The person claiming the lien must file an affidavit with the county clerk of the county in which the property is located not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. 53-052

- US Legal Forms

-

Texas Affidavit of Claim of Lien by Contractor - Mechanics Liens -...

Tx Claim Liens

Description Texas Affidavit Of Lien Form

Affidavit Lien Liens Related forms

View Limited Liability Company LLC Operating Agreement

View Single Member Limited Liability Company LLC Operating Agreement

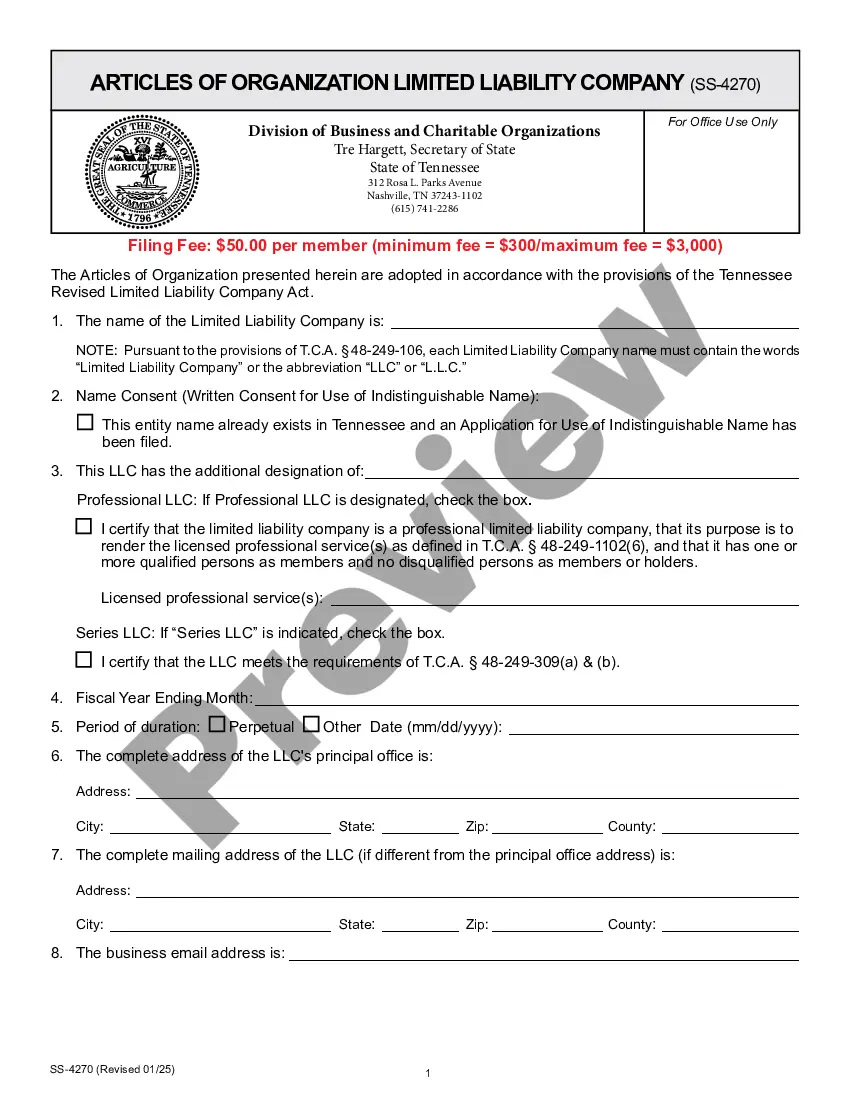

View Tennessee Articles of Organization for Domestic Limited Liability Company LLC

View Tennessee Professional Limited Liability Company PLLC Formation Package

View Renunciation And Disclaimer of Property from Will by Testate

Related legal definitions

How to fill out Contractors Lien?

- If you're a returning user, log into your US Legal Forms account and download the necessary document by clicking the Download button, ensuring your subscription is active.

- For new users, begin by checking the Preview mode and form description to guarantee you've selected the right document for your jurisdiction.

- If the form doesn’t meet your requirements, utilize the Search tab to find an alternative template.

- Click the Buy Now button to purchase your chosen document and select your preferred subscription plan. You will need to create an account for access.

- Complete your purchase by entering your payment details, either through a credit card or PayPal.

- Finally, download the form to your device and access it anytime through the My Forms section of your account.

In conclusion, US Legal Forms stands out with its robust collection of over 85,000 filled and editable legal documents, more than competitors at a similar cost. With additional support from premium experts, you can ensure your documents are accurate and legally sound.

Start your journey with US Legal Forms today to simplify your legal documentation process!

Texas Affidavit Lien Form Rating

Texas Claim Liens Form popularity

Texas Claim Lien Other Form Names

Affidavit Claim Form FAQ

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

A creditor can file a lien judgment with the county clerk in whichever Texas county the property is located or the debtor has real estate. A judgment lien will remain on the debtor's property for ten years, even if the property changes ownership.

Avoid harassing the people that owe you money. Keep phone calls short. Write letters. Get a collection agency to write demand letters. Offer to settle for less than is due. Hire a collection agency. Small claims court. File a lawsuit.

Once filed and perfected, a mechanic's lien creates a security interest in the property for the amount the creditor is owed. The lien is not against the owner, it is against the owner's property.If there is more than one lien against the same property, the law determines the order in which each lien is paid.

Bring your Affidavit of Lien to the county recorder's office in the county where the property is located, and pay the lien recording fee. After recording a Texas mechanics lien, claimants must provide notice to the property owner and GC within 5 days of filing.

Bring your Affidavit of Lien to the county recorder's office in the county where the property is located, and pay the lien recording fee. After recording a Texas mechanics lien, claimants must provide notice to the property owner and GC within 5 days of filing.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

While they don't require lien filings to be notarized, they do require a lien filer to jump through various other hoops that, if not done properly, might cause your filing to be rejected or invalidated: Delaware.

A federal tax lien is the government's legal claim against your business assets. The IRS will file a lien, and this happens as a result of tax debt not being paid.By filing a lien, the IRS is marking your business assets bank accounts, building, land, etc.

Contractors Lien Interesting Questions

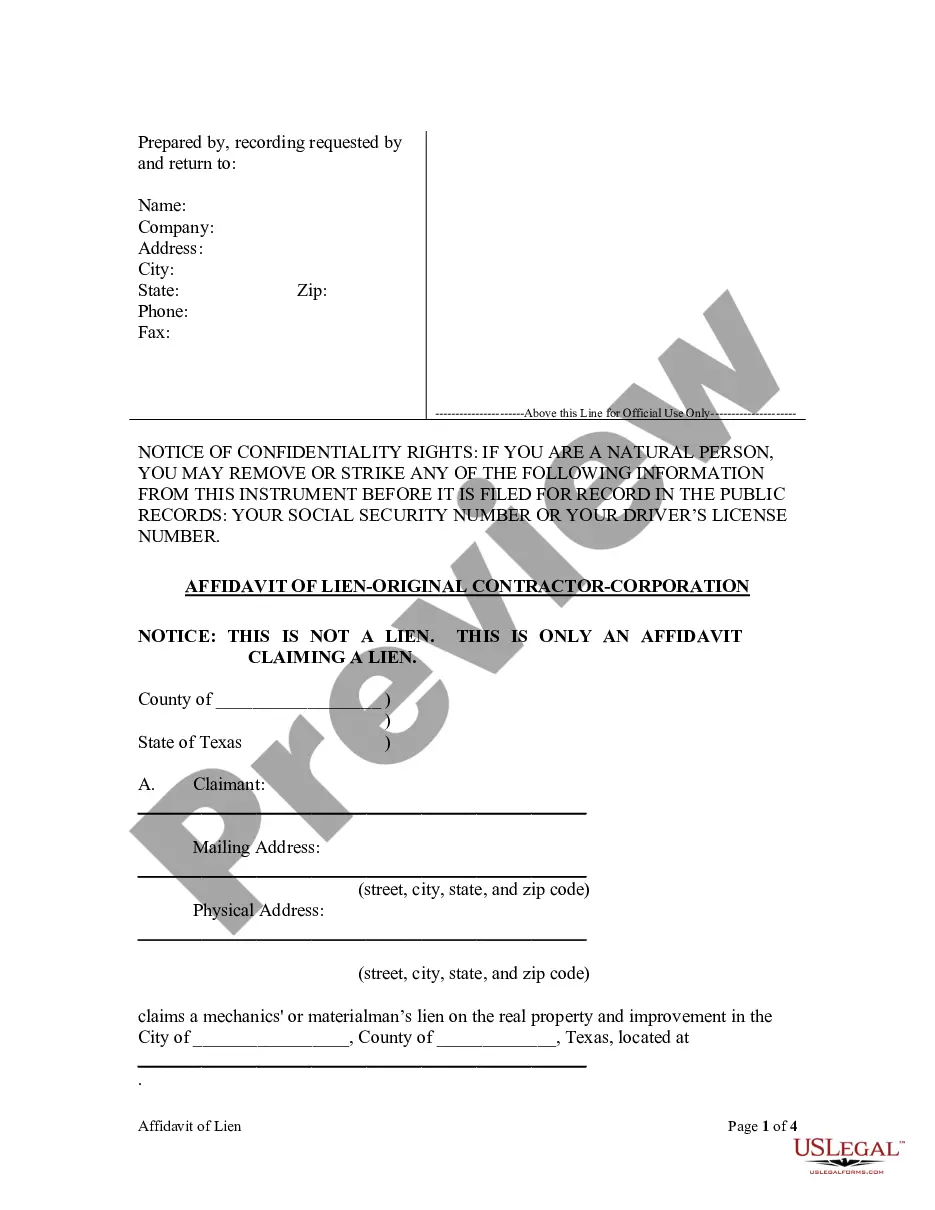

An Affidavit of Lien is a document that asserts a mechanics' or materialman's lien on real property for unpaid labor, services, or materials provided.

