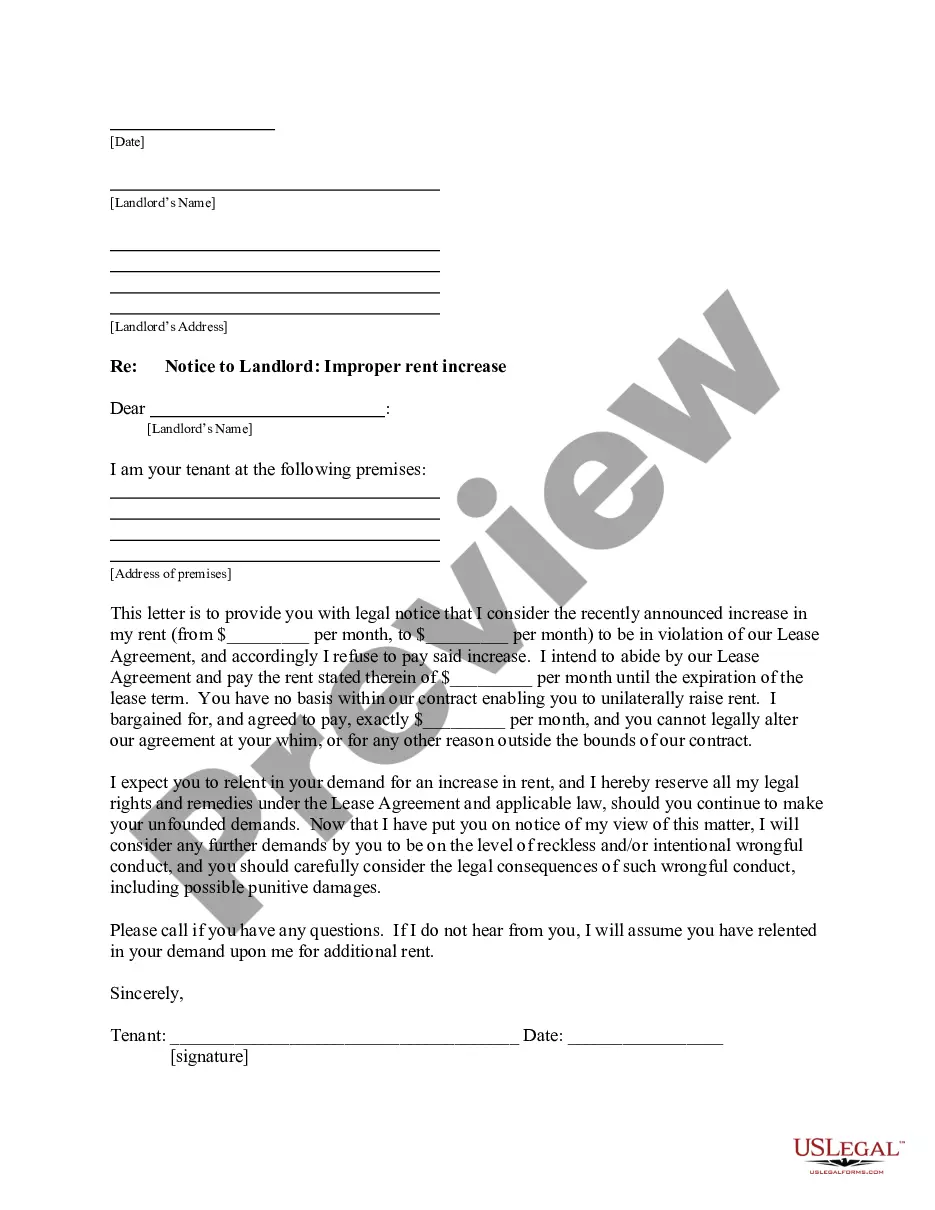

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Texas Amendment to Living Trust

Description

Key Concepts & Definitions

Living Trust: A legal document created by an individual, known as the grantor, that is used to manage assets during their lifetime and distribute them after death. A revocable living trust can be amended or revoked as long as the grantor is alive and competent.

Trust Amendment: A formal change or addition to a trust document that adjusts provisions without replacing the entire agreement.

Probate Process: A legal process in which a deceased person's will is validated, their financial affairs settled, and assets distributed to heirs and designated beneficiaries.

Step-by-Step Guide on How to Amend a Living Trust

- Review the Current Trust Agreement: Examine the terms of the existing trust to understand the scope and limitations of amendments permissible under the original document.

