A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

- US Legal Forms

-

Wisconsin Agreement or Contract for Deed for Sale and Purchase of Real...

Sale A

Description Contract Real Ka

Contract Real Executory Related forms

View Buyer's Request for Accounting from Seller under Contract for Deed

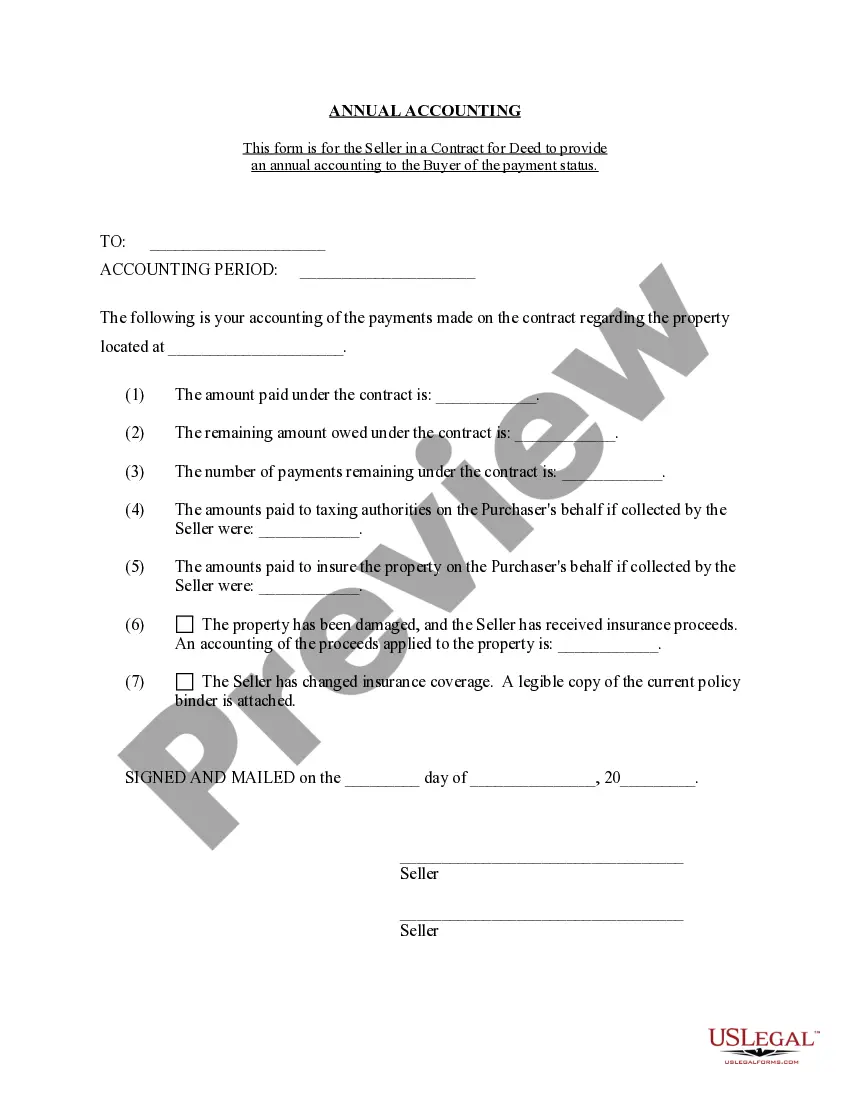

View Contract for Deed Seller's Annual Accounting Statement

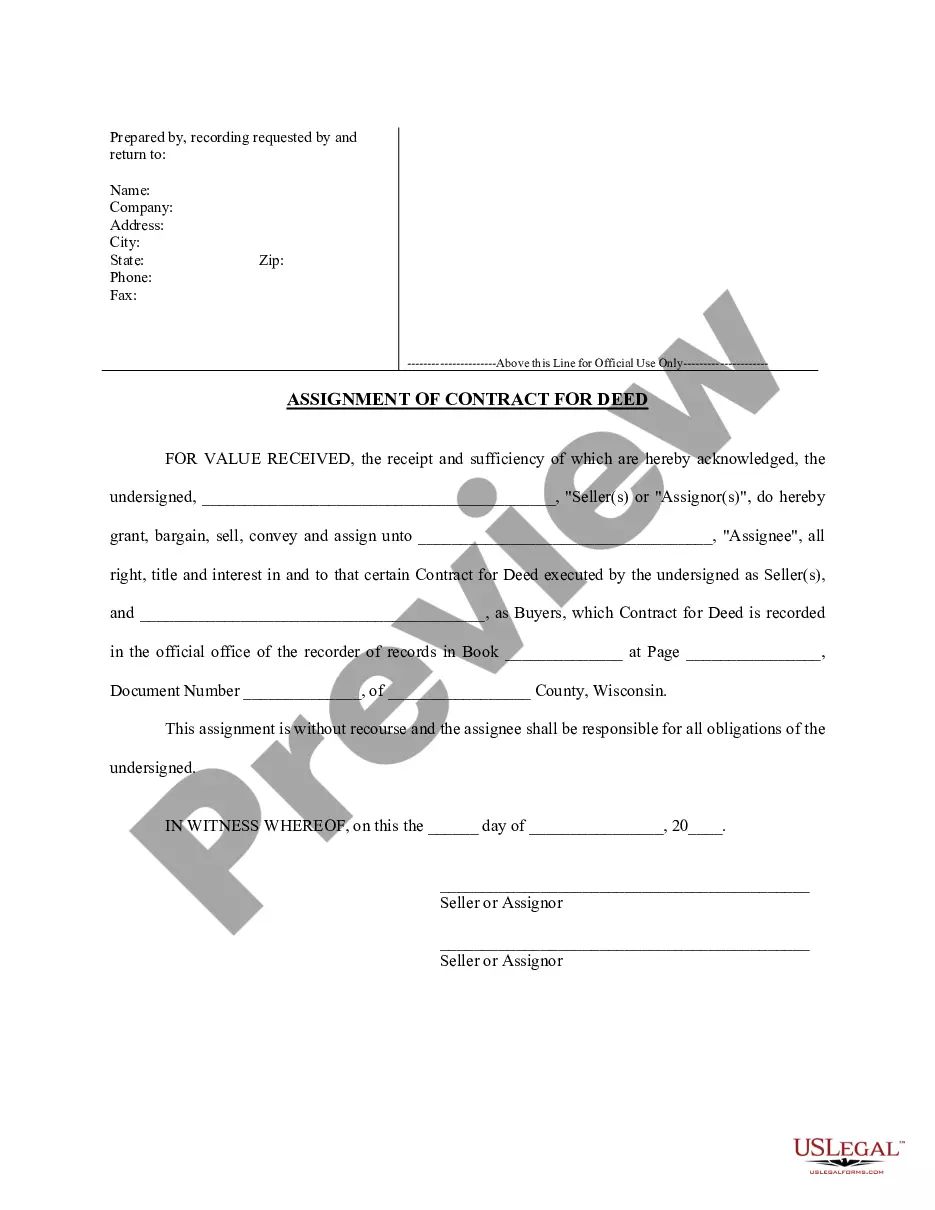

View Assignment of Contract for Deed by Seller

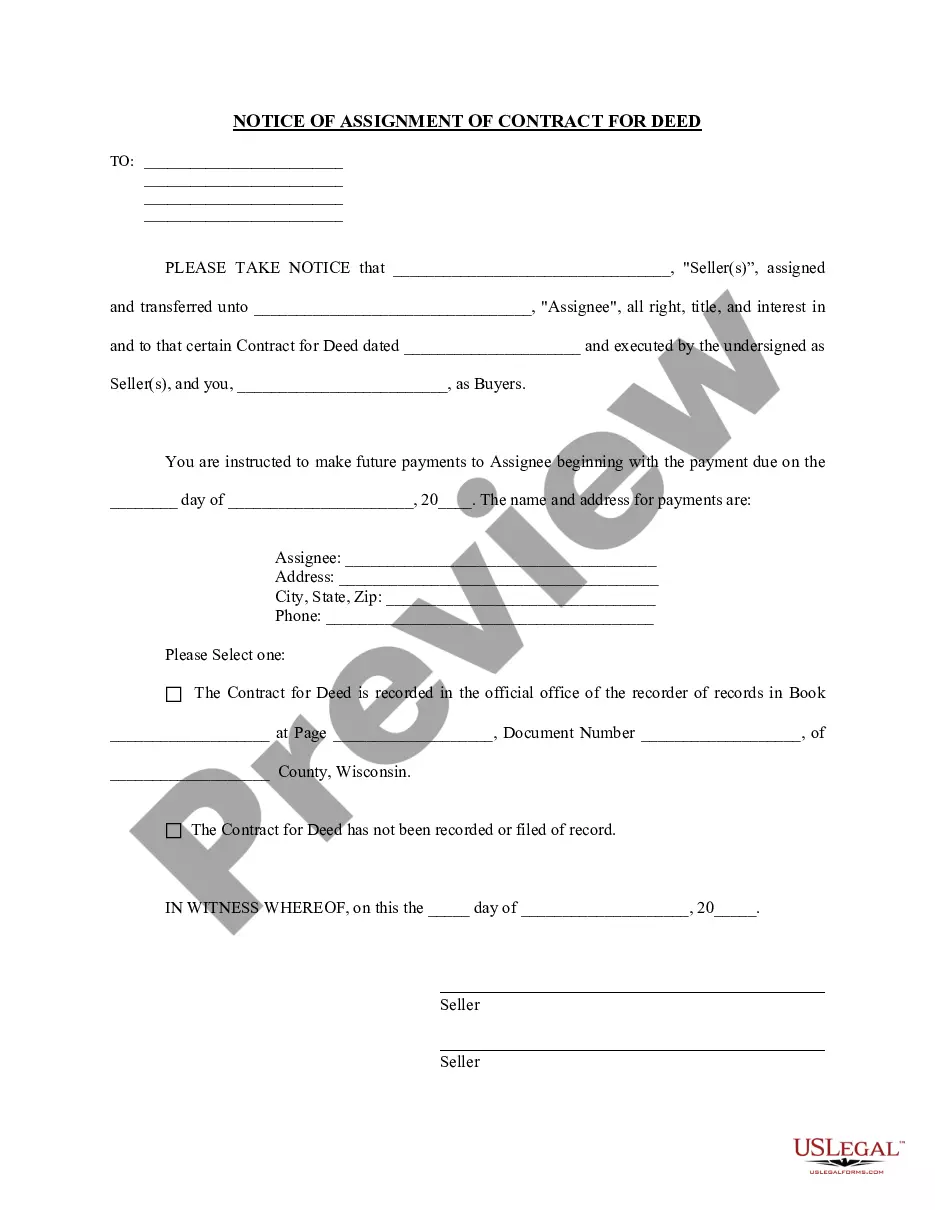

View Notice of Assignment of Contract for Deed

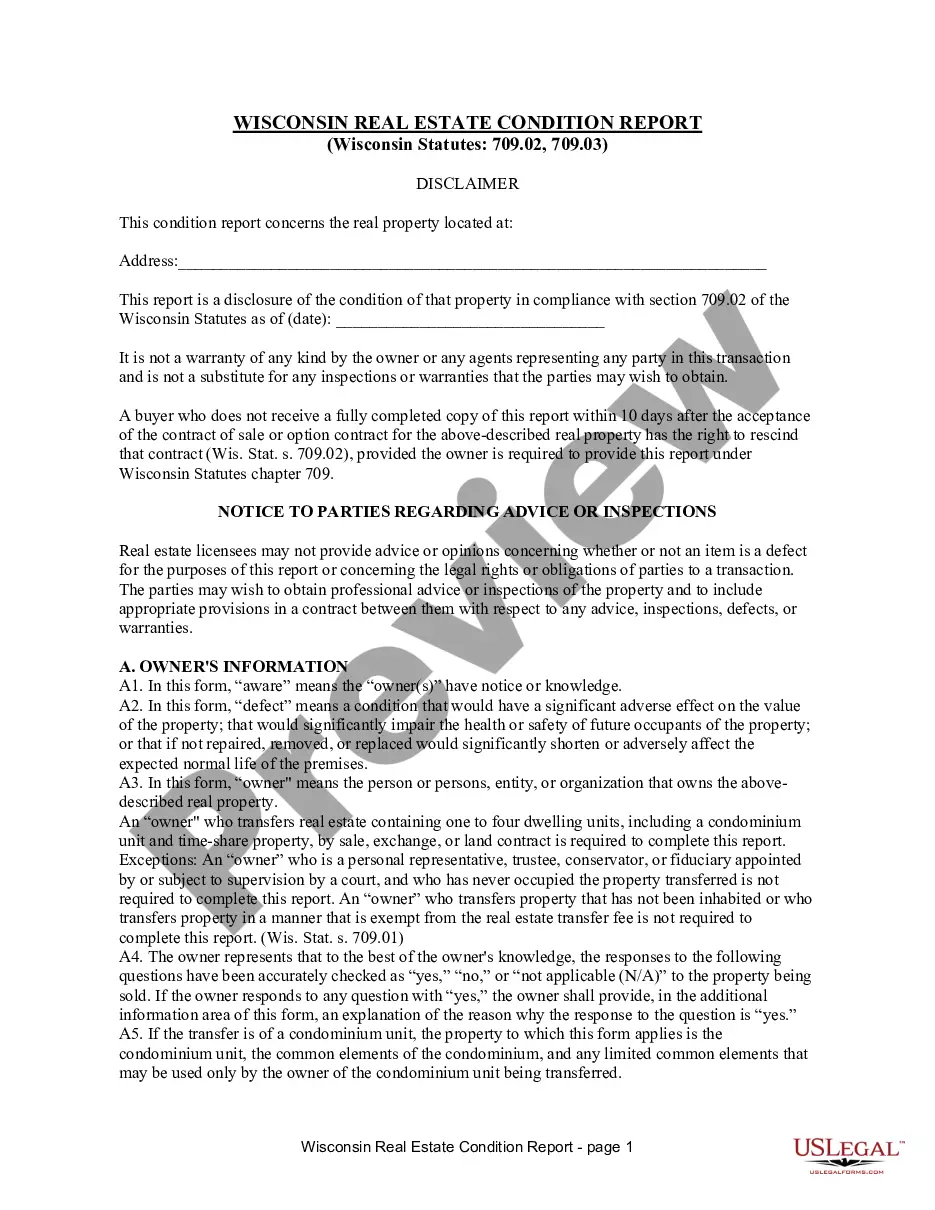

View Residential Real Estate Sales Disclosure Statement

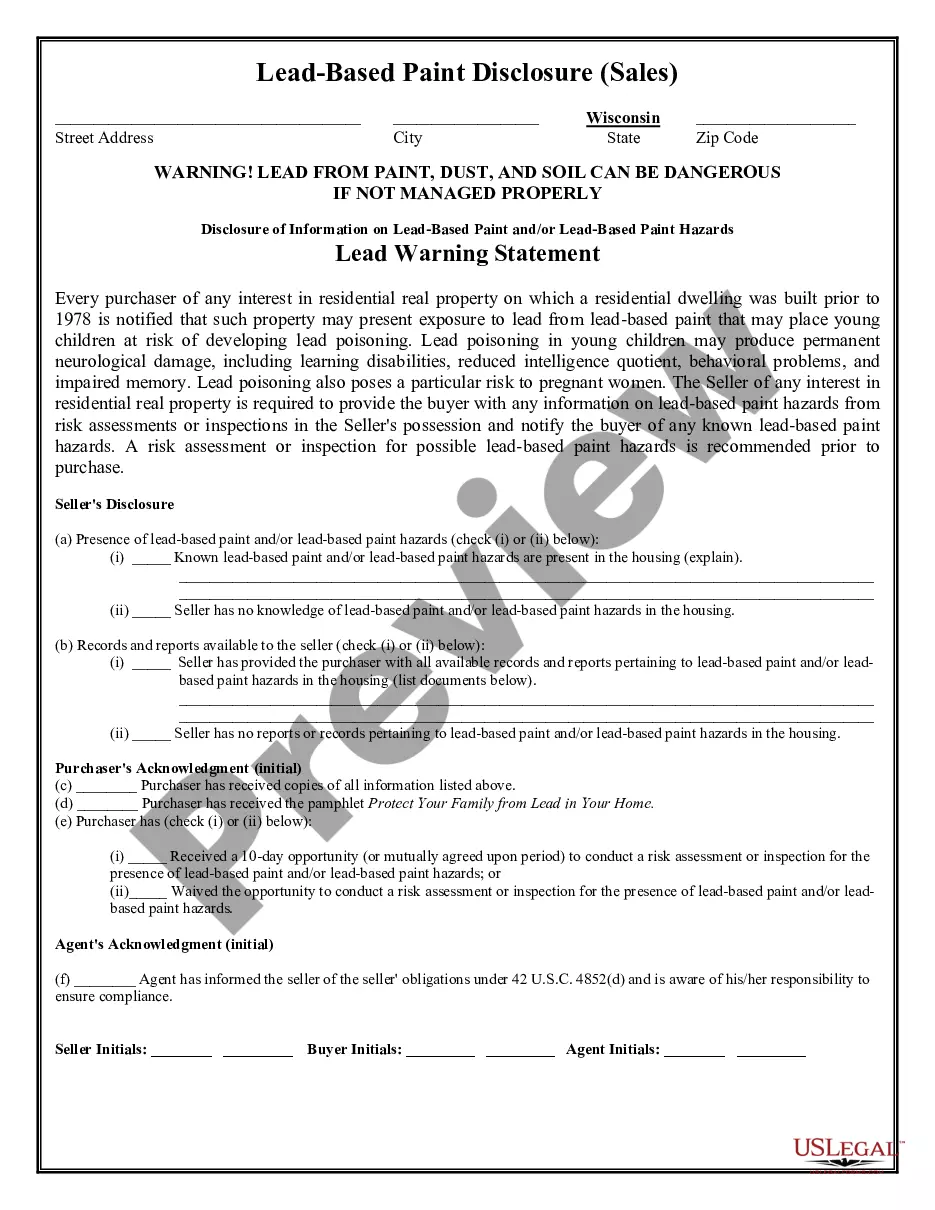

View Lead Based Paint Disclosure for Sales Transaction

Related legal definitions

How to fill out Contract Deed Real?

Out of the multitude of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before purchasing them. Its complete library of 85,000 templates is grouped by state and use for simplicity. All the documents available on the platform have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, click Download and access your Form name from the My Forms; the My Forms tab keeps all of your saved documents.

Keep to the tips listed below to obtain the form:

- Once you discover a Form name, make certain it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Search for a new template via the Search engine if the one you have already found is not proper.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service provides easy and fast access to samples that fit both legal professionals and their clients.

Contract A Executory Form Rating

Deed Aka Land Form popularity

Deed Real Estate Other Form Names

Contract Ak Land FAQ

The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

A land contract carries purchase obligations as the buyer had already committed into a financing agreement for the full purchase. On the other hand, a rent to own contract involves less obligations whereby the buyer has the option, but is not obligated to buy the property after the contract period.