No, this document is not a lien; it is only an affidavit claiming a lien.

If you are a natural person, you can remove or strike your social security number or driver's license number from the document before it is filed.

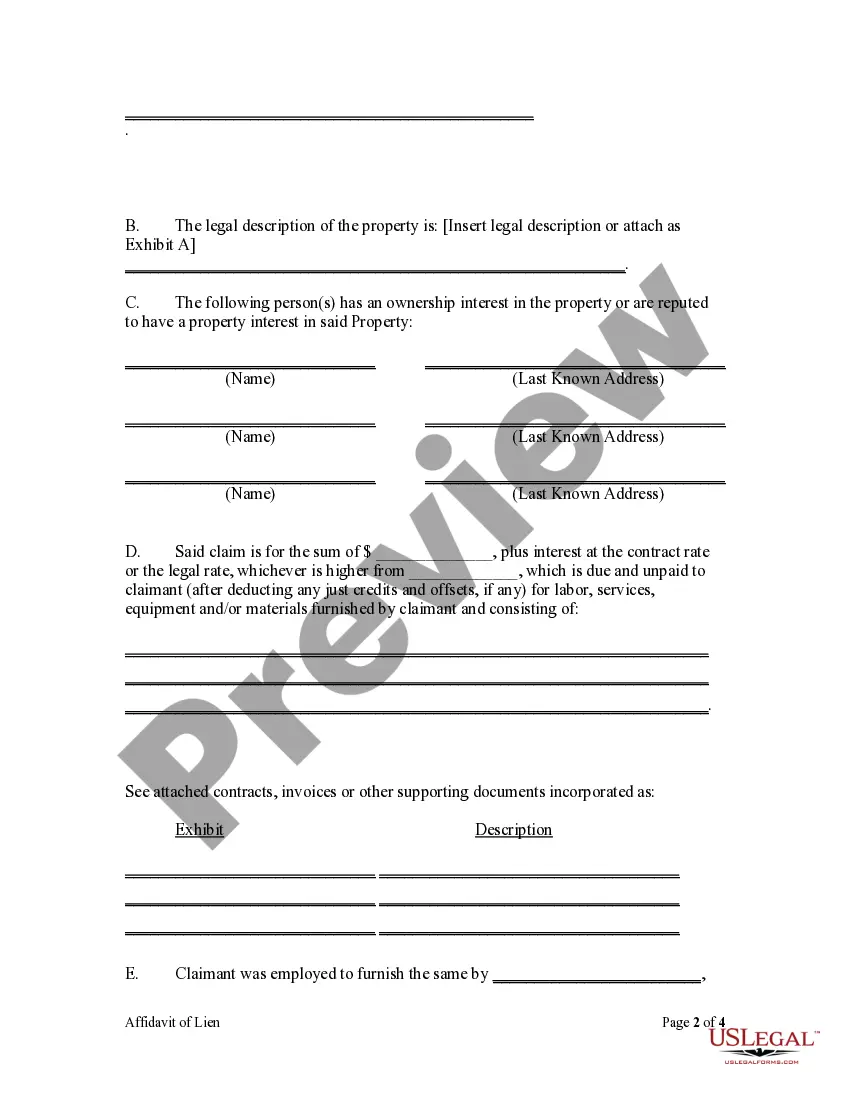

You need to provide the claimant's information, property details, the amount due, a description of services or materials provided, and the owner's information.

This affidavit should be filed for record in the public records in the county where the property is located.

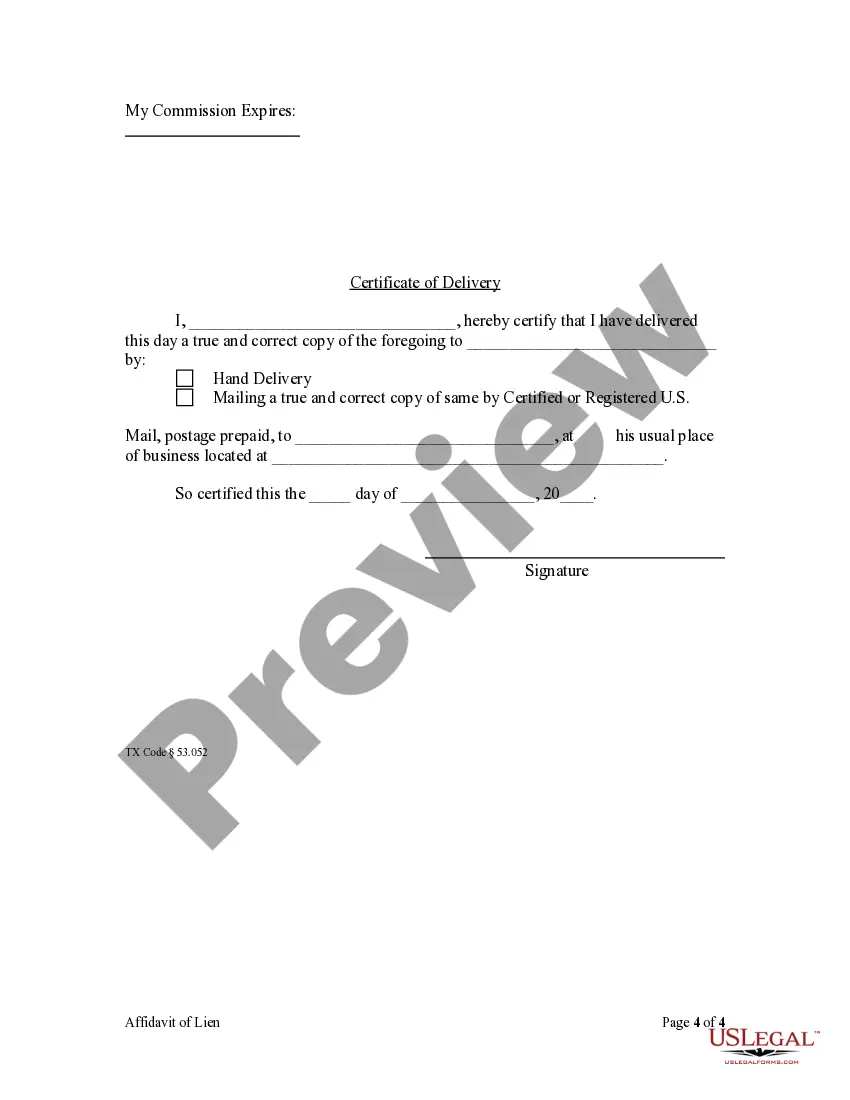

The certificate of delivery includes a statement of delivery method and recipient information for the affidavit.

Claim Mechanics Form Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Texas

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Connecticut

-

Delaware

-

District of Columbia

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Rhode Island

-

South Carolina

-

South Dakota

-

Utah

-

Vermont

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Note: This summary is not intended to be an all inclusive discussion of Texas Law of Mechanic's liens, but does contain basic and other provisions.

Definitions as used herein.

"Labor" means labor used in the direct prosecution of the work.

"Material" means all or part of:

(A) the material, machinery, fixtures, or tools incorporated

into the work, consumed in the direct prosecution of the work, or

ordered and delivered for incorporation or consumption;

(B) rent at a reasonable rate and actual running repairs at a reasonable

cost for construction equipment used or reasonably required and

delivered for use in the direct prosecution of the work at the site of

the construction or repair; or

(C) power, water, fuel, and lubricants consumed or ordered and

delivered for consumption in the direct prosecution of the work.

"Mechanic's lien" means the lien provided by Texas Laws, Chapter 53.

"Original contract" means an agreement to which an owner is a party either directly or by implication of law.

"Original contractor" means a person contracting with an owner either directly or through the owner's agent.

"Residence" means a single-family house, duplex, triplex, or quadruplex or a unit in a multiunit structure used for residential purposes that is:

(A) owned by one or more adult persons; and

(B) used or intended to be used as a dwelling by one of the owners.

