Small Estate Affidavit for Estates Not More Than $50,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

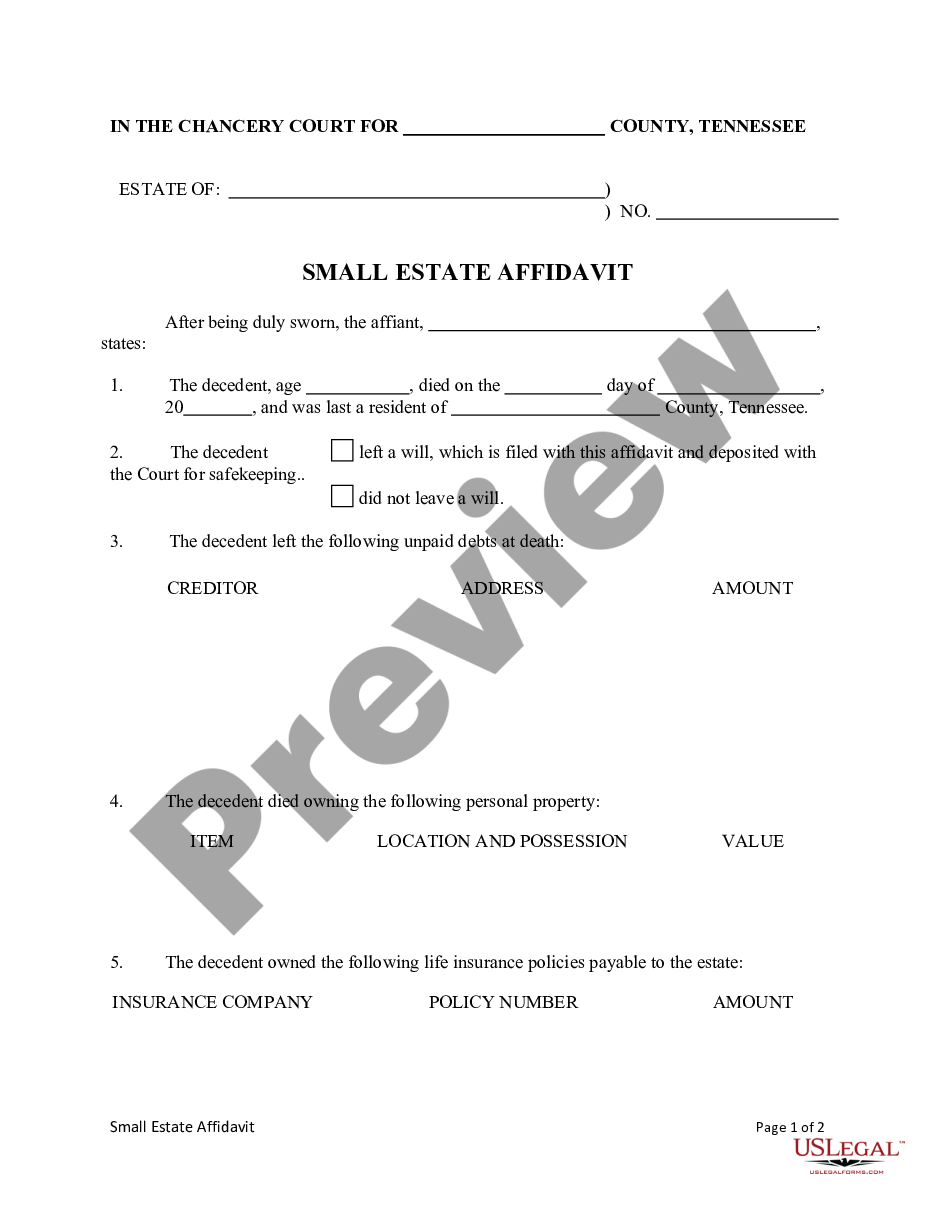

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Tennessee Summary:

Under Tennessee statute, where as estate is valued at less than $50,000, an interested party may, forty-five (45) days after the death of the decedent, file with the clerk of court a small estate affidavit, and proceed to use said affidavit to collect any debts owed to the decedent.

Tennessee Requirements:

Tennessee requirements are set forth in the statutes below.

30-4-101. Short title.

This chapter shall be known as "The Small Estates Act."

30-4-102. Definitions.