Step 1: Apply For A Mortgage. Step 2: Research The Neighborhood. Step 3: Find A Property. Step 4: Ask For A Seller's Disclosure. Step 5: Make An Offer. Step 6: Hire A Lawyer And Home Inspector. Step 7: Negotiate. Step 8: Finalize Home Financing And Closing.

1 Stating Basic Information in Your Contract. 2 Setting Forth the Payment Terms. 3 Disclosing Important Information to the Buyer. 4 Advising Parties About Closing Procedures.

A land contract is a form of seller financing. The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons.

Con: Buyer Depends On Seller Unless the seller owns the property outright, he is still making payments to a lending institution. If, for any reason, the seller does not make regular payments, the property can be foreclosed upon, leaving the buyer with a worthless contract and no home.

The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

_________/- (Rupees ____________________________), will be received by the FIRST PARTY from the SECOND PARTY, at the time of registration of the Sale Deed, the FIRST PARTY doth hereby agree to grant, convey, sell, transfer and assign all his rights, titles and interests in the said portion of the said property, fully

Agreement Contract A Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Wisconsin

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wyoming

CHAPTER 705 MULTIPLE-PARTY AND AGENCY ACCOUNTS; NONPROBATE TRANSFERS AT DEATH; TRANSFER ON DEATH SECURITY REGISTRATION; SUBCHAPTER II NONPROBATE TRANSFERS AT DEATH; NONPROBATE TRANSFER OF REAL PROPERTY

705.15 Nonprobate transfer of real property on death.

(1) An interest in real property that is solely owned, owned by spouses as survivorship marital property, or owned by 2 or more persons as joint tenants may be transferred without probate to a designated TOD beneficiary as provided in this section on the death of the sole owner or the last to die of the multiple owners.

