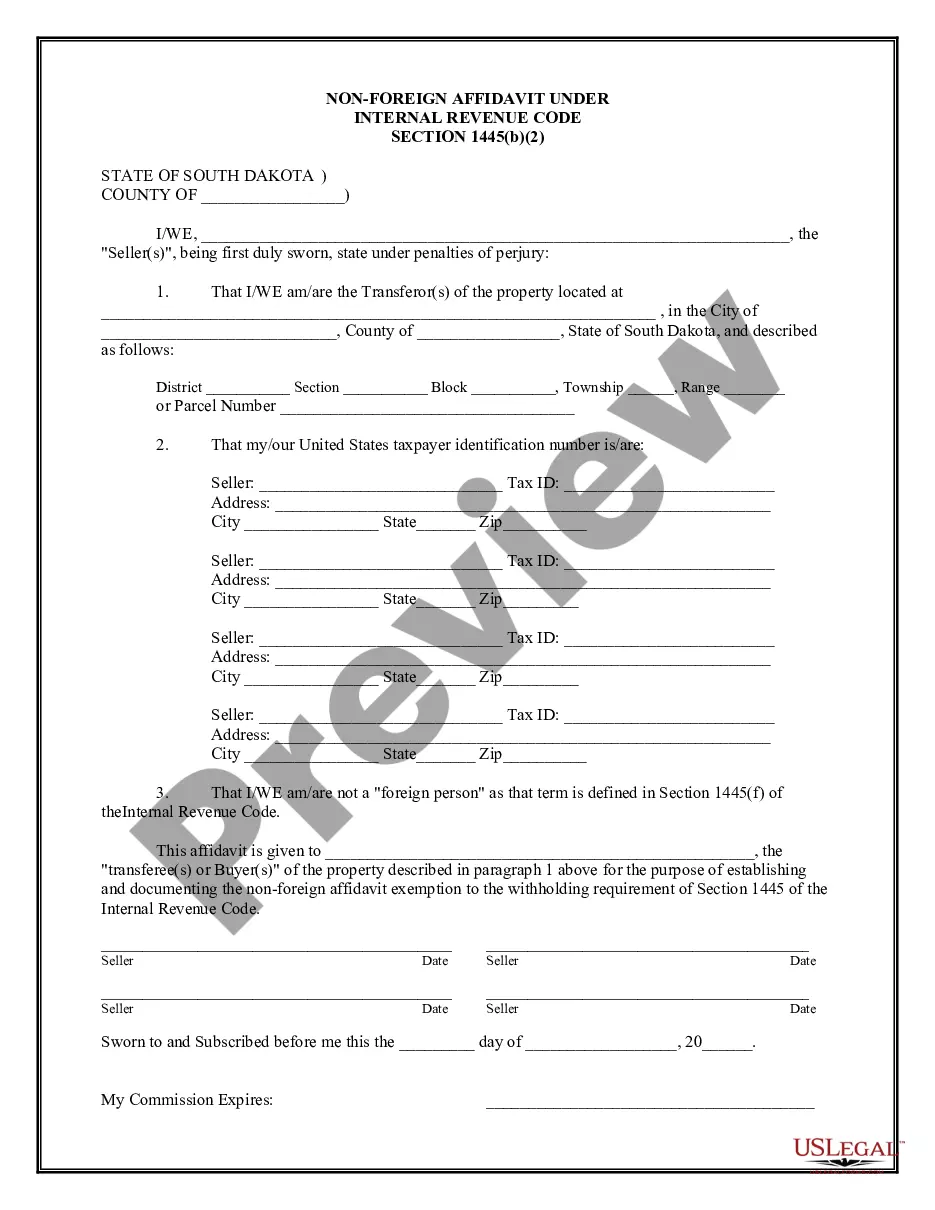

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

South Dakota Non-Foreign Affidavit Under IRC 1445

Description

How to fill out South Dakota Non-Foreign Affidavit Under IRC 1445?

Get access to high quality South Dakota Non-Foreign Affidavit Under IRC 1445 samples online with US Legal Forms. Prevent days of lost time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get more than 85,000 state-specific authorized and tax forms you can save and submit in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the South Dakota Non-Foreign Affidavit Under IRC 1445 you’re considering is appropriate for your state.

- View the form making use of the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by credit card or PayPal to finish making an account.

- Choose a favored file format to save the document (.pdf or .docx).

You can now open up the South Dakota Non-Foreign Affidavit Under IRC 1445 example and fill it out online or print it out and do it yourself. Take into account sending the file to your legal counsel to make certain everything is filled out correctly. If you make a error, print and complete sample again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.If the law applies to your purchase, then within 20 days of the sale, you are required to file Form 8288 with the IRS.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.