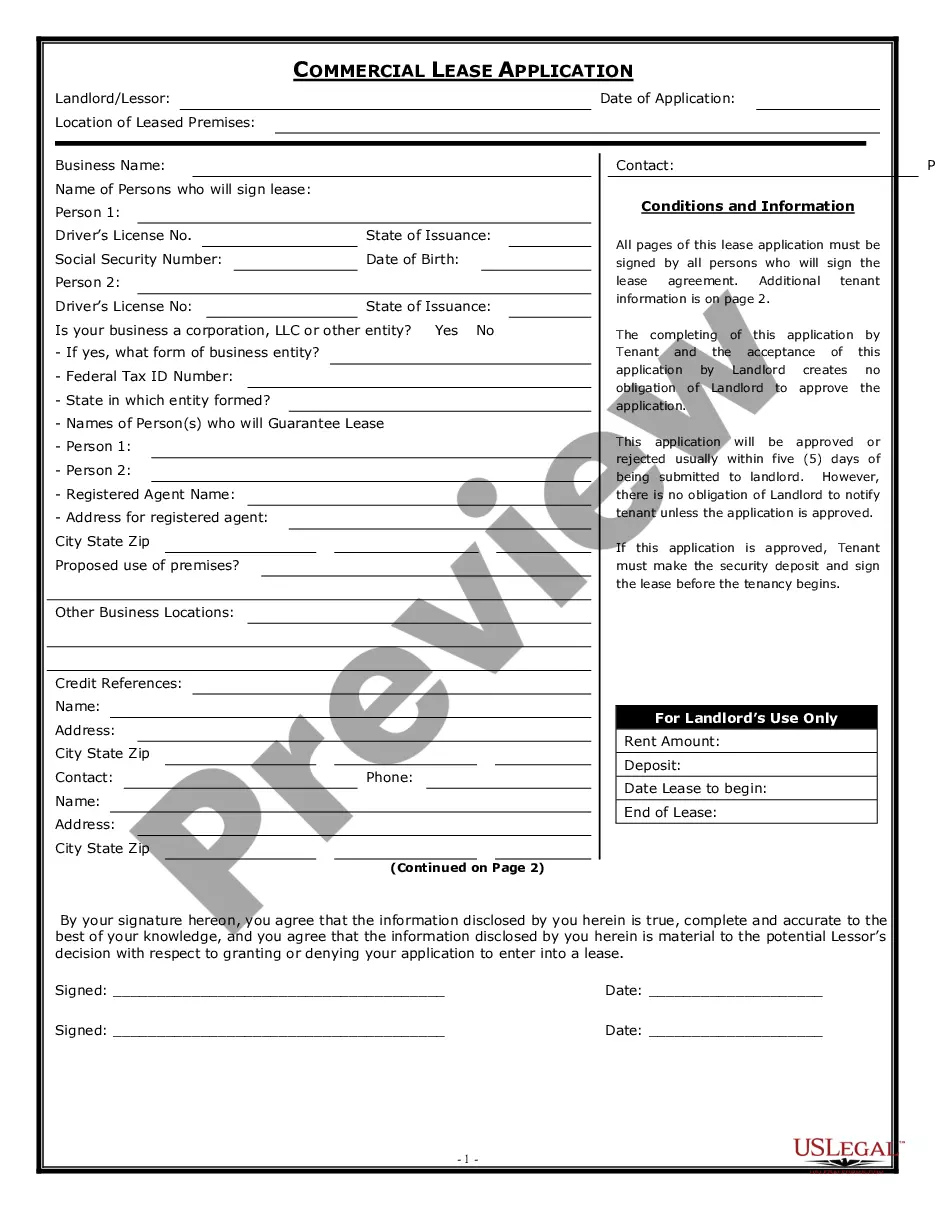

Commercial Tenant Application

Description Commercial Lease Application

How to fill out Utah Commercial Rental Lease Application Questionnaire?

- If you're a returning user, log into your account and click the Download button to obtain your form. Ensure your subscription is up-to-date; if not, renew it according to your chosen payment plan.

- For first-time users, start by checking the Preview mode and form description to confirm you've selected the correct document that aligns with your needs and local jurisdiction's requirements.

- If you encounter any inconsistencies, utilize the Search tab above to find an alternative template that fits your needs.

- Once you find the right document, click the Buy Now button and select your preferred subscription plan. You'll need to register an account for full access to our resources.