(2) A TOD beneficiary may be designated on a deed that evidences ownership of the property interest in the owner or owners by including the words "transfer on death" or "pay on death," or the abbreviation "TOD" or "POD," after the name of the owner or owners of the property and before the name of the beneficiary or beneficiaries. The designation may be included on the original deed that passes the property interest to the owner or owners or may be made at a later time by the sole owner or all then surviving owners by executing and recording another deed that designates a TOD beneficiary. A TOD beneficiary designation is not effective unless the deed on which the designation is made is recorded.

(3) The designation of a TOD beneficiary on a deed does not affect ownership of the property until the owner's death. The designation may be canceled or changed at any time by the sole owner or all then surviving owners, without the consent of the beneficiary, by executing and recording another deed that designates a different beneficiary or no beneficiary. The recording of a deed that designates a TOD beneficiary or no beneficiary revokes any designation made in a previously recorded deed relating to the same property interest.

(4) On the death of the sole owner or the last to die of multiple owners, ownership of the interest in the real property passes, subject to any lien or other encumbrance, to the designated TOD beneficiary or beneficiaries who survive all owners and to any predeceased beneficiary's issue who would take under s. 854.06 (3). If no beneficiary or predeceased beneficiary's issue who would take under s. 854.06 (3) survives the death of all owners, the interest in the real property passes to the estate of the deceased sole owner or the estate of the last to die of the multiple owners.

(5) A TOD beneficiary's interest in the property on the death of the sole owner or the last to die of multiple owners may be confirmed as provided in s. 863.27, 865.201, or 867.046.

(6) Chapter 854 applies to transfers on death under this section.

History: 2005 a. 206.

WISCONSIN STATUTES

CHAPTER 706 CONVEYANCES OF REAL PROPERTY; RECORDING; TITLES

706.001 Scope and construction.

(1) Subject to the exclusions in sub. (2), this chapter shall govern every transaction by which any interest in land is created, aliened, mortgaged, assigned or may be otherwise affected in law or in equity.

(2) Excluded from the operation of this chapter are transactions which an interest in land is affected:

(a) By act or operation of law; or

(b) By will; or

(bm) By nonprobate transfer on death under s. 705.15; or

(c) By lease for a term limited to one year or less; or by contract or option to lease for such period which postpones the commencement of the agreed lease to a time not later than 60 days after the date of the contract or option; or by assignment, modification or termination of lease when, at the time such assignment, modification or termination is made, the unexpired term is limited to one year or less, and remains so limited under the lease as modified; except that instruments relating to such excluded transactions, if in recordable form, shall be entitled to record.

(3) This chapter shall be liberally construed, in cases of conflict or ambiguity, so as to effectuate the intentions of parties who have acted in good faith.

History: 1999 a. 85 ss. 135, 138; 2005 a. 206.

The doctrine of part performance is not an "operation of law" under sub. (2) (a) that excludes the application of ch. 706 to a transaction. Wyss v. Albee, 183 Wis. 2d 245, 515 N.W.2d 517 (Ct. App. 1994).

Transactions in which an interest in land is affected by act or operation of law are excluded from operation of this chapter under sub. (2). Dow Family, LLC v. PHH Mortgage Corporation, 2014 WI 56, 354 Wis. 2d 796, 848 N.W.2d 728, 13-0221.

706.01 Definitions.

In this chapter:

(4) "Conveyance" means a written instrument, evidencing a transaction governed by this chapter, that satisfies the requirements of s. 706.02, subject to s. 706.25.

(5) "Conveyance of mineral interests" means any transaction under s. 706.001 (1) entered into for the purpose of determining the presence, location, quality or quantity of metalliferous minerals or for the purpose of mining, developing or extracting metalliferous minerals, or both. Any transaction under s. 706.001 (1) entered into by a mining company is rebuttably presumed to be a conveyance of mineral interests.

(6) "Grantor" means the person from whom an interest in lands passes by conveyance, including, without limitation, lessors, vendors, mortgagors, optionors, releasors, assignors and trust settlors of interest in lands, and "grantee" means the person to whom the interest in land passes. Whenever consistent with the context, reference to the interest of a party includes the interest of the party's heirs, successors, personal representatives and assigns.

(7) "Homestead" means the dwelling, and so much of the land surrounding it as is reasonably necessary for use of the dwelling as a home, but not less than one-fourth acre, if available, and not exceeding 40 acres.

(7m) "Interest in minerals" means any fee simple interest in minerals beneath the surface of land that is:

(a) Separate from the fee simple interest in the surface of the land; and

(b) Created by an instrument transferring, granting, assigning or reserving the minerals.

(7r) "Legal description" means a description of a specific parcel of real estate that is described in one of the following ways, whichever is appropriate:

(a) By one of the ways under s. 66.0217 (1) (c).

(b) By condominium name, unit number, and appurtenance number in a platted condominium development.

(8) "Metalliferous minerals" means naturally occurring minerals containing metal.

(8m) "Mineral" means a naturally occurring substance recognized by standard authorities as mineral, whether metalliferous or nonmetalliferous.

(9) "Mining company" means any person or agent of a person who has a prospecting permit under s. 293.45 or a mining permit under s. 293.49 or 295.58.

(10) "Signed" includes any handwritten signature or symbol on a conveyance intended by the person affixing or adopting the signature or symbol to constitute an execution of the conveyance.

History: 1971 c. 41; 1977 c. 253; ; 1983 a. 189, 455; 1993 a. 486; 1995 a. 227; 1999 a. 85; 2005 a. 41, 421; 2013 a. 1; 2015 a. 196.<br />

<br />

A necessary implication under s. 706.10 (3) is one that is so clear as to be express; it is a required implication. The words “heirs and assigns,” or any similar language, are unnecessary under s. 706.10 (3) to indicate a transferable interest. As a matter of law, “Grantee” has the exact same meaning as “Grantee and his heirs and assigns” unless another meaning is expressly stated or implied. Therefore, “heirs and assigns” need not be construed as having any legal effect and the use of the term in a grant of water flowage rights and not in a grant of sand removal rights in the same deed did not create a necessary implication that the sand rights were non-transferable. Borek Cranberry Marsh v. Jackson County, 2010 WI 95, 328 Wis. 2d 613, 785 N.W.2d 615, 08-1144.<br />

<br />

706.02 Formal requisites.<br />

<br />

(1) Transactions under s. 706.001 (1) shall not be valid unless evidenced by a conveyance that satisfies all of the following:<br />

<br />

(a) Identifies the parties; and<br />

<br />

(b) Identifies the land; and<br />

<br />

(c) Identifies the interest conveyed, and any material term, condition, reservation, exception or contingency upon which the interest is to arise, continue or be extinguished, limited or encumbered; and<br />

<br />

(d) Is signed by or on behalf of each of the grantors; and<br />

<br />

(e) Is signed by or on behalf of all parties, if a lease or contract to convey; and<br />

<br />

(f) Is signed, or joined in by separate conveyance, by or on behalf of each spouse, if the conveyance alienates any interest of a married person in a homestead under s. 706.01 (7) except conveyances between spouses, but on a purchase money mortgage pledging that property as security only the purchaser need sign the mortgage; and<br />

<br />

(g) Is delivered. Except under s. 706.09, a conveyance delivered upon a parol limitation or condition shall be subject thereto only if the issue arises in an action or proceeding commenced within 5 years following the date of such conditional delivery; however, when death or survival of a grantor is made such a limiting or conditioning circumstance, the conveyance shall be subject thereto only if the issue arises in an action or proceeding commenced within such 5-year period and commenced prior to such death.<br />

<br />

(2) A conveyance may satisfy any of the foregoing requirements of this section:<br />

<br />

(a) By specific reference, in a writing signed as required, to extrinsic writings in existence when the conveyance is executed; or<br />

<br />

(b) By physical annexation of several writings to one another, with the mutual consent of the parties; or<br />

<br />

(c) By several writings which show expressly on their faces that they refer to the same transaction, and which the parties have mutually acknowledged by conduct or agreement as evidences of the transaction.<br />

<br />

History: 1971 c. 211 s. 126; 1977 c. 177; 1999 a. 85.<br />

<br />

There can be no waiver of the necessity of a spouse’s joining in a deed of a homestead and no finding of agency will sustain the deed. Wangen v. Leum, 46 Wis. 2d 60, 174 N.W.2d 266 (1970).<br />

<br />

In pleading a contract that is subject to the statute of frauds, it is not necessary to allege facts to establish that the contract complies with the statute or is within its exceptions. Ritterbusch v. Ritterbusch, 50 Wis. 2d 633, 184 N.W.2d 865 (1971).<br />

<br />

An option to purchase land must be in writing and cannot be modified orally, but a seller may orally agree to accept payment in full rather than in installments. Kubnick v. Bohne, 56 Wis. 2d 527, 202 N.W.2d 400 (1972).<br />

<br />

The test of undue influence to set aside a will is also applicable in order to void an inter vivos transfer due to undue influence. Ward v. Ward, 62 Wis. 2d 543, 215 N.W.2d 3 (1976).<br />

<br />

Standing alone, an added provision in a 30-day option agreement to purchase real estate did not comply with the statute of frauds. Edlebeck v. Barnes, 63 Wis. 2d 240, 216 N.W.2d 551 (1974).<br />

<br />

An oral contract for the conveyance of an interest in land is void unless there is a memorandum that conforms to the statute of frauds. Trimble v. Wis. Builders, Inc. 72 Wis. 2d 435, 241 N.W.2d 409 (1976).<br />

<br />

When a contract for the sale of land with an indefinite description is taken out of the statute of frauds by part performance, extrinsic evidence admissible but for the statute of frauds may be introduced to provide the description. Clay v. Bradley, 74 Wis. 2d 153, 246 N.W.2d 142 (1976).<br />

