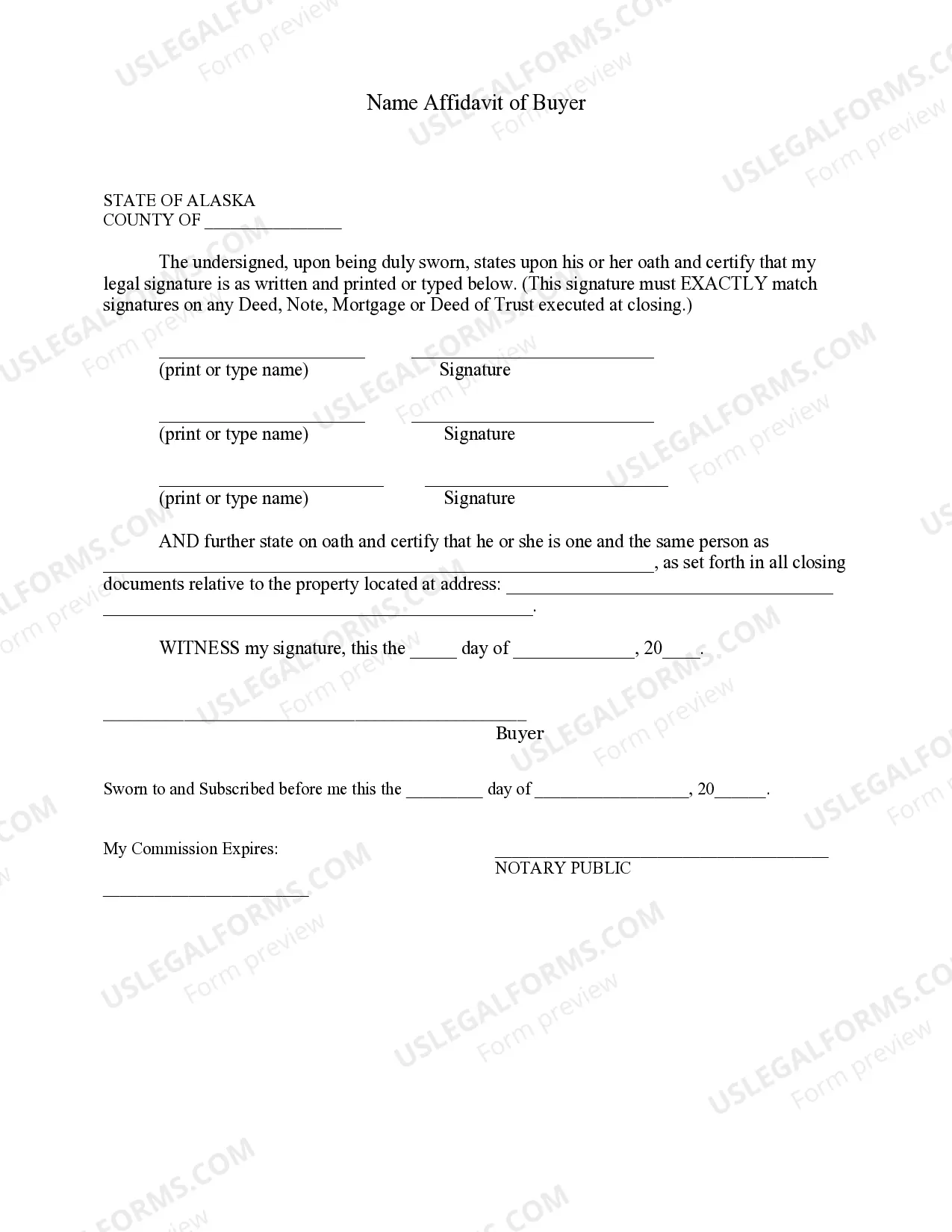

The Buyers Name Affidavit is for the Buyer to provide a statement of his or her legal name and signature, as well as to certify to other "known as" names. Many times persons sign documents in different ways and the name affidavit is necessary to clarify that the signatures are one and the same person. i.e. John Jones, John T. Jones and J.T. Jones are one and the same person.

Alaska Name Affidavit of Buyer

Description

How to fill out Alaska Name Affidavit Of Buyer?

Utilizing Alaska Name Affidavit of Buyer templates crafted by experienced attorneys allows you to evade complications when filing paperwork.

Simply download the document from our site, fill it in, and have an attorney verify it.

This will conserve far more time and expenses compared to hiring legal advice to create a document from scratch for your needs.

Minimize the time spent on document preparation with US Legal Forms!

- If you already possess a US Legal Forms membership, just Log In to your profile and navigate back to the document page.

- Locate the Download button next to the templates you are reviewing.

- After downloading a form, you will find all your saved templates in the My documents section.

- If you lack a subscription, it's not an issue.

- Simply follow the steps below to create an online account, obtain, and complete your Alaska Name Affidavit of Buyer form.

- Ensure that you are downloading the appropriate state-specific document.

Form popularity

FAQ

Federal law gives borrowers what is known as the "right of rescission." This means that borrowers after signing the closing papers for a home equity loan or refinance have three days to back out of that deal.

Seller's real estate agentYour agent is tasked with facilitating the closing process and making sure that both parties have taken care of unfinished businesssometimes including pre-signing documentationbefore coming to the table at closing.

The clear benefit of closing later in the month is that you won't need to bring as much cash to closing. That's because mortgage interest accrues from the date of closing through the last day of the month. So, with an end-of-month closing, there'll only be a small window for interest to accrue, and less for you to pay.

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New

Yes. For certain types of mortgages, after you sign your mortgage closing documents, you may be able to change your mind. You have the right to cancel, also known as the right of rescission, for most non-purchase money mortgages.Refinances and home equity loans are examples of non-purchase money mortgages.