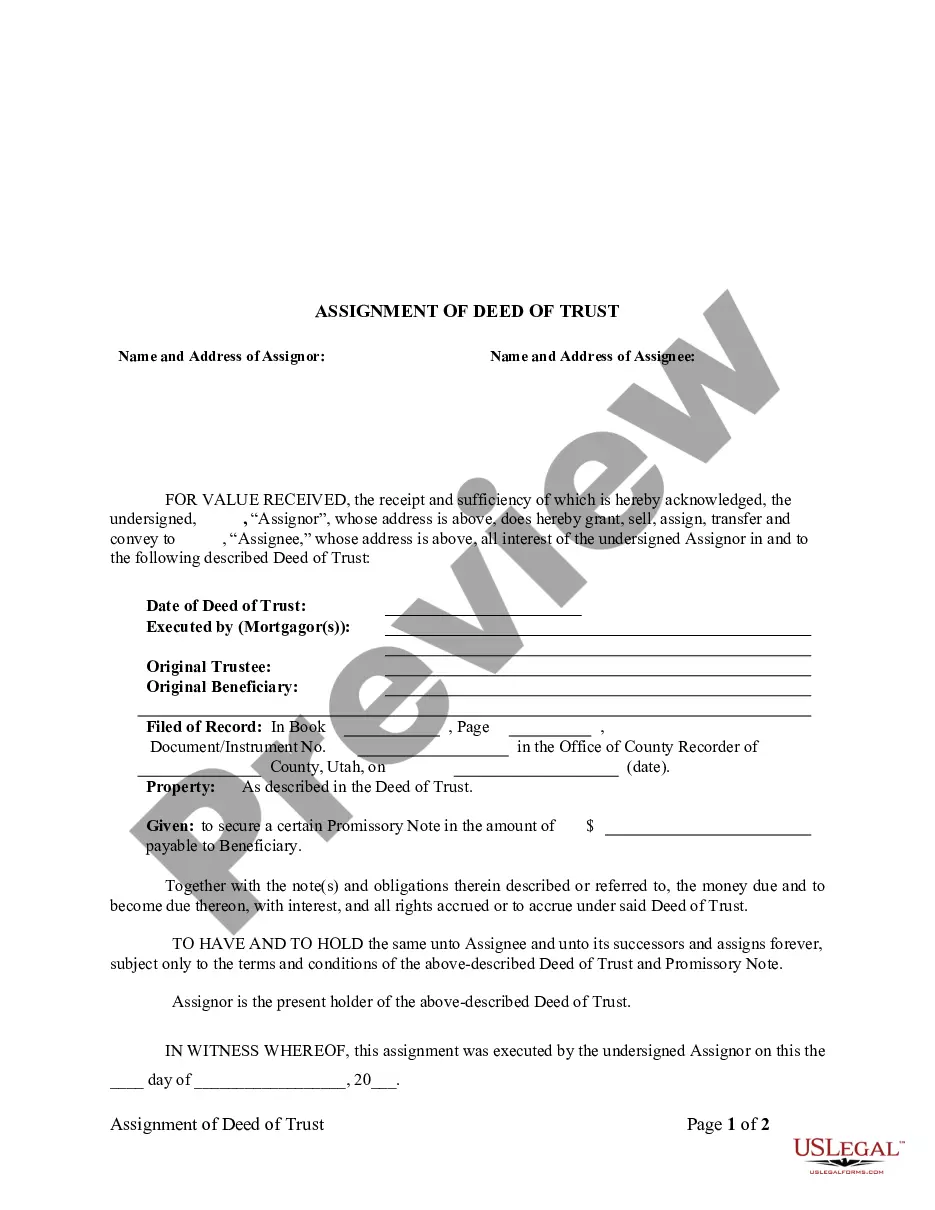

Assignment of Deed of Trust by Individual Mortgage Holder

Assignments Generally:

Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Utah Law

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

None required. Lender

or servicer who fails to release the security interest on a secured loan

within 90 days after receipt of the final payment of the loan is liable.

(see below)

Recording Satisfaction:

Any trust deed, ... reconveyance of the trust property, if acknowledged as provided by

law, is entitled to be recorded.

Penalty:

A secured lender or servicer who fails to release the security interest on a secured loan within 90 days

after receipt of the final payment of the loan is liable to another secured

lender on the real property or the owner or titleholder of the real property

for:

