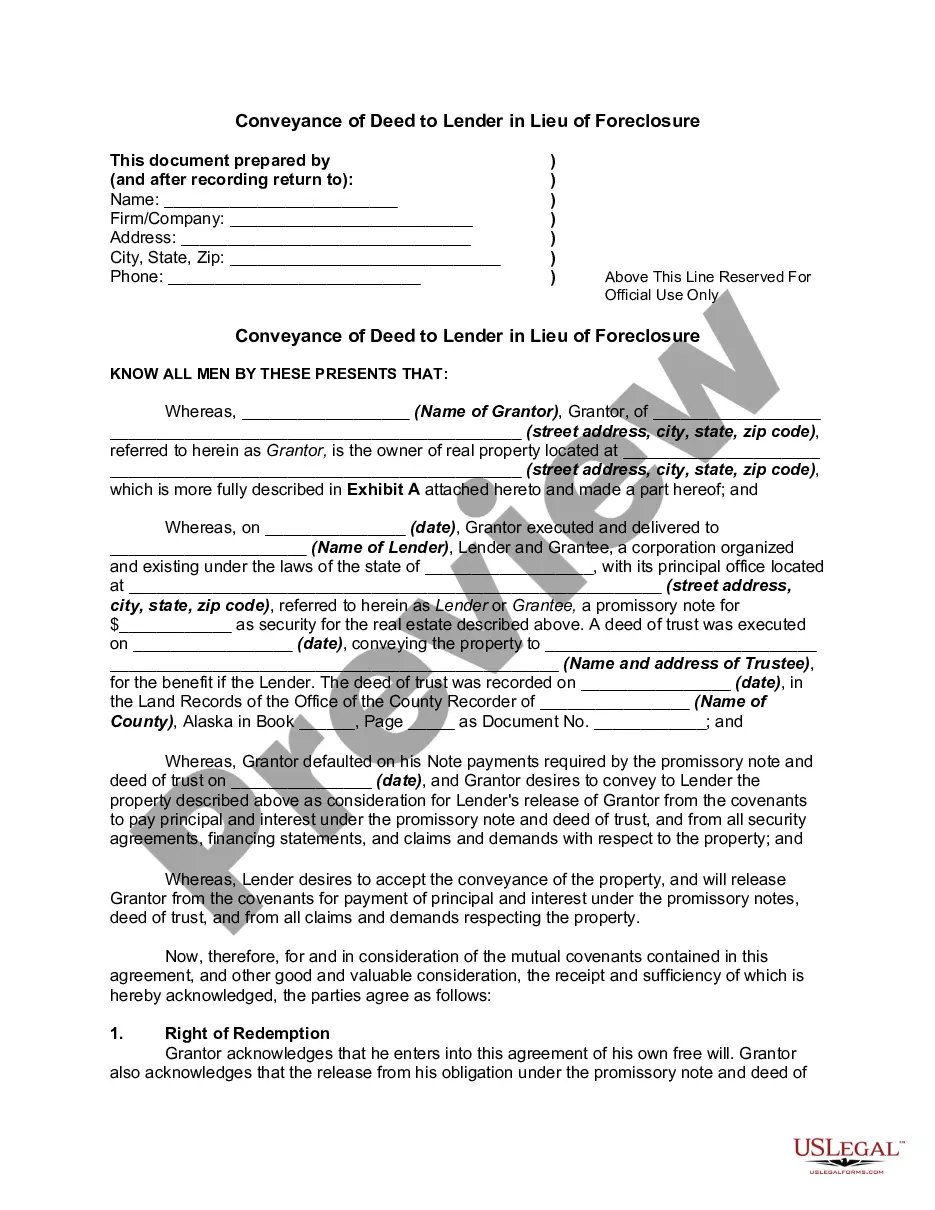

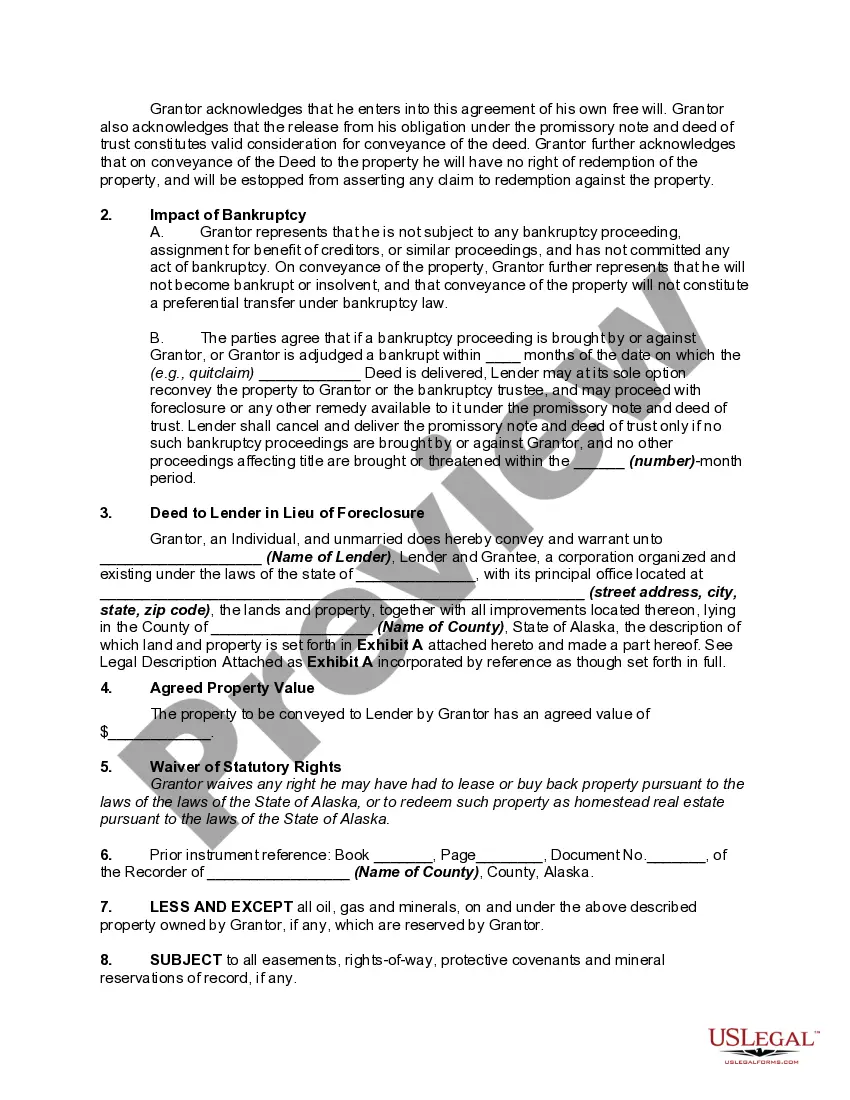

A deed in lieu of foreclosure is an agreement reached between a homeowner and a lender in which the homeowner turns over the deed to the home, and the lender agrees to halt foreclosure proceedings. Negotiating a deed in lieu of foreclosure agreement is a way to avoid foreclosure. As a general rule, in a deed in lieu of foreclosure settlement, the homeowner signs away the deed, giving the home to the lender, and the lender writes off the homeowner's debt, essentially canceling the mortgage or deed of trust.

Alaska Conveyance of Deed to Lender in Lieu of Foreclosure

Description Exhibit Cover Sheet Template

How to fill out Alaska Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Utilizing Alaska Conveyance of Deed to Lender instead of foreclosure templates crafted by proficient attorneys helps you evade complications when filing papers.

Just download the example from our site, complete it, and request a lawyer to review it.

This approach can save you considerably more time and effort compared to asking a lawyer to draft a document for you from scratch.

Make the most of the Preview feature and examine the description (if available) to determine if you need this specific example, and if so, just click Buy Now.

- If you already possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a file, your saved examples will be found in the My documents tab.

- If you lack a subscription, there's no need for concern.

- Just adhere to the steps below to register for your account online, acquire, and complete your Alaska Conveyance of Deed to Lender in Lieu of Foreclosure template.

- Verify that you’re obtaining the appropriate state-specific form.

Sample Deed Of Conveyance Form popularity

Conveyance Deed Other Form Names

FAQ

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy.

First, approach your lender with sufficient proof of inability to repay your mortgage, and then offer a deed in lieu of foreclosure. Second, negotiate the terms of any reports to credit bureaus your lender may make after it accepts your deed in lieu.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for being relieved of the mortgage debt.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.