<br />

The question under sub. (1) (b) of whether property boundaries are identified to a reasonable certainty is for the jury to determine with the aid of all competent extrinsic evidence. Zapuchlak v. Hucal, 82 Wis. 2d 184, 262 N.W.2d 514 (1978).<br />

<br />

The homestead defense under sub. (1) (f) is not defeated by s. 706.04, but a tort claim may exist against a signing spouse who misrepresents the non-signing spouse’s acquiescence. Glinski v. Sheldon, 88 Wis. 2d 509, 276 N.W.2d 815 (1979).<br />

<br />

The defense of the statute of frauds is waived if not raised in the trial court. Hine v. Vilter, 88 Wis. 2d 645, 277 N.W.2d 772 (1979).<br />

<br />

A mortgage fraudulently executed by the use of a forged signature of one grantor was wholly void. State Bank of Drummond v. Christophersen, 93 Wis. 2d 148, 286 N.W.2d 547 (1980).<br />

<br />

When a contract for the sale of land and personalty is not divisible, the contract is entirely void if this section is not satisfied. Spensley Feed v. Livingston Feed, 128 Wis. 2d 279, 381 N.W.2d 601 (Ct. App. 1985).<br />

<br />

The homestead signature requirement of sub. (1) (f) must be waived affirmatively by actual signing of the mortgage. A failure to plead the statute of frauds as an affirmative defense did not constitute a waiver. Weber v. Weber, 176 Wis. 2d 1085, 501 N.W.2d 413 (1993).<br />

<br />

A quitclaim deed of a married couple’s homestead from one spouse to the other is not valid to alienate the grantor’s interest in the property in any way that would eliminate either spouse’s contractual obligations under a mortgage containing a valid dragnet clause. Schmidt v. Waukesha State Bank, 204 Wis. 2d 426, 555 N.W.2d 655 (Ct. App. 1996), 95-1850.<br />

<br />

An in-court oral stipulation could create a mortgage interest in property, but a homestead conveyance must bear the conveyor’s signatures. Because the stipulation lacked signatures, it was not a mortgage that could defeat the homestead exemption under s. 815.20. Equitable Bank, S.S.B. v. Chabron, 2000 WI App 210, 238 Wis. 2d 708, 618 N.W.2d 262, 99-2639.<br />

<br />

If the language within the four corners of a deed is unambiguous, the court need look no further for the parties’ intent. Eckendorf v. Austin, 2000 WI App 219, 239 Wis. 2d 69, 619 N.W.2d 129, 00-0713.<br />

<br />

Spouses may affirmatively waive the homestead protection in sub. (1) (f) in a premarital agreement. Jones v. Estate of Jones, 2002 WI 61, 253 Wis. 2d 158, 646 N.W.2d 280, 01-1025.<br />

<br />

A conveyance that “identifies the land” as required by sub. (1) means the conveyance must identify the property with “reasonable certainty.” “Reasonable certainty” means that by the aid of the facts and circumstances surrounding the parties at the time the court can with reasonable certainty determine the land which is to be conveyed. It does not, however, necessarily require a legal description. Anderson v. Quinn, 2007 WI App 260, 306 Wis. 2d 686, 743 N.W.2d 492, 06-2462.<br />

<br />

Parol evidence in the context of the statute of frauds does not operate to supply fatal omissions of a writing but rather to render the writing intelligible. A clear distinction must be drawn between the proper admission of extrinsic evidence for the purpose of applying the description to identified property versus the improper supplying of a description or adding to a description that on its face is insufficient. As the description “remaining acreage” was, on its face, insufficient to identify the specific property, parol evidence would not be admissible under the statute of frauds. 303, LLC v. Born, 2012 WI App 115, 344 Wis. 2d 364, 823 N.W.2d 269, 11-2368.<br />

<br />

The mortgage in this case was equitably assigned to the holder of the original note by operation of law upon transfer of the note. Therefore, equitable assignment of the mortgage was not barred by the statute of frauds under this section. Dow Family, LLC v. PHH Mortgage Corporation, 2014 WI 56, 354 Wis. 2d 796, 848 N.W.2d 728, 13-0221.<br />

<br />

Mere ambiguity does not render a contract unenforceable vis-à-vis the statute of frauds. Rather, when a conveyance includes a description of property that can be applied in multiple ways, the statute of frauds requires that parol evidence of intent be connected in some way to the language of the agreement. Prezioso v. Aerts, 2014 WI App 126, 358 Wis. 2d 714, 858 N.W.2d 386, 13-2762.<br />

<br />

The statute of frauds does not bar a tort action for intentional misrepresentation. Winger v. Winger, 82 F.3d 140 (1996).<br />

<br />

706.04 Equitable relief.<br />

<br />

A transaction which does not satisfy one or more of the requirements of s. 706.02 may be enforceable in whole or in part under doctrines of equity, provided all of the elements of the transaction are clearly and satisfactorily proved and, in addition:<br />

<br />

(1) The deficiency of the conveyance may be supplied by reformation in equity; or<br />

<br />

(2) The party against whom enforcement is sought would be unjustly enriched if enforcement of the transaction were denied; or<br />

<br />

(3) The party against whom enforcement is sought is equitably estopped from asserting the deficiency. A party may be so estopped whenever, pursuant to the transaction and in good faith reliance thereon, the party claiming estoppel has changed his or her position to the party’s substantial detriment under circumstances such that the detriment so incurred may not be effectively recovered otherwise than by enforcement of the transaction, and either:<br />

<br />

(a) The grantee has been admitted into substantial possession or use of the premises or has been permitted to retain such possession or use after termination of a prior right thereto; or<br />

<br />

(b) The detriment so incurred was incurred with the prior knowing consent or approval of the party sought to be estopped.<br />

<br />

History: 1993 a. 486.<br />

<br />

A partnership created to deal in real estate is void unless conforming to the statute of frauds unless all parties have performed the contract, thus indicating their acquiescence in its terms. In re Estate of Schaefer, 72 Wis. 2d 600, 241 N.W.2d 607 (1976).<br />

<br />

In an equity action seeking the conveyance of a farm under an oral agreement, the trial court properly ordered the conveyance under sub. (3) when the tenants gave up plans to build a home on other property, planted crops on the farm, and painted the interior of the farmhouse. Krauza v. Mauritz, 78 Wis. 2d 276, 254 N.W.2d 251 (1977).<br />

<br />

Personal services to a vendor in reliance upon an oral agreement are not enough, standing alone, to constitute part performance. In the Matter of the Estate of Lade, 82 Wis. 2d 80, 260 N.W.2d 665 (1978).<br />

<br />

Under sub. (3) (a), a grantee with knowledge of the facts giving rise to equitable estoppel against the grantor takes title subject to the estoppel. Brevig v. Webster, 88 Wis. 2d 165, 277 N.W.2d 321 (Ct. App. 1979).<br />

<br />

The homestead defense under s. 706.02 (1) (f) is not defeated by this section, but a tort claim may exist against a signing spouse who misrepresents the non-signing spouse’s acquiescence. Glinski v. Sheldon, 88 Wis. 2d 509, 276 N.W.2d 815 (1979).<br />

<br />

Failure to execute a document can be cured under this section. The “unclean hands” defense is discussed. Security Pacific National Bank v. Ginkowski, 140 Wis. 2d 332, 410 N.W.2d 589 (Ct. App. 1987).<br />

<br />

Once a deed has been properly executed and recorded, a court, in equity, may not alter the document when a party later expresses a different intent than was memorialized. Wynhoff v. Vogt, 2000 WI App 57, 233 Wis. 2d 673, 608 N.W.2d 400, 99-0103.<br />

<br />

Section 706.04 does not refer to deficiencies under s. 706.03. Triple Interest, Inc. v. Motel 6, Inc. 414 F. Supp. 589 (1976).<br />

<br />

706.05 Formal requisites for record.<br />

<br />

(1) Subject to s. 59.43 (2m), every conveyance, and every other instrument which affects title to land in this state, shall be entitled to record in the office of the register of deeds of each county in which land affected thereby may lie.<br />

<br />

(2) Except as different or additional requirements may be provided by law, every instrument offered for record shall:<br />

<br />

(a) Bear such signatures as are required by law;<br />

<br />

(b) Contain a form of authentication authorized by s. 706.06 or 706.07;<br />

<br />

(c) Identify, to the extent that the nature of the instrument permits, and in form and terms which permit ready entry upon the various books and indexes publicly maintained as land records of such county, the land to which such instrument relates and the parties or other persons whose interests in such land are affected. Except as provided in sub. (2m), identification may be either by the terms of the instrument or by reference to an instrument of record in the same office, naming the place where such record may be found.<br />

<br />

(2m) (a) Except as provided in par. (b), any document submitted for recording or filing that is to be indexed in the real estate records, any document submitted for recording or filing that modifies an original mortgage or land contract and any subordination agreement submitted for recording or filing shall contain the full legal description of the property to which it relates if the document or subordination agreement is intended to relate to a particular parcel of land. The legal description may be included on the document or may be attached to the document. Any such document shall also contain the document number of any original mortgage or land contract that the document affects and, if given on the original mortgage or land contract, the volume and page numbers of the original mortgage or land contract.<br />

<br />

(b) The requirement of a full legal description under par. (a) does not apply to:<br />

<br />

1. Descriptions of easements for the construction, operation or maintenance of electric, gas, railroad, water, telecommunications or telephone lines or facilities.<br />

<br />

2. Descriptions of property that is subject to liens granted on property thereafter acquired by a rural electric cooperative organized under ch. 185, by a telephone cooperative organized under ch. 185 or 193, by a pipeline company under s. 76.02 (5), by a public utility under s. 196.01 (5), by a railroad under s. 195.02 (1), or by a water carrier under s. 195.02 (5).<br />

<br />

(c) The requirement under par. (a) does not affect the validity of liens under par. (b) 2.<br />

<br />

(3) In addition to the requirements under sub. (2), every conveyance of mineral interests offered for record shall:<br />

<br />

(a) Fully disclose the terms and conditions of the agreement including both the financial arrangements and the exploration rights. Financial arrangements include the consideration exchanged for the interest in land, terms for payment, optional payments, royalty agreements and similar arrangements. Exploration rights include the conditions and extent of any surface and subsurface rights to the land, options to purchase further interest in the land, options to conduct mining operations and similar arrangements.<br />

