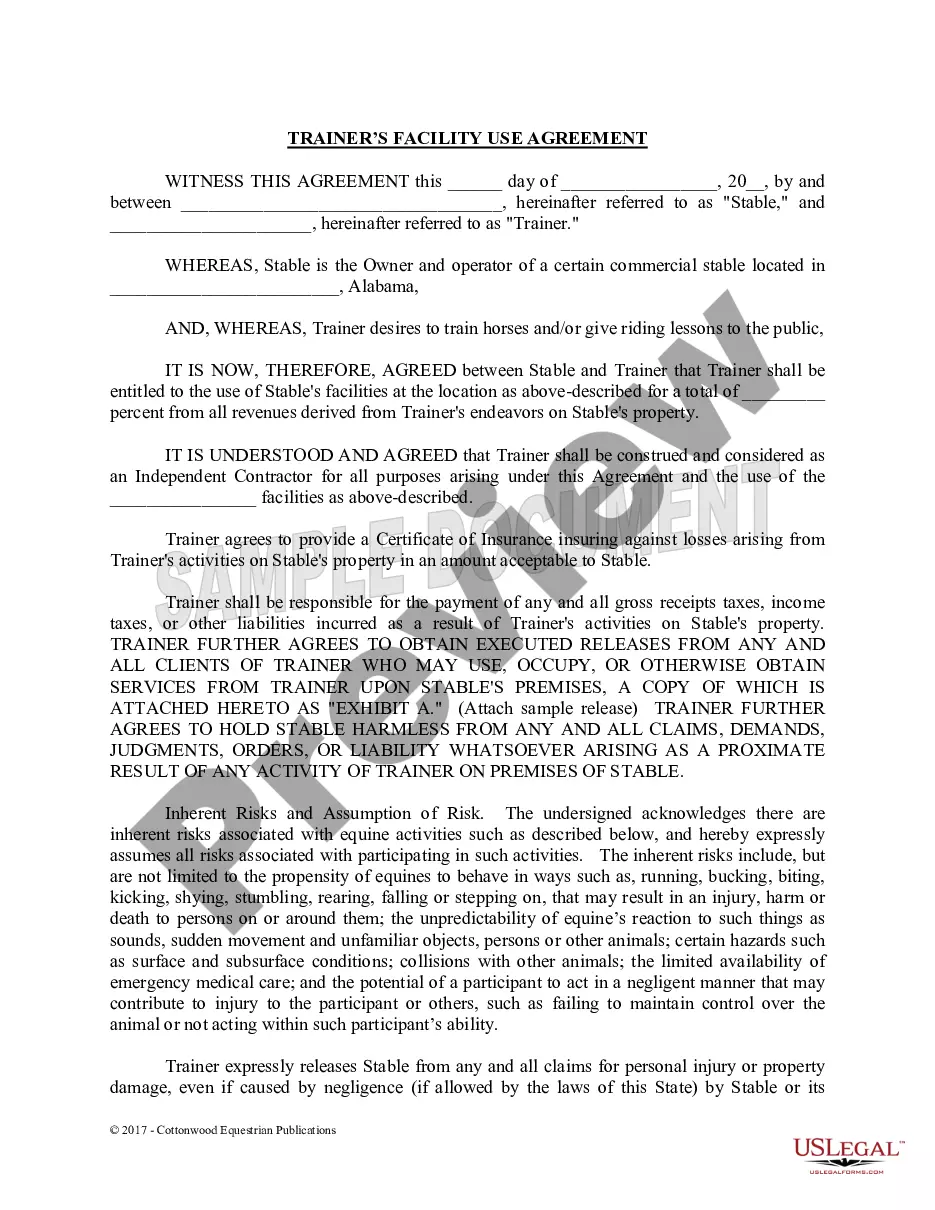

This form is execution instructions to assist creditors in seizing permanent fund dividends from the debtor only, not to seize other property of the debtor. This is an official form from the Alaska Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Alaska statutes and law.

Alaska Executing on the Permanent Fund Dividend: Creditor's Instructions, CIV-503

Description

How to fill out Alaska Executing On The Permanent Fund Dividend: Creditor's Instructions, CIV-503?

Using Alaska Implementing the Permanent Fund Dividend - Creditor's Instructions instances crafted by experienced attorneys provides you the chance to bypass hassles when filling out paperwork.

Simply save the example from our site, complete it, and ask a lawyer to verify it.

This approach can save you considerably more time and energy than searching for an attorney to draft a document from scratch to meet your requirements.

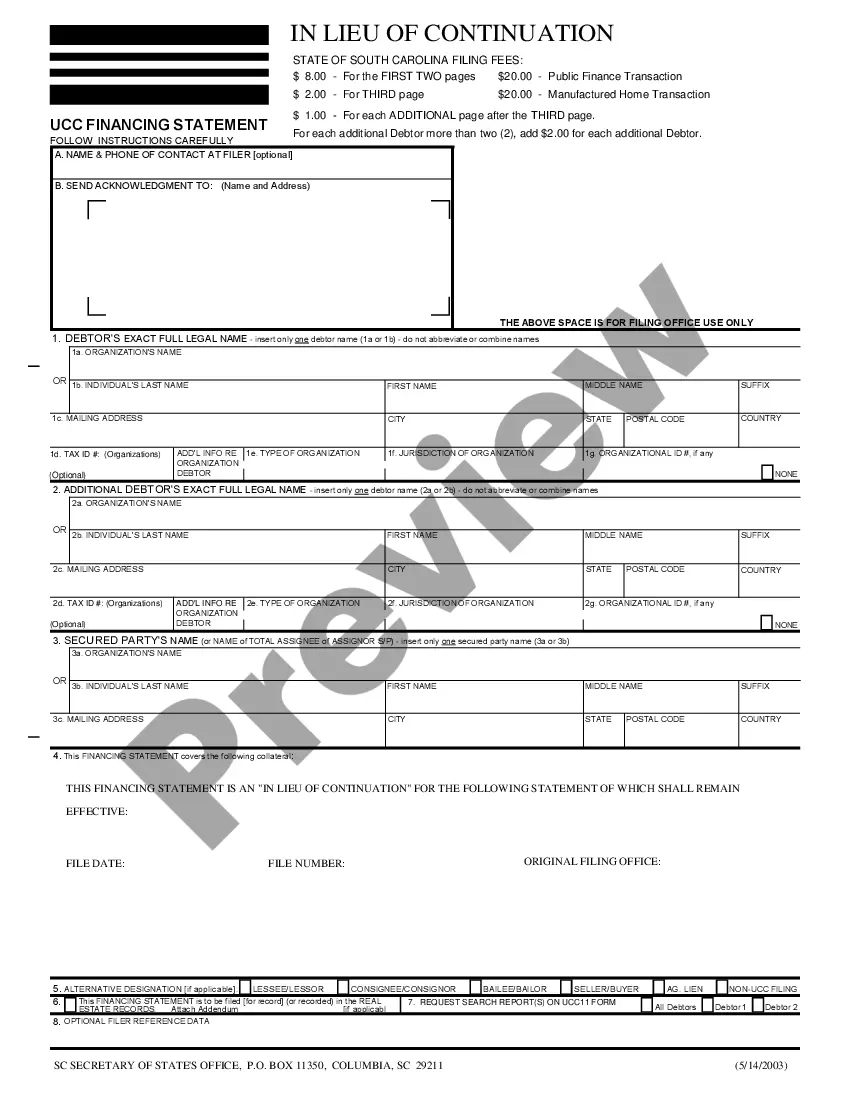

Utilize the Preview functionality and read the description (if provided) to determine if you require this specific template, and if you do, just click Buy Now. Search for another document using the Search field if needed. Select a subscription that fits your needs. Begin with your credit card or PayPal. Opt for a file format and download your document. Once you’ve completed all of the above steps, you will be able to fill out, create a hard copy, and sign the Alaska Implementing the Permanent Fund Dividend - Creditor's Instructions template. Ensure to verify all entered information for accuracy before submitting it or dispatching it. Reduce the time taken on document completion with US Legal Forms!

- If you already possess a US Legal Forms subscription, simply Log In/">Log In to your profile and return to the form page.

- Locate the Download button beside the templates you are reviewing.

- After downloading a document, you will find all your saved samples in the My documents section.

- If you lack a subscription, it’s not an issue.

- Just adhere to the steps below to register for an account online, obtain, and complete your Alaska Implementing the Permanent Fund Dividend - Creditor's Instructions template.

- Verify that you’re downloading the correct state-specific document.

Form popularity

FAQ

Taxpayers report the PFD payments as other income on Line 21 of Form 1040, Line 13 of Form 1040A or Line 3 of Form 1040EZ. The PFD payments are added to your other ordinary income from work and other sources. The federal income tax rate applied to a PFD payment will depend on your total income from all sources.

What are the requirements to qualify to receive a dividend? To be eligible for a Permanent Fund Dividend, you must have been an Alaska resident for the entire calendar year preceding the date you apply for the dividend. You must also intend to remain an Alaska resident indefinitely at the time that you apply.

Select the Federal tab. Select Wages & Income. On the Your income summary screen, scroll down to Less Common Income and select Show more. Select Start next to Child's Income (Under Age 24).

Your 2020 Alaska Permanent Fund dividend goes in the 1099-MISC section.

The Alaska Permanent Fund sets aside a certain share of oil revenues to continue benefiting current and all future generations of Alaskans. Many citizens also believed that the legislature too quickly and too inefficiently spent the $900 million bonus the state got in 1969 after leasing out the oil fields.

Sentenced as a result of a felony conviction during 2020; Incarcerated at any time during 2020 as the result of a felony conviction; or. Incarcerated at any time during 2020 as the result of a misdemeanor conviction in Alaska if convicted of a prior felony or two or more prior misdemeanors since January 1, 1997.

The PFD is considered unearned income, as it is derived from interest and dividends instead of employment. In 2012, the IRS set the unearned income threshold at $950, and the 2012 PFD was $1,174. If your minor child received a PFD in 2012, she was required to file a tax return.

Taxpayers report the PFD payments as other income on Line 21 of Form 1040, Line 13 of Form 1040A or Line 3 of Form 1040EZ. The PFD payments are added to your other ordinary income from work and other sources. The federal income tax rate applied to a PFD payment will depend on your total income from all sources.

Open your return in TurboTax. (To do this, sign in to TurboTax and click the orange Take me to my return button.) In the search box, search for alaska fund and then click the "Jump to" link in the search results. Answer Yes to Did you get a 1099-MISC? (even if the answer is no).