As used in this chapter, unless the context clearly requires otherwise:

(1) "Affiant" means the person executing the affidavit provided for in § 30-4-103;

(2) "Court" means the court then exercising probate jurisdiction in the county in which the decedent had legal residence on the date of death;

(3) "Person" means an individual, partnership, firm, business trust, corporation or other legal entity, and includes both singular and plural and masculine and feminine, as appropriate;

(4) "Property" means personal property, or any interest in personal property, owned by the decedent on the date of death, other than personal property held as tenants by the entirety or jointly with right of survivorship or personal property payable to a beneficiary other than the decedent's estate; and

(5) "Small estate" means the estate of a decedent in which the value of the property does not exceed fifty thousand dollars ($50,000).

HISTORY: Acts 1972, ch. 687, § 2; 1974, ch. 529, § 1; 1979, ch. 81, § 1; T.C.A., § 30-2002; Acts 1997, ch. 426, § 12; 2014, ch. 829, §§ 1, 8.

30-4-103. Affidavit - Filing fees - Bond - Discharge.

Whenever a decedent leaves a small estate, it may be administered in the following manner:

(1) (A) After the expiration of forty-five (45) days from the date of decedent's death, provided no petition for the appointment of a personal representative of the decedent has been filed in that period of time and decedent's estate is a small estate within the meaning of this chapter, one (1) or more of decedent's competent, adult legatees or devisees or personal representatives named in the decedent's will, if a will was left, or heirs or next of kin, if no will was left, or in either a testate or intestate estate, any creditor proving that creditor's debt on oath before the court, shall file with the clerk of the court an affidavit which shall set forth the following facts:

(i) Whether or not decedent left a will, and if so, the original shall be presented to the court for examination by the clerk. The original will has not been proven and therefore shall not be recorded. A copy of the original will shall be filed to support the affidavit. The original will shall be deposited with the court for safekeeping;

(ii) A list of unpaid debts left by decedent and the name and address of each creditor and the amount due that creditor;

(iii) An itemized description and the value of all of decedent's property, the names and addresses of all persons known to have possession of any of decedent's property, and a schedule of all insurance on decedent's life payable to the decedent's estate;