<br />

(b) Fully disclose the parties including any principal, parent corporation, partner or business associate with an interest in the conveyance. This paragraph shall be interpreted to provide maximum disclosure of any person with an economic interest in the transaction.<br />

<br />

(4) Any person who anticipates becoming a party to a number of conveyances of a given form may cause a prototype of such form to be recorded, accompanied by a certificate declaring the intention of the recording party to incorporate the terms of such prototype in future recorded conveyances by reference.<br />

<br />

(5) Copies of instruments affecting title to land in this state, authenticated by certificate of any public officer, either of this or any other state or foreign country, in whose office the original is filed or recorded pursuant to law, may be recorded in every case in which the original would be entitled to record under this section.<br />

<br />

(6) Except as may otherwise be expressly provided, no instrument shall be denied acceptance for record because of the absence of venue, seals, witnesses or other matter of form.<br />

<br />

(7) Every instrument which the register of deeds shall accept for record shall be deemed duly recorded despite its failure to conform to one or more of the requirements of this section, provided the instrument is properly indexed in a public index maintained in the office of such register of deeds and recorded at length at the place there shown.<br />

<br />

(8) A duly recorded certificate signed by or on behalf of the holder of record of any mortgage or other security interest in lands, and authenticated as provided by s. 706.06 or 706.07 identifying the mortgage or other interest and stating that the same has been paid or satisfied in whole or in part, shall be sufficient to satisfy such mortgage or other interest of record.<br />

<br />

(12) Every conveyance of any interest in real property offered for recordation shall be accompanied by the form under s. 77.22 (2). If the property is subject to certification under s. 101.122 (4) (a), waiver under s. 101.122 (4) (b) or stipulation under s. 101.122 (4) (c), the documents of conveyance offered for recordation shall have appended the certificate required under s. 101.122 (4) (a), a waiver under s. 101.122 (4) (b) or a stipulation under s. 101.122 (4) (c).<br />

<br />

History: 1971 c. 211; 1977 c. 217, 253, 447; 1979 c. 221; 1983 a. 492 s. 3; 1985 a. 174; 1991 a. 66, 269; 1993 a. 145, 486; 1995 a. 110, 201; 1997 a. 35; 1999 a. 96; 2005 a. 179, 441; 2013 a. 66.<br />

<br />

Under sub. (1), only instruments that affect an interest in land are entitled to be recorded. A land patent is the instrument by which the government conveys title to portions of the public domain to private individuals. “Land patents,” “updates of land patent” and other, similarly-titled documents filed by private individuals that purport to be grants of private land from private individuals to themselves or other private individuals are not true land patents and are invalid on their face and not entitled to recording. OAG 4-12.<br />

<br />

706.055 Conveyances of mineral rights.<br />

<br />

The register of deeds shall record all conveyances of mineral interests in the index maintained under s. 59.43 (9).<br />

<br />

History: 1977 c. 253; 2009 a. 98.<br />

<br />

706.06 Authentication.<br />

<br />

(1) Any instrument may be acknowledged, or its execution otherwise authenticated by its signators, as provided by the laws of this state; or as provided in this section or s. 706.07.<br />

<br />

(2) Any public officer entitled by virtue of his or her office to administer oaths, and any member in good standing of the State Bar of Wisconsin, may authenticate one or more of the signatures on an instrument relating to lands in this state, by endorsing the instrument “Acknowledged,” “Authenticated,” or “Signatures Guaranteed,” or other words to similar effect, adding the date of authentication, his or her own signature, and his or her official or professional title. The endorsement, unless expressly limited, shall operate as an authentication of all signatures on the instrument; and shall constitute a certification that each authenticated signature is the genuine signature of the person represented; and, as to signatures made in a representative capacity, shall constitute a certification that the signer purported, and was believed, to be such representative.<br />

<br />

(3) Affidavits shall be authenticated by a certificate of due execution of the instrument, executed by a person entitled to administer oaths.<br />

<br />

(4) In addition to any criminal penalty or civil remedy otherwise provided by law, knowingly false authentication of an instrument shall subject the authenticator to liability in tort for compensatory and punitive damages caused thereby to any person.<br />

<br />

History: 1971 c. 211; 1973 c. 243; 1979 c. 110; 1983 a. 492 s. 3; 1993 a. 486; 2001 a. 103.<br />

<br />

706.07 Uniform law on notarial acts.<br />

<br />

(1) DEFINITIONS. In this section:<br />

<br />

(a) “Acknowledgment” means a declaration by a person that the person has executed an instrument for the purposes stated therein and, if the instrument is executed in a representative capacity, that the person signed the instrument with proper authority and executed it as the act of the person or entity represented and identified therein.<br />

<br />

(b) “In a representative capacity” means:<br />

<br />

1. For and on behalf of a corporation, partnership, trust, or other entity, as an authorized officer, agent, partner, trustee, or other representative;<br />

<br />

2. As a public officer, personal representative, guardian, or other representative, in the capacity recited in the instrument;<br />

<br />

3. As an attorney in fact for a principal; or<br />

<br />

4. In any other capacity as an authorized representative of another.<br />

<br />

(c) “Notarial act” means any act that a notary public of this state is authorized to perform, and includes taking an acknowledgment, administering an oath or affirmation, taking a verification upon oath or affirmation, witnessing or attesting a signature, certifying or attesting a copy, and noting a protest of a negotiable instrument.<br />

<br />

(d) “Notarial officer” means a notary public or other officer authorized to perform notarial acts.<br />

<br />

(e) “Verification upon oath or affirmation” means a declaration that a statement is true made by a person upon oath or affirmation.<br />

<br />

(2) NOTARIAL ACTS.<br />

<br />

(a) In taking an acknowledgment, the notarial officer must determine, either from personal knowledge or from satisfactory evidence, that the person appearing before the officer and making the acknowledgment is the person whose true signature is on the instrument.<br />

<br />

(b) In taking a verification upon oath or affirmation, the notarial officer must determine, either from personal knowledge or from satisfactory evidence, that the person appearing before the officer and making the verification is the person whose true signature is on the statement verified.<br />

<br />

(c) In witnessing or attesting a signature, the notarial officer must determine, either from personal knowledge or from satisfactory evidence, that the signature is that of the person appearing before the officer and named therein.<br />

<br />

(d) In certifying or attesting a copy of a document or other item, the notarial officer must determine that the proffered copy is a full, true, and accurate transcription or reproduction of that which was copied.<br />

<br />

(e) In making or noting a protest of a negotiable instrument, the notarial officer must determine the matters set forth in s. 403.505 (2).<br />

<br />

(f) A notarial officer has satisfactory evidence that a person is the person whose true signature is on a document if that person:<br />

<br />

1. Is personally known to the notarial officer;<br />

<br />

2. Is identified upon the oath or affirmation of a credible witness personally known to the notarial officer; or<br />

<br />

3. Is identified on the basis of identification documents.<br />

<br />

(3) NOTARIAL ACTS IN THIS STATE.<br />

<br />

(a) A notarial act may be performed within this state by the following persons of this state:<br />

<br />

1. A notary public;<br />

<br />

2. A judge, clerk or deputy clerk of a court of record;<br />

<br />

3. A court commissioner;<br />

<br />

4. A register of deeds or deputy register of deeds;<br />

<br />

5. A municipal judge; or<br />

<br />

6. A county clerk or deputy county clerk.<br />

<br />

(b) Notarial acts performed within this state under federal authority as provided in sub. (5) have the same effect as if performed by a notarial officer of this state.<br />

<br />

(c) The signature and title of a person performing a notarial act are prima facie evidence that the signature is genuine and that the person holds the designated title.<br />

<br />

(4) NOTARIAL ACTS IN OTHER JURISDICTIONS OF THE UNITED STATES.<br />

<br />

(a) A notarial act has the same effect under the law of this state as if performed by a notarial officer of this state, if performed in another state, commonwealth, territory, district, or possession of the United States by any of the following persons:<br />

<br />

1. A notary public of that jurisdiction;<br />

<br />

2. A judge, clerk, or deputy clerk of a court of that jurisdiction; or<br />

<br />

3. Any other person authorized by the law of that jurisdiction to perform notarial acts.<br />

<br />

(b) Notarial acts performed in other jurisdictions of the United States under federal authority as provided in sub. (5) have the same effect as if performed by a notarial officer of this state.<br />

<br />

(c) The signature and title of a person performing a notarial act are prima facie evidence that the signature is genuine and that the person holds the designated title.<br />

<br />

(d) The signature and indicated title of an officer listed in par. (a) 1. or 2. conclusively establish the authority of a holder of that title to perform a notarial act.<br />

<br />

(5) NOTARIAL ACTS UNDER FEDERAL AUTHORITY.<br />

<br />

(a) A notarial act has the same effect under the law of this state as if performed by a notarial officer of this state if performed anywhere by any of the following persons under authority granted by the law of the United States:<br />

<br />

1. A judge, clerk, or deputy clerk of a court.<br />

<br />

2. A commissioned officer on active duty in the military service of the United States.<br />

<br />

3. An officer of the foreign service or consular officer of the United States.<br />

<br />

4. Any other person authorized by federal law to perform notarial acts.<br />

<br />

(b) The signature and title of a person performing a notarial act are prima facie evidence that the signature is genuine and that the person holds the designated title.<br />

<br />

(c) The signature and indicated title of an officer listed in par. (a) 1., 2. or 3. conclusively establish the authority of a holder of that title to perform a notarial act.<br />

<br />

(6) FOREIGN NOTARIAL ACTS.<br />

<br />

(a) A notarial act has the same effect under the law of this state as if performed by a notarial officer of this state if performed within the jurisdiction of and under authority of a foreign nation or its constituent units or a multinational or international organization by any of the following persons:<br />

<br />

1. A notary public or notary;<br />

<br />

2. A judge, clerk, or deputy clerk of a court of record; or<br />

<br />

3. Any other person authorized by the law of that jurisdiction to perform notarial acts.<br />

<br />

(b) An “apostille” in the form prescribed by the Hague convention of October 5, 1961, conclusively establishes that the signature of the notarial officer is genuine and that the officer holds the indicated office.<br />

<br />

(c) A certificate by a foreign service or consular officer of the United States stationed in the nation under the jurisdiction of which the notarial act was performed, or a certificate by a foreign service or consular officer of that nation stationed in the United States, conclusively establishes any matter relating to the authenticity or validity of the notarial act set forth in the certificate.<br />