(a) the greater of $1,000 or treble actual damages incurred because

of the failure to release the security interest, including all expenses

incurred in completing a quiet title action; and

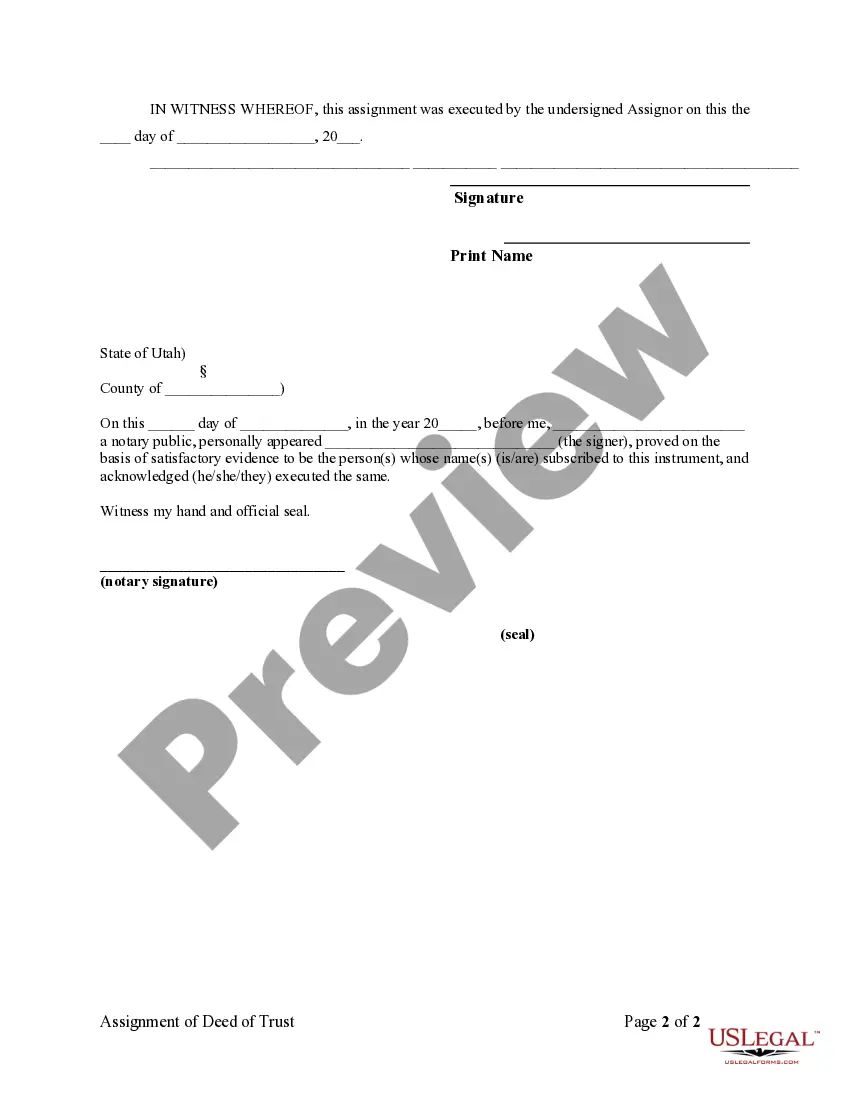

Acknowledgment:

An assignment or satisfaction

must contain a proper Utah acknowledgment, or other acknowledgment approved

by Statute.

Utah Statutes

57-1-36. Trust deeds -- Instruments entitled to be

recorded -- Assignment of a beneficial interest.

Any trust deed, substitution of trustee, assignment of a

beneficial interest under a trust deed, notice of default, trustee's deed,

reconveyance of the trust property, and any instrument by which any trust

deed is subordinated or waived as to priority, if acknowledged as provided

by law, is entitled to be recorded. The recording of an assignment of a beneficial interest in the trust deed does not

in itself impart notice of the assignment to the trustor, his heirs or

personal representatives, so as to invalidate any payment made by any of

them to the person holding the note, bond, or other instrument evidencing

the obligation by the trust deed.

57-1-38. Release of security interest.

(1) As used in this section:

(b) (i) "Secured loan" means a loan or

extension of credit, the repayment of which is secured by a mortgage, a

trust deed, the holding or retention of legal title under a real estate

sales contract, or other security interest in real property, whether or

not the security interest is perfected.

(c) "Security interest" means an interest

in real property that secures payment or performance of an obligation.

Security interest includes a lien or encumbrance.

(d) "Servicer" means a person that services

and receives loan payments on behalf of a secured lender with respect to

a secured loan.

(2) This section may not be interpreted

to validate, invalidate, alter, or otherwise affect the foreclosure of

a mortgage, the exercise of a trustee's power of sale, the exercise of

a seller's right of reentry under a real estate sales contract, or the

exercise of any other power or remedy of a secured lender to enforce the

repayment of a secured loan.

(3) A secured lender or servicer who

fails to release the security interest on a secured loan within 90 days

after receipt of the final payment of the loan is liable to another secured

lender on the real property or the owner or titleholder of the real property

for:

(a) the greater of $1,000 or treble

actual damages incurred because of the failure to release the security

interest, including all expenses incurred in completing a quiet title action;

and

(4) A secured lender or servicer is not

liable under Subsection (3) if the secured lender or servicer:

(a) has established a reasonable procedure

to release the security interest on a secured loan in a timely manner after

the final payment on the loan;

(c) is unable to release the security

interest within 90 days after receipt of the final payment because of the

action or inaction of an agency or other person beyond its direct control.