Alaska Notice of Possible Claim Against the Second Injury Fund

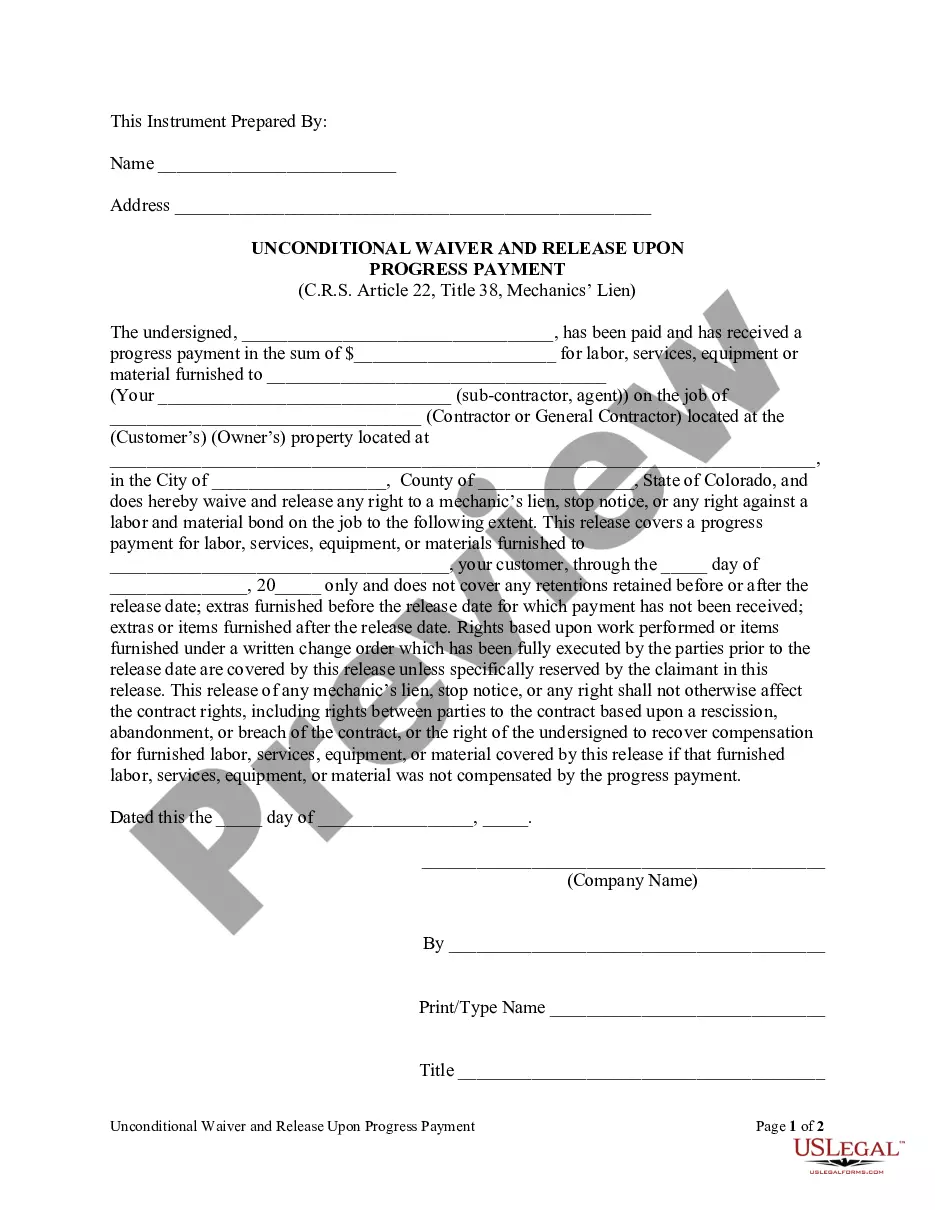

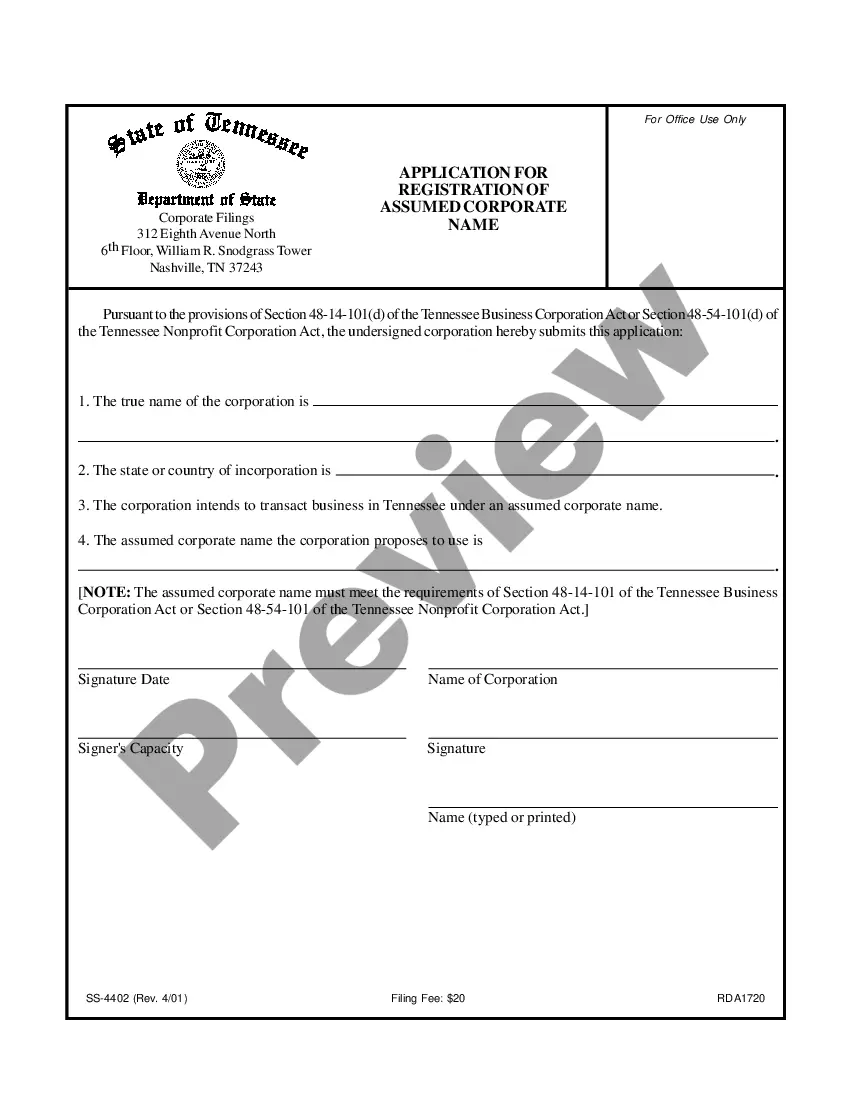

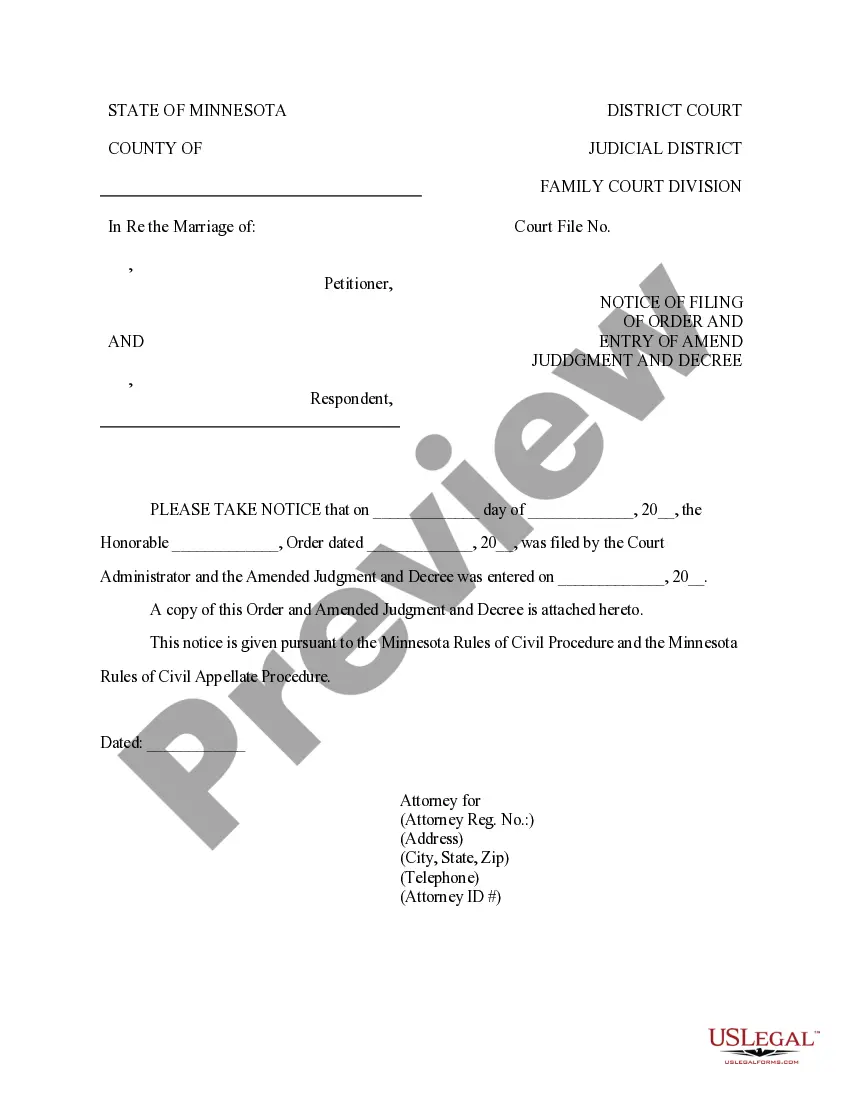

Description

How to fill out Alaska Notice Of Possible Claim Against The Second Injury Fund?

Utilizing templates for the Alaska Notice of Potential Claim Against the Second Injury Fund created by skilled lawyers helps you avoid hassles when completing paperwork.

Simply obtain the template from our site, complete it, and seek legal advice to verify it.

This can save you significantly more time and money than hiring an attorney to create a document from scratch tailored to your needs.

Once you have completed all of the steps above, you will be able to fill out, print, and sign the Alaska Notice of Possible Claim Against the Second Injury Fund template. Remember to verify all entered information for accuracy before submitting or mailing it out. Minimize the time spent on document creation with US Legal Forms!

- If you already have a US Legal Forms subscription, just Log In to your account and go back to the template page.

- Locate the Download button next to the templates you are reviewing.