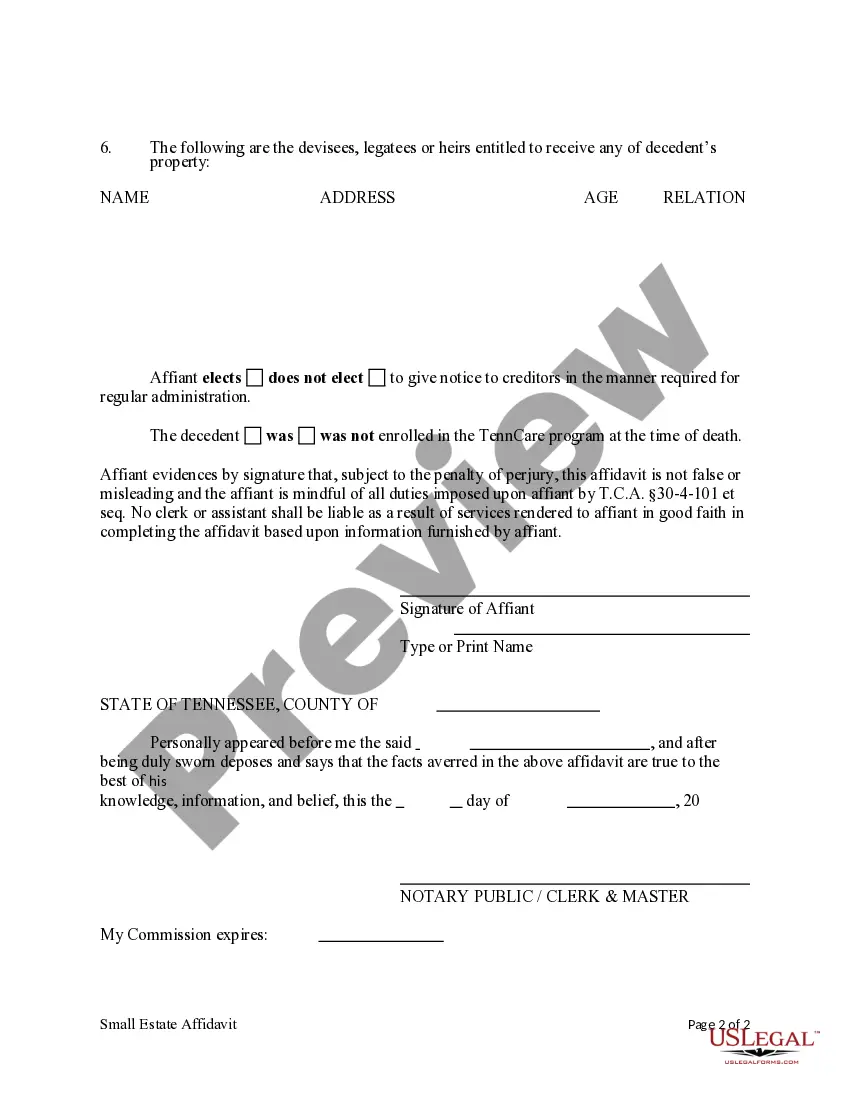

(iv) The name, age, address and relationship, if any, of each devisee, legatee or heir entitled to receive any of decedent's property; and

(B) The form of the affidavit required by this section shall disclose that the affiant evidences by signature that, subject to the penalty for perjury, the affidavit is not false or misleading and that the affiant is mindful of all duties imposed upon the affiant by this chapter. No clerk or assistant shall be liable as a result of services rendered to the affiant in good faith in completing the affidavit based upon information furnished by the affiant;

(C) Upon the motion of one (1) or more of the decedent's competent, adult legatees or devisees if a will was left, or the decedent's heirs or next of kin if no will was left, or upon its own motion, the court may, in its discretion for good cause shown, reduce the forty-five day period required by subdivision (1)(A);