- Consult with an Estate Planning Attorney: Legal advice is crucial to ensure the amendment complies with state laws and trust practices.

- Determine Necessary Changes: Identify the modifications needed, such as changing beneficiaries, trustees, or terms regarding the management of financial assets.

- Execute the Amendment: The trust amendment must be in writing, and the grantor must sign it, typically in the presence of a notary.

- Store the Amendment with the Trust Document: The amendment should be kept with the original trust document to avoid any confusion during the trust administration process.

Risk Analysis of Amending a Living Trust

Amending a trust can lead to several risks including potential disputes among beneficiaries, misinterpretation of new terms, and errors during the amendment process which could invalidate the document. Consulting with a skilled attorney can mitigate these risks significantly.

Best Practices in Trust Amendment

- Ensure Clarity: Clearly articulate changes in the amendment to avoid ambiguity that could lead to trust litigation.

- Maintain Uniformity: Ensure the amendment's terms do not conflict with any state laws or the original purposes of the trust.

- Record Keeping: Always retain a copy of the amendment with the trust document and notify trustees and beneficiaries about the amendments.

FAQ

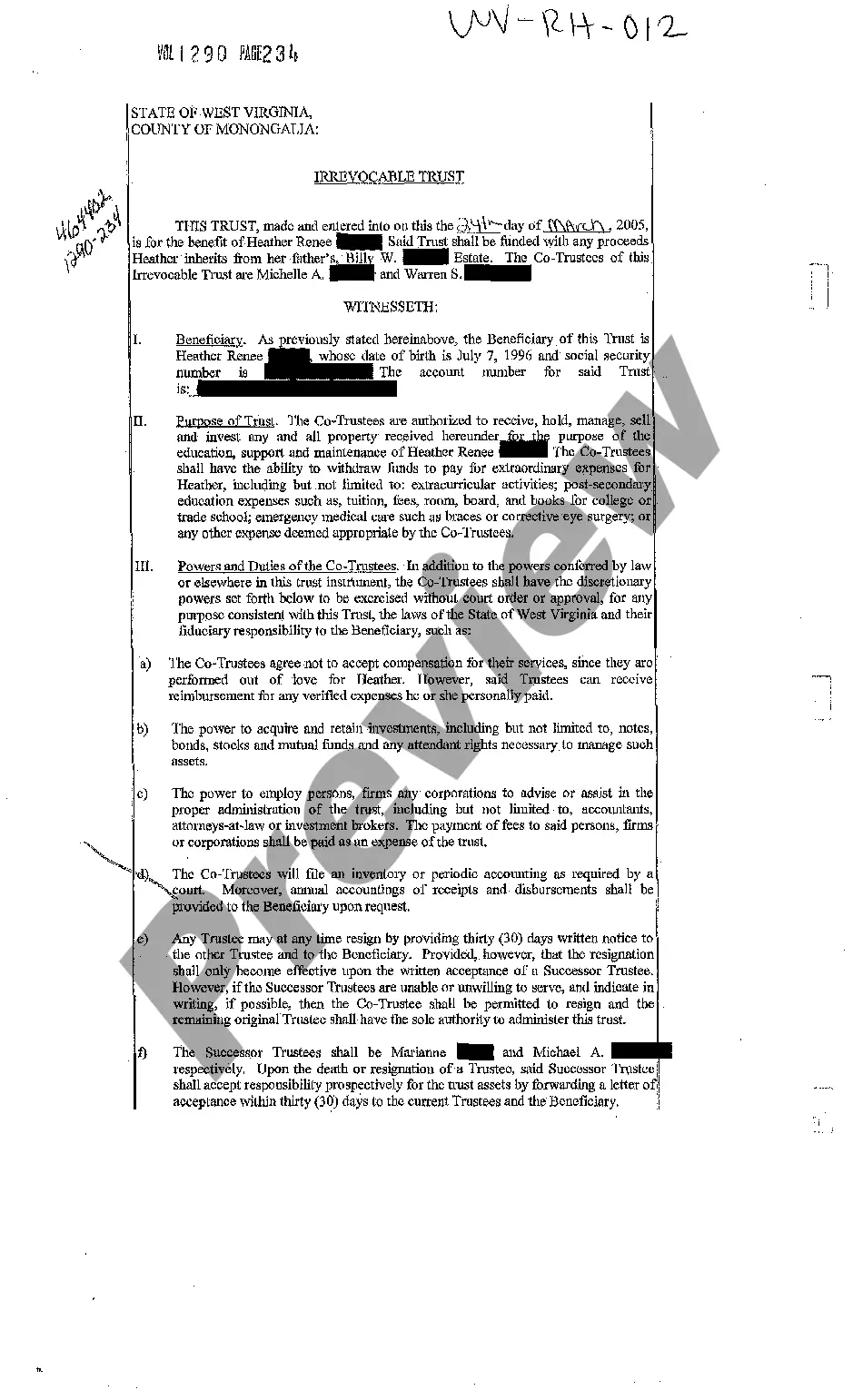

Can I amend any type of living trust? You can amend a revocable living trust, but an irrevocable living trust typically cannot be amended once it is set up.

