Wisconsin Satisfaction of Judgment

What this document covers

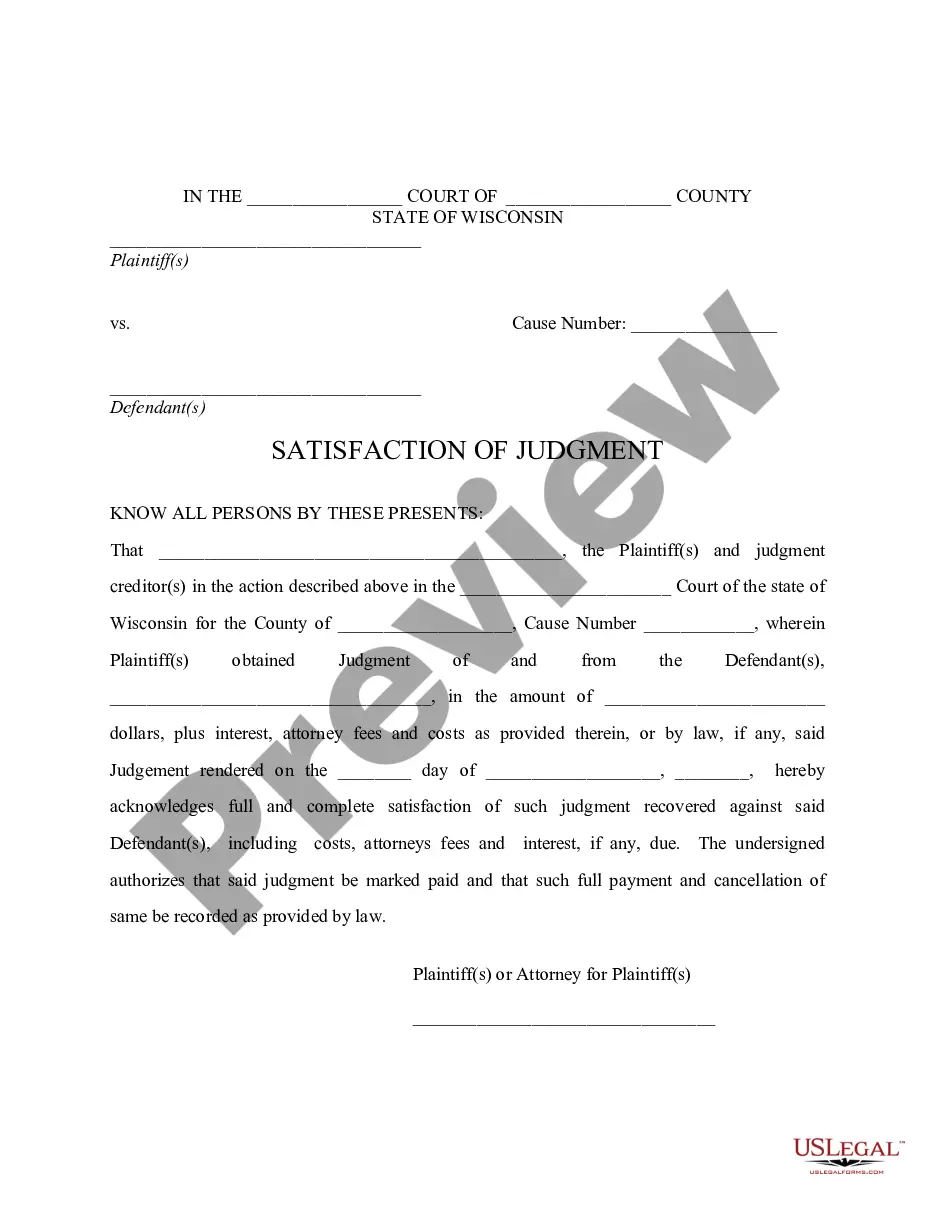

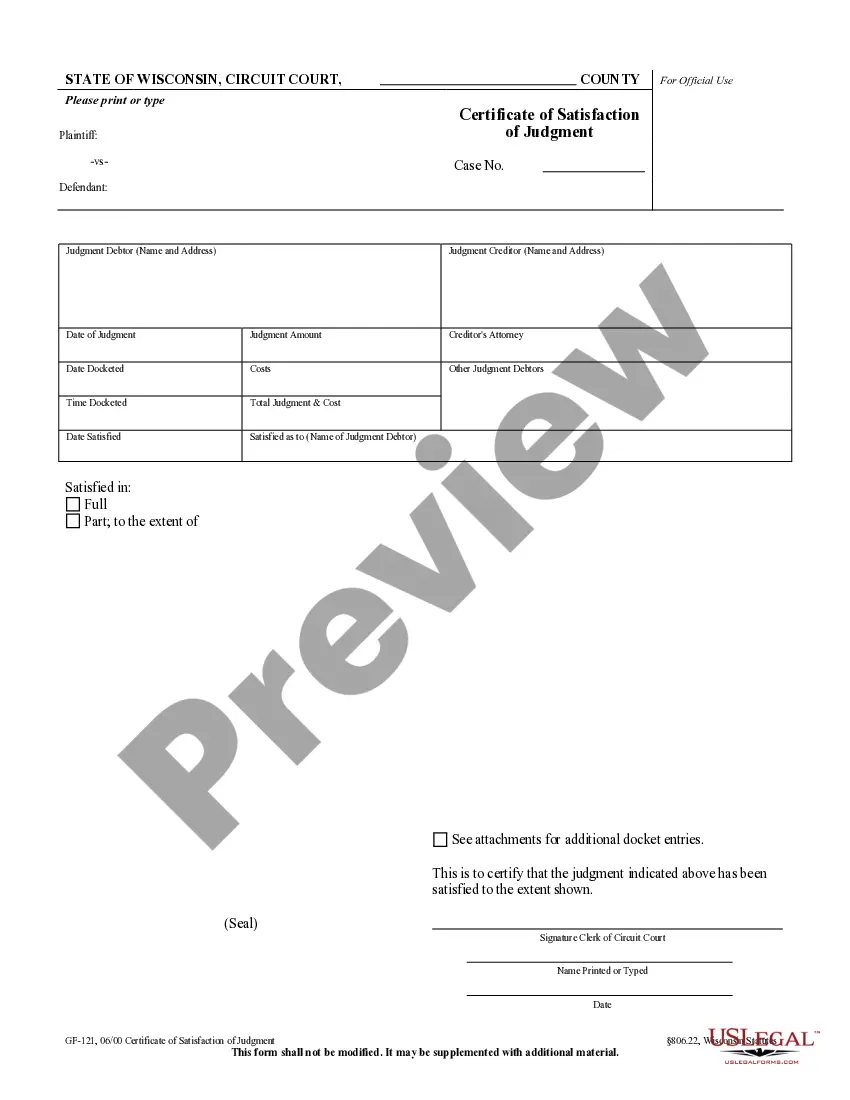

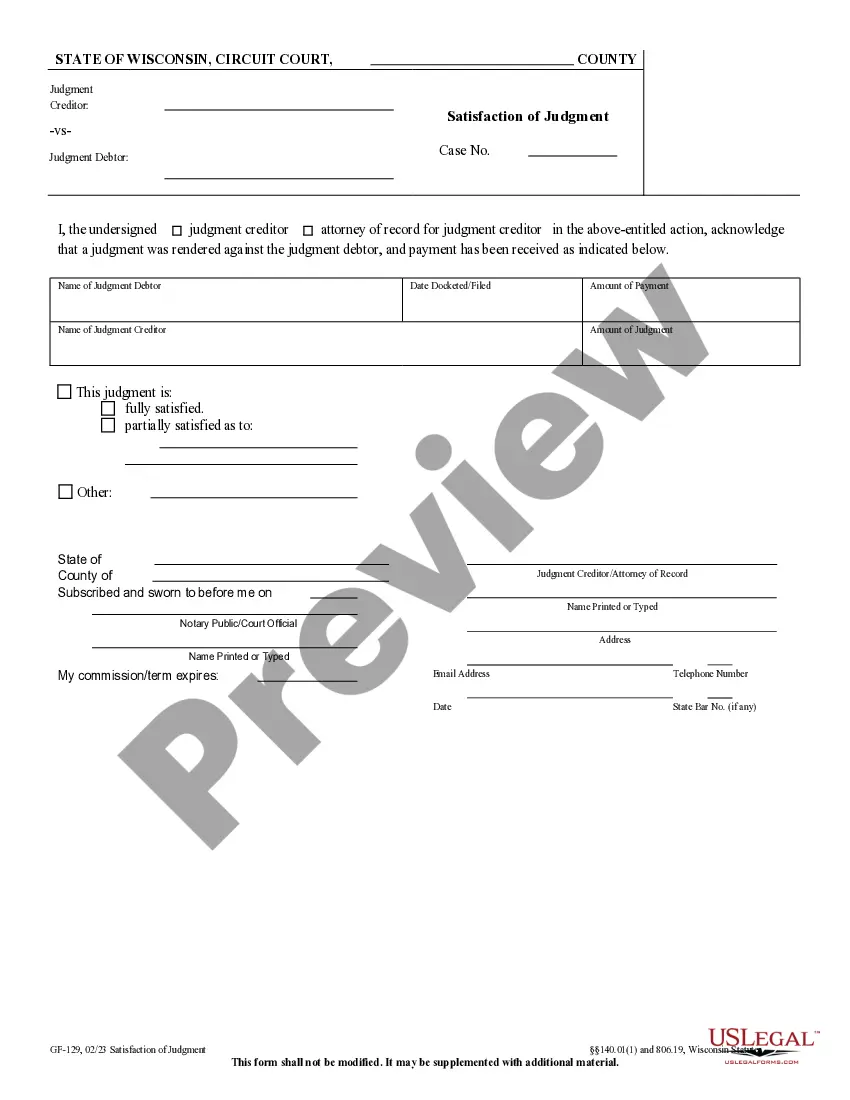

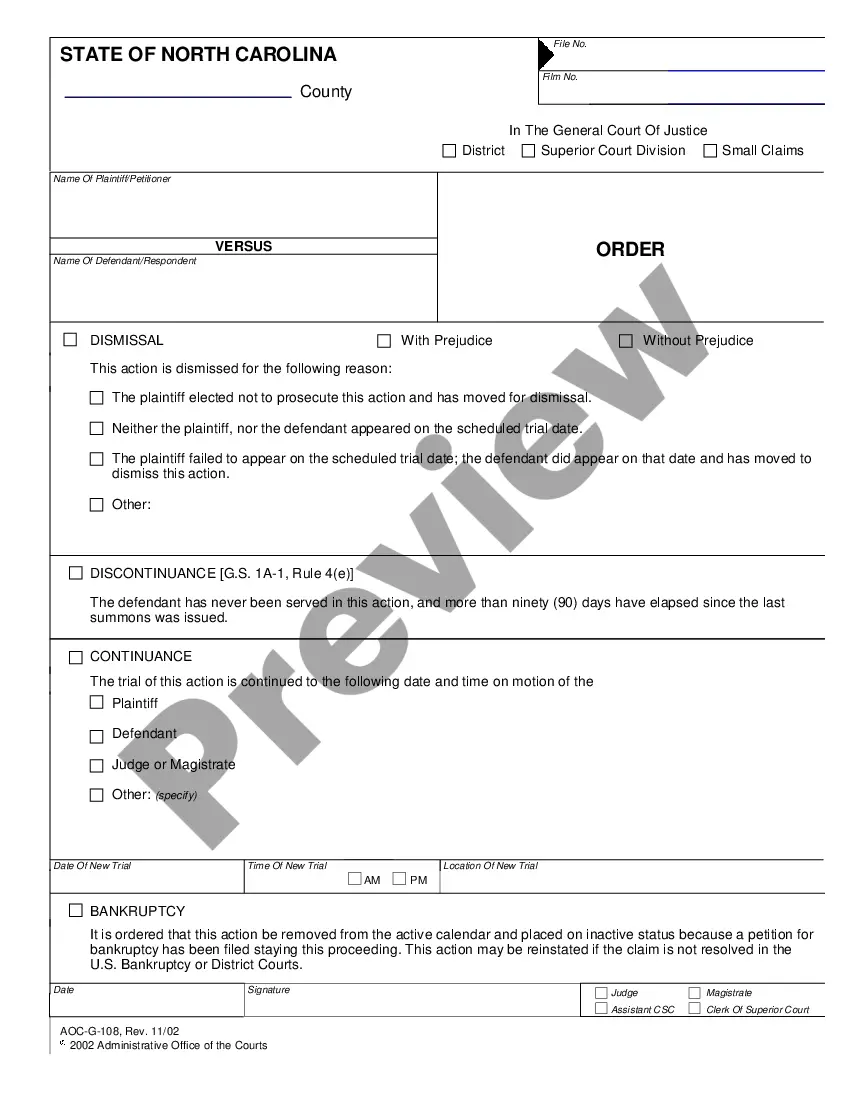

The Wisconsin Satisfaction of Judgment is a legal document used to acknowledge the full payment of a judgment debt by the debtor. This form is filed by the judgment creditor once the debtor has satisfied the amount owed, effectively releasing the debtor from the judgment. Unlike other legal forms related to judgments, this specific form ensures that the debtor's obligation is officially marked as fulfilled in the court records.

Main sections of this form

- Case information including court name, county, and cause number.

- Details of the judgment creditor and debtor, including their names and the amount of the judgment.

- A statement acknowledging that the judgment has been fully satisfied.

- Signature and contact information of the judgment creditor or their attorney.