"Residential construction contract" means a contract between an owner and a contractor in which the contractor agrees to construct or repair the owner's residence, including improvements appurtenant to the residence.

"Residential construction project" means a project for the construction or repair of a new or existing residence, including improvements appurtenant to the residence, as provided by a residential construction contract.

"Retainage" means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. The term does not include retainage under Subchapter E.

"Specially fabricated material" means material fabricated for use as a component of the construction or repair so as to be reasonably unsuitable for use elsewhere.

"Subcontractor" means a person who has furnished labor or materials to fulfill an obligation to an original contractor or to a subcontractor to perform all or part of the work required by an original contract.

"Work" means any part of construction or repair performed under an original contract.

"Completion" of an original contract means the actual completion of the work, including any extras or change orders reasonably required or contemplated under the original contract, other than warranty work or replacement or repair of the work performed under the contract. § 53.001.

Number of Contractors: There may be one or more contractors for a constrution project. 53.002.

Notice Requirements: Any notice or other written communication may be delivered in person to the party entitled to the notice or to that party's agent, regardless of the manner prescribed by law. If notice is sent by registered or certified mail, deposit or mailing of the notice in the United States mail in the form required constitutes compliance with the notice requirement. This subsection does not apply if the law requires receipt of the notice by the person to whom it is directed. If a written notice is received by the person entitled to receive it, the method by which the notice was delivered is immaterial. 53.003.

Persons Entitled to Lien:

A person has a lien if the person labors, specially fabricates material, or furnishes labor or materials for construction or repair in this state of:

(A) a house, building, or improvement;

(B) a levee or embankment to be erected for the reclamation of

overflow land along a river or creek; or

(C) a railroad;

and the person labors, specially fabricates the material, or furnishes the labor or materials under or by virtue of a contract with the owner or the owner's agent, trustee, receiver, contractor, or subcontractor.

A person who specially fabricates material has a lien even if the material is not delivered.

An architect, engineer, or surveyor who prepares a plan or plat under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver in connection with the actual or proposed design, construction, or repair of improvements on real property or the location of the boundaries of real property has a lien on the property.

A person who provides labor, plant material, or other supplies for the installation of landscaping for a house, building, or improvement, including the construction of a retention pond, retaining wall, berm, irrigation system, fountain, or other similar installation, under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver has a lien on the property. 53.021.

Property to Which Lien Extends: The lien extends to the house, building, fixtures, or improvements, the land reclaimed from overflow, or the railroad and all of its properties, and to each lot of land necessarily connected or reclaimed. The lien does not extend to abutting sidewalks, streets, and utilities that are public property. A lien against land in a city, town, or village extends to each lot on which the house, building, or improvement is situated or on which the labor was performed. A lien against land not in a city, town, or village extends to not more than 50 acres on which the house, building, or improvement is situated or on which the labor was performed. 53.022.

Payment Secured by Lien: The lien secures payment for:

(1) the labor done or material furnished for the construction

or repair;

(2) the specially fabricated material, even if the material has

not been delivered or incorporated into the construction or repair,

less its fair salvage value; or

(3) the preparation of a plan or plat by an architect, engineer,

or surveyor. 53.023.

Limitation on Subcontractor's Lien: The amount of a lien claimed by a subcontractor may not exceed:

(1) an amount equal to the proportion of the total subcontract

price that the sum of the labor performed, materials furnished, materials specially fabricated, reasonable overhead costs incurred,

and proportionate profit margin bears to the total subcontract price; minus

(2) the sum of previous payments received by the claimant on the

subcontract. 53.024.

Limitation on Ordinary Retainage Lien: A lien for retainage is valid only for the amount specified to be retained in the contract, including any amendments to the contract, between the claimant and the original contractor or between the claimant and a subcontractor. 53.025.

Inception of Mechanic's Lien - Affidavit of Commencement: Except as provided below for special lien claimants, the time of inception of a mechanic's lien is the commencement of construction of improvements or delivery of materials to the land on which the improvements are to be located and on which the materials are to be used. The construction or materials must be visible from inspection of the land on which the improvements are being made.

An owner and original contractor may jointly file an affidavit of commencement with the county clerk of the county in which the land is located not later than the 30th day after the date of actual commencement of construction of the improvements or delivery of materials to the land. See Form TX-09-09 or TX-09A-09. Such an affidavit filed in compliance with law is prima facie evidence of the date of the commencement of the improvement described in the affidavit. The time of inception of a mechanic's lien arising from work described in an affidavit of commencement is the date of commencement of the work stated in the affidavit.

The time of inception of a lien that is created by an architect, engineer, or surveyor who prepares a plan or plat under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver in connection with the actual or proposed design, construction, or repair of improvements on real property or the location of the boundaries of real property, or a person who provides labor, plant material, or other supplies for the installation of landscaping for a house, building, or improvement, including the construction of a retention pond, retaining wall, berm, irrigation system, fountain, or other similar installation, under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver, is the date of recording of an affidavit of lien. The priority of a lien claimed by a person entitled to such liens with respect to other mechanic's liens is determined by the date of recording. Such liens are not valid or enforceable against a grantee or purchaser who acquires an interest in the real property before the time of inception of the lien. 53.124.

Affidavit Required For Payment: Any person who furnishes labor or materials for the construction of improvements on real property shall, if requested and as a condition of payment for such labor or materials, provide to the requesting party, or the party's agent, an affidavit stating that the person has paid each of the person's subcontractors, laborers, or materialmen in full for all labor and materials provided to the person for the construction. In the event, however, that the person has not paid each of the person's subcontractors, laborers, or materialmen in full, the person shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each subcontractor, laborer, or materialman to whom the payment is owed. See Form TX-02-09, TX-02A-09, TX-02B-09 or TX-02C-09.

The seller of any real property shall, upon request by the purchaser or the purchaser's agent prior to closing of the purchase of the real property, provide to the purchaser or the purchaser's agent, a written affidavit stating that the seller has paid each of the seller's contractors, laborers, or materialmen in full for all labor and materials provided to the seller through the date specified in the affidavit for any construction of improvements on the real property and that the seller is not indebted to any person, firm, or corporation by reason of any such construction through the date specified in the affidavit. In the event that the seller has not paid each of the seller's contractors, laborers, or materialmen in full for labor and material provided through the date specified in the affidavit, the seller shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each contractor, laborer, or materialman to whom the payment is owed.

The affidavit may include:

(1) a waiver or release of lien rights by the affiant that

is conditioned on the receipt of actual payment or collection of funds

when payment is made by check or draft;

(2) a warranty or representation that certain bills or classes of

bills will be paid by the affiant from funds paid in reliance on the affidavit;

and

(3) an indemnification by the affiant for any loss or expense resulting

from false or incorrect information in the affidavit.

A person, including a seller, commits an offense if the person intentionally, knowingly, or recklessly makes a false or misleading statement in an affidavit under this section. An offense under this section is a misdemeanor. A person adjudged guilty of an offense under this section shall be punished by a fine not to exceed $4,000 or confinement in jail for a term not to exceed one year or both a fine and confinement. A person may not receive community supervision for the offense.

A person signing an affidavit under this section is personally liable for any loss or damage resulting from any false or incorrect information in the affidavit. § 53.085.

Procedure to Claim Lien - Filing of Affidavit: Except as otherwise provided, the person claiming the lien must file an affidavit with the county clerk of the county in which the property is located or into which the railroad extends not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. A person claiming a lien arising from a residential construction project must file an affidavit with the county clerk of the county in which the property is located not later than the 15th day of the third calendar month after the day on which the indebtedness accrues. 53.052. See Forms TX-01-09, TX-01A-09, TX-01B-09, TX-01C-09 and TX-01D-09.