<br />

(d) An official stamp or seal of the person performing the notarial act is prima facie evidence that the signature is genuine and that the person holds the indicated title.<br />

<br />

(e) An official stamp or seal of an officer listed in par. (a) 1. or 2. is prima facie evidence that a person with the indicated title has authority to perform notarial acts.<br />

<br />

(f) If the title of office and indication of authority to perform notarial acts appears either in a digest of foreign law or in a list customarily used as a source for that information, the authority of an officer with that title to perform notarial acts is conclusively established.<br />

<br />

(7) CERTIFICATE OF NOTARIAL ACTS.<br />

<br />

(a) A notarial act must be evidenced by a certificate signed and dated by a notarial officer. The certificate must include identification of the jurisdiction in which the notarial act is performed and the title of the office of the notarial officer and may include the official stamp or seal of office. If the officer is a notary public, the certificate must also indicate the date of expiration, if any, of the commission of office, but omission of that information may subsequently be corrected. If the officer is a commissioned officer on active duty in the military service of the United States, it must also include the officer’s rank.<br />

<br />

(b) A certificate of a notarial act is sufficient if it meets the requirements of par. (a) and it:<br />

<br />

1. Is in the short form set forth in sub. (8);<br />

<br />

2. Is in a form otherwise prescribed by the law of this state;<br />

<br />

3. Is in a form prescribed by the laws or regulations applicable in the place in which the notarial act was performed; or<br />

<br />

4. Sets forth the actions of the notarial officer and those are sufficient to meet the requirements of the designated notarial act.<br />

<br />

(c) By executing a certificate of a notarial act, the notarial officer certifies that the officer has made the determination required by sub. (2).<br />

<br />

(8) SHORT FORMS. The following short form certificates of notarial acts are sufficient for the purposes indicated, if completed with the information required by sub. (7) (a):<br />

<br />

(a) For an acknowledgment in an individual capacity:<br />

<br />

State of ….<br />

<br />

County of ….<br />

<br />

This instrument was acknowledged before me on (date) by (name(s) of person(s)).<br />

<br />

…. (Signature of notarial officer)<br />

<br />

(Seal, if any)<br />

<br />

…. Title (and Rank) [My commission expires: ….]<br />

<br />

(b) For an acknowledgment in a representative capacity:<br />

<br />

State of ….<br />

<br />

County of ….<br />

<br />

This instrument was acknowledged before me on (date) by (name(s) of person(s)) as (type of authority, e.g., officer, trustee, etc.) of (name of party on behalf of whom instrument was executed).<br />

<br />

…. (Signature of notarial officer)<br />

<br />

(Seal, if any)<br />

<br />

…. Title (and Rank) [My commission expires: ….]<br />

<br />

(c) For a verification upon oath or affirmation:<br />

<br />

State of ….<br />

<br />

County of ….<br />

<br />

Signed and sworn to (or affirmed) before me on (date) by (name(s) of person(s) making statement).<br />

<br />

…. (Signature of notarial officer)<br />

<br />

(Seal, if any)<br />

<br />

…. Title (and Rank) [My commission expires: ….]<br />

<br />

(d) For witnessing or attesting a signature:<br />

<br />

State of ….<br />

<br />

County of ….<br />

<br />

Signed or attested before me on (date) by (name(s) of person(s)).<br />

<br />

…. (Signature of notarial officer)<br />

<br />

(Seal, if any)<br />

<br />

…. Title (and Rank) [My commission expires: ….]<br />

<br />

(e) For attestation of a copy of a document:<br />

<br />

State of …<br />

<br />

County of ….<br />

<br />

I certify that this is a true and correct copy of a document in the possession of ….<br />

<br />

Dated: ….<br />

<br />

….(Signature of notarial officer)<br />

<br />

(Seal, if any)<br />

<br />

….. Title (and Rank) [My commission expires: ….]<br />

<br />

(9) NOTARIAL ACTS AFFECTED BY THIS SECTION. This section applies to notarial acts performed on or after November 1, 1984.<br />

<br />

(10) UNIFORMITY OF APPLICATION AND CONSTRUCTION. This section shall be applied and construed to effectuate its general purpose to make uniform the law with respect to the subject of this section among states enacting it.<br />

<br />

(11) SHORT TITLE. This section may be cited as the uniform law on notarial acts.<br />

<br />

History: 1983 a. 492; 1989 a. 123; 1995 a. 449; 1999 a. 85.<br />

<br />

706.08 Nonrecording, effect.<br />

<br />

(1)(a) Except for patents issued by the United States or this state, or by the proper officers of either, every conveyance that is not recorded as provided by law shall be void as against any subsequent purchaser, in good faith and for a valuable consideration, of the same real estate or any portion of the same real estate whose conveyance is recorded first.<br />

<br />

(b) A conveyance of mineral interests which is not recorded in the office of the register of deeds of the county in which the land is located, within 30 days after it is signed by the lessor, is void.<br />

<br />

(2) Where a public tract index or abstract of title index is maintained, an instrument properly indexed therein and recorded at length at the place there shown shall be deemed to be duly recorded for purposes of this section, despite any error or omission in the process of including the instrument, or prior instruments in the same chain of title, in other records. Where an instrument is not properly indexed in such tract or abstract of title index, or where such index is not publicly maintained, the instrument shall be deemed to be duly recorded only if the instrument, together with prior instruments necessary to trace title by use of alphabetical indexes by names of parties, are properly indexed in such alphabetical indexes, and recorded at length at the places there shown. Wherever an instrument is duly recorded hereunder, its record shall be effective as of the date and hour at which it is shown by the general index to have been accepted for record.<br />

<br />

(3) When an express trust is created, but its existence is not disclosed in a recorded conveyance to the trustee, the title of the trustee shall be deemed absolute as against the subsequent creditors of the trustee not having notice of the trust and as against purchasers from such trustee without notice and for a valuable consideration.<br />

<br />

(4) It shall be conclusively presumed that a person is a trustee of a valid express trust and has full power of conveyance if all of the following occur:<br />

<br />

(a) The person is designated as trustee and holds an interest in land as trustee.<br />

<br />

(b) The person’s authority and powers as trustee are not set forth in a recorded instrument.<br />

<br />

(c) The person conveys an interest in land as trustee to a good faith purchaser, as defined in s. 401.201 (2) (qm).<br />

<br />

(5) When a conveyance purports to be absolute in terms, but is made or intended to be made defeasible by force of another instrument for that purpose, the original conveyance shall not be thereby defeated or affected as against any person other than the maker of the defeasance or the maker’s heirs or devisees or persons having actual notice thereof, unless the instrument of defeasance has been recorded in the office of the register of deeds of the county where the lands lie.<br />

<br />

(6) The recording of an assignment of a mortgage shall not in itself be deemed notice of such assignment to the mortgagor so as to invalidate any payment made to the mortgagee without actual notice of such assignment.<br />

<br />

(7) No letter of attorney or other instrument containing a power to convey lands, when executed and recorded under this chapter, shall be deemed to be revoked by any act of the party by whom it was executed unless the instrument containing such revocation is also recorded in the same office in which the instrument containing the power was recorded, and such record shall import notice to all persons, including the agent named in said letter of attorney of the contents thereof. The death of the party executing such letter of attorney shall not operate as a revocation thereof as to the attorney or agent until the attorney or agent has notice of the death, or as to one who without notice of such death in good faith deals with the attorney or agent.<br />

<br />

History: 1977 c. 253; 1989 a. 231; 1993 a. 486; 1999 a. 85; 2009 a. 320.<br />

<br />

An unrecorded conveyance, if delivered, is valid against judgment creditors since they are not bona fide creditors for value. West Federal Savings & Loan v. Interstate Investment, 57 Wis. 2d 690, 205 N.W.2d 361 (1973).<br />

<br />

A purchaser having constructive notice that there may have been an unrecorded conveyance was not a “purchaser in good faith” under sub. (1) (a). Kordecki v. Rizzo, 106 Wis. 2d 713, 317 N.W.2d 479 (1982).<br />

<br />

An original mortgagee’s knowledge of a prior mortgage not properly of record will not be imputed to an assignee of the mortgage with no knowledge of the prior mortgage and does not render the assignee not a purchaser in good faith under sub. (1) (a) who cannot claim priority. The Bank of New Glarus v. Swartwood, 2006 WI App 224, 297 Wis. 2d 458, 725 N.W.2d 944, 05-0647.<br />

<br />

“Good faith” for purposes of sub. (1) (a) exists only when there is no notice under s. 706.09. Anderson v. Quinn, 2007 WI App 260, 306 Wis. 2d 686, 743 N.W.2d 492, 06-2462.<br />

<br />

706.09 Notice of conveyance from the record.<br />

<br />

(1) WHEN CONVEYANCE IS FREE OF PRIOR ADVERSE CLAIM. A purchaser for a valuable consideration, without notice as defined in sub. (2), and the purchaser’s successors in interest, shall take and hold the estate or interest purported to be conveyed to such purchaser free of any claim adverse to or inconsistent with such estate or interest, if such adverse claim is dependent for its validity or priority upon:<br />

<br />

(a) Nondelivery. Nondelivery, or conditional or revocable delivery, of any recorded conveyance, unless the condition or revocability is expressly referred to in such conveyance or other recorded instrument.<br />

<br />

(b) Conveyance outside chain of title not identified by definite reference. Any conveyance, transaction or event not appearing of record in the chain of title to the real estate affected, unless such conveyance, transaction or event is identified by definite reference in an instrument of record in such chain. No reference shall be definite which fails to specify, by direct reference to a particular place in the public land record, or, by positive statement, the nature and scope of the prior outstanding interest created or affected by such conveyance, transaction or event, the identity of the original or subsequent owner or holder of such interest, the real estate affected, and the approximate date of such conveyance, transaction or event.<br />

<br />

(c) Unrecorded extensions of interests expiring by lapse of time. Continuance, extension or renewal of rights of grantees, purchasers, optionees, or lessees under any land contract, option, lease or other conveyance of an interest limited to expire, absolutely or upon a contingency, within a fixed or determinable time, where 2 years have elapsed after such time, unless there is recorded a notice or other instrument referring to such continuance, extension or renewal and stating or providing a later time for the enforcement, exercise, performance or termination of such interest and then only if less than 2 years have elapsed after such later time. This paragraph shall not apply to life estates, mortgages or trust deeds, nor shall it inferentially extend any interest otherwise expiring by lapse of time.<br />

