Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

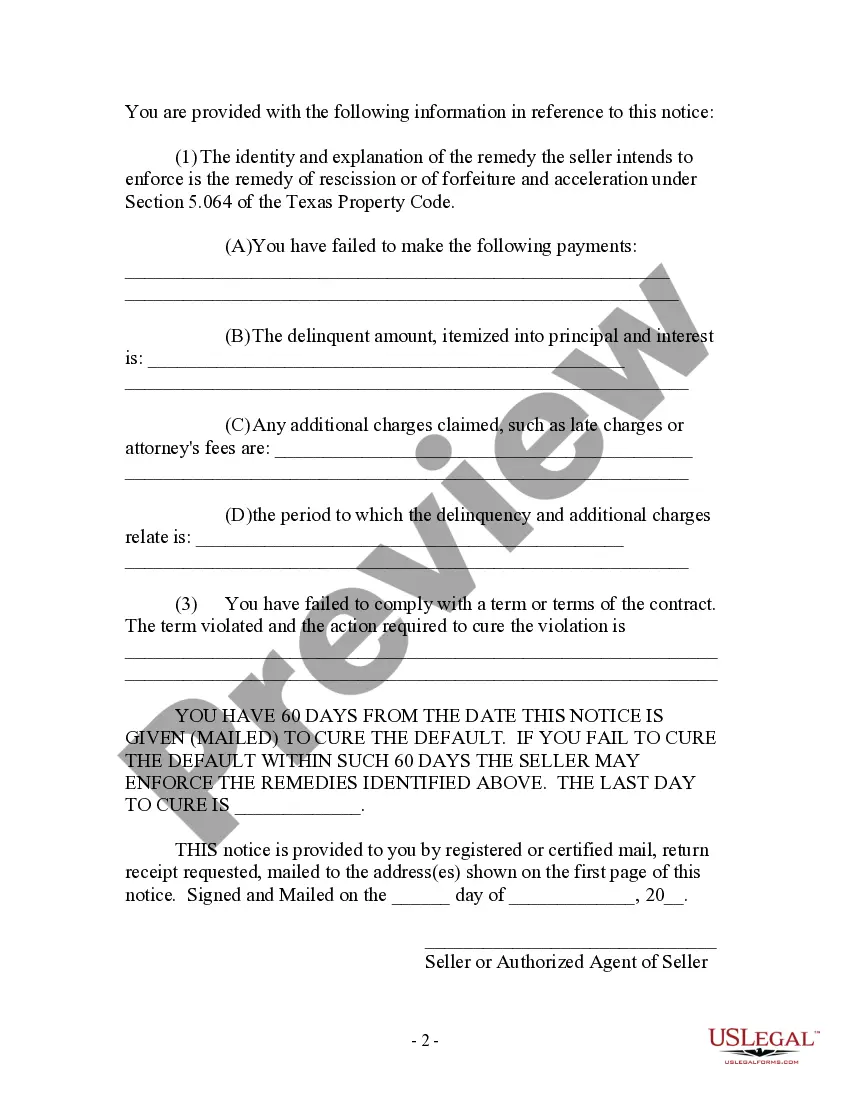

Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

Description

Key Concepts & Definitions

Contract for Deed: A legal agreement for real estate where the buyer makes payments to the seller for a period before obtaining full legal title.Notice of Default: A formal notice given by the seller to the buyer indicating the buyer's failure to meet the terms of the contract for deed.

Land Contract: Another term for a contract for deed, typically used when real estate is sold with the seller financing the purchase without a traditional mortgage.

Default Provision: Specific clauses within a contract that define the conditions under which a party is considered in default.

Step-by-Step Guide: Issuing a Notice of Default by Seller

- Review the Contract: Identify the default provision stated in the contract for deed.

- Document the Default: Record specifics of the breach, such as missed payments or other violations of the contract terms.

- Draft the Notice: Include details of the default, relevant clauses from the contract, and a timeline for corrective action.

- Send the Notice: Deliver the notice via certified mail or another method specified in the contract to ensure proof of delivery.

- Consider Next Steps: Depending on the buyer's response, consider remedial actions, which could range from renegotiation to initiating foreclosure proceedings under state law.

Risk Analysis: Default and Termination of Contract for Deed

- Legal Risks: Improper handling of the notice of default can lead to disputes and potential lawsuits.

- Financial Risks: Buyers may incur damages or lose the property in a foreclosure process, while sellers might face prolonged periods without payment or costs involved in re-selling the property.

- Reputation Risks: Handling the default process poorly can affect the reputation of either party within the real estate market.

Best Practices for Handling Notices of Default in Real Estate

- Clear Communication: Always express the terms and consequences of default clearly in the contract deed.

- Legal Compliance: Ensure all notices and procedures comply with property law and mortgage provisions under the applicable state law.

- Record Keeping: Maintain detailed records and documentation at every step to support legal and financial decision-making.

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

Get access to high quality Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments templates online with US Legal Forms. Avoid days of wasted time seeking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get over 85,000 state-specific authorized and tax samples that you can save and complete in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- See if the Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments you’re considering is appropriate for your state.

- View the form utilizing the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a preferred format to save the document (.pdf or .docx).

You can now open up the Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments template and fill it out online or print it out and get it done by hand. Consider sending the file to your legal counsel to make certain things are completed properly. If you make a mistake, print and fill sample once again (once you’ve made an account every document you download is reusable). Create your US Legal Forms account now and access much more templates.

Form popularity

FAQ

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

If a seller defaults, he must return all deposits, plus added reasonable expenses, to the buyer. The other party may also seek to compel the erring party to complete the deal under specific performance. From a buyer's point of view, it is advisable to get the sale agreement registered.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A contract for deed is a different form of seller-finance. In a contract for deed, the seller keeps the title to the property and the buyer does not receive a deed to the property.In Texas, contracts for deed on residential property are considered potentially predatory and subject to strict consumer-protection laws.