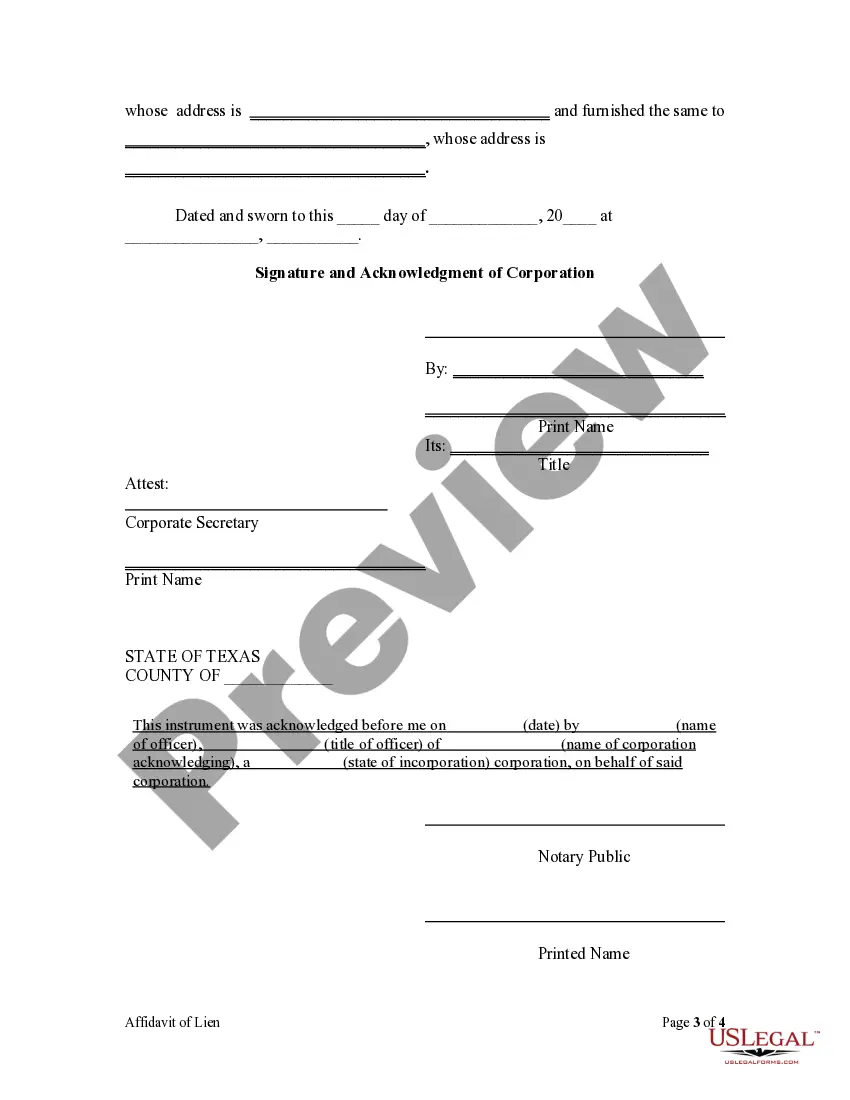

Contents of Affidavit: The affidavit must be signed by the person claiming the lien or by another person on the claimant's behalf and must contain substantially:

(1) a sworn statement of the amount of

the claim;

(2) the name and last known address of

the owner or reputed owner;

(3) a general statement of the kind of

work done and materials furnished by the claimant and, for a claimant other

than an original contractor, a statement of each month in which the work

was done and materials furnished for which payment is requested;

(4) the name and last known address of

the person by whom the claimant was employed or to whom the claimant furnished

the materials or labor;

(5) the name and last known address of

the original contractor;

(6) a description, legally sufficient for

identification, of the property sought to be charged with the lien;

(7) the claimant's name, mailing address,

and, if different, physical address; and

(8) for a claimant other than an original

contractor, a statement identifying the date each notice of the claim was

sent to the owner and the method by which the notice was sent.

The claimant may attach to the affidavit a copy of any applicable written agreement or contract and a copy of each notice sent to the owner.

The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated. The affidavit may use any abbreviations or symbols customary in the trade. 53.054. See Forms TX-01-09, TX-01A-09, TX-01B-09, TX-01C-09 and TX-01D-09.

Notice of Filed Affidavit: A person who files an affidavit must send a copy of the affidavit by registered or certified mail to the owner or reputed owner at the owner's last known business or residence address not later than the fifth day after the date the affidavit is filed with the county clerk.

If the person is not an original contractor, the person must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. 53.055.

Accrual of Indebtedness: Indebtedness accrues on a contract under which a plan or plat is prepared, labor was performed, materials furnished, or specially fabricated materials are to be furnished in accordance with the provisions below.

Indebtedness to an original contractor accrues:

(1) on the last day of the month in which

a written declaration by the original contractor or the owner is received

by the other party to the original contract stating that the original contract

has been terminated; or

(2) on the last day of the month in which

the original contract has been completed, finally settled, or abandoned.

Indebtedness to a subcontractor, or to any person not covered above, who has furnished labor or material to an original contractor or to another subcontractor accrues on the last day of the last month in which the labor was performed or the material furnished.

Indebtedness for specially fabricated material accrues:

(1) on the last day of the last month in

which materials were delivered;

(2) on the last day of the last month in

which delivery of the last of the material would normally have been required

at the job site; or

(3) on the last day of the month of any

material breach or termination of the original contract by the owner or

contractor or of the subcontract under which the specially fabricated material

was furnished.

A claim for retainage accrues on the last day of the month in which all work called for by the contract between the owner and the original contractor has been completed, finally settled, or abandoned. 53.053.

Derivative Claimant: Notice to Owner or Original Contractor: Except as provided by below dealing with residential construction contracts, a claimant other than an original contractor must give the notice prescribed by this section for the lien to be valid.

If the lien claim arises from a debt incurred by a subcontractor, the claimant must give to the original contractor written notice of the unpaid balance. The claimant must give the notice not later than the 15th day of the second month following each month in which all or part of the claimant's labor was performed or material delivered. The claimant must give the same notice to the owner or reputed owner and the original contractor not later than the 15th day of the third month following each month in which all or part of the claimant's labor was performed or material or specially fabricated material was delivered.

If the lien claim arises from a debt incurred by the original contractor, the claimant must give notice to the owner or reputed owner, with a copy to the original contractor, in accordance with the paragraph above.

To authorize the owner to withhold funds, the notice to the owner must state that if the claim remains unpaid, the owner may be personally liable and the owner's property may be subjected to a lien unless:

(1) the owner withholds payments from the

contractor for payment of the claim; or

(2) the claim is otherwise paid or settled.

The notice must be sent by registered or certified mail and must be addressed to the owner or reputed owner or the original contractor, as applicable, at his last known business or residence address.

A copy of the statement or billing in the usual and customary form is sufficient as notice under this section. § 53.056. See Form TX-08-09 or TX-08A-09.

Derivative Claimant: Notice for Contractual Retainage Claim:

(a) A claimant may give notice under this section instead of or in addition

to notice under Section 53.056 or 53.252 if the claimant is to labor, furnish

labor or materials, or specially fabricate materials under an agreement

with an original contractor or a subcontractor providing for retainage.

(b) The claimant must give the owner or

reputed owner notice of the retainage agreement not later than the 15th

day of the second month following the delivery of materials or the performance

of labor by the claimant that first occurs after the claimant has agreed

to the contractual retainage. If the agreement is with a subcontractor,

the claimant must also give notice within that time to the original contractor.

(c) The notice must contain:

(1) the sum to be retained;

(2) the due date or dates, if known; and

(3) a general indication of the nature

of the agreement.

(d) The notice must be sent by registered

or certified mail to the last known business or residence address of the

owner or reputed owner or the original contractor, as applicable.

(e) If a claimant gives notice under this

section and Section 53.055 or, if the claim relates to a residential construction

project, under this section and Section 53.252, the claimant is not required

to give any other notice as to the retainage. § 53.057.

Authority to Withhold Funds for Benefit of Claimants: If an owner receives notice under Section 53.056, 53.057, 53.058, 53.252, or 53.253, the owner may withhold from payments to the original contractor an amount necessary to pay the claim for which he receives notice.

If notice is sent in a form that substantially complies with Section 53.056 or 53.252, the owner may withhold the funds immediately on receipt of the notice.

If notice is sent under Section 53.057, the owner may withhold funds immediately on receipt of a copy of the claimant's affidavit prepared in accordance with Sections 53.052 through 53.055.

If notice is sent under Section 53.058, the owner may withhold funds immediately on receipt of the notices sent under Subsection (e) of that section. If notice is sent as provided by Section 53.253(b), the owner may withhold funds immediately on receipt of the notice sent as required by Section 53.252. § 53.081.

Time for Which Funds are Withheld: Unless payment is made under Section 53.083 or the claim is otherwise settled, discharged, indemnified under Subchapter H or I, or determined to be invalid by a final judgment of a court, the owner shall retain the funds withheld until:

(1) the time for filing the affidavit of

mechanic's lien has passed; or

(2) if a lien affidavit has been filed,

until the lien claim has been satisfied or released. § 53.082.

Payment to Claimant on Demand: The claimant may make written demand for payment of the claim to an owner authorized to withhold funds under this subchapter. The demand must give notice to the owner that all or part of the claim has accrued under Section 53.053 or is past due according to the agreement between the parties.

The claimant must send a copy of the demand to the original contractor. The original contractor may give the owner written notice that the contractor intends to dispute the claim. The original contractor must give the notice not later than the 30th day after the day he receives the copy of the demand. If the original contractor does not give the owner timely notice, he is considered to have assented to the demand and the owner shall pay the claim.

The claimant's demand may accompany the original notice of nonpayment or of a past-due claim and may be stamped or written in legible form on the face of the notice.

Unless the lien has been secured, the demand may not be made after expiration of the time within which the claimant may secure the lien for the claim. § 53.083. See Form TX-014-09 or TX-014A-09.

Owner's Liability: Except for the amount required to be retained under Subchapter E, the owner is not liable for any amount paid to the original contractor before the owner is authorized to withhold funds under this subchapter.