- After downloading a document, you will find your saved templates in the My documents section.

- If you do not have a subscription, it’s not a significant issue. Just follow the instructions below to register for your account online, obtain, and finish your Alaska Notice of Possible Claim Against the Second Injury Fund template.

- Verify and ensure you are downloading the correct state-specific form.

- Utilize the Preview option and read the description (if available) to determine if you need this specific template; if so, simply click Buy Now.

Form popularity

FAQ

The Second Injury Fund compensates injured employees when a current work-related injury combines with a prior disability to create an increased combined disability. The Second Injury Fund is funded by a surcharge paid by employers. The Missouri State Treasurer is the custodian of the Fund.

The purpose of second injury funds is to encourage employers to retain disabled employees or hire employees with disabilities. Second injury funds protect the employer from the additional cost of a workers compensation claim that combines a new injury and prior disability.

Average Settlement for Work-related Lower Back Injuries According to an analysis of workers who received settlements for workplace accidents, the average compensation for back injuries was $23,600. This amount was slightly higher than the mean settlement for all types of injuries, which was $21,800.

The purpose of second injury funds is to encourage employers to retain disabled employees or hire employees with disabilities. Second injury funds protect the employer from the additional cost of a workers compensation claim that combines a new injury and prior disability.

Alaska, Arizona, Georgia, Louisiana, Massachusetts, New Hampshire, and Nevada are examples of states with active second injury fund statutes with a strong employer knowledge element.

Alaska, Arizona, Georgia, Louisiana, Massachusetts, New Hampshire, and Nevada are examples of states with active second injury fund statutes with a strong employer knowledge element.

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

The Second Injury Fund pays the disabled employee the difference between the employer's liability and the balance of his or her disability or impairment. This way, the employee is fully covered.

As a result, in the vast majority of circumstances, workers' compensation benefits are not taxable under state or federal law.