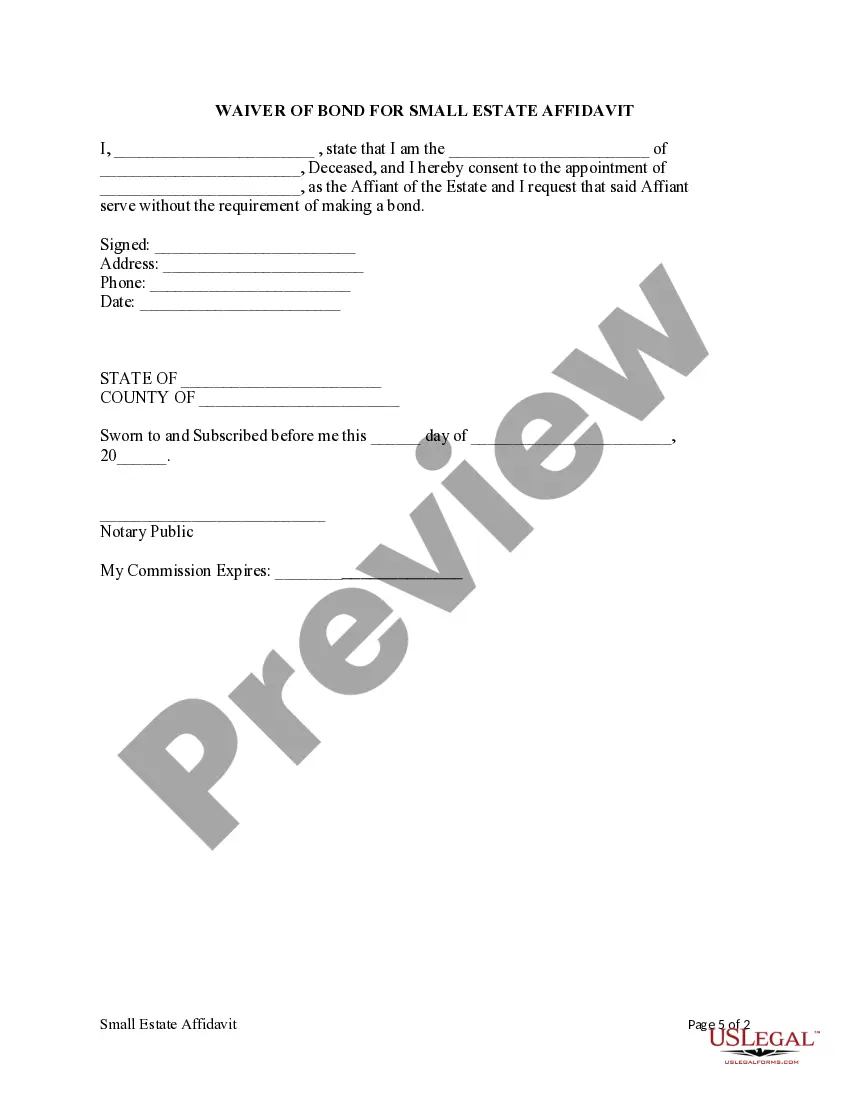

(D) A competent adult who is not a legatee or devisee or personal representative named in the decedent's will, or an heir or next of kin of the deceased, may be appointed as the affiant for a small estate by the court, if all competent adult legatees or devisees or personal representatives named in the decedent's will, if a will was left, or heirs or next of kin, if no will was left, consent in writing to the appointment of the competent adult as the affiant; provided, that any person who is appointed as an affiant pursuant to these provisions shall comply with all other provisions of this section, including the bond provisions contained in subdivision (5). The consent shall not be required of any personal representative who is named in the decedent's will and who has renounced the appointment, in order for the court to appoint an affiant for a small estate;

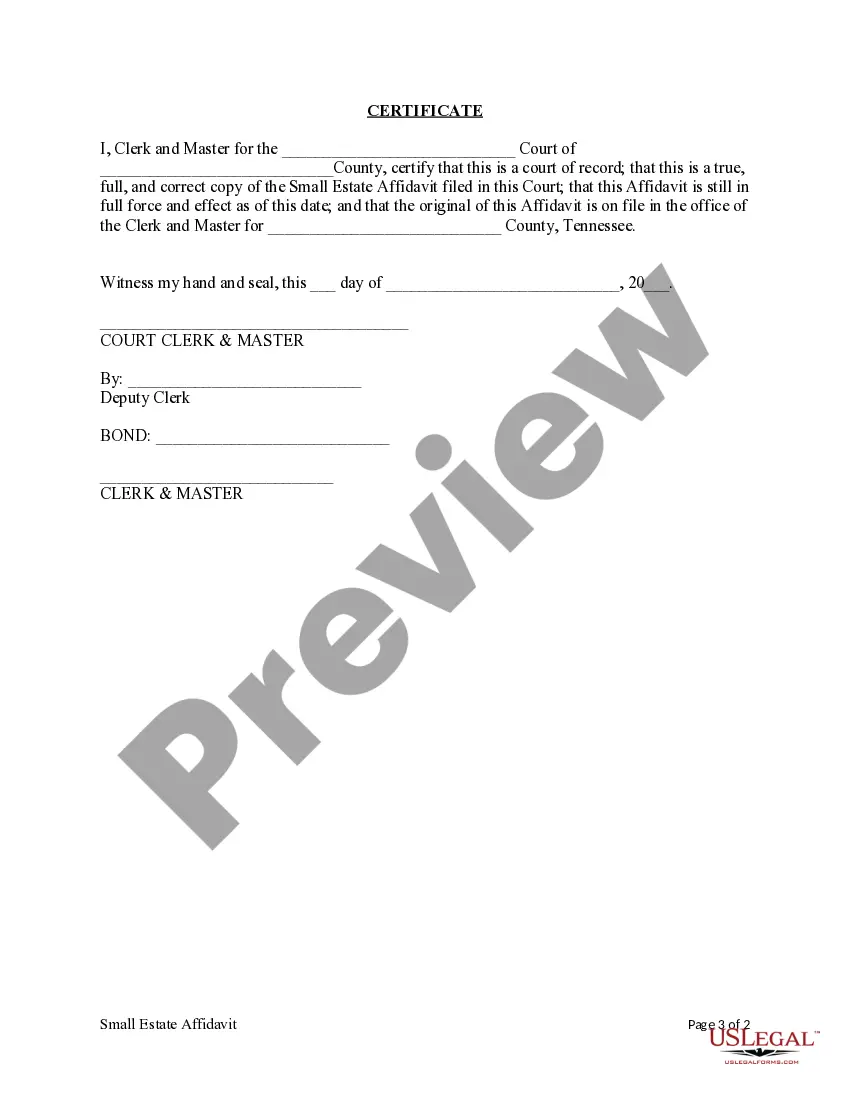

(2) The court shall receive and file the original affidavit as a part of the court's permanent records, shall assign it a number and shall index it as other estates are indexed. The clerk shall deliver to the affiant as many certified copies of the affidavit as are requested, onto which are affixed a clerk's stamp and seal certifying that the affidavit has been filed in the office of the probate court. An affidavit may be amended to the extent that the aggregate amount does not exceed the statutory limitation;