If the owner has received the notices required by Subchapter C or K, if the lien has been secured, and if the claim has been reduced to final judgment, the owner is liable and the owner's property is subject to a claim for any money paid to the original contractor after the owner was authorized to withhold funds under this subchapter. The owner is liable for that amount in addition to any amount for which he is liable under Subchapter E. § 53.084.

Required Retainage: During the progress of work under an original contract for which a mechanic's lien may be claimed and for 30 days after the work is completed, the owner shall retain:

(1) 10 percent of the contract price of the work to the

owner; or

(2) 10 percent of the value of the work, measured by the proportion

that the work done bears to the work to be done, using the contract price

or, if there is no contract price, using the reasonable value of the completed

work.

In this section, "owner" includes the owner's agent, trustee, or receiver. § 53.101.

Payment Secured by Retainage: The retained funds secure the payment of artisans and mechanics who perform labor or service and the payment of other persons who furnish material, material and labor, or specially fabricated material for any contractor, subcontractor, agent, or receiver in the performance of the work. § 53.102.

Lien on Retained Funds: A claimant has a lien on the retained funds if the claimant:

(1) sends the notices required by this chapter in the time and manner

required; and

(2) files an affidavit claiming a lien not later than the 30th

day after the work is completed. § 53.103.

Preferences: Individual artisans and mechanics are entitled to a preference to the retained funds and shall share proportionately to the extent of their claims for wages and fringe benefits earned.

After payment of artisans and mechanics who are entitled to a preference under the paragraph above, other participating claimants share proportionately in the balance of the retained funds. § 53.104.

Owner's Liability for Failure to Retain: If the owner fails or refuses to comply with this subchapter, the claimants complying with this chapter have a lien, at least to the extent of the amount that should have been retained from the original contract under which they are claiming, against the house, building, structure, fixture, or improvement and all of its properties and against the lot or lots of land necessarily connected.

The claimants share the lien proportionately in accordance with the preference provided by Section 53.104. § 53.105.

Affidavit of Completion: An owner may file with the county clerk of the county in which the property is located an affidavit of completion. The affidavit must contain:

(1) the name and address of the owner;

(2) the name and address of the original contractor;

(3) a description, legally sufficient for identification, of the

real property on which the improvements are located;

(4) a description of the improvements furnished under the original

contract;

(5) a statement that the improvements under the original contract

have been completed and the date of completion; and

(6) a conspicuous statement that a claimant may not have a lien

on retained funds unless the claimant files the affidavit claiming a lien

not later than the 30th day after the date of completion.

A copy of the affidavit must be sent by certified or registered mail to the original contractor not later than the date the affidavit is filed and to each claimant who sends a notice of lien liability to the owner under Section 53.056, 53.057, 53.058, 53.252, or 53.253 not later than the date the affidavit is filed or the 10th day after the date the owner receives the notice of lien liability, whichever is later.

A copy of the affidavit must also be sent to each person who furnishes labor or materials for the property and who furnishes the owner with a written request for the copy. The owner must furnish the copy to the person not later than the date the affidavit is filed or the 10th day after the date the request is received, whichever is later.

Except as provided by this subsection, an affidavit filed under this section on or before the 10th day after the date of completion of the improvements is prima facie evidence of the date the work under the original contract is completed for purposes of this subchapter. If the affidavit is filed after the 10th day after the date of completion, the date of completion for purposes of this subchapter is the date the affidavit is filed. This subsection does not apply to a person to whom the affidavit was not sent as required by this section.§ 53.106. See Form TX-04-09 or TX-04A-09.

Preference Over Other Creditors: All subcontractors, laborers, and materialmen who have a mechanic's lien have preference over other creditors of the original contractor. § 53.121.

Equality of Mechanic's Liens: Except as provided by Subchapter E and Section 53.124(e), perfected mechanic's liens are on equal footing without reference to the date of filing the affidavit claiming the lien.

If the proceeds of a foreclosure sale of property are insufficient to discharge all mechanic's liens against the property, the proceeds shall be paid pro rata on the perfected mechanic's liens on which suit is brought.

This chapter does not affect the contract between the owner and the original contractor as to the amount, manner, or time of payment of the contract price. § 53.122.

Priority of Mechanic's Lien Over Other Liens: Except as provided by this section, a mechanic's lien attaches to the house, building, improvements, or railroad property in preference to any prior lien, encumbrance, or mortgage on the land on which it is located, and the person enforcing the lien may have the house, building, improvement, or any piece of the railroad property sold separately.

The mechanic's lien does not affect any lien, encumbrance, or mortgage on the land or improvement at the time of the inception of the mechanic's lien, and the holder of the lien, encumbrance, or mortgage need not be made a party to a suit to foreclose the mechanic's lien. § 53.123.

Enforcement of Remedies Against Money Due Original Contractor or Subcontractor: A creditor of an original contractor may not collect, enforce a security interest against, garnish, or levy execution on the money due the original contractor or the contractor's surety from the owner, and a creditor of a subcontractor may not collect, enforce a security interest against, garnish, or levy execution on the money due the subcontractor, to the prejudice of the subcontractors, mechanics, laborers, materialmen, or their sureties.

A surety issuing a payment bond or performance bond in connection with the improvements has a priority claim over other creditors of its principal to contract funds to the extent of any loss it suffers or incurs. That priority does not excuse the surety from paying any obligations that it may have under its payment bonds. § 53.151.

Release of Claim or Lien: When a debt for labor or materials is satisfied or paid by collected funds, the person who furnished the labor or materials shall, not later than the 10th day after the date of receipt of a written request, furnish to the requesting person a release of the indebtedness and any lien claimed, to the extent of the indebtedness paid. An owner, the original contractor, or any person making the payment may request the release.

A release of lien must be in a form that would permit it to be filed of record. § 53.152. See Form TX-05-09 or TX-05A-09

Defense of Actions: If an affidavit claiming a mechanic's lien is filed by a person other than the original contractor, the original contractor shall defend at his own expense a suit brought on the claim.

If the suit results in judgment on the lien against the owner or the owner's property, the owner is entitled to deduct the amount of the judgment and costs from any amount due the original contractor. If the owner has settled with the original contractor in full, the owner is entitled to recover from the original contractor any amount paid for which the original contractor was originally liable. § 53.153.

Foreclosure: A mechanic's lien may be foreclosed only on judgment of a court of competent jurisdiction foreclosing the lien and ordering the sale of the property subject to the lien. § 53.154.

Transfer of Property Sold: If the house, building, improvement, or any piece of railroad property is sold separately, the officer making the sale shall place the purchaser in possession. The purchaser is entitled to a reasonable time after the date of purchase within which to remove the purchased property. § 53.155.

Costs and Attorney's Fees: In any proceeding to foreclose a lien or to enforce a claim against a bond issued under Subchapter H, I, or J1 or in any proceeding to declare that any lien or claim is invalid or unenforceable in whole or in part, the court may award costs and reasonable attorney's fees as are equitable and just. § 53.156.

Discharge of Lien: A mechanic's lien or affidavit claiming a mechanic's lien filed under Section 53.052 may be discharged of record by:

(1) recording a lien release signed by the claimant under

Section 53.152;

(2) failing to institute suit to foreclose the lien in the county

in which the property is located within the period prescribed by Section

53.158, 53.175, or 53.208;

(3) recording the original or certified copy of a final judgment

or decree of a court of competent jurisdiction providing for the discharge;

(4) filing the bond and notice in compliance with Subchapter H;

(5) filing the bond in compliance with Subchapter I; or

(6) recording a certified copy of the order removing the lien under

Section 53.160 and a certificate from the clerk of the court that states

that no bond or deposit as described by Section 53.161 was filed by the

claimant within 30 days after the date the order was entered. § 53.157.

Period for Bringing Suit to Foreclose Lien: Except as provided by Subsection (b), suit must be brought to foreclose the lien within two years after the last day a claimant may file the lien affidavit under Section 53.052 or within one year after completion, termination, or abandonment of the work under the original contract under which the lien is claimed, whichever is later.

For a claim arising from a residential construction project, suit must be brought to foreclose the lien within one year after the last day a claimant may file a lien affidavit under Section 53.052 or within one year after completion, termination, or abandonment of the work under the original contract under which the lien is claimed, whichever is later. § 53.158.

Obligation to Furnish Information: An owner, on written request, shall furnish the following information within a reasonable time, but not later than the 10th day after the date the request is received, to any person furnishing labor or materials for the project:

(1) a description of the real property being improved legally

sufficient to identify it;

(2) whether there is a surety bond and if so, the name and last

known address of the surety and a copy of the bond; and

(3) whether there are any prior recorded liens or security interests

on the real property being improved and if so, the name and address of

the person having the lien or security interest. See TX-03-09 or TX-03A-09.