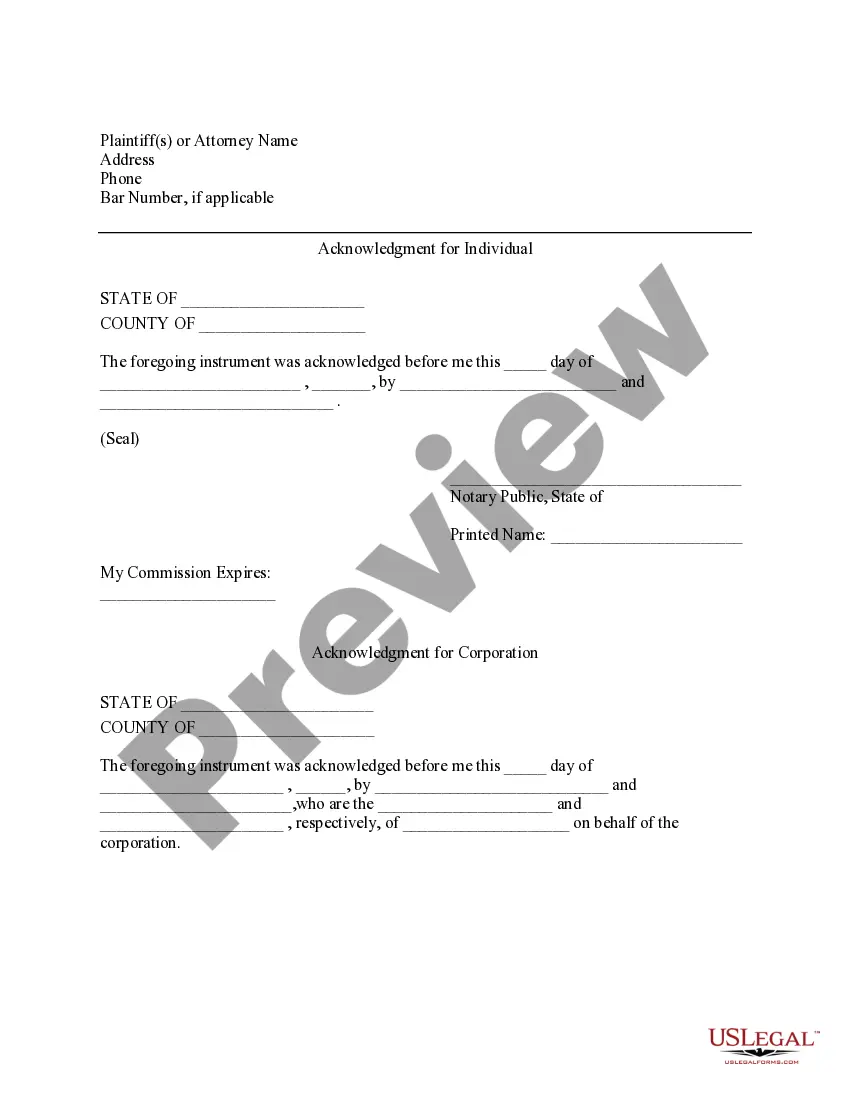

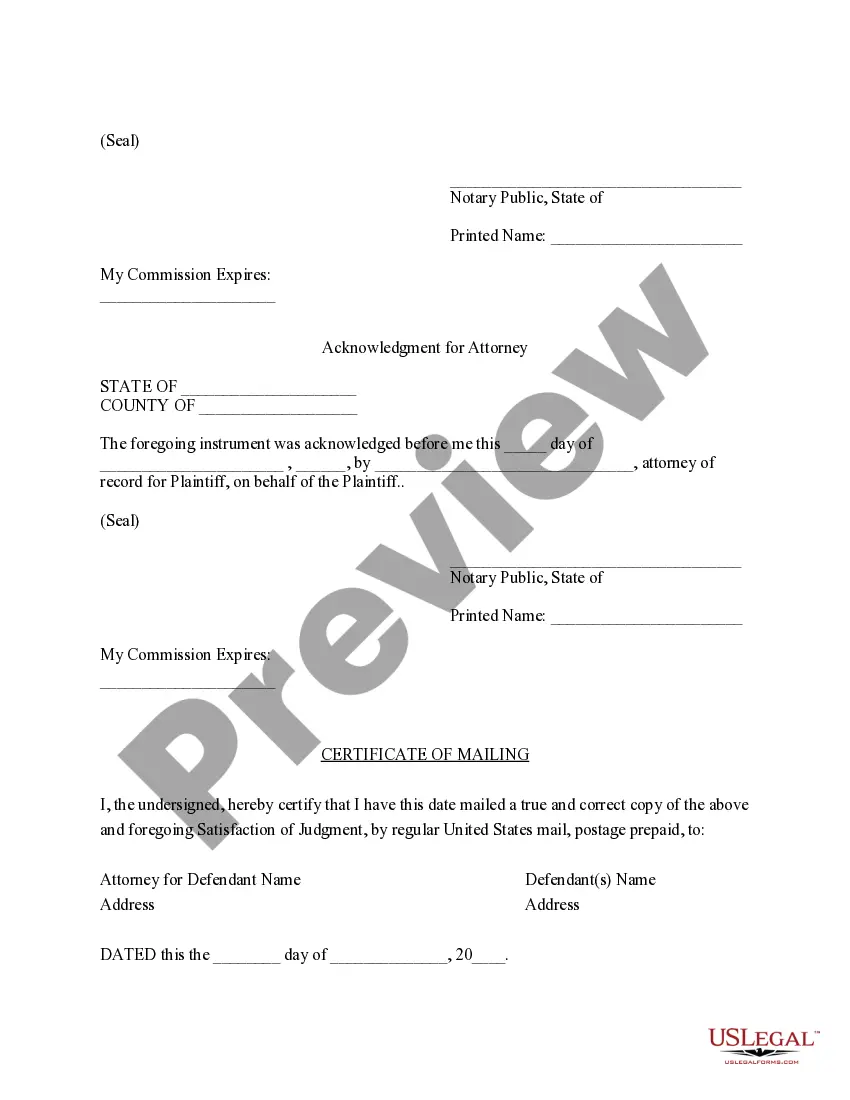

- Notarization section for individual, corporate, or attorney acknowledgments.

- Certificate of mailing to confirm delivery to the defendant's attorney.

When to use this form

This form should be used when a judgment creditor wishes to document and confirm that a judgment debt has been fully paid by the debtor. You would typically complete this form after receiving the final payment and before marking the case as closed in court records. It is a necessary step to ensure that the debtor is released from any further obligations related to the judgment.

Who can use this document

This form is intended for:

- Judgment creditors who have received full payment of a judgment debt.

- Attorneys representing judgment creditors.

- Parties involved in a legal judgment in Wisconsin who wish to officially resolve their obligations.

Instructions for completing this form

- Identify the court name, county, and case number at the top of the form.

- Enter the names of the plaintiff and defendant, along with the judgment amount.

- Sign and date the form to acknowledge the full satisfaction of the judgment.

- If required, have the form notarized by a licensed notary public.