- Proceed to check out by providing your credit card details or using your PayPal account to finalize the transaction.

- Finally, download your form and save it on your device. You can access it anytime through the My Forms menu in your profile.

US Legal Forms empowers both individuals and attorneys by providing access to a comprehensive library of over 85,000 fillable legal forms. This extensive collection helps ensure that you find exactly what you need at competitive costs.

Ultimately, the efficient process and expert assistance offered by US Legal Forms can guide you in creating precise, legally sound documents. Start your journey with us today!

Form popularity

FAQ

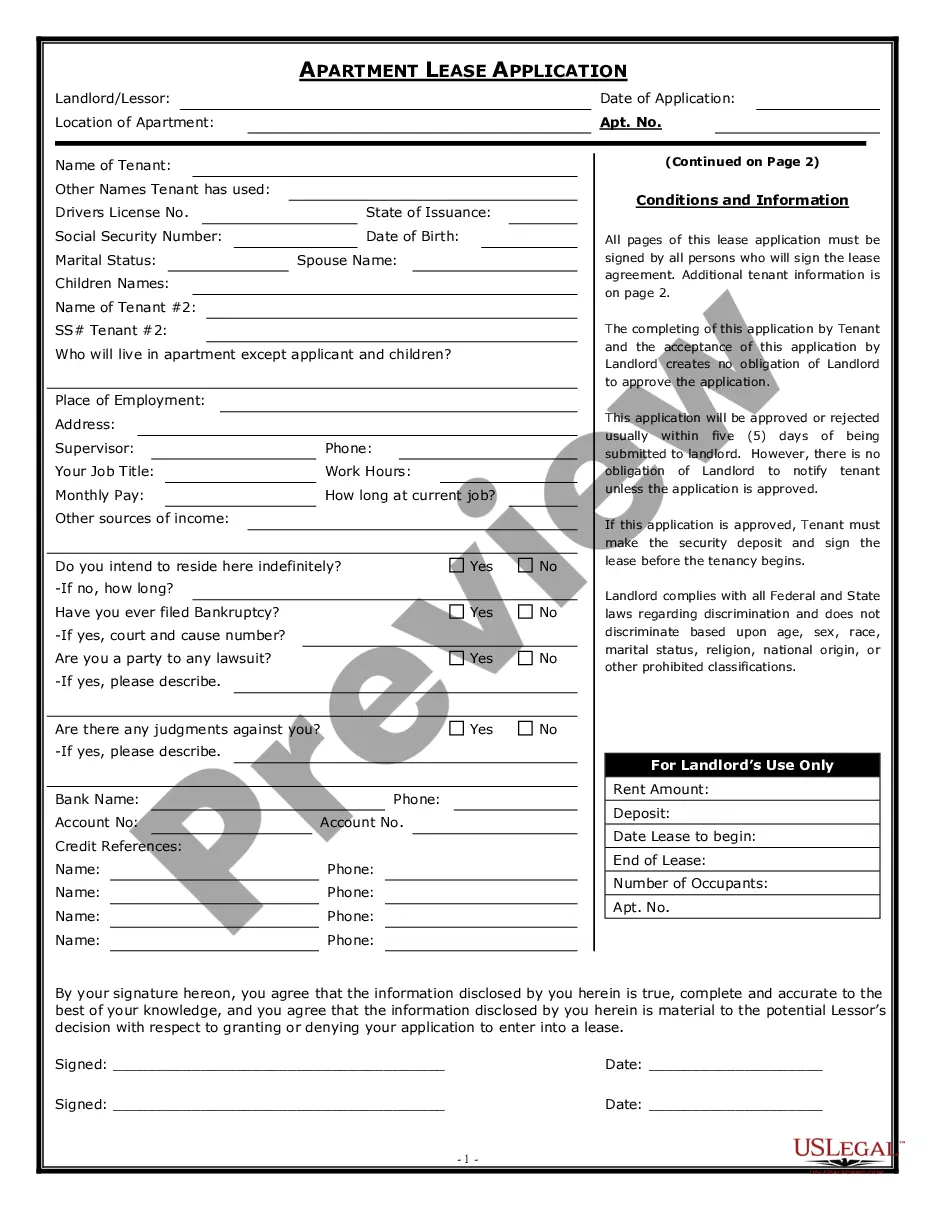

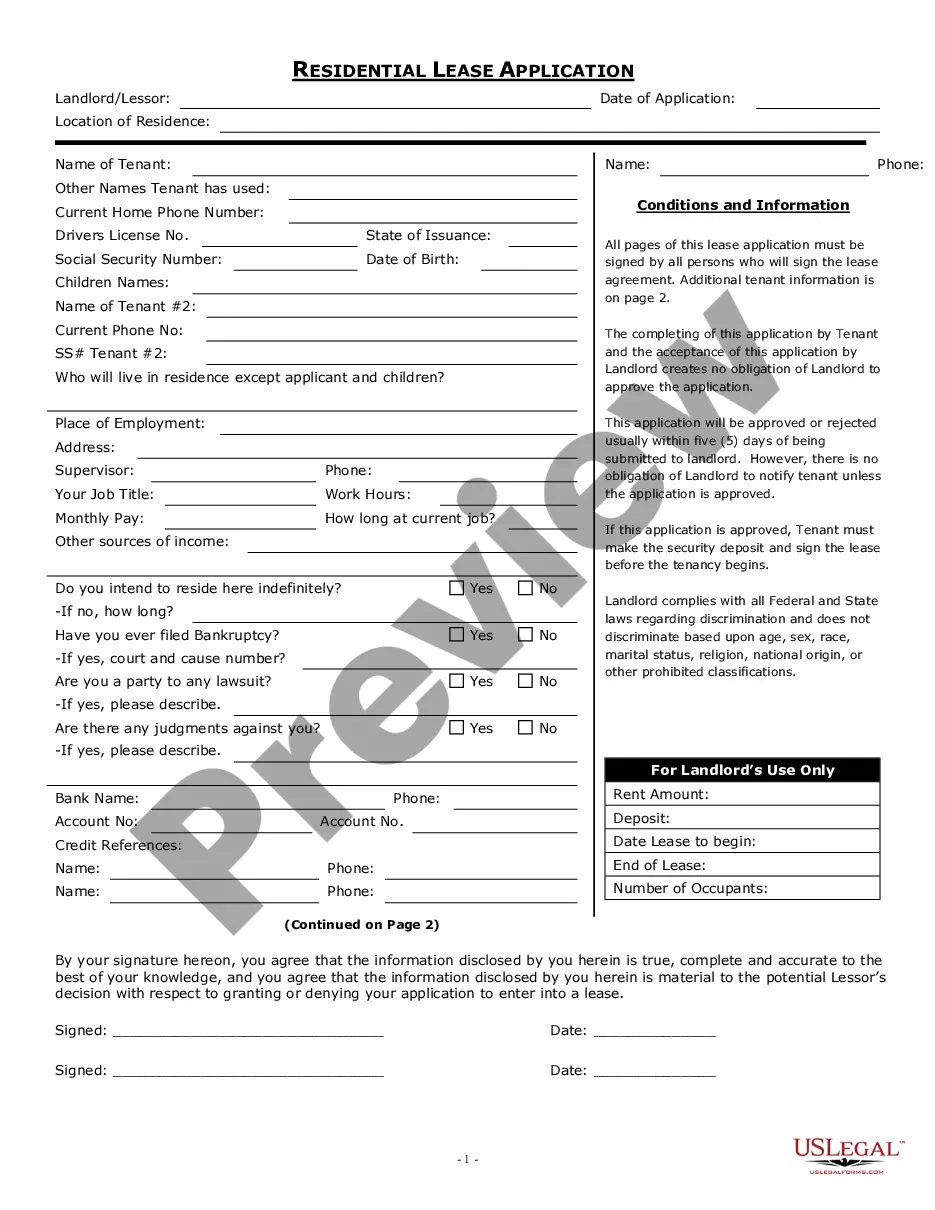

A security deposit is typically an amount equivalent to one or two month's rent, which is deposited by the tenant to secure, as far as money can, the tenant's performance of the tenant's obligations under the Lease.