An original contractor, on written request by a person who furnished work under the original contract, shall furnish to the person the following information within a reasonable time, but not later than the 10th day after the date the request is received:

(1) the name and last known address of the person to whom

the original contractor furnished labor or materials for the construction

project; and

(2) whether the original contractor has furnished or has been furnished

a payment bond for any of the work on the construction project and if so,

the name and last known address of the surety and a copy of the bond. See

TX-03B-09 or TX-03C-09.

A subcontractor, on written request by an owner of the property being improved, the original contractor, a surety on a bond covering the original contract, or any person furnishing work under the subcontract, shall furnish to the person the following information within a reasonable time, but not later than the 10th day after the date the request is received:

(1) the name and last known address of each person from

whom the subcontractor purchased labor or materials for the construction

project, other than those materials that were furnished to the project

from the subcontractor's inventory;

(2) the name and last known address of each person to whom the subcontractor

furnished labor or materials for the construction project; and

(3) whether the subcontractor has furnished or has been furnished

a payment bond for any of the work on the construction project and if so,

the name and last known address of the surety and a copy of the bond. See

TX-03D-09 or TX-03E-09.

Not later than the 30th day after the date a written request is received from the owner, the contractor under whom a claim of lien or under whom a bond is made, or a surety on a bond on which a claim is made, a claimant for a lien or under a bond shall furnish to the requesting person a copy of any applicable written agreement, purchase order, or contract and any billing, statement, or payment request of the claimant reflecting the amount claimed and the work performed by the claimant for which the claim is made. If requested, the claimant shall provide the estimated amount due for each calendar month in which the claimant has performed labor or furnished materials.

If a person from whom information is requested does not have a direct contractual relationship on the project with the person requesting the information, the person from whom information is requested, other than a claimant requested to furnish information under Subsection (d), may require payment of the actual costs, not to exceed $25, in furnishing the requested information.

A person, other than a claimant requested to furnish information under Subsection (d), who fails to furnish information as required by this section is liable to the requesting person for that person's reasonable and necessary costs incurred in procuring the requested information. § 53.159.

SPECIAL PROVISIONS FOR RESIDENTIAL CONSTRUCTION PROJECTS

Procedures for Residential Construction Projects: A person must comply with this subchapter in addition to the other applicable provisions of this chapter to perfect a lien that arises from a claim resulting from a residential construction project. § 53.251.

Derivative Claimant: Notice to Owner or Original Contractor: A claimant other than an original contractor must give the notice prescribed by this section for the lien to be valid. If the property that is the subject of the lien is a homestead, the notice must also comply with Section 53.254.

The claimant must give to the owner or reputed owner and the original contractor written notice of the unpaid balance. The claimant must give the notice not later than the 15th day of the second month following each month in which all or part of the claimant's labor was performed or material or specially fabricated material was delivered.

To authorize the owner to withhold funds under Subchapter D, the notice to the owner must state that if the claim remains unpaid, the owner may be personally liable and the owner's property may be subjected to a lien unless: (1) the owner withholds payments from the contractor for payment of the claim; or (2) the claim is otherwise paid or settled.

The notice must be sent by registered or certified mail and must be addressed to the owner or reputed owner and the original contractor, as applicable, at the person's last known business or residence address.

A copy of the statement or billing in the usual and customary form is sufficient as notice under this section. § 53.252. See TX-08-09 or TX-08A-09.

Homestead: To fix a lien on a homestead, the person who is to furnish material or perform labor and the owner must execute a written contract setting forth the terms of the agreement.

The contract must be executed before the material is furnished or the labor is performed.

If the owner is married, the contract must be signed by both spouses.

If the contract is made by an original contractor, the contract inures to the benefit of all persons who labor or furnish material for the original contractor.

The contract must be filed with the county clerk of the county in which the homestead is located. The county clerk shall record the contract in records kept for that purpose.

An affidavit for lien filed under this subchapter that relates to a homestead must contain the following notice conspicuously printed, stamped, or typed in a size equal to at least 10-point boldface or the computer equivalent, at the top of the page:

"NOTICE: THIS IS NOT A LIEN. THIS IS ONLY AN AFFIDAVIT CLAIMING A LIEN."

For the lien on a homestead to be valid, the notice required to be given to the owner under Section 53.252 must include or have attached the following statement:

"If a subcontractor or supplier who furnishes materials or performs labor for construction of improvements on your property is not paid, your property may be subject to a lien for the unpaid amount if:

(1) after receiving notice of the unpaid

claim from the claimant, you fail to withhold payment to your contractor

that is sufficient to cover the unpaid claim until the dispute is resolved;

or

(2) during construction and for 30 days

after completion of construction, you fail to retain 10 percent of the

contract price or 10 percent of the value of the work performed by your contractor.

"If you have complied with the law regarding the 10 percent retainage and you have withheld payment to the contractor sufficient to cover any written notice of claim and have paid that amount, if any, to the claimant, any lien claim filed on your property by a subcontractor or supplier, other than a person who contracted directly with you, will not be a valid lien on your property. In addition, except for the required 10 percent retainage, you are not liable to a subcontractor or supplier for any amount paid to your contractor before you received written notice of the claim." § 53.254. See FORM TX-010-09.

Disclosure Statement Required for Residential Construction Contract: Before a residential construction contract is executed by the owner, the original contractor shall deliver to the owner a disclosure statement described by this section. The failure of a contractor to comply with this section does not invalidate a lien under this chapter, a contract lien, or a deed of trust. § 53.255. See Form TX-011-09.

List of Subcontractors and Suppliers: Except as provided by Subsection (d), for the construction of improvements under a residential construction contract, the original contractor shall:

(1) furnish to the owner before the commencement of construction

a written list that identifies by name, address, and telephone number each

subcontractor and supplier the contractor intends to use in the work to

be performed; and

(2) provide the owner with an updated list of subcontractors and

suppliers not later than the 15th day after the date a subcontractor or

supplier is added or deleted.

The list must contain the following notice conspicuously printed, stamped, or typed in a size equal to at least 10-point boldface or the computer equivalent:

"NOTICE: THIS LIST OF SUBCONTRACTORS AND SUPPLIERS MAY NOT BE A FINAL LISTING. UNLESS YOU SIGN A WAIVER OF YOUR RIGHT TO RECEIVE UPDATED INFORMATION, THE CONTRACTOR IS REQUIRED BY LAW TO SUPPLY UPDATED INFORMATION, AS THE INFORMATION BECOMES AVAILABLE, FOR EACH SUBCONTRACTOR OR SUPPLIER USED IN THE WORK PERFORMED ON YOUR RESIDENCE."

The failure of a contractor to comply with this section does not invalidate a lien under this chapter, a contract lien, or a deed of trust.See Forms TX-012-09.

An owner may waive the right to receive the list of subcontractors and suppliers or any updated information required by this section only as provided by this subsection. The waiver must be in writing and may be included in the residential construction contract. If the waiver is not included as a provision of the residential construction contract, the separate waiver statement must be signed by the owner. The waiver must be conspicuously printed in at least 10-point bold-faced type and read substantially as required by statute. § 53.256. See Forms TX-013-09.

Provisions Related to Closing of Loan for Construction of Improvements: If the owner is obtaining third-party financing for the construction of improvements under a residential construction contract, the lender shall deliver to the owner all documentation relating to the closing of the loan not later than one business day before the date of the closing. If a bona fide emergency or another good cause exists and the lender obtains the written consent of the owner, the lender may provide the documentation to the owner or the lender may modify previously provided documentation on the date of closing.

The lender shall provide to the owner the disclosure statement described by Section 53.255(b). The disclosure statement must be provided to the owner before the date of closing. If a bona fide emergency or another good cause exists and the lender obtains the written consent of the owner, the lender may provide the disclosure statement at the closing. The lender shall retain a signed and dated copy of the disclosure statement with the closing documents.

The failure of a lender to comply with this section does not invalidate a lien under this chapter, a contract lien, or a deed of trust.§ 53.257.See Form TX-011-09.

Disbursements of Funds: At the time the original contractor requests payment from the owner or the owner's lender for the construction of improvements under a residential construction contract, the original contractor shall provide to the owner a disbursement statement. The statement may include any information agreed to by the owner and the original contractor and must include at least the name and address of each person who subcontracted directly with the original contractor and who the original contractor intends to pay from the requested funds. The original contractor shall provide the disbursement statement: (1) in the manner agreed to in writing by the owner and original contractor; or (2) if no agreement exists, by depositing the statement in the United States mail, first class, postage paid, and properly addressed to the owner or by hand delivering the statement to the owner before the original contractor receives the requested funds.

If the owner finances the construction of improvements through a third party that advances loan proceeds directly to the original contractor, the lender shall:

(1) obtain from the original contractor the signed disbursement

statement required by Subsection (a) that covers the funds for which the

original contractor is requesting payment; and

(2) provide to the owner a statement of funds disbursed by the

lender since the last statement was provided to the owner.

The lender shall provide to the owner the lender's disbursement statement and the disbursement statement the lender obtained from the contractor before the lender disburses the funds to the original contractor. The disbursement statements may be provided in any manner agreed to by the lender and the owner.