(3) The clerk shall charge and receive such fees for processing a small estate as authorized and provided in §§ 8-21-401 and 32-1-112;

(4) The affiant shall make bond payable to the state for the benefit of those entitled with two (2) or more sufficient sureties or one (1) corporate surety. The amount of the bond shall equal the value of the decedent's estate to be administered under this chapter. However, bond shall not be required of the affiant if § 30-1-201 would not require such from a personal representative;

(5) The affiant and the sureties on the affiant's bond may obtain discharge from liability under the bond in either of two (2) ways:<br />

<br />

(A) The court may enter an order discharging the affiant and the sureties on the affiant’s bond after the affiant files:<br />

<br />

(i) Either the tax receipt issued pursuant to § 67-8-420, or the certificate issued pursuant to § 67-8-409; and<br />

<br />

(ii) An affidavit that each debt of the decedent is paid.<br />

<br />

(B) Instead of filing as provided in subdivision (5)(A), the affiant and the sureties on the affiant’s bond may wait until the first anniversary of the filing of the affidavit when the court shall automatically discharge them from liability.<br />

<br />

HISTORY: Acts 1972, ch. 687, § 3; 1980, ch. 626, § 1; 1981, ch. 444, § 1; 1982, ch. 565, §§ 1, 2; T.C.A., § 30-2003; Acts 1988, ch. 854, §§ 10, 11; 1997, ch. 426, §§ 13-15; 2004, ch. 866, § 1; 2005, ch. 99, § 6; 2006, ch. 813, § 1; 2013, ch. 360, § 1.<br />

<br />

30-4-104. Administration by affiant.<br />

<br />

(a) Every person indebted to decedent’s estate, or having possession of any property belonging to the estate, or acting as registrar or transfer agent of any shares of stock, bonds, notes or other evidence of ownership, indebtedness, property or right belonging to decedent’s estate shall be furnished a copy of the affidavit by the affiant, duly certified to by the clerk of the court, and upon receipt of the copy of affidavit, and upon demand of the affiant, shall pay, transfer and deliver to affiant all indebtedness owing by and other property in possession of or subject to registration and/or transfer by, the person to whom the copy of affidavit has been delivered.<br />

<br />

(b) Every person making payment, transfer or delivery of property belonging to a decedent’s estate to the affiant pursuant to this chapter shall be released and discharged from all further liability to the estate and its creditors to the same extent as if the payment, transfer or delivery were made to the duly appointed, qualified and acting personal representative of the decedent, and the person making the payment, transfer or delivery shall not be required to see to its application or to inquire into the truth or completeness of any statement in the affidavit.<br />

<br />

(c) If the decedent left a will, the decedent’s property shall be distributed as provided in the will, and if the decedent left no will it shall go to the decedent’s heirs as provided by law in case of other intestacies, and both the affiant and the person to whom payment, transfer or delivery of any property is made by the affiant shall be and remain liable, to the extent of the value of the property so received, to unpaid creditors of the decedent and to every other person having a prior claim against the decedent’s estate or prior right to any of the decedent’s property, and also shall be accountable to any personal representative of the decedent thereafter appointed.<br />

<br />

(d) The affiant shall file returns and pay the tax on property in the decedent’s estate, as required by title 67, chapter 8, parts 3-5, as now or hereafter amended, revised or recodified.<br />

<br />

(e) If any person having possession of any of the decedent’s property, upon receipt of a copy of the affidavit certified by the clerk, refuses to pay, transfer or deliver the property to or at the direction of the affiant, the property may be recovered or transfer and delivery of the property compelled in an action brought in any court of competent jurisdiction for that purpose upon proof of the facts required to be stated in the affidavit, and costs of the proceeding shall be adjudged against a person wrongfully refusing to pay, transfer or deliver the property.<br />

<br />

HISTORY: Acts 1972, ch. 687, § 4; T.C.A., § 30-2004.<br />

<br />

30-4-105. Construction of chapter.<br />

<br />

This chapter shall be cumulative to existing law relating to the administration of decedents’ estates and is intended to provide an optional and alternative method for the administration of small estates.<br />

<br />

HISTORY: Acts 1972, ch. 687, § 5; T.C.A., § 30-2005.