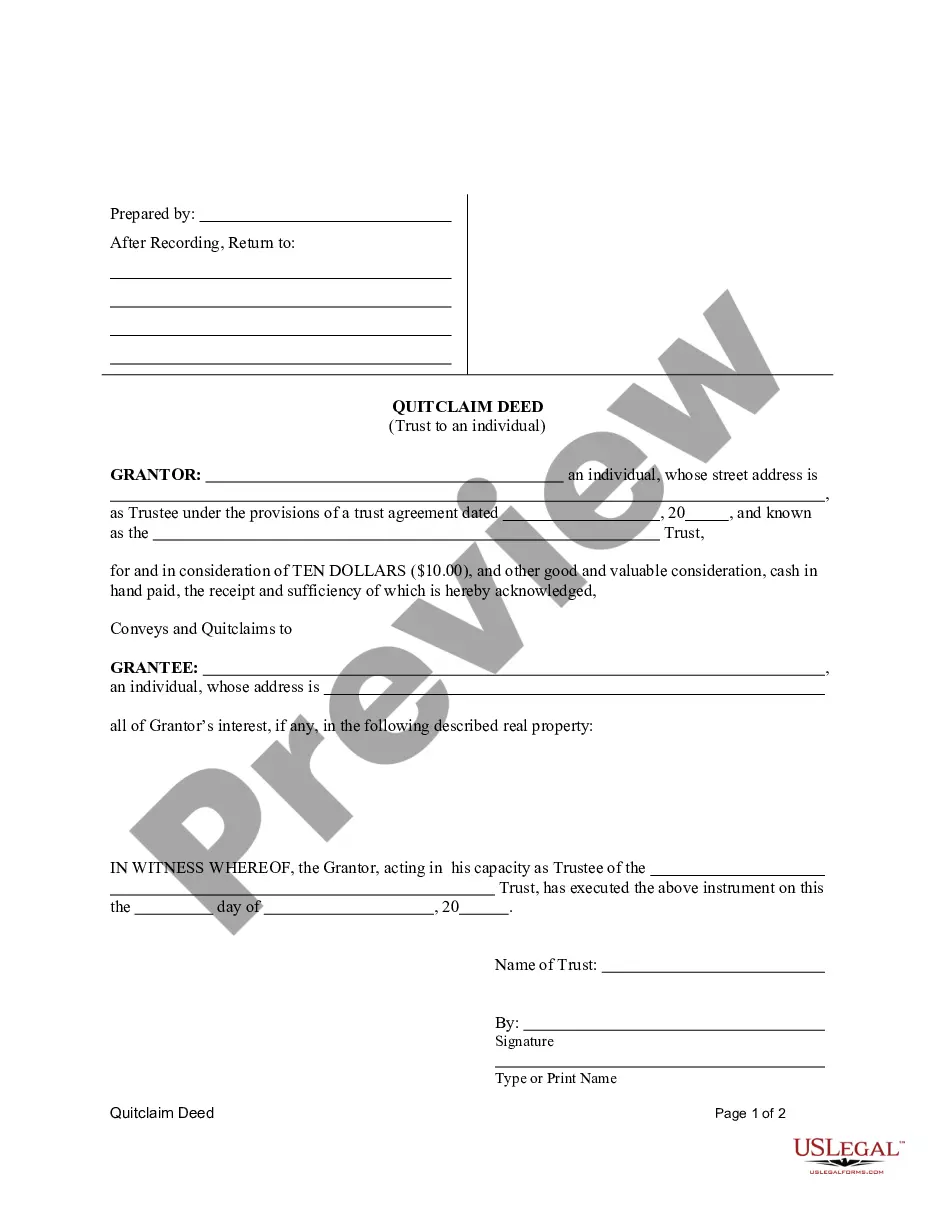

This form is a Quitclaim Deed where the Grantor is a Trustand the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Alaska Quitclaim Deed from Trust to a Individual

Description

How to fill out Alaska Quitclaim Deed From Trust To A Individual?

Employing the Alaska Quitclaim Deed from Trust to an Individual models produced by experienced lawyers provides you the chance to evade troubles while finalizing documents. Simply download the example from our site, complete it, and ask an attorney to review it.

This can assist you in conserving considerably more time and effort than hiring a legal expert to draft a document on your behalf.

If you possess a US Legal Forms membership, just Log In to your account and revisit the sample page. Locate the Download button adjacent to the templates you’re examining. After you download a document, you will find all your stored samples in the My documents tab.

Once you have completed all the steps above, you will have the capability to finalize, print, and sign the Alaska Quitclaim Deed from Trust to an Individual example. Remember to verify all entered information for accuracy before submitting or sending it out. Reduce the time you invest in completing documents with US Legal Forms!

- When you lack a subscription, that isn’t an issue.

- Just adhere to the step-by-step instructions provided below to register for your online account, obtain, and fill out your Alaska Quitclaim Deed from Trust to an Individual template.

- Confirm and ensure you are downloading the correct form that is specific to your state.

- Utilize the Preview feature and review the description (if provided) to determine if you need this particular sample and if so, simply click Buy Now.

- Search for another example using the Search bar if necessary.

- Select a subscription that aligns with your requirements.

- Initiate the process using your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Alaska quit claim deeds must be submitted to the recording district that is local to the property. They must also be accompanied by the applicable recording fee set by regulation; if the document is to be recorded for multiple purposes, it must be accompanied by the applicable fee for each of the multiple purposes.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)