or any other reason. It allows a trusted individual to handle all banking transactions, ensuring your financial matters are managed properly even if you are not able to do so yourself.

Intended users of this form

- Individuals who wish to designate someone to handle their banking affairs.

- People anticipating potential incapacity or wanting to plan for future banking needs.

- Anyone needing a trusted agent to act on their behalf for specific banking transactions.

Steps to complete this form

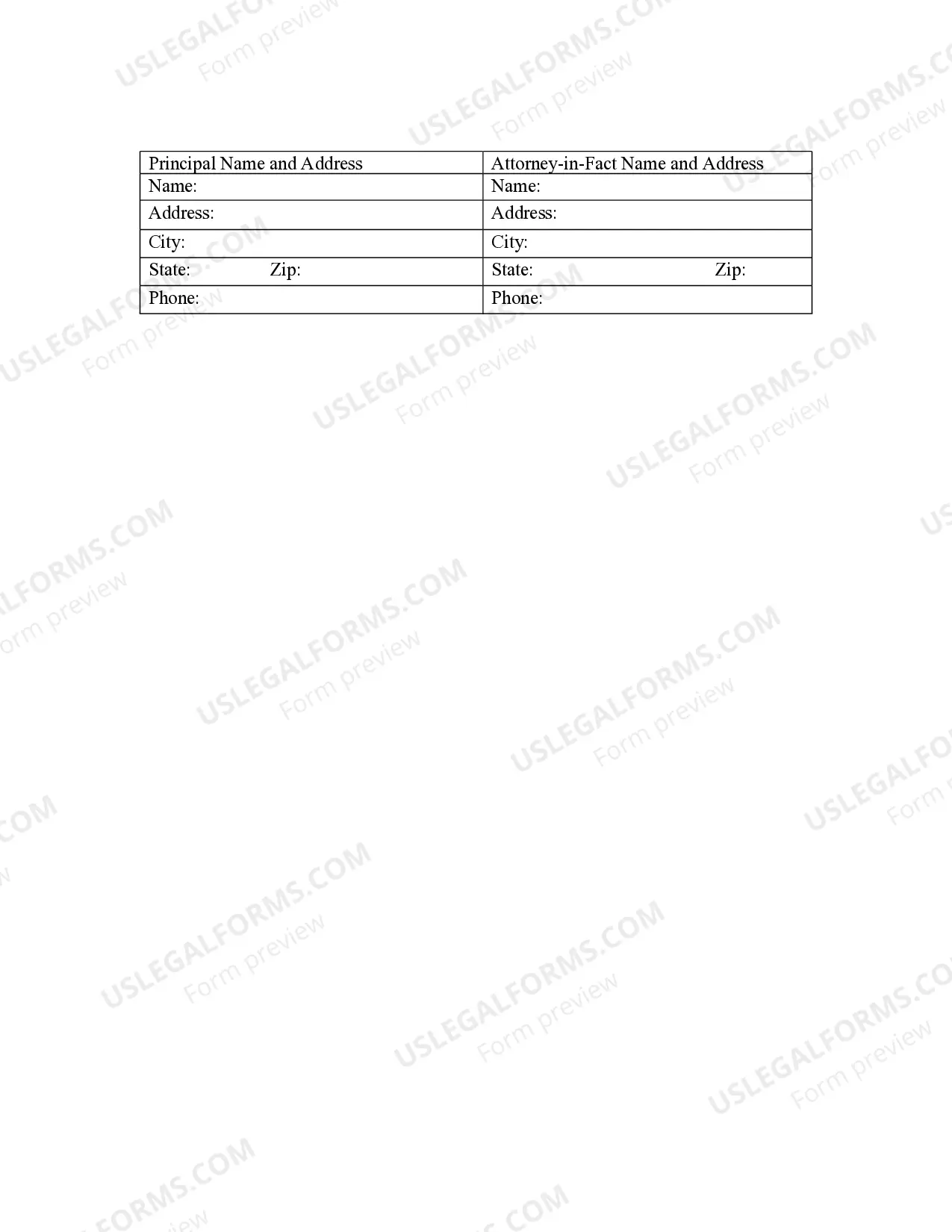

- Identify the principal by entering your full name and address.

- Designate the agent by providing their full name and address.

- Specify the bank and provide its address where the agent will operate.

- List the specific powers you are granting to the agent related to your bank accounts.

- Sign the document in the presence of witnesses to validate the power of attorney.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to have the document witnessed properly.

- Not specifying the bank or account details clearly.

- Providing unclear powers that the agent can exercise.

- neglecting to update the form if circumstances change, such as a change in agent.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy customization of specific details.

- Reliability of forms drafted by licensed attorneys ensures legal compliance.

What to keep in mind

- The Special Durable Power of Attorney is limited to banking matters.

- It remains effective during periods of incapacity.

- Proper completion requires clear identification of all parties and powers granted.

Form popularity

FAQ

Before you can manage the donor's account, you must show the bank the original registered lasting power of attorney ( LPA ) or a copy of it signed on every page by the donor, a solicitor or notary.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

If you want your attorney to deal with any real estate you own in NSW, then the Power of Attorney document must be registered with the NSW Land Registry Services. Otherwise, there is no requirement for your Power of Attorney to be registered.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.