Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

About this form

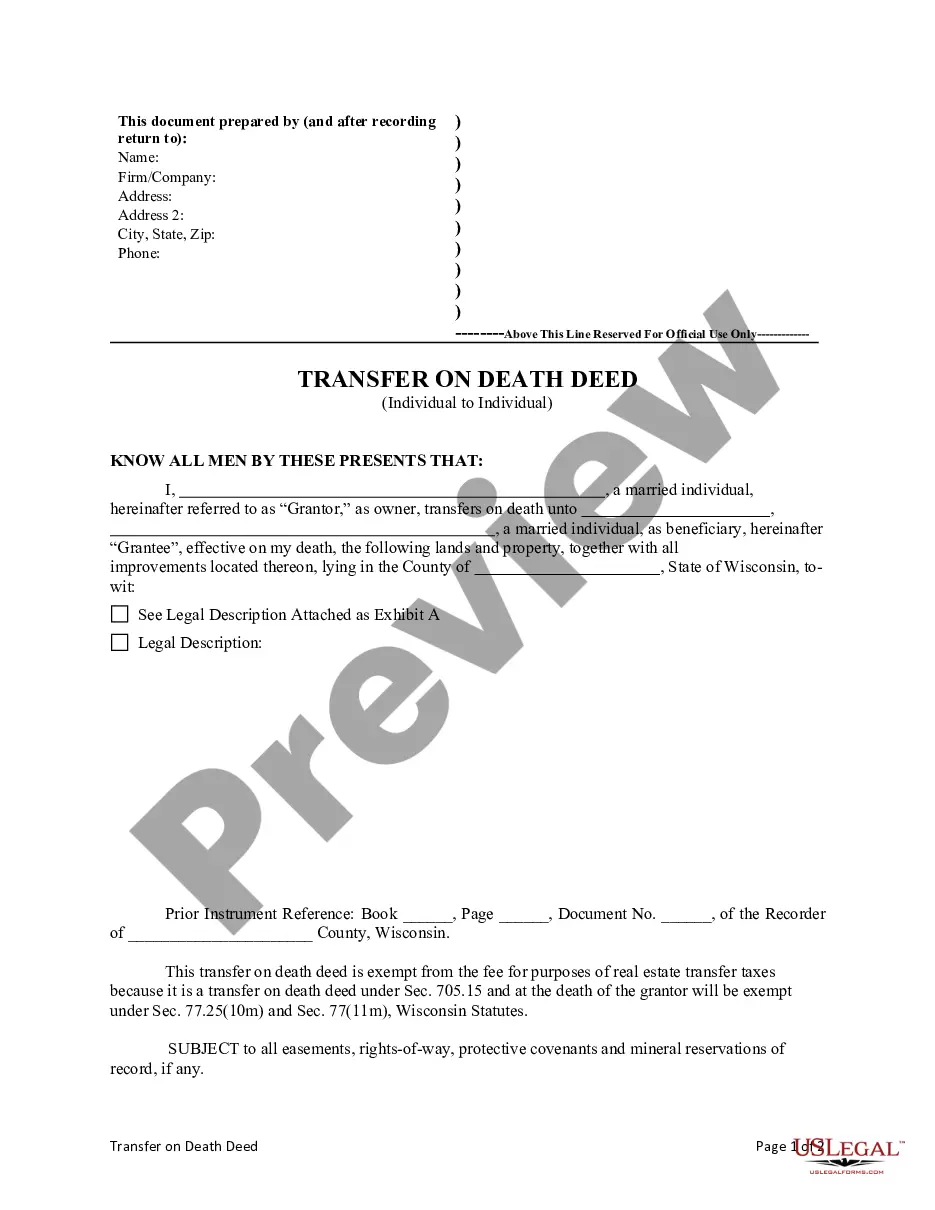

The Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document used to transfer ownership of real estate from one individual (the Grantor) to another (the Grantee) upon the Grantor's death. Unlike traditional deeds, this form does not transfer ownership during the Grantor's lifetime, allowing for revocation or alteration of the beneficiary designation at any time. Its primary purpose is to facilitate the transfer of property while avoiding the probate process after the Grantor's death.

Key parts of this document

- Information about the Grantor and Grantee, including names and addresses.

- A description of the property being transferred, including any existing covenants.

- Legal language ensuring the transfer on death is valid and enforceable.

- Identification of any easements, rights-of-way, or mineral reservations related to the property.

