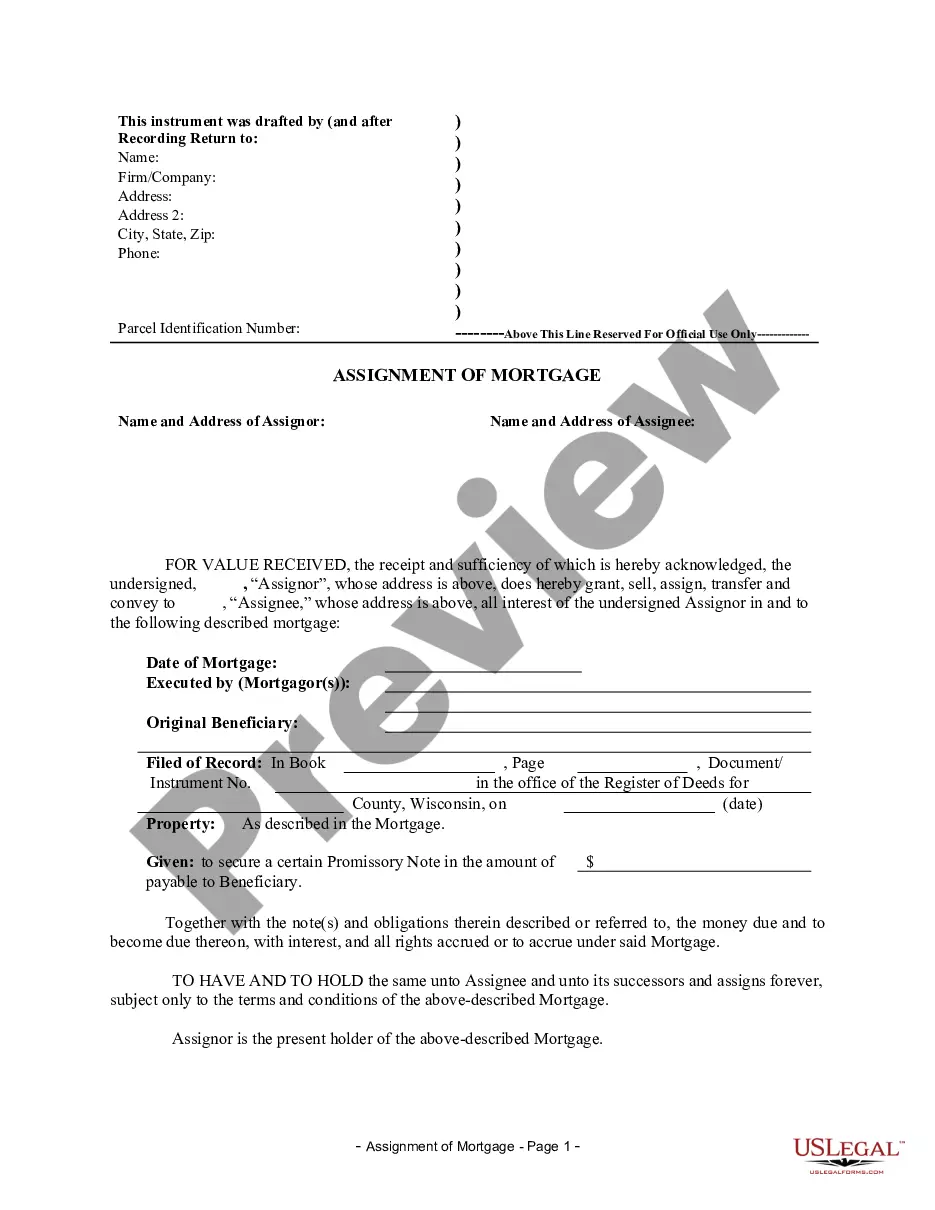

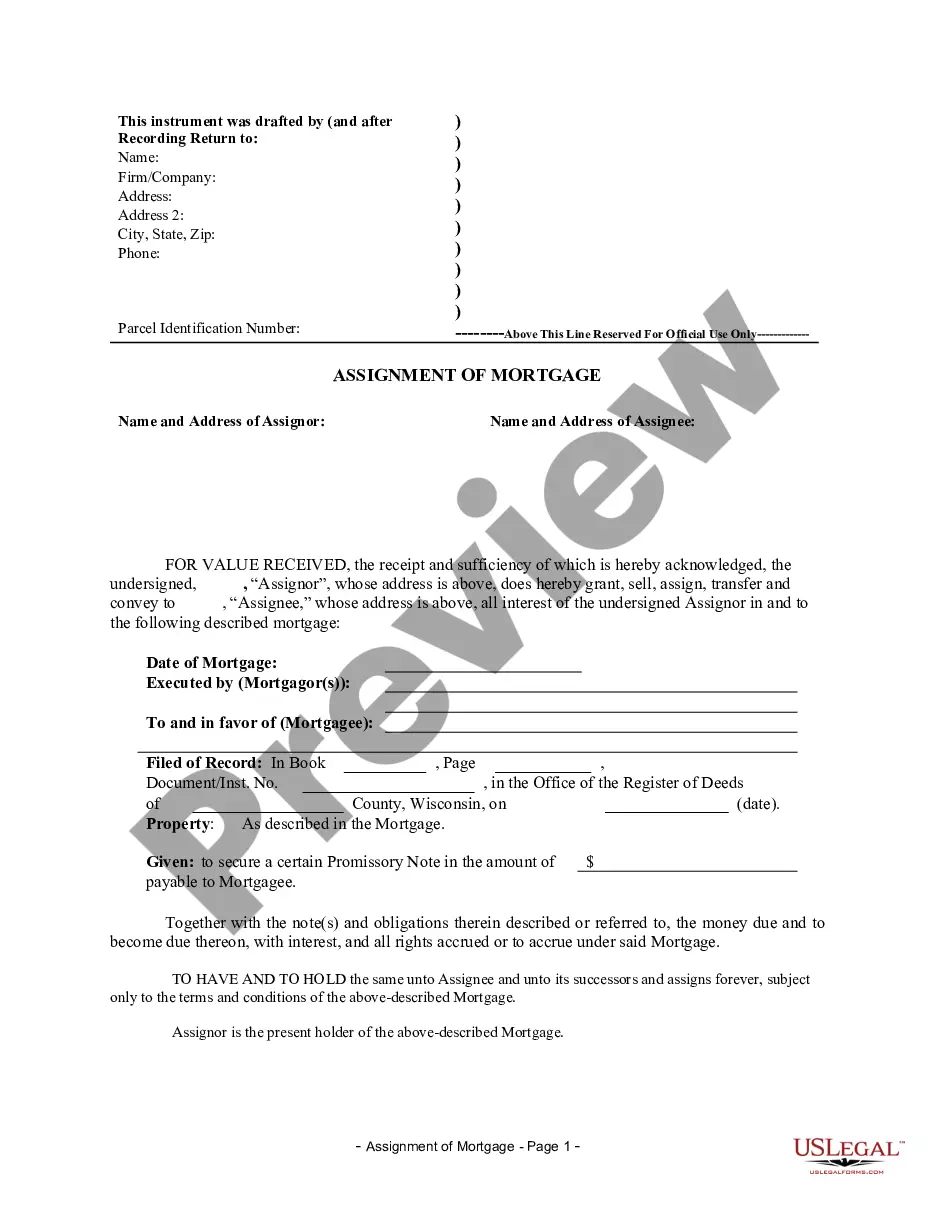

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Wisconsin Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Wisconsin Assignment Of Mortgage By Corporate Mortgage Holder?

Out of the large number of platforms that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its extensive library of 85,000 samples is categorized by state and use for simplicity. All the documents available on the platform have already been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and get access to your Form name from the My Forms; the My Forms tab keeps your downloaded documents.

Keep to the guidelines listed below to get the document:

- Once you discover a Form name, ensure it is the one for the state you really need it to file in.

- Preview the template and read the document description before downloading the sample.

- Search for a new sample via the Search engine if the one you have already found isn’t correct.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

Once you have downloaded your Form name, you are able to edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our platform offers quick and simple access to templates that fit both lawyers and their customers.

Form popularity

FAQ

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.