Wisconsin Warranty Deed from Individual to a Trust

Understanding this form

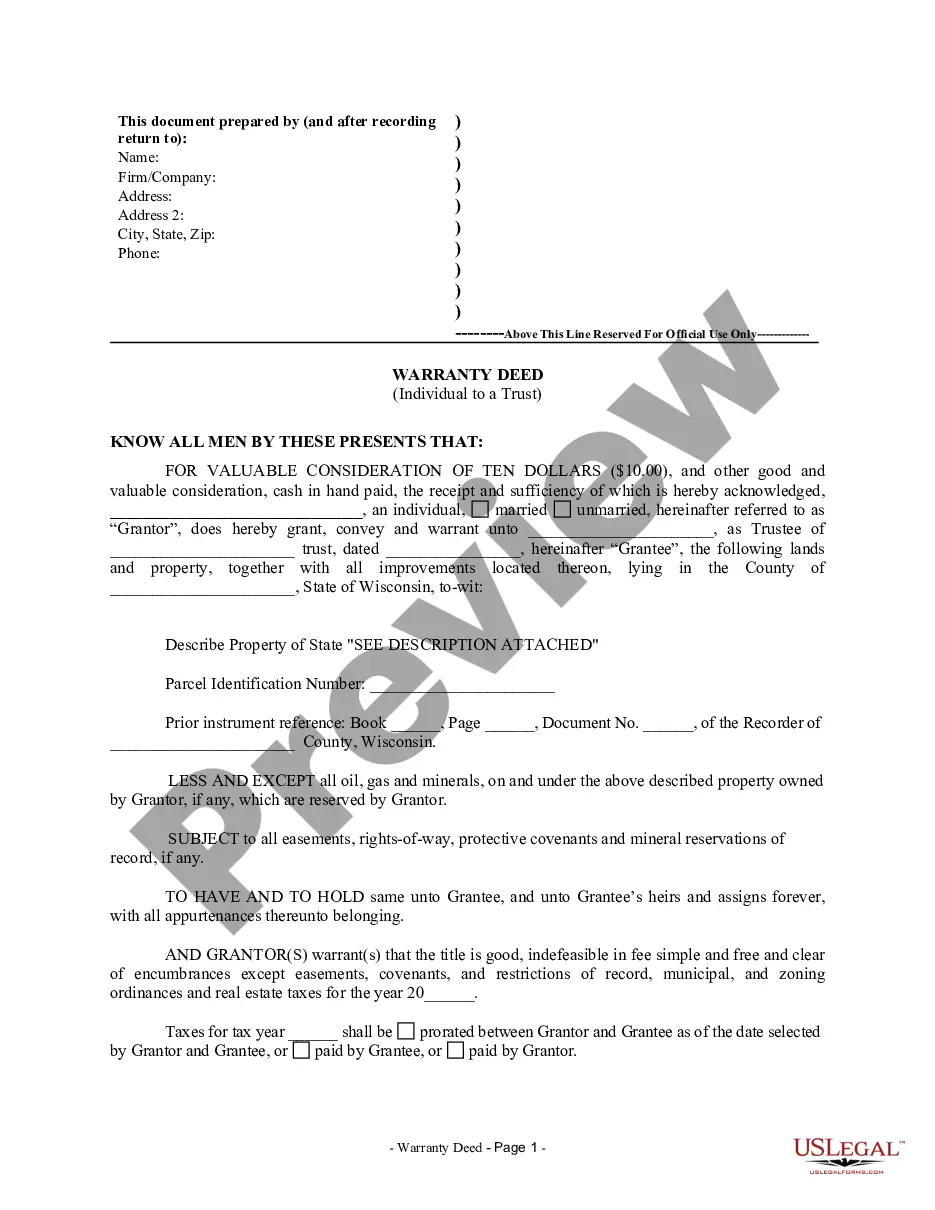

This Warranty Deed from Individual to a Trust is a legal document in which an individual, known as the grantor, transfers property ownership to a trust, represented by a trustee. The deed guarantees that the grantor has the legal right to make this transfer and that the title is clear of encumbrances, except for stated easements and reservations. This form is crucial for ensuring a smooth transfer of real estate assets into a trust, helping to protect the property and manage it according to the grantor's wishes.

Form components explained

- Property description: Identifies the specific property being transferred.

- Parcel identification number: A unique identifier for the property.

- Prior instrument reference: Links to previous ownership documentation.

- Reservation clause: Excludes oil, gas, and minerals from the transfer, if applicable.

- Warranties by the grantor: Ensures the title is clear and marketable.