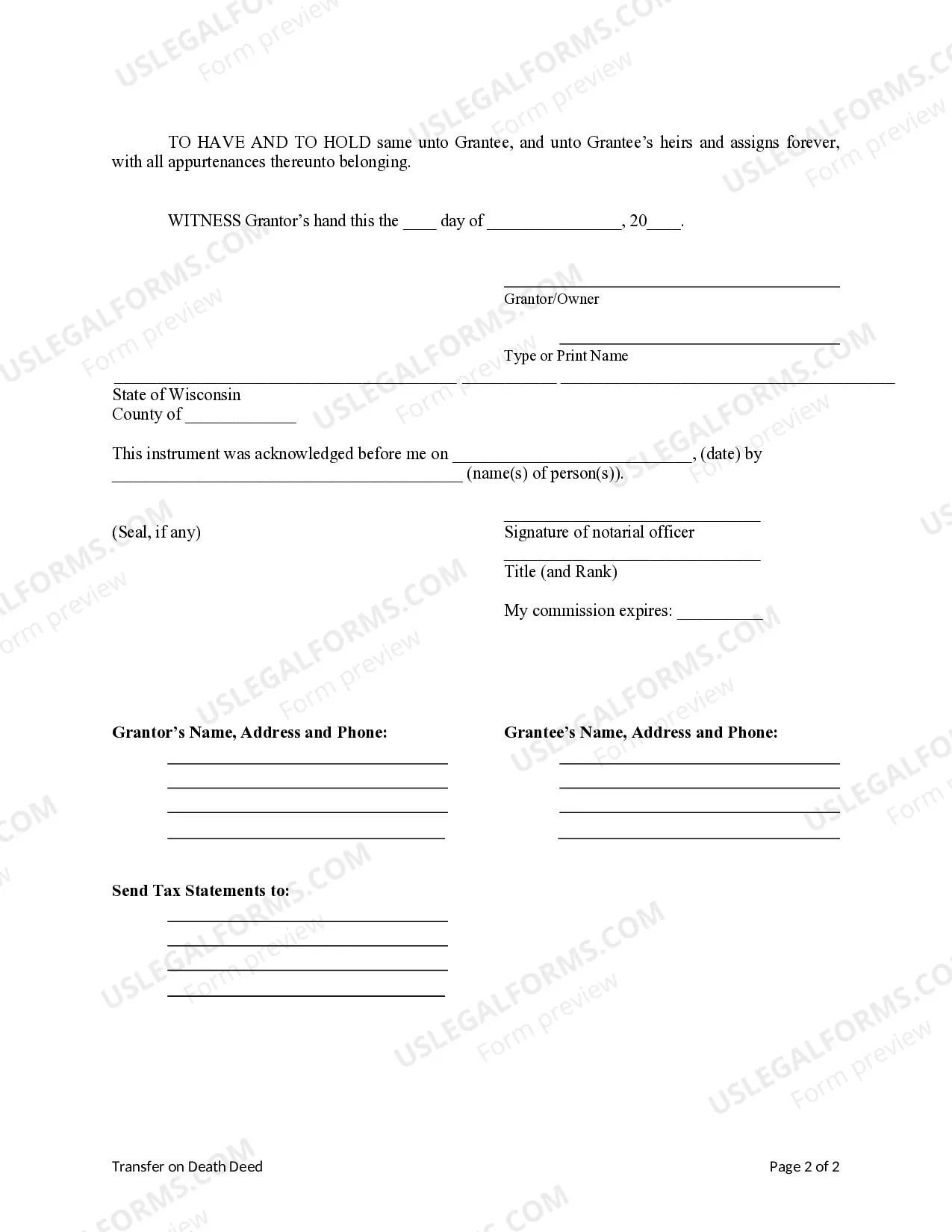

- Signature section for the Grantor and a witness.

When to use this document

This form is ideal for individuals who wish to specify who will inherit their property after their death without the need for probate. It is particularly useful for those who want to retain control over their property during their lifetime and ensure an efficient transfer to a designated beneficiary upon their passing.

Intended users of this form

This form is suitable for:

- Individuals who own real estate and wish to designate a beneficiary.

- Grantors looking to simplify the transfer of property to heirs.

- Homeowners who want to avoid probate and related legal fees.

Steps to complete this form

- Identify the parties involved: fill in the names and addresses of the Grantor and Grantee.

- Specify the property: provide a detailed description of the real estate being transferred.

- Review any existing easements and covenants that may affect the property.

- Complete the signature section by having the Grantor and a witness sign the form.

- Record the completed deed with the appropriate local authority to ensure its validity.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Mistakes to watch out for

- Failing to include a property description, which can invalidate the deed.

- Not having the deed signed by a witness if required.

- Forgetting to record the deed with local authorities, which can lead to complications.

- Using outdated forms that do not comply with current state law.

Benefits of using this form online

- Convenience of access and immediate download of the form.

- Easy customization to fit specific property and beneficiary information.

- Expert-reviewed templates ensure legal compliance and reliability.

Form popularity

FAQ

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.