<br />

(d) Nonidentity of persons in chain of title. Nonidentity of persons named in, signing or acknowledging one or more related conveyances or instruments affecting real estate, provided the persons appear in such conveyances under identical names or under variants thereof, including inclusion, exclusion or use of: commonly recognized abbreviations, contractions, initials, or foreign, colloquial, or other equivalents; first or middle names or initials; simple transpositions which produce substantially similar pronunciation; articles or prepositions in names or titles; description of entities as corporations, companies, or any abbreviation or contraction of either; name suffixes such as senior or junior; where such identity or variance has appeared of record for 5 years.<br />

<br />

(e) Marital interests. Homestead of the spouse of any transferor of an interest in real estate, if the recorded conveyance purporting to transfer the homestead states that the person executing it is single, unmarried or widowed or fails to indicate the marital status of the transferor, and if the conveyance has, in either case, appeared of record for 5 years. This paragraph does not apply to the interest of a married person who is described of record as a holder in joint tenancy or of marital property with that transferor.<br />

<br />

(f) Lack of authority of officers, agents or fiduciaries. Any defect or insufficiency in authorization of any purported officer, partner, manager, agent, or fiduciary to act in the name or on behalf of any corporation, partnership, limited liability company, principal, trust, estate, minor, individual adjudicated incompetent, or other holder of an interest in real estate purported to be conveyed in a representative capacity, after the conveyance has appeared of record for 5 years.<br />

<br />

(g) Defects in judicial proceedings. Any defect or irregularity, jurisdictional or otherwise, in an action or proceeding out of which any judgment or order affecting real estate issued after the judgment or order has appeared of record for 5 years.<br />

<br />

(h) Nonexistence, incapacity or incompetency. Nonexistence, acts in excess of legal powers or legal incapacity or incompetency of any purported person or legal entity, whether natural or artificial, foreign or domestic, provided the recorded conveyance or instrument affecting the real estate shall purport to have been duly executed by such purported person or legal entity, and shall have appeared of record for 5 years.<br />

<br />

(i) Facts not asserted of record. Any fact not appearing of record, but the opposite or contradiction of which appears affirmatively and expressly in a conveyance, affidavit or other instrument of record in the chain of title of the real estate affected for 5 years. Such facts may, without limitation by noninclusion, relate to age, sex, birth, death, capacity, relationship, family history, descent, heirship, names, identity of persons, marriage, marital status, homestead, possession or adverse possession, residence, service in the armed forces, conflicts and ambiguities in descriptions of land in recorded instruments, identification of any recorded plats or subdivisions, corporate authorization to convey, and the happening of any condition or event which terminates an estate or interest.<br />

<br />

(j) Defects in tax deed. Nonexistence or illegality of any proceedings from and including the assessment of the real estate for taxation up to and including the execution of the tax deed after the tax deed has been of record for 5 years.<br />

<br />

(k) Interests not of record within 30 years. Any interest of which no affirmative and express notice appears of record within 30 years.<br />

<br />

(2) NOTICE OF PRIOR CLAIM. A purchaser has notice of a prior outstanding claim or interest, within the meaning of this section wherever, at the time such purchaser’s interest arises in law or equity:<br />

<br />

(a) Affirmative notice. Such purchaser has affirmative notice apart from the record of the existence of such prior outstanding claim, including notice, actual or constructive, arising from use or occupancy of the real estate by any person at the time such purchaser’s interest therein arises, whether or not such use or occupancy is exclusive; but no constructive notice shall be deemed to arise from use or occupancy unless due and diligent inquiry of persons using or occupying such real estate would, under the circumstances, reasonably have disclosed such prior outstanding interest; nor unless such use or occupancy is actual, visible, open and notorious; or<br />

<br />

(b) Notice of record within 30 years. There appears of record in the chain of title of the real estate affected, within 30 years and prior to the time at which the interest of such purchaser arises in law or equity, an instrument affording affirmative and express notice of such prior outstanding interest conforming to the requirements of definiteness of sub. (1) (b); or<br />

<br />

(c) Same. The applicable provisions of sub. (1) (c) to (k) requiring that an instrument remain for a time of record, have not been fully satisfied.<br />

<br />

(3) WHEN PRIOR INTEREST NOT BARRED. This section shall not be applied to bar or infringe any prior outstanding interest in real estate:<br />

<br />

(a) Public service corporations, railroads, electric cooperatives, trustees, natural gas companies, governmental units. While owned, occupied or used by any public service corporation, any railroad corporation as defined in s. 195.02 (1), any water carrier as defined in s. 195.02 (5), any electric cooperative organized and operating on a nonprofit basis under ch. 185, any natural gas company, as defined in 15 USC 717a (6), or any trustee or receiver of any such corporation, electric cooperative, or natural gas company, or any mortgagee or trust deed trustee or receiver thereof; nor any such interest while held by the United States, the state or any political subdivision or municipal corporation thereof; or<br />

<br />

(b) Unplatted, unimproved, unused, etc. Which, at the time such subsequent purchaser’s interest arises, is unplatted, vacant and unoccupied, unused, unimproved and uncultivated; except that this paragraph shall not apply to prior interests dependent for validity or priority upon the circumstances described in sub. (1) (a), (b), (j) and (k).<br />

<br />

(4) CHAIN OF TITLE: DEFINITION. The term “chain of title” as used in this section includes instruments, actions and proceedings discoverable by reasonable search of the public records and indexes affecting real estate in the offices of the register of deeds and in probate and of clerks of courts of the counties in which the real estate is located; a tract index shall be deemed an index where the same is publicly maintained.<br />

<br />

(5) CONSTRUCTION. Nothing in this section shall be construed to raise or support any inference adverse or hostile to marketability of titles.<br />

<br />

(6) EFFECTIVE DATE. This section shall take effect and may be invoked by qualified purchasers without notice as defined in sub. (2) whose interests arise on or after July 1, 1968, and by their successors in interest thereafter.<br />

<br />

History: 1975 c. 94 s. 91 (16); 1979 c. 110; 1983 a. 186; 1987 a. 330; 1993 a. 112, 486, 496; 2005 a. 179, 387; 2009 a. 378, 379.<br />

<br />

This section does not create or govern interests in land but deals with circumstances when a purchaser of land will be held to have notice of adverse interests. Interests arising through adverse possession or use are governed by ch. 893. Rock Lake Estates Unit Owners Association, Inc. v. Town of Lake Mills, 195 Wis. 2d 348, 536 N.W.2d 415 (Ct. App. 1995), 94-2488.<br />

<br />

A purchaser of land has 3 sources of information from which to learn of rights to the land: 1) records in the office of register of deeds; 2) other public records that are usually not recorded, such as judgments and liens; and 3) the land itself, to find rights that arise by virtue of possession or use. The purchaser is chargeable with knowledge of the location of the land’s boundaries as against 3rd persons. Hoey Outdoor Advertising, Inc. v. Ricci, 2002 WI App 231, 256 Wis. 2d 347, 653 N.W.2d 763, 01-2186.<br />

<br />

Sub. (2) (b) does not require purchasers for value to find, in the absence of a proper recording, that an interest could possibly be discovered. Such a requirement would be contrary to the very purpose of the recording statutes, to ensure a clear and certain system of property conveyance. Associates Financial Services Company of Wisconsin, Inc. v. Brown, 2002 WI App 300, 258 Wis. 2d 915, 656 N.W.2d 56, 01-3416.<br />

<br />

Sub. (1) (k) applies to easements. Turner v. Taylor, 2003 WI App 256, 268 Wis. 2d 628, 673 N.W.2d 716, 03-0705.<br />

<br />

An original mortgagee’s knowledge of a prior mortgage not properly of record will not be imputed to an assignee of the mortgage with no knowledge of the prior mortgage and does not render the assignee not a purchaser in good faith under s. 706.08 (1) (a) who cannot claim priority. The Bank of New Glarus v. Swartwood, 2006 WI App 224, 297 Wis. 2d 458, 725 N.W.2d 944, 05-0647.<br />

<br />

The notice requirements in sub. (2) explain when use or occupancy gives a buyer a duty to inquire about rights held by others. Nothing in that section distinguishes between prescriptive rights and improperly recorded rights. Anderson v. Quinn, 2007 WI App 260, 306 Wis. 2d 686, 743 N.W.2d 492, 06-2462.<br />

<br />

Marketable title and stale records: Clearing exceptions and closing deals. Halligan, WBB May, 1986.<br />

<br />

CHAPTER 709 DISCLOSURES BY OWNERS OF RESIDENTIAL REAL ESTATE<br />

<br />

709.01 Requirements for transfer.<br />

<br />

(1) Except as provided in sub. (2), all persons who transfer real property located in this state, including a condominium unit and time-share property, by sale, exchange, or land contract, unless the transfer is exempt from the real estate transfer fee under s. 77.25, shall comply with ss. 709.02 to 709.04 and 709.06.<br />

<br />

(2) Subsection (1) does not apply to any of the following persons, if those persons have never occupied the property transferred:<br />

<br />

(a) Personal representatives.<br />

<br />

(b) Trustees.<br />

<br />

(c) Conservators.<br />

<br />

(d) Fiduciaries who are appointed by, or subject to the supervision of, a court.<br />

CHAPTER 705 MULTIPLE-PARTY AND AGENCY ACCOUNTS; NONPROBATE TRANSFERS AT DEATH; TRANSFER ON DEATH SECURITY REGISTRATION; SUBCHAPTER II NONPROBATE TRANSFERS AT DEATH; NONPROBATE TRANSFER OF REAL PROPERTY

705.15 Nonprobate transfer of real property on death.

(1) An interest in real property that is solely owned, owned by spouses as survivorship marital property, or owned by 2 or more persons as joint tenants may be transferred without probate to a designated TOD beneficiary as provided in this section on the death of the sole owner or the last to die of the multiple owners.