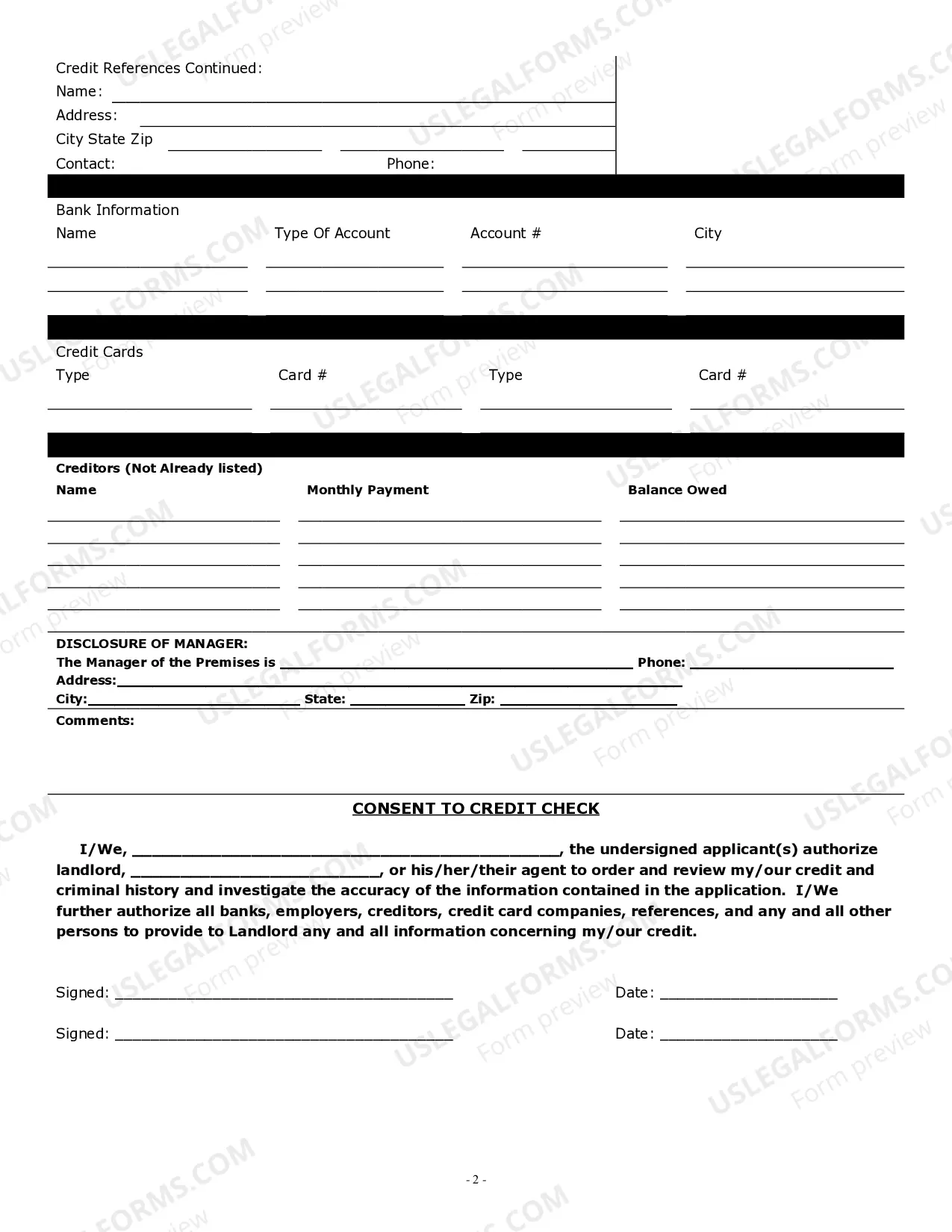

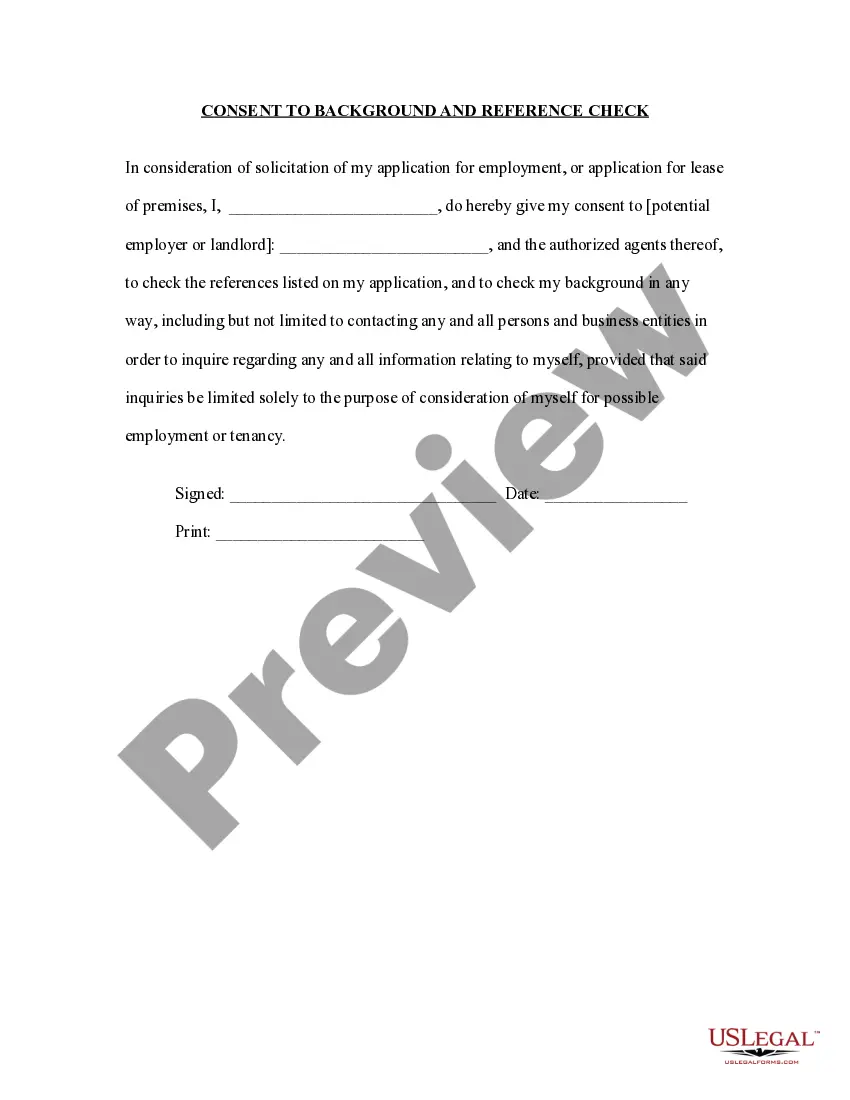

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.

Commercial leases generally fall into one of three major categories based on how the building's operating expenses are passed on to tenants: Gross or full-service lease. You pay a flat monthly rate from which the landlord pays all operating expenses, including utilities, property taxes and maintenance.

