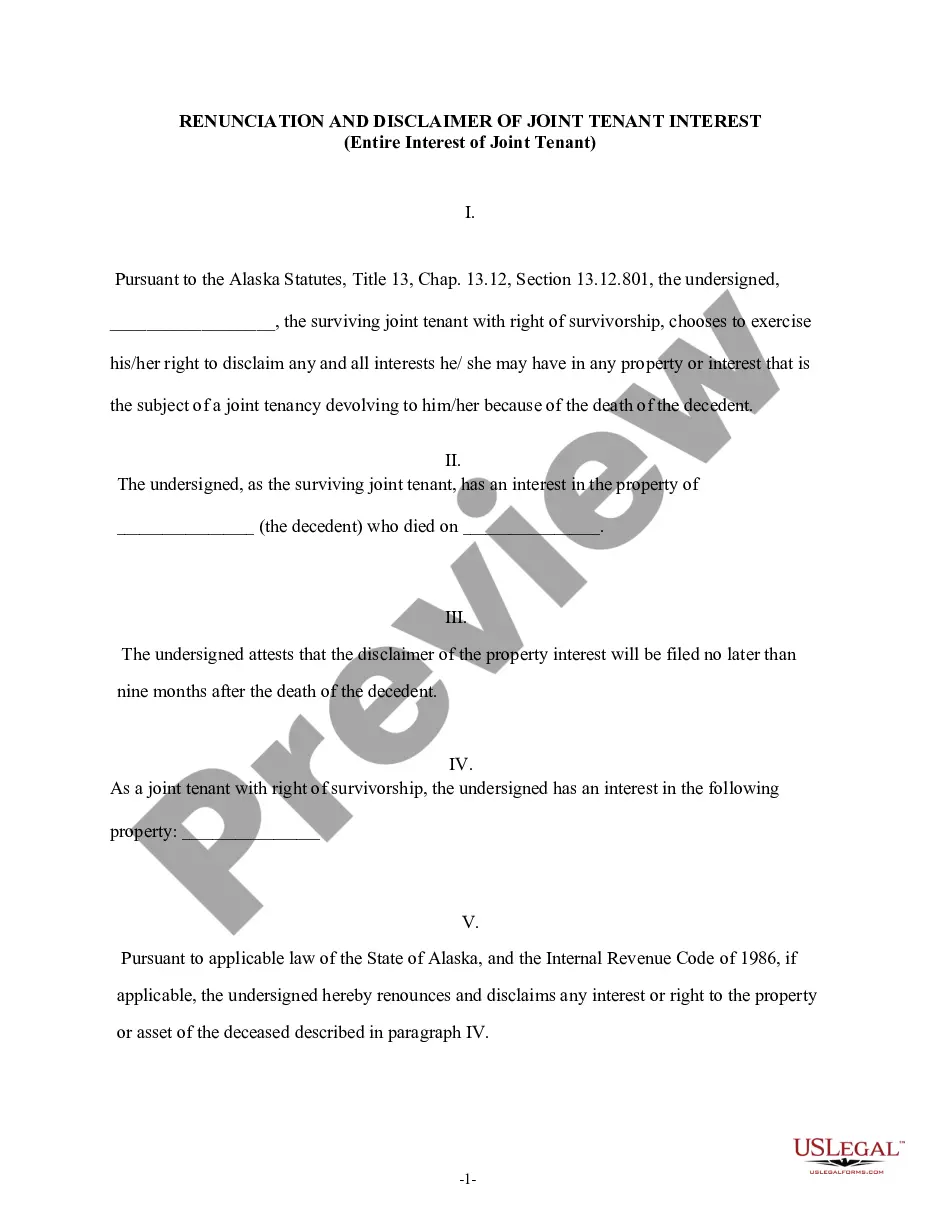

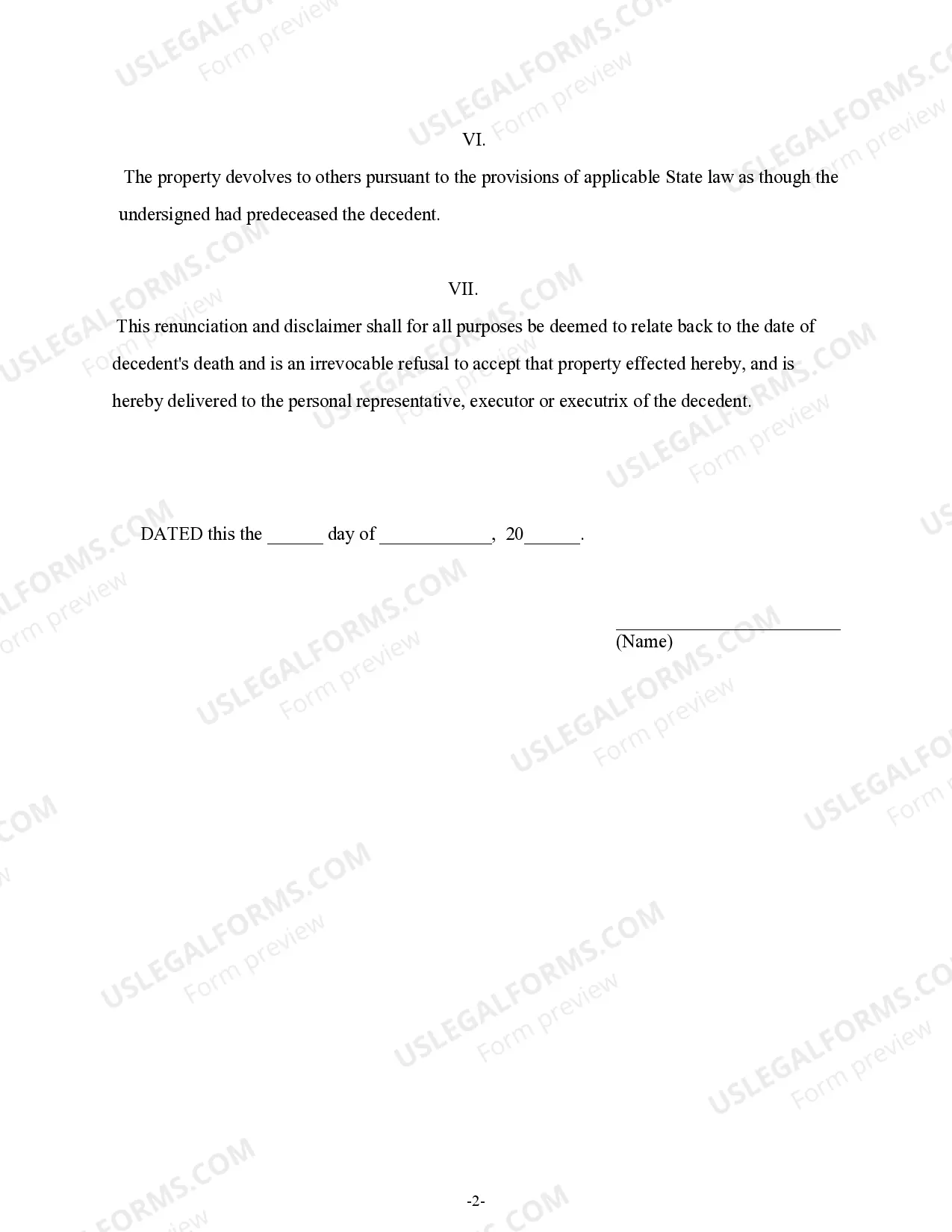

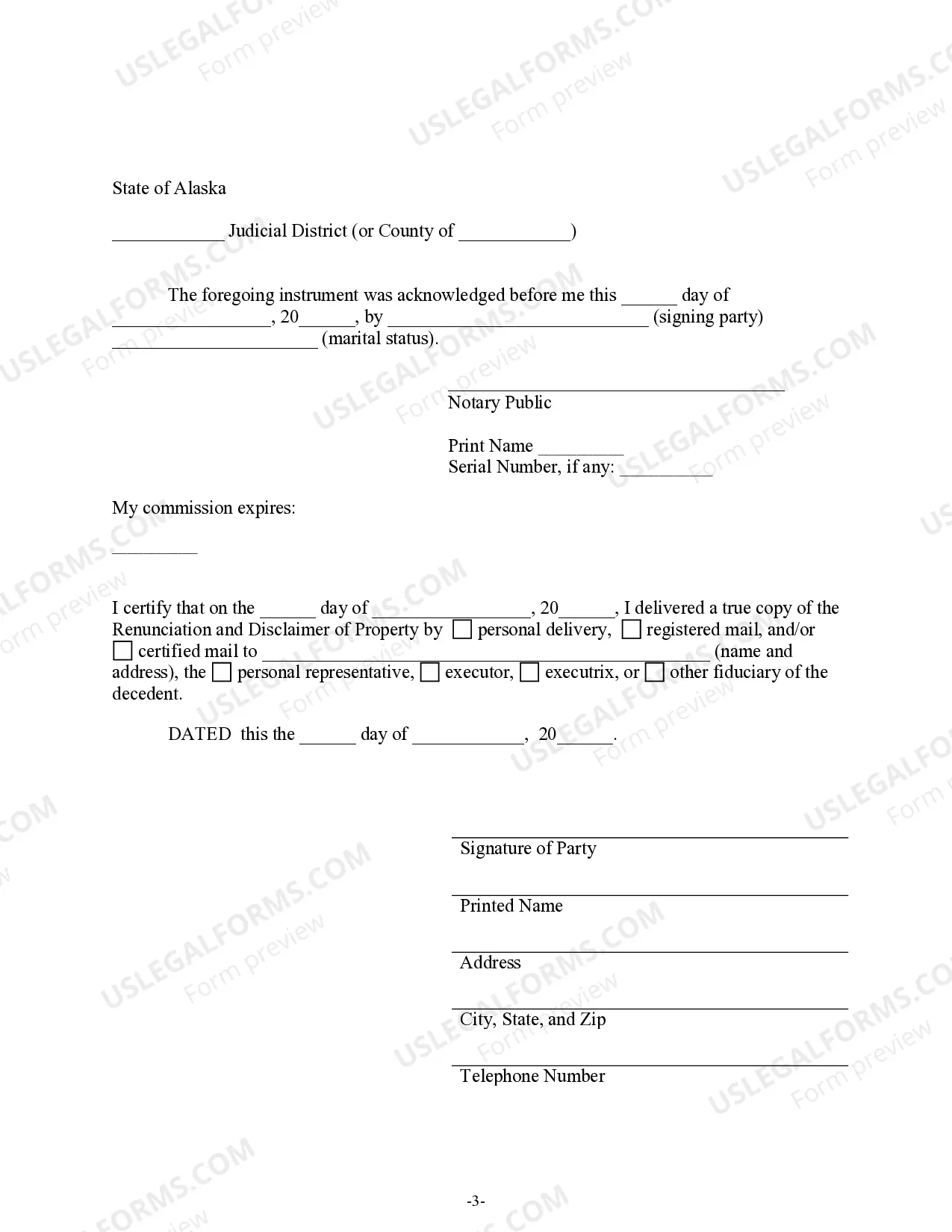

This Renunciation and Disclaimer of a Joint Tenant Interest is used when the beneficiary is the surviving joint tenant with a right of survivorship. The beneficiary has chosen to exercise his/her option to disclaim his/her entire interest in the property acquired from the decedent through joint tenancy. The beneficiary has received the right to disclaim his/her interest in the property based upon the Alaska Statutes, Title 13, Chap. 13.12, Section 13.12.801. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Alaska Renunciation and Disclaimer of Joint Tenant or Tenancy Interest

Description

How to fill out Alaska Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

Utilizing Alaska Renunciation and Disclaimer of Joint Tenant or Tenancy Interest templates crafted by skilled lawyers offers you the chance to avert difficulties when completing forms.

Simply download the sample from our site, complete it, and request an attorney to review it. Doing so can assist you in conserving significantly more time and money than seeking an attorney to create a document entirely from the beginning for you.

If you already possess a US Legal Forms subscription, just Log In to your account and return to the form page. Locate the Download button adjacent to the templates you’re examining. After downloading a document, you will find all of your saved samples in the My documents section.

- When you lack a subscription, it's not a major issue.

- Just adhere to the instructions below to register for your account online, obtain, and finalize your Alaska Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template.

- Verify and confirm that you are downloading the right state-specific form.

- Utilize the Preview feature and assess the description (if available) to determine if you need this particular template and if so, simply click Buy Now.

- Search for another sample using the Search field if required.

- Choose a subscription that aligns with your needs.

- Begin using your credit card or PayPal.

Form popularity

FAQ

In New South Wales, the Registrar General is able record the State of New South Wales as the proprietor of disclaimed land. The land will remain subject to any charges and mortgages despite the change in proprietor.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

The surviving spouse can serve as the sole trustee, but cannot have any power to direct the beneficial enjoyment of the disclaimed property unless the power is limited by an "ascertainable standard." This is necessary both to qualify the disclaimer and to avoid any taxable general power of appointment.