Notice of Garnishment and Notice of Right to Exemptions, is an official form from the Alaska Court System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alaska statutes and law.

Alaska Notice of Garnishment and Notice of Right to Exemptions, CIV-530

Description

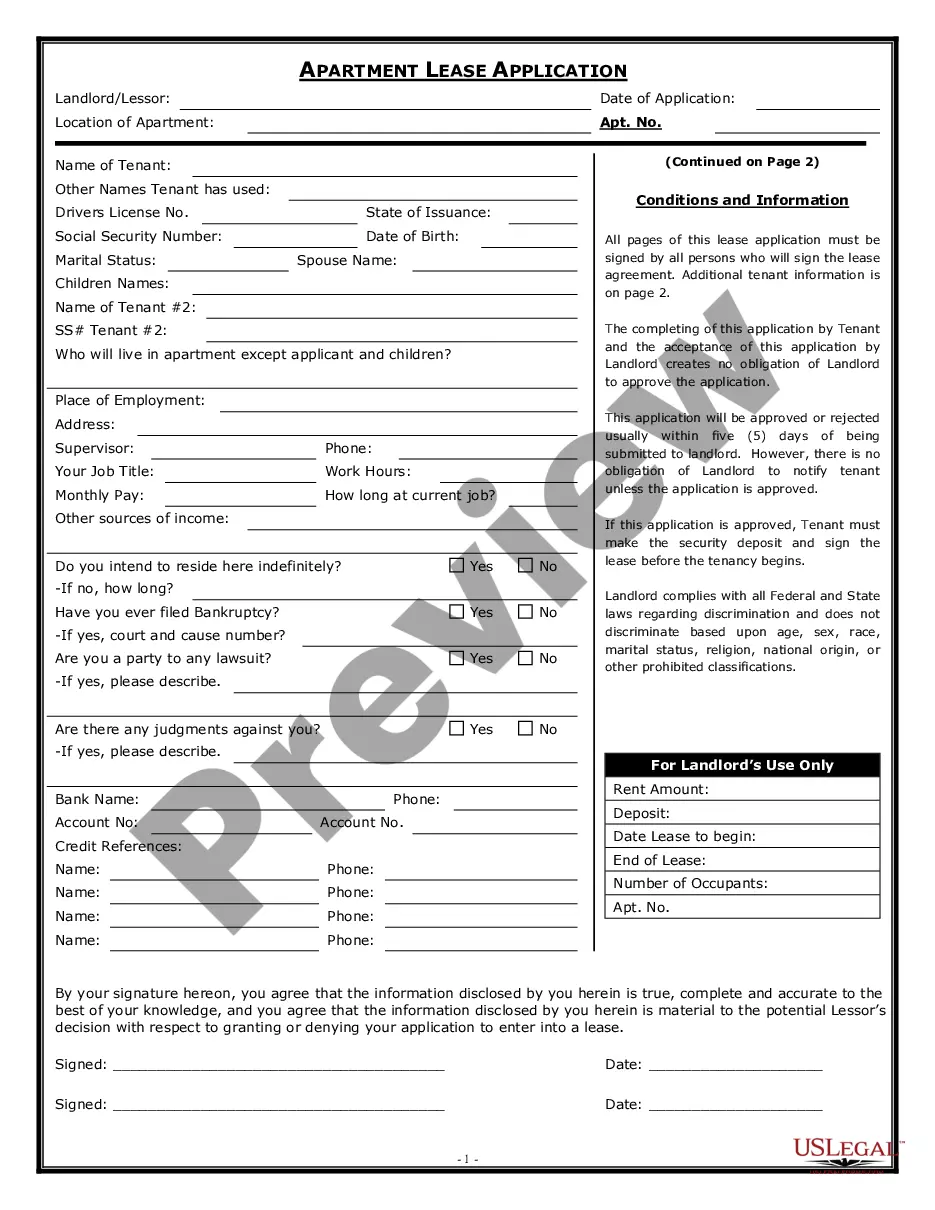

How to fill out Alaska Notice Of Garnishment And Notice Of Right To Exemptions, CIV-530?

Employing samples of Alaska Notice of Garnishment and Notice of Right to Exemptions formulated by expert lawyers helps you steer clear of complications when filing documents.

Simply download the form from our site, complete it, and ask a legal expert to verify it.

This approach will save you considerably more time and effort than searching for a lawyer to create a document entirely from the beginning for you.

Make sure to verify that you’re acquiring the correct state-specific form. Utilize the Preview feature and read the description (if available) to determine if this particular sample is necessary, and if so, simply click Purchase Now. If needed, find another template using the Search field. Select a subscription that suits your needs. Begin utilizing your credit card or PayPal. Choose a file format and download your document. After completing all the steps above, you’ll be able to fill out, print, and sign the Alaska Notice of Garnishment and Notice of Right to Exemptions template. Don’t forget to double-check all entered information for accuracy before submitting or dispatching it. Minimize the time spent on preparing documents with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just Log In/">Log In to your account and return to the form section.