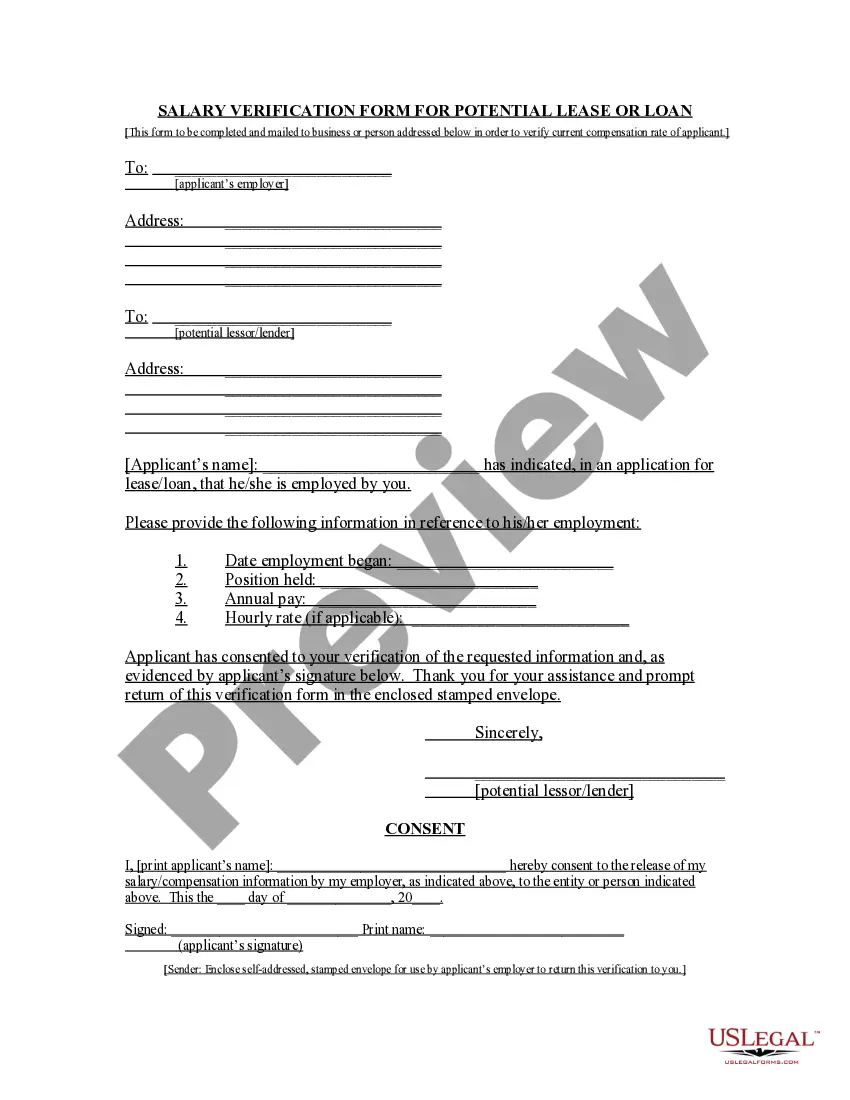

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

Bank references. Current credit reports/scores from all three reporting bureaus. Previous/current landlord references (for an existing business moving to a new location) Personal and corporate financial statement(s) A copy of your business plan. Business bank statement(s) Prior tax returns.

Are you building for the future? Is the location safe? Is the office space adequately wired for your business and equipment needs. How much will furniture cost? How much will the rent increase each year? What's included in the lease? Who handles repairs?

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

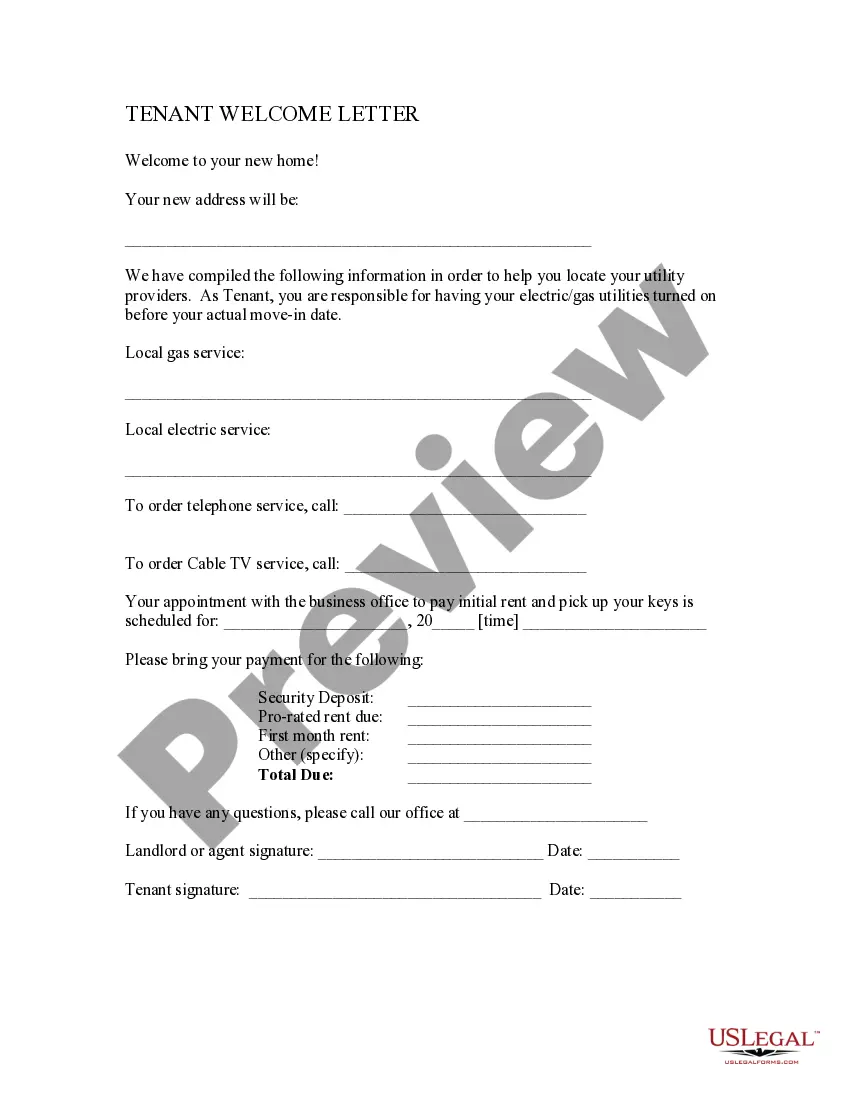

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.