The lender is not responsible for the accuracy of the information contained in the disbursement statement obtained from the original contractor.

The failure of a lender or an original contractor to comply with this section does not invalidate a lien under this chapter, a contract lien, or a deed of trust.

A person commits an offense if the person intentionally, knowingly, or recklessly provides false or misleading information in a disbursement statement required under this section. An offense under this section is a misdemeanor. A person adjudged guilty of an offense under this section shall be punished by a fine not to exceed $4,000 or confinement in jail for a term not to exceed one year or both a fine and confinement. A person may not receive community supervision for the offense.§ 53.258.See Form TX-016-09

Final Bills - Paid Affidavit Required: As a condition of final payment under a residential construction contract, the original contractor shall, at the time the final payment is tendered, execute and deliver to the owner, or the owner's agent, an affidavit stating that the original contractor has paid each person in full for all labor and materials used in the construction of improvements on the real property. If the original contractor has not paid each person in full, the original contractor shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each person to whom a payment is owed.

The seller of any real property on which a structure of not more than four units is constructed and that is intended as the principal place of residence for the purchaser shall, at the closing of the purchase of the real property, execute and deliver to the purchaser, or the purchaser's agent, an affidavit stating that the seller has paid each person in full for all labor and materials used in the construction of improvements on the real property and that the seller is not indebted to any person by reason of any construction. In the event that the seller has not paid each person in full, the seller shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each person to whom a payment is owed.

A person commits an offense if the person intentionally, knowingly, or recklessly makes a false or misleading statement in an affidavit under this section. An offense under this section is a misdemeanor. A person adjudged guilty of an offense under this section shall be punished by a fine not to exceed $4,000 or confinement in jail for a term not to exceed one year or both a fine and confinement. A person may not receive community supervision for the offense.

A person signing an affidavit under this section is personally liable for any loss or damage resulting from any false or incorrect information in the affidavit. § 53.259.See Form TX-014A-09 or TX-015-09.

Conveyance to Contractor Not Required: An original contractor may not require an owner of real property to convey the real property to the original contractor or an entity controlled by the original contractor as a condition to the performance of the residential construction contract for improvements to the real property.§ 53.260.

Note: This summary is not intended to be an all inclusive discussion of Texas Law of Mechanic's liens, but does contain basic and other provisions.

Definitions as used herein.

"Labor" means labor used in the direct prosecution of the work.

"Material" means all or part of:

(A) the material, machinery, fixtures, or tools incorporated

into the work, consumed in the direct prosecution of the work, or

ordered and delivered for incorporation or consumption;

(B) rent at a reasonable rate and actual running repairs at a reasonable

cost for construction equipment used or reasonably required and

delivered for use in the direct prosecution of the work at the site of

the construction or repair; or

(C) power, water, fuel, and lubricants consumed or ordered and

delivered for consumption in the direct prosecution of the work.

"Mechanic's lien" means the lien provided by Texas Laws, Chapter 53.

"Original contract" means an agreement to which an owner is a party either directly or by implication of law.

"Original contractor" means a person contracting with an owner either directly or through the owner's agent.

"Residence" means a single-family house, duplex, triplex, or quadruplex or a unit in a multiunit structure used for residential purposes that is:

(A) owned by one or more adult persons; and

(B) used or intended to be used as a dwelling by one of the owners.

"Residential construction contract" means a contract between an owner and a contractor in which the contractor agrees to construct or repair the owner's residence, including improvements appurtenant to the residence.

"Residential construction project" means a project for the construction or repair of a new or existing residence, including improvements appurtenant to the residence, as provided by a residential construction contract.

"Retainage" means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. The term does not include retainage under Subchapter E.

"Specially fabricated material" means material fabricated for use as a component of the construction or repair so as to be reasonably unsuitable for use elsewhere.

"Subcontractor" means a person who has furnished labor or materials to fulfill an obligation to an original contractor or to a subcontractor to perform all or part of the work required by an original contract.

"Work" means any part of construction or repair performed under an original contract.

"Completion" of an original contract means the actual completion of the work, including any extras or change orders reasonably required or contemplated under the original contract, other than warranty work or replacement or repair of the work performed under the contract. § 53.001.

Number of Contractors: There may be one or more contractors for a constrution project. 53.002.

Notice Requirements: Any notice or other written communication may be delivered in person to the party entitled to the notice or to that party's agent, regardless of the manner prescribed by law. If notice is sent by registered or certified mail, deposit or mailing of the notice in the United States mail in the form required constitutes compliance with the notice requirement. This subsection does not apply if the law requires receipt of the notice by the person to whom it is directed. If a written notice is received by the person entitled to receive it, the method by which the notice was delivered is immaterial. 53.003.

Persons Entitled to Lien:

A person has a lien if the person labors, specially fabricates material, or furnishes labor or materials for construction or repair in this state of:

(A) a house, building, or improvement;

(B) a levee or embankment to be erected for the reclamation of

overflow land along a river or creek; or

(C) a railroad;

and the person labors, specially fabricates the material, or furnishes the labor or materials under or by virtue of a contract with the owner or the owner's agent, trustee, receiver, contractor, or subcontractor.

A person who specially fabricates material has a lien even if the material is not delivered.

An architect, engineer, or surveyor who prepares a plan or plat under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver in connection with the actual or proposed design, construction, or repair of improvements on real property or the location of the boundaries of real property has a lien on the property.

A person who provides labor, plant material, or other supplies for the installation of landscaping for a house, building, or improvement, including the construction of a retention pond, retaining wall, berm, irrigation system, fountain, or other similar installation, under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver has a lien on the property. 53.021.

Property to Which Lien Extends: The lien extends to the house, building, fixtures, or improvements, the land reclaimed from overflow, or the railroad and all of its properties, and to each lot of land necessarily connected or reclaimed. The lien does not extend to abutting sidewalks, streets, and utilities that are public property. A lien against land in a city, town, or village extends to each lot on which the house, building, or improvement is situated or on which the labor was performed. A lien against land not in a city, town, or village extends to not more than 50 acres on which the house, building, or improvement is situated or on which the labor was performed. 53.022.

Payment Secured by Lien: The lien secures payment for:

(1) the labor done or material furnished for the construction

or repair;

(2) the specially fabricated material, even if the material has

not been delivered or incorporated into the construction or repair,

less its fair salvage value; or

(3) the preparation of a plan or plat by an architect, engineer,

or surveyor. 53.023.

Limitation on Subcontractor's Lien: The amount of a lien claimed by a subcontractor may not exceed:

(1) an amount equal to the proportion of the total subcontract

price that the sum of the labor performed, materials furnished, materials specially fabricated, reasonable overhead costs incurred,

and proportionate profit margin bears to the total subcontract price; minus

(2) the sum of previous payments received by the claimant on the

subcontract. 53.024.

Limitation on Ordinary Retainage Lien: A lien for retainage is valid only for the amount specified to be retained in the contract, including any amendments to the contract, between the claimant and the original contractor or between the claimant and a subcontractor. 53.025.

Inception of Mechanic's Lien - Affidavit of Commencement: Except as provided below for special lien claimants, the time of inception of a mechanic's lien is the commencement of construction of improvements or delivery of materials to the land on which the improvements are to be located and on which the materials are to be used. The construction or materials must be visible from inspection of the land on which the improvements are being made.

An owner and original contractor may jointly file an affidavit of commencement with the county clerk of the county in which the land is located not later than the 30th day after the date of actual commencement of construction of the improvements or delivery of materials to the land. See Form TX-09-09 or TX-09A-09. Such an affidavit filed in compliance with law is prima facie evidence of the date of the commencement of the improvement described in the affidavit. The time of inception of a mechanic's lien arising from work described in an affidavit of commencement is the date of commencement of the work stated in the affidavit.

The time of inception of a lien that is created by an architect, engineer, or surveyor who prepares a plan or plat under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver in connection with the actual or proposed design, construction, or repair of improvements on real property or the location of the boundaries of real property, or a person who provides labor, plant material, or other supplies for the installation of landscaping for a house, building, or improvement, including the construction of a retention pond, retaining wall, berm, irrigation system, fountain, or other similar installation, under or by virtue of a written contract with the owner or the owner's agent, trustee, or receiver, is the date of recording of an affidavit of lien. The priority of a lien claimed by a person entitled to such liens with respect to other mechanic's liens is determined by the date of recording. Such liens are not valid or enforceable against a grantee or purchaser who acquires an interest in the real property before the time of inception of the lien. 53.124.

Affidavit Required For Payment: Any person who furnishes labor or materials for the construction of improvements on real property shall, if requested and as a condition of payment for such labor or materials, provide to the requesting party, or the party's agent, an affidavit stating that the person has paid each of the person's subcontractors, laborers, or materialmen in full for all labor and materials provided to the person for the construction. In the event, however, that the person has not paid each of the person's subcontractors, laborers, or materialmen in full, the person shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each subcontractor, laborer, or materialman to whom the payment is owed. See Form TX-02-09, TX-02A-09, TX-02B-09 or TX-02C-09.