- Mail a copy of the completed form to the defendant's attorney as a record of satisfaction.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to enter the correct court or case number.

- Not signing the form or missing the notary acknowledgment.

- Neglecting to provide a complete mailing address for the defendant's attorney.

- Leaving out the amount satisfied or including incorrect figures.

What to keep in mind

- The Wisconsin Satisfaction of Judgment formally documents the payment of a judgment debt.

- Ensure all requirements are met, including court information and notarization.

- Use this form to release the debtor from further obligations related to the judgment.

- Be mindful to properly file and mail copies as required by local regulations.

Form popularity

FAQ

Paying down or paying off the amount associated with the judgment will have no impact on the credit score.Even though a satisfied judgment does not have a positive impact on score, a lender may consider it a good sign of willingness to pay and may override the score and grant the credit Matt may seek in the future.

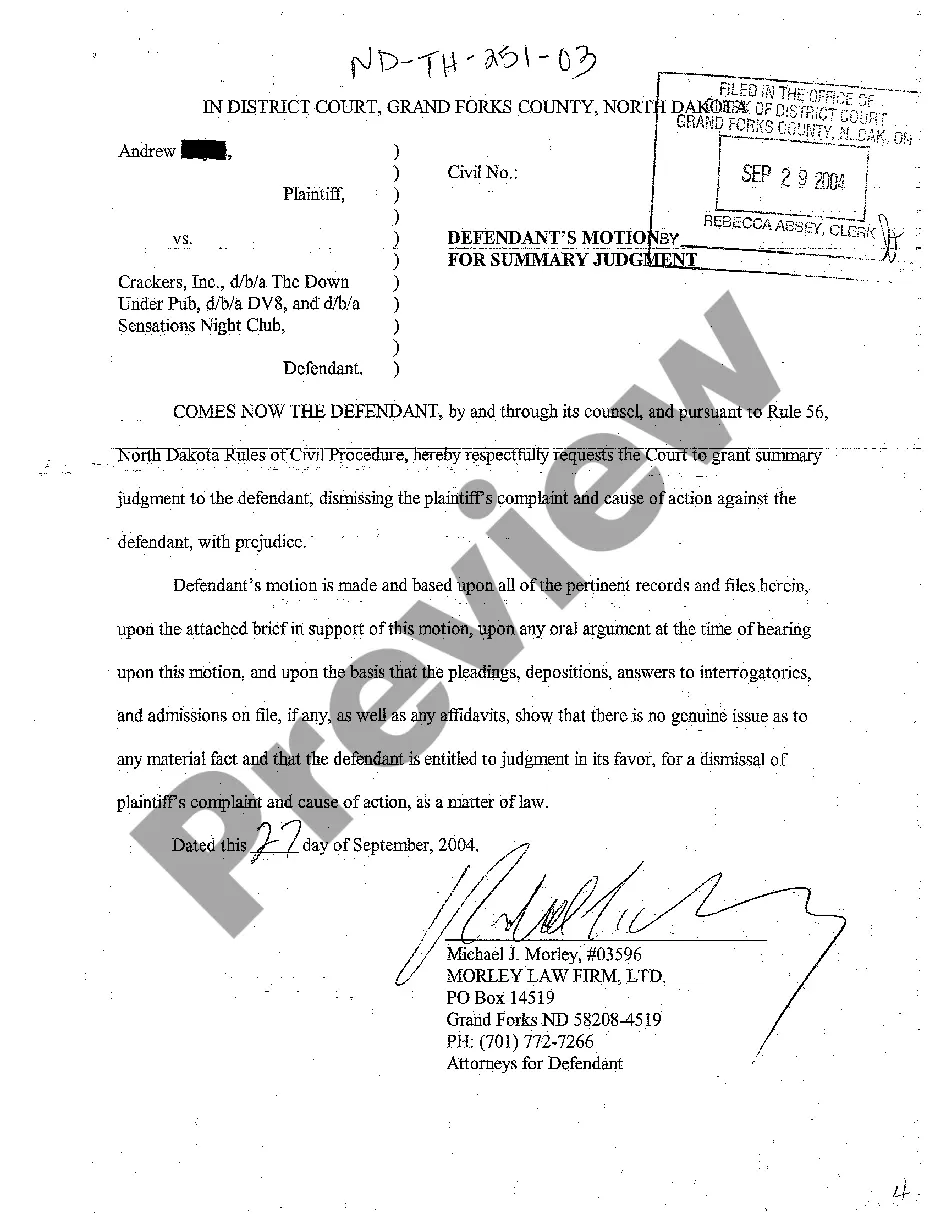

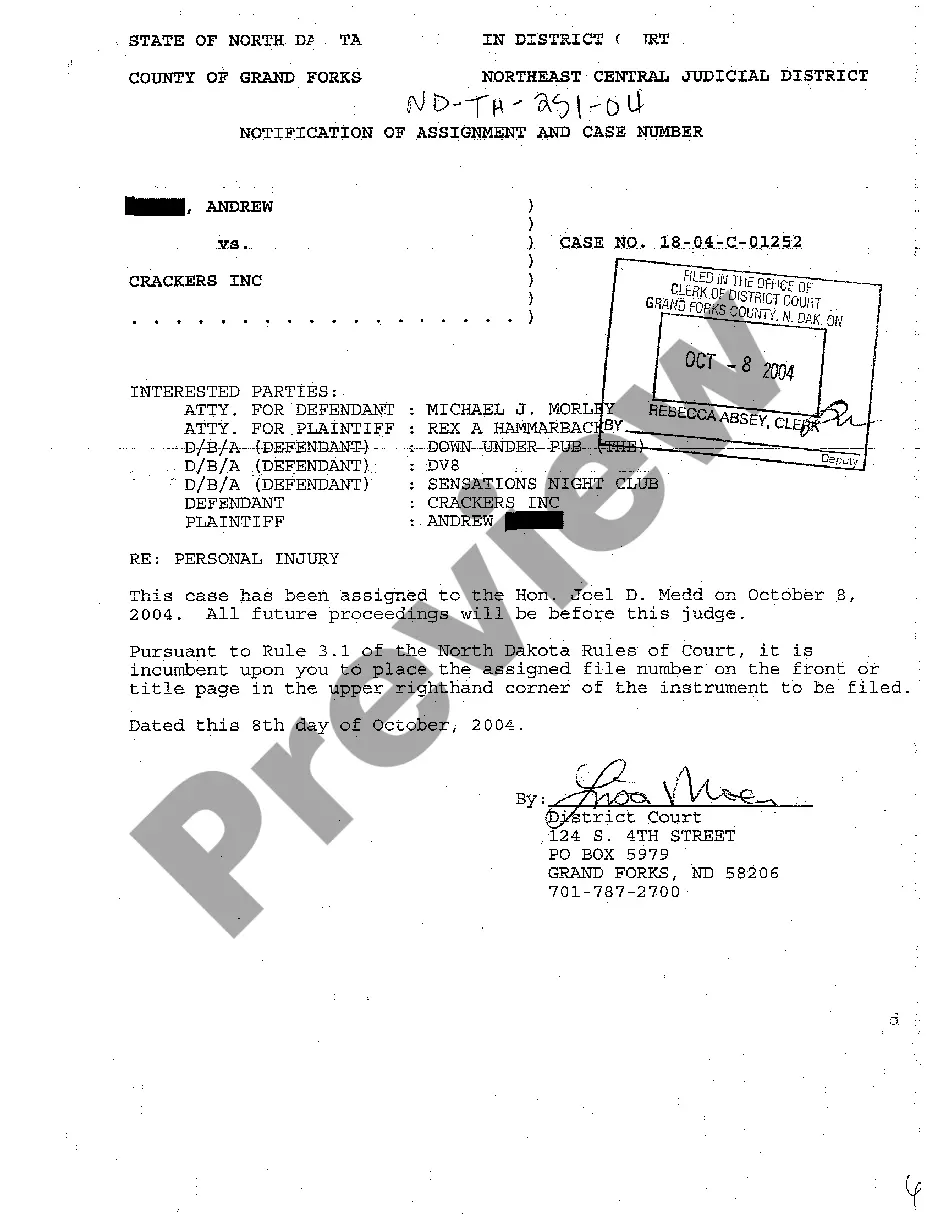

A court form that the judgment creditor must fill out, sign, and file with the court when the judgment is fully paid. If no liens exist, the back of the Notice of Entry of Judgment can be signed and filed with the court. (See judgment creditor, judgment .)