How often can I amend my living trust? You can amend it as often as needed, as long as you comply with legal requirements and the terms set out in the trust agreement.

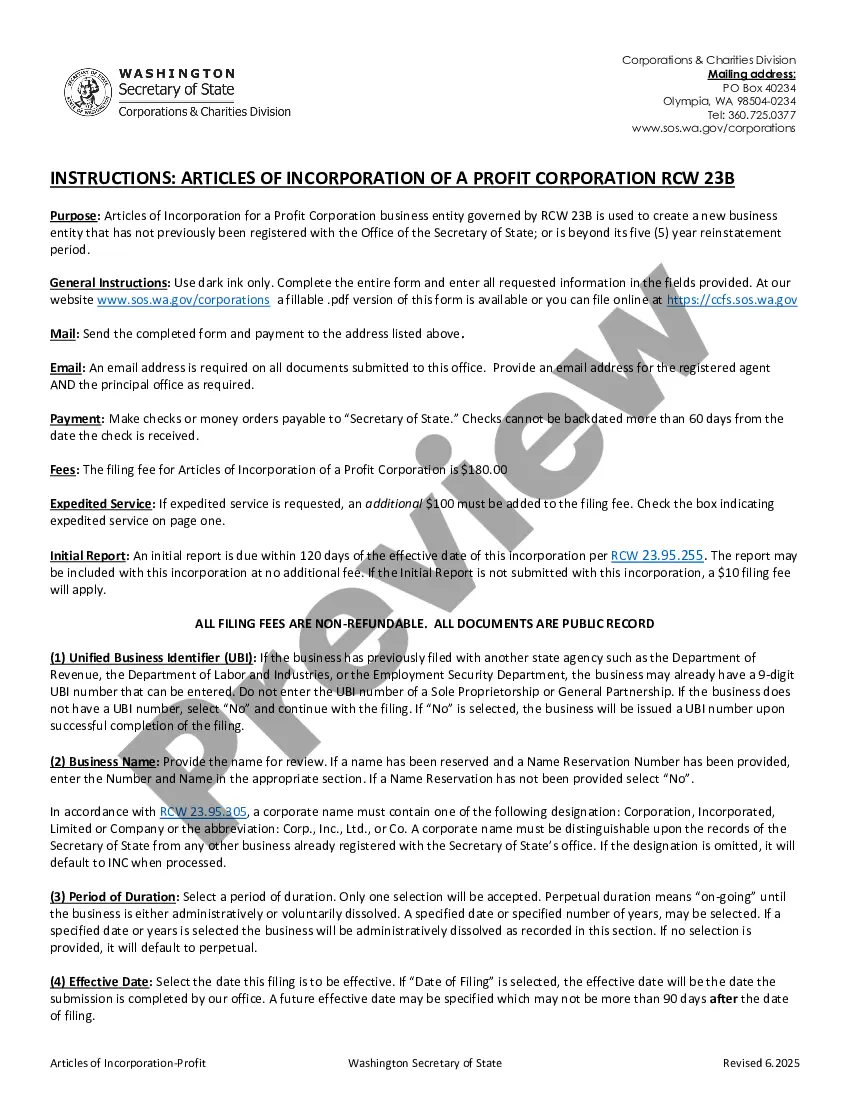

How to fill out Texas Amendment To Living Trust?

Get access to top quality Texas Amendment to Living Trust templates online with US Legal Forms. Prevent hours of lost time looking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific authorized and tax templates that you could download and fill out in clicks within the Forms library.

To get the example, log in to your account and click on Download button. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Check if the Texas Amendment to Living Trust you’re considering is appropriate for your state.

- Look at the form using the Preview function and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to finish making an account.

- Select a favored format to download the document (.pdf or .docx).

Now you can open the Texas Amendment to Living Trust example and fill it out online or print it and do it yourself. Take into account giving the file to your legal counsel to ensure all things are filled in appropriately. If you make a mistake, print out and fill application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.