(2) A TOD beneficiary may be designated on a deed that evidences ownership of the property interest in the owner or owners by including the words "transfer on death" or "pay on death," or the abbreviation "TOD" or "POD," after the name of the owner or owners of the property and before the name of the beneficiary or beneficiaries. The designation may be included on the original deed that passes the property interest to the owner or owners or may be made at a later time by the sole owner or all then surviving owners by executing and recording another deed that designates a TOD beneficiary. A TOD beneficiary designation is not effective unless the deed on which the designation is made is recorded.

(3) The designation of a TOD beneficiary on a deed does not affect ownership of the property until the owner's death. The designation may be canceled or changed at any time by the sole owner or all then surviving owners, without the consent of the beneficiary, by executing and recording another deed that designates a different beneficiary or no beneficiary. The recording of a deed that designates a TOD beneficiary or no beneficiary revokes any designation made in a previously recorded deed relating to the same property interest.

(4) On the death of the sole owner or the last to die of multiple owners, ownership of the interest in the real property passes, subject to any lien or other encumbrance, to the designated TOD beneficiary or beneficiaries who survive all owners and to any predeceased beneficiary's issue who would take under s. 854.06 (3). If no beneficiary or predeceased beneficiary's issue who would take under s. 854.06 (3) survives the death of all owners, the interest in the real property passes to the estate of the deceased sole owner or the estate of the last to die of the multiple owners.

(5) A TOD beneficiary's interest in the property on the death of the sole owner or the last to die of multiple owners may be confirmed as provided in s. 863.27, 865.201, or 867.046.

(6) Chapter 854 applies to transfers on death under this section.

History: 2005 a. 206.

WISCONSIN STATUTES

CHAPTER 706 CONVEYANCES OF REAL PROPERTY; RECORDING; TITLES

706.001 Scope and construction.

(1) Subject to the exclusions in sub. (2), this chapter shall govern every transaction by which any interest in land is created, aliened, mortgaged, assigned or may be otherwise affected in law or in equity.

(2) Excluded from the operation of this chapter are transactions which an interest in land is affected:

(a) By act or operation of law; or

(b) By will; or

(bm) By nonprobate transfer on death under s. 705.15; or

(c) By lease for a term limited to one year or less; or by contract or option to lease for such period which postpones the commencement of the agreed lease to a time not later than 60 days after the date of the contract or option; or by assignment, modification or termination of lease when, at the time such assignment, modification or termination is made, the unexpired term is limited to one year or less, and remains so limited under the lease as modified; except that instruments relating to such excluded transactions, if in recordable form, shall be entitled to record.

(3) This chapter shall be liberally construed, in cases of conflict or ambiguity, so as to effectuate the intentions of parties who have acted in good faith.

History: 1999 a. 85 ss. 135, 138; 2005 a. 206.

The doctrine of part performance is not an "operation of law" under sub. (2) (a) that excludes the application of ch. 706 to a transaction. Wyss v. Albee, 183 Wis. 2d 245, 515 N.W.2d 517 (Ct. App. 1994).

Transactions in which an interest in land is affected by act or operation of law are excluded from operation of this chapter under sub. (2). Dow Family, LLC v. PHH Mortgage Corporation, 2014 WI 56, 354 Wis. 2d 796, 848 N.W.2d 728, 13-0221.

706.01 Definitions.

In this chapter:

(4) "Conveyance" means a written instrument, evidencing a transaction governed by this chapter, that satisfies the requirements of s. 706.02, subject to s. 706.25.

(5) "Conveyance of mineral interests" means any transaction under s. 706.001 (1) entered into for the purpose of determining the presence, location, quality or quantity of metalliferous minerals or for the purpose of mining, developing or extracting metalliferous minerals, or both. Any transaction under s. 706.001 (1) entered into by a mining company is rebuttably presumed to be a conveyance of mineral interests.

(6) "Grantor" means the person from whom an interest in lands passes by conveyance, including, without limitation, lessors, vendors, mortgagors, optionors, releasors, assignors and trust settlors of interest in lands, and "grantee" means the person to whom the interest in land passes. Whenever consistent with the context, reference to the interest of a party includes the interest of the party's heirs, successors, personal representatives and assigns.

(7) "Homestead" means the dwelling, and so much of the land surrounding it as is reasonably necessary for use of the dwelling as a home, but not less than one-fourth acre, if available, and not exceeding 40 acres.

(7m) "Interest in minerals" means any fee simple interest in minerals beneath the surface of land that is:

(a) Separate from the fee simple interest in the surface of the land; and

(b) Created by an instrument transferring, granting, assigning or reserving the minerals.

(7r) "Legal description" means a description of a specific parcel of real estate that is described in one of the following ways, whichever is appropriate:

(a) By one of the ways under s. 66.0217 (1) (c).

(b) By condominium name, unit number, and appurtenance number in a platted condominium development.

(8) "Metalliferous minerals" means naturally occurring minerals containing metal.

(8m) "Mineral" means a naturally occurring substance recognized by standard authorities as mineral, whether metalliferous or nonmetalliferous.

(9) "Mining company" means any person or agent of a person who has a prospecting permit under s. 293.45 or a mining permit under s. 293.49 or 295.58.

(10) "Signed" includes any handwritten signature or symbol on a conveyance intended by the person affixing or adopting the signature or symbol to constitute an execution of the conveyance.

History: 1971 c. 41; 1977 c. 253; ; 1983 a. 189, 455; 1993 a. 486; 1995 a. 227; 1999 a. 85; 2005 a. 41, 421; 2013 a. 1; 2015 a. 196.<br />

<br />

A necessary implication under s. 706.10 (3) is one that is so clear as to be express; it is a required implication. The words “heirs and assigns,” or any similar language, are unnecessary under s. 706.10 (3) to indicate a transferable interest. As a matter of law, “Grantee” has the exact same meaning as “Grantee and his heirs and assigns” unless another meaning is expressly stated or implied. Therefore, “heirs and assigns” need not be construed as having any legal effect and the use of the term in a grant of water flowage rights and not in a grant of sand removal rights in the same deed did not create a necessary implication that the sand rights were non-transferable. Borek Cranberry Marsh v. Jackson County, 2010 WI 95, 328 Wis. 2d 613, 785 N.W.2d 615, 08-1144.<br />

<br />

706.02 Formal requisites.<br />

<br />

(1) Transactions under s. 706.001 (1) shall not be valid unless evidenced by a conveyance that satisfies all of the following:<br />

<br />

(a) Identifies the parties; and<br />

<br />

(b) Identifies the land; and<br />

<br />

(c) Identifies the interest conveyed, and any material term, condition, reservation, exception or contingency upon which the interest is to arise, continue or be extinguished, limited or encumbered; and<br />

<br />

(d) Is signed by or on behalf of each of the grantors; and<br />

<br />

(e) Is signed by or on behalf of all parties, if a lease or contract to convey; and<br />

<br />

(f) Is signed, or joined in by separate conveyance, by or on behalf of each spouse, if the conveyance alienates any interest of a married person in a homestead under s. 706.01 (7) except conveyances between spouses, but on a purchase money mortgage pledging that property as security only the purchaser need sign the mortgage; and<br />

<br />

(g) Is delivered. Except under s. 706.09, a conveyance delivered upon a parol limitation or condition shall be subject thereto only if the issue arises in an action or proceeding commenced within 5 years following the date of such conditional delivery; however, when death or survival of a grantor is made such a limiting or conditioning circumstance, the conveyance shall be subject thereto only if the issue arises in an action or proceeding commenced within such 5-year period and commenced prior to such death.<br />

<br />

(2) A conveyance may satisfy any of the foregoing requirements of this section:<br />

<br />

(a) By specific reference, in a writing signed as required, to extrinsic writings in existence when the conveyance is executed; or<br />

<br />

(b) By physical annexation of several writings to one another, with the mutual consent of the parties; or<br />

<br />

(c) By several writings which show expressly on their faces that they refer to the same transaction, and which the parties have mutually acknowledged by conduct or agreement as evidences of the transaction.<br />

<br />

History: 1971 c. 211 s. 126; 1977 c. 177; 1999 a. 85.<br />

<br />

There can be no waiver of the necessity of a spouse’s joining in a deed of a homestead and no finding of agency will sustain the deed. Wangen v. Leum, 46 Wis. 2d 60, 174 N.W.2d 266 (1970).<br />

<br />

In pleading a contract that is subject to the statute of frauds, it is not necessary to allege facts to establish that the contract complies with the statute or is within its exceptions. Ritterbusch v. Ritterbusch, 50 Wis. 2d 633, 184 N.W.2d 865 (1971).<br />

<br />

An option to purchase land must be in writing and cannot be modified orally, but a seller may orally agree to accept payment in full rather than in installments. Kubnick v. Bohne, 56 Wis. 2d 527, 202 N.W.2d 400 (1972).<br />

<br />

The test of undue influence to set aside a will is also applicable in order to void an inter vivos transfer due to undue influence. Ward v. Ward, 62 Wis. 2d 543, 215 N.W.2d 3 (1976).<br />

<br />

Standing alone, an added provision in a 30-day option agreement to purchase real estate did not comply with the statute of frauds. Edlebeck v. Barnes, 63 Wis. 2d 240, 216 N.W.2d 551 (1974).<br />

<br />

An oral contract for the conveyance of an interest in land is void unless there is a memorandum that conforms to the statute of frauds. Trimble v. Wis. Builders, Inc. 72 Wis. 2d 435, 241 N.W.2d 409 (1976).<br />

<br />

When a contract for the sale of land with an indefinite description is taken out of the statute of frauds by part performance, extrinsic evidence admissible but for the statute of frauds may be introduced to provide the description. Clay v. Bradley, 74 Wis. 2d 153, 246 N.W.2d 142 (1976).<br />

<br />

The question under sub. (1) (b) of whether property boundaries are identified to a reasonable certainty is for the jury to determine with the aid of all competent extrinsic evidence. Zapuchlak v. Hucal, 82 Wis. 2d 184, 262 N.W.2d 514 (1978).<br />

<br />

The homestead defense under sub. (1) (f) is not defeated by s. 706.04, but a tort claim may exist against a signing spouse who misrepresents the non-signing spouse’s acquiescence. Glinski v. Sheldon, 88 Wis. 2d 509, 276 N.W.2d 815 (1979).<br />

<br />

The defense of the statute of frauds is waived if not raised in the trial court. Hine v. Vilter, 88 Wis. 2d 645, 277 N.W.2d 772 (1979).<br />

<br />