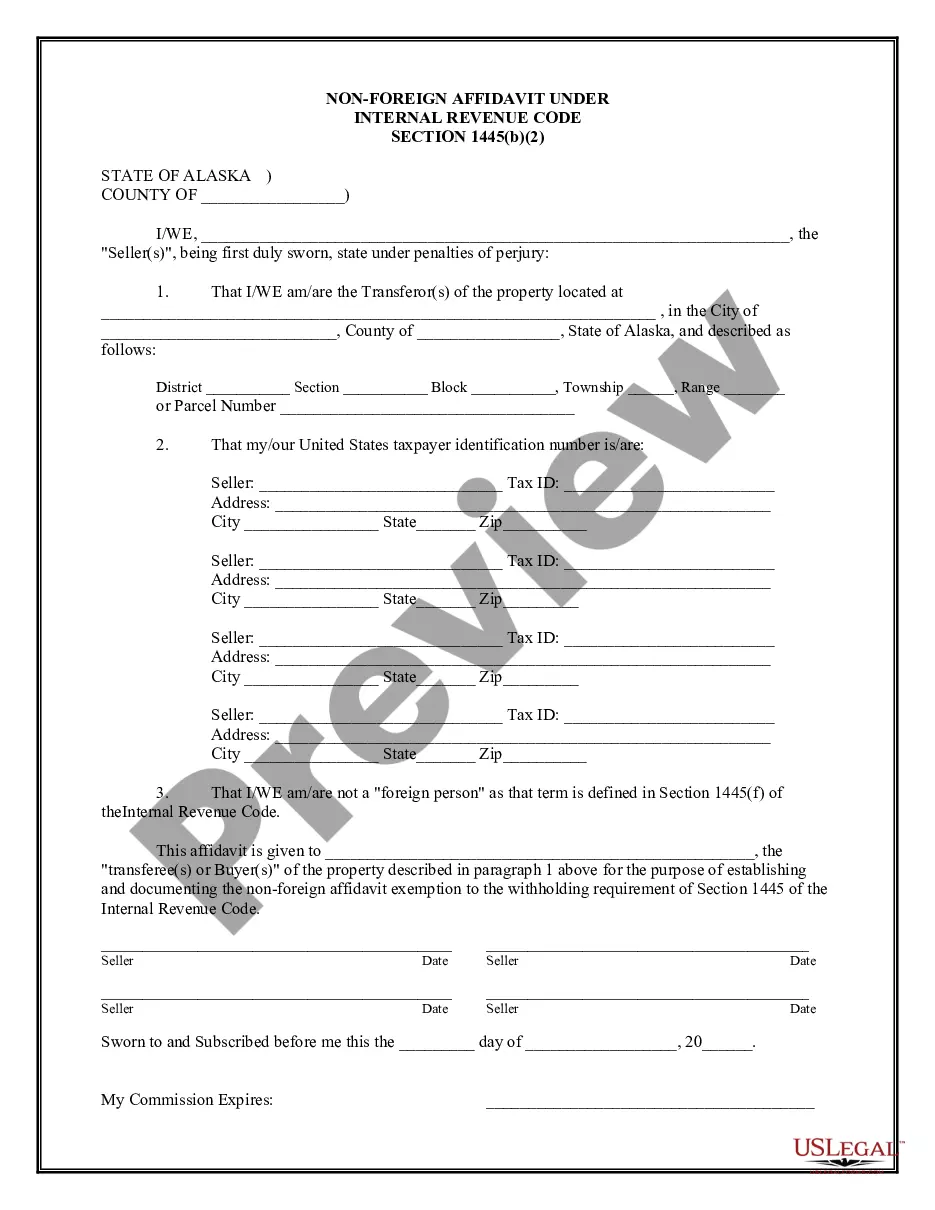