The seller of any real property shall, upon request by the purchaser or the purchaser's agent prior to closing of the purchase of the real property, provide to the purchaser or the purchaser's agent, a written affidavit stating that the seller has paid each of the seller's contractors, laborers, or materialmen in full for all labor and materials provided to the seller through the date specified in the affidavit for any construction of improvements on the real property and that the seller is not indebted to any person, firm, or corporation by reason of any such construction through the date specified in the affidavit. In the event that the seller has not paid each of the seller's contractors, laborers, or materialmen in full for labor and material provided through the date specified in the affidavit, the seller shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each contractor, laborer, or materialman to whom the payment is owed.

The affidavit may include:

(1) a waiver or release of lien rights by the affiant that

is conditioned on the receipt of actual payment or collection of funds

when payment is made by check or draft;

(2) a warranty or representation that certain bills or classes of

bills will be paid by the affiant from funds paid in reliance on the affidavit;

and

(3) an indemnification by the affiant for any loss or expense resulting

from false or incorrect information in the affidavit.

A person, including a seller, commits an offense if the person intentionally, knowingly, or recklessly makes a false or misleading statement in an affidavit under this section. An offense under this section is a misdemeanor. A person adjudged guilty of an offense under this section shall be punished by a fine not to exceed $4,000 or confinement in jail for a term not to exceed one year or both a fine and confinement. A person may not receive community supervision for the offense.

A person signing an affidavit under this section is personally liable for any loss or damage resulting from any false or incorrect information in the affidavit. § 53.085.

Procedure to Claim Lien - Filing of Affidavit: Except as otherwise provided, the person claiming the lien must file an affidavit with the county clerk of the county in which the property is located or into which the railroad extends not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. A person claiming a lien arising from a residential construction project must file an affidavit with the county clerk of the county in which the property is located not later than the 15th day of the third calendar month after the day on which the indebtedness accrues. 53.052. See Forms TX-01-09, TX-01A-09, TX-01B-09, TX-01C-09 and TX-01D-09.

Contents of Affidavit: The affidavit must be signed by the person claiming the lien or by another person on the claimant's behalf and must contain substantially:

(1) a sworn statement of the amount of

the claim;

(2) the name and last known address of

the owner or reputed owner;

(3) a general statement of the kind of

work done and materials furnished by the claimant and, for a claimant other

than an original contractor, a statement of each month in which the work

was done and materials furnished for which payment is requested;

(4) the name and last known address of

the person by whom the claimant was employed or to whom the claimant furnished

the materials or labor;

(5) the name and last known address of

the original contractor;

(6) a description, legally sufficient for

identification, of the property sought to be charged with the lien;

(7) the claimant's name, mailing address,

and, if different, physical address; and

(8) for a claimant other than an original

contractor, a statement identifying the date each notice of the claim was

sent to the owner and the method by which the notice was sent.

The claimant may attach to the affidavit a copy of any applicable written agreement or contract and a copy of each notice sent to the owner.

The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated. The affidavit may use any abbreviations or symbols customary in the trade. 53.054. See Forms TX-01-09, TX-01A-09, TX-01B-09, TX-01C-09 and TX-01D-09.

Notice of Filed Affidavit: A person who files an affidavit must send a copy of the affidavit by registered or certified mail to the owner or reputed owner at the owner's last known business or residence address not later than the fifth day after the date the affidavit is filed with the county clerk.

If the person is not an original contractor, the person must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. 53.055.

Accrual of Indebtedness: Indebtedness accrues on a contract under which a plan or plat is prepared, labor was performed, materials furnished, or specially fabricated materials are to be furnished in accordance with the provisions below.

Indebtedness to an original contractor accrues:

(1) on the last day of the month in which

a written declaration by the original contractor or the owner is received

by the other party to the original contract stating that the original contract

has been terminated; or

(2) on the last day of the month in which

the original contract has been completed, finally settled, or abandoned.

Indebtedness to a subcontractor, or to any person not covered above, who has furnished labor or material to an original contractor or to another subcontractor accrues on the last day of the last month in which the labor was performed or the material furnished.

Indebtedness for specially fabricated material accrues:

(1) on the last day of the last month in

which materials were delivered;

(2) on the last day of the last month in

which delivery of the last of the material would normally have been required

at the job site; or

(3) on the last day of the month of any

material breach or termination of the original contract by the owner or

contractor or of the subcontract under which the specially fabricated material

was furnished.

A claim for retainage accrues on the last day of the month in which all work called for by the contract between the owner and the original contractor has been completed, finally settled, or abandoned. 53.053.

Derivative Claimant: Notice to Owner or Original Contractor: Except as provided by below dealing with residential construction contracts, a claimant other than an original contractor must give the notice prescribed by this section for the lien to be valid.

If the lien claim arises from a debt incurred by a subcontractor, the claimant must give to the original contractor written notice of the unpaid balance. The claimant must give the notice not later than the 15th day of the second month following each month in which all or part of the claimant's labor was performed or material delivered. The claimant must give the same notice to the owner or reputed owner and the original contractor not later than the 15th day of the third month following each month in which all or part of the claimant's labor was performed or material or specially fabricated material was delivered.

If the lien claim arises from a debt incurred by the original contractor, the claimant must give notice to the owner or reputed owner, with a copy to the original contractor, in accordance with the paragraph above.

To authorize the owner to withhold funds, the notice to the owner must state that if the claim remains unpaid, the owner may be personally liable and the owner's property may be subjected to a lien unless:

(1) the owner withholds payments from the

contractor for payment of the claim; or

(2) the claim is otherwise paid or settled.

The notice must be sent by registered or certified mail and must be addressed to the owner or reputed owner or the original contractor, as applicable, at his last known business or residence address.

A copy of the statement or billing in the usual and customary form is sufficient as notice under this section. § 53.056. See Form TX-08-09 or TX-08A-09.

Derivative Claimant: Notice for Contractual Retainage Claim:

(a) A claimant may give notice under this section instead of or in addition

to notice under Section 53.056 or 53.252 if the claimant is to labor, furnish

labor or materials, or specially fabricate materials under an agreement

with an original contractor or a subcontractor providing for retainage.

(b) The claimant must give the owner or

reputed owner notice of the retainage agreement not later than the 15th

day of the second month following the delivery of materials or the performance

of labor by the claimant that first occurs after the claimant has agreed

to the contractual retainage. If the agreement is with a subcontractor,

the claimant must also give notice within that time to the original contractor.

(c) The notice must contain:

(1) the sum to be retained;

(2) the due date or dates, if known; and

(3) a general indication of the nature

of the agreement.

(d) The notice must be sent by registered

or certified mail to the last known business or residence address of the

owner or reputed owner or the original contractor, as applicable.

(e) If a claimant gives notice under this

section and Section 53.055 or, if the claim relates to a residential construction

project, under this section and Section 53.252, the claimant is not required

to give any other notice as to the retainage. § 53.057.

Authority to Withhold Funds for Benefit of Claimants: If an owner receives notice under Section 53.056, 53.057, 53.058, 53.252, or 53.253, the owner may withhold from payments to the original contractor an amount necessary to pay the claim for which he receives notice.

If notice is sent in a form that substantially complies with Section 53.056 or 53.252, the owner may withhold the funds immediately on receipt of the notice.

If notice is sent under Section 53.057, the owner may withhold funds immediately on receipt of a copy of the claimant's affidavit prepared in accordance with Sections 53.052 through 53.055.

If notice is sent under Section 53.058, the owner may withhold funds immediately on receipt of the notices sent under Subsection (e) of that section. If notice is sent as provided by Section 53.253(b), the owner may withhold funds immediately on receipt of the notice sent as required by Section 53.252. § 53.081.

Time for Which Funds are Withheld: Unless payment is made under Section 53.083 or the claim is otherwise settled, discharged, indemnified under Subchapter H or I, or determined to be invalid by a final judgment of a court, the owner shall retain the funds withheld until:

(1) the time for filing the affidavit of

mechanic's lien has passed; or

(2) if a lien affidavit has been filed,

until the lien claim has been satisfied or released. § 53.082.

Payment to Claimant on Demand: The claimant may make written demand for payment of the claim to an owner authorized to withhold funds under this subchapter. The demand must give notice to the owner that all or part of the claim has accrued under Section 53.053 or is past due according to the agreement between the parties.

The claimant must send a copy of the demand to the original contractor. The original contractor may give the owner written notice that the contractor intends to dispute the claim. The original contractor must give the notice not later than the 30th day after the day he receives the copy of the demand. If the original contractor does not give the owner timely notice, he is considered to have assented to the demand and the owner shall pay the claim.

The claimant's demand may accompany the original notice of nonpayment or of a past-due claim and may be stamped or written in legible form on the face of the notice.