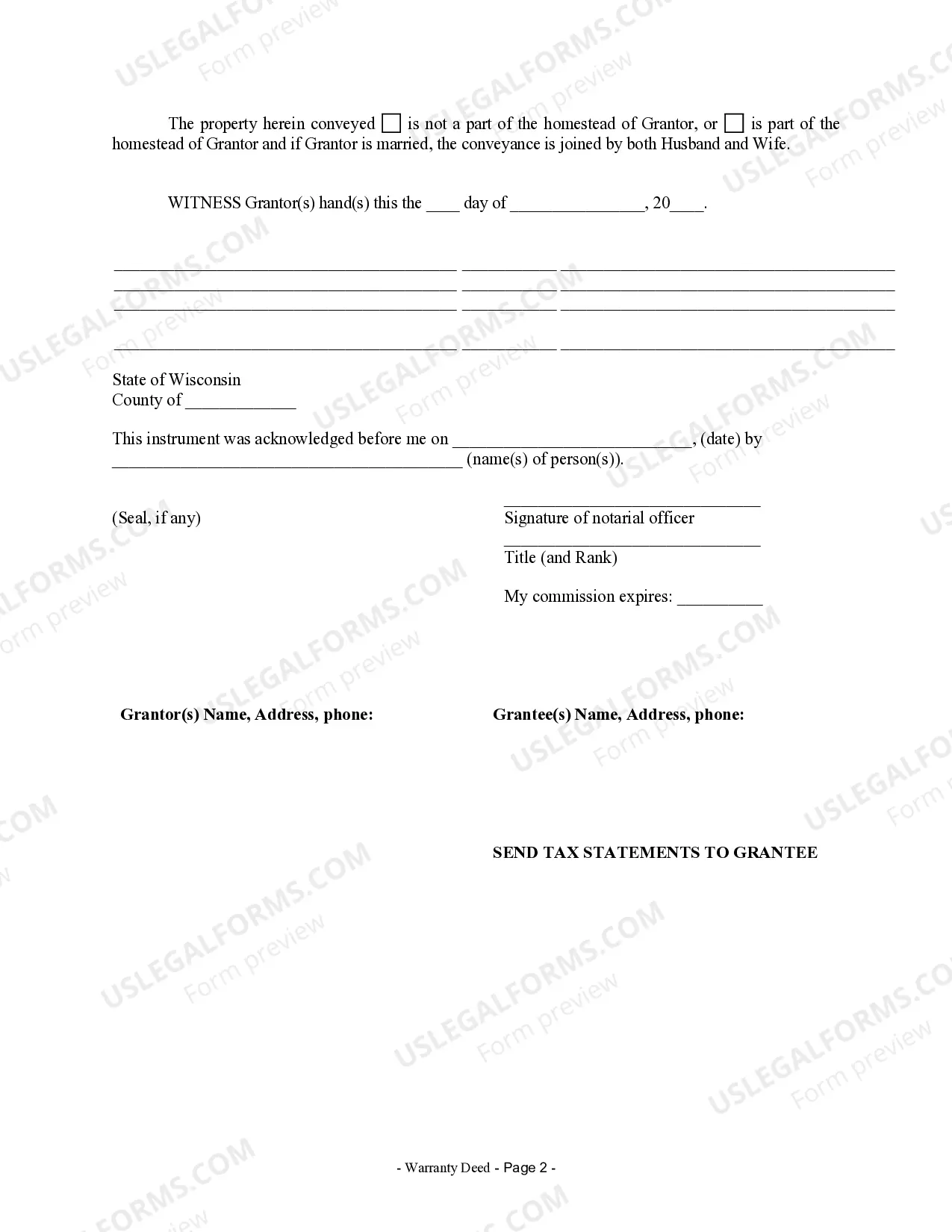

- Signature lines: Areas for the grantor and, if applicable, both spouses to sign.

Common use cases

This form is commonly used when an individual wishes to transfer property into a trust for estate planning purposes. It is particularly beneficial for managing and protecting assets through a trust, ensuring the property is handled according to the grantor's intent after their passing or in the event of incapacity. Situations may include transferring family homes or investment properties into a trust to benefit heirs or manage wealth efficiently.

Intended users of this form

- Individuals looking to establish a trust for their assets.

- Grantors who wish to transfer their real estate into a trust.

- Estate planners managing family estates for future generations.

- Couples transferring jointly held property into a trust.

Steps to complete this form

- Identify the grantor: Enter the name of the individual transferring the property.

- Describe the property: Provide a detailed description of the property, including the parcel identification number.

- Enter the prior instrument reference: Include the book and page number, along with the document number of the previous deed.

- Specify reservations: Clarify any minerals or resources reserved by the grantor.

- Sign and date the deed: The grantor should sign the document, and if applicable, have their spouse sign as well.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete property description.

- Ignoring the reservation of minerals, which could lead to future disputes.

- Neglecting to sign the deed or having missing signatures.

Benefits of using this form online

- Easy accessibility: Download and complete the form from anywhere.

- Editability: Tailor the form to meet your specific needs before printing.

- Reliability: The forms are drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A trustee deed offers no such warranties about the title.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).