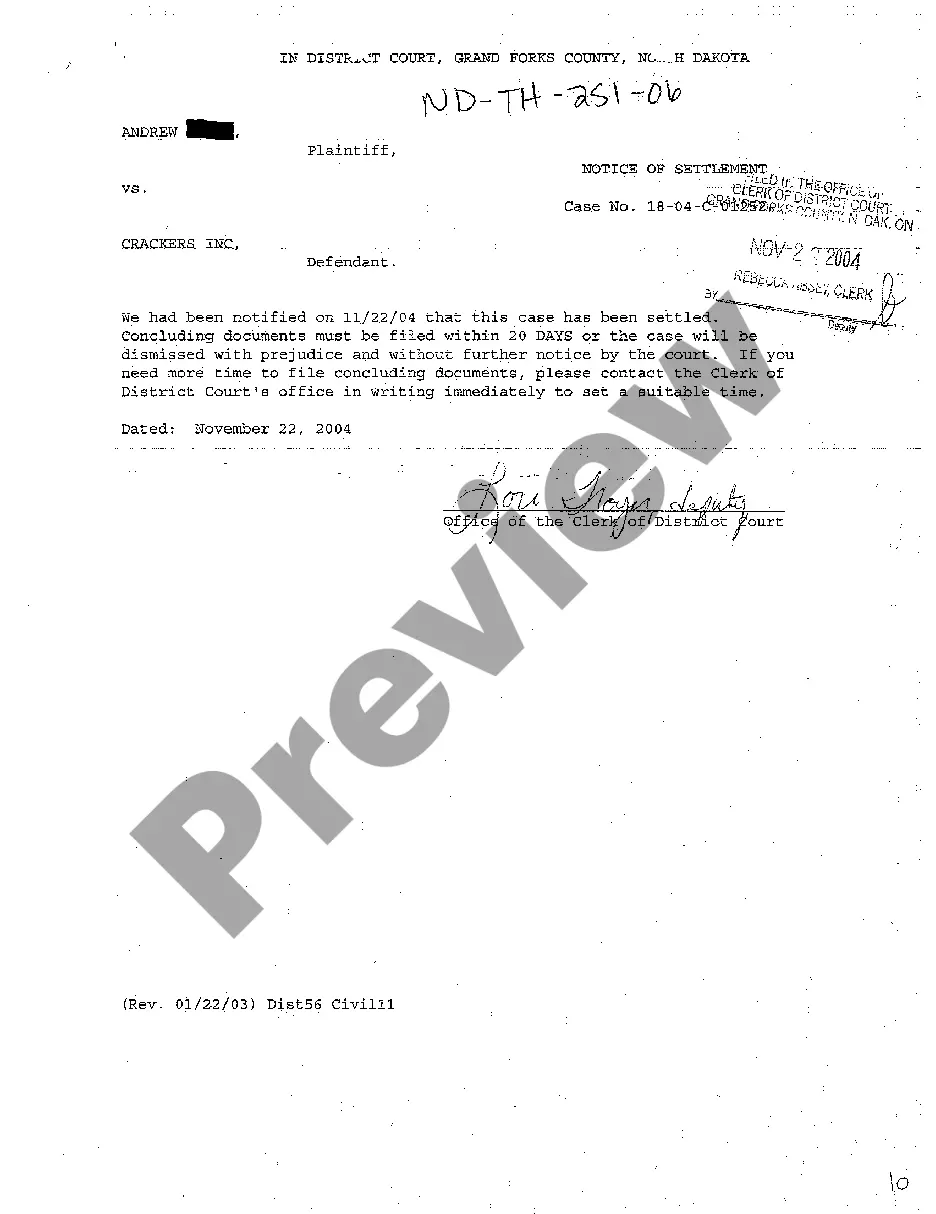

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments satisfied or not aren't going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.If a civil judgment is still on your credit report, file a dispute with the appropriate credit reporting agencies to have it removed.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later.

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Request the court to validate the judgment. Verify information provided from the court. Dispute any inaccuracies found. Consider professional help.