- Locate the Download button adjacent to the template you’re reviewing.

- Once the file is downloaded, you can access all of your stored samples in the My documents tab.

- If you don’t have a subscription, that's not an issue.

- Just follow the instructions below to register for an account online, obtain, and fill out your Alaska Notice of Garnishment and Notice of Right to Exemptions template.

Form popularity

FAQ

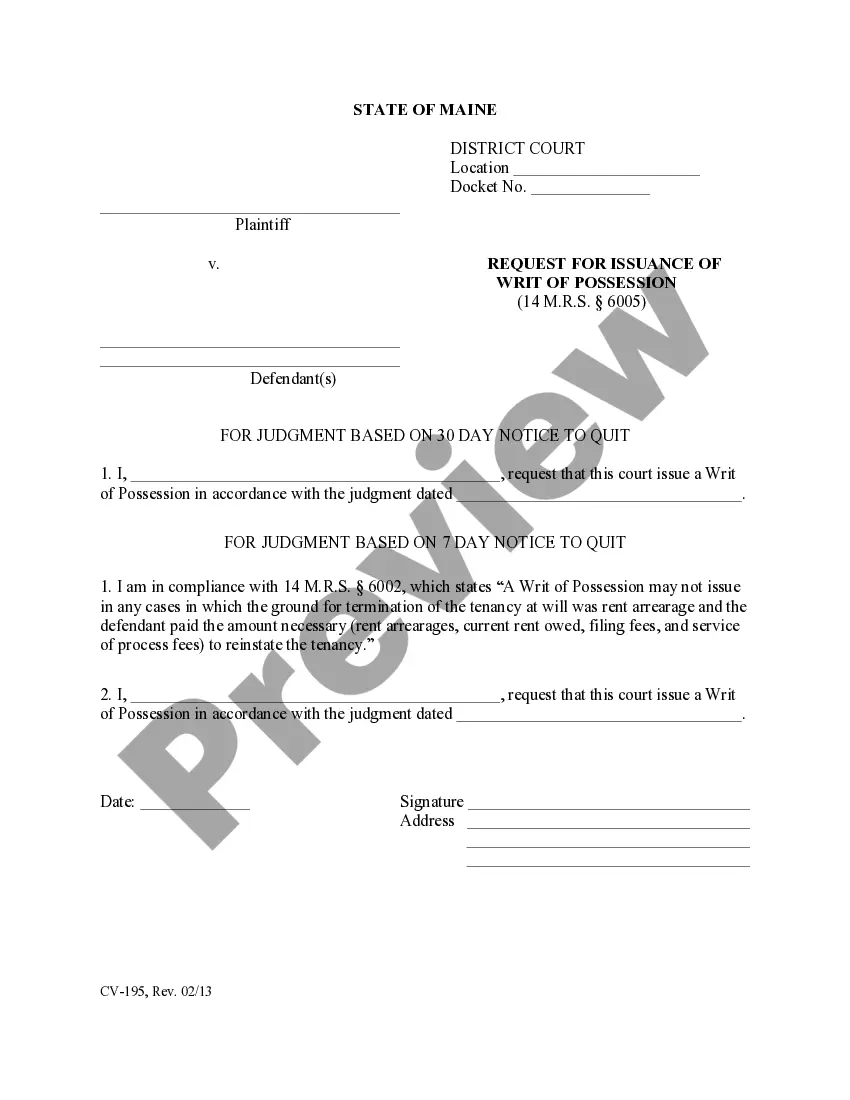

What Happens When a Garnishment Summons Is Served?In the case of a nonearnings garnishment, the garnishee must provide a written disclosure to the creditor within 20 days after service of the garnishment summons that identifies all indebtedness, money, or property that the garnishee owes to the debtor.

Funds Exempt from Bank Account Garnishment Social Security, and other government benefit, or payments. Monies received for child support or alimony (spousal support) Workers' compensation payments. Retirement funds, such as those from pensions or annuities.

The court order is called a garnishment. What's important to know is that federal benefits ordinarily are exempt from garnishment. That means you should be able to protect your federal funds from being taken by your creditors, although you might have to go to court to do so.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.

A Claim of Exemption is a form a debtor files with the levying officer (like the sheriff or marshal) explaining why the property or money that the creditor wants to take should be exempt (excluded). There are laws and rules that say which types of income or property are exempt.

The exempt benefits are typically funds received from the government for a specific reason. For example, Veteran's Assistance benefits, Social Security, Workers' Compensation, Unemployment and Disability are benefits that cannot be seized in order to pay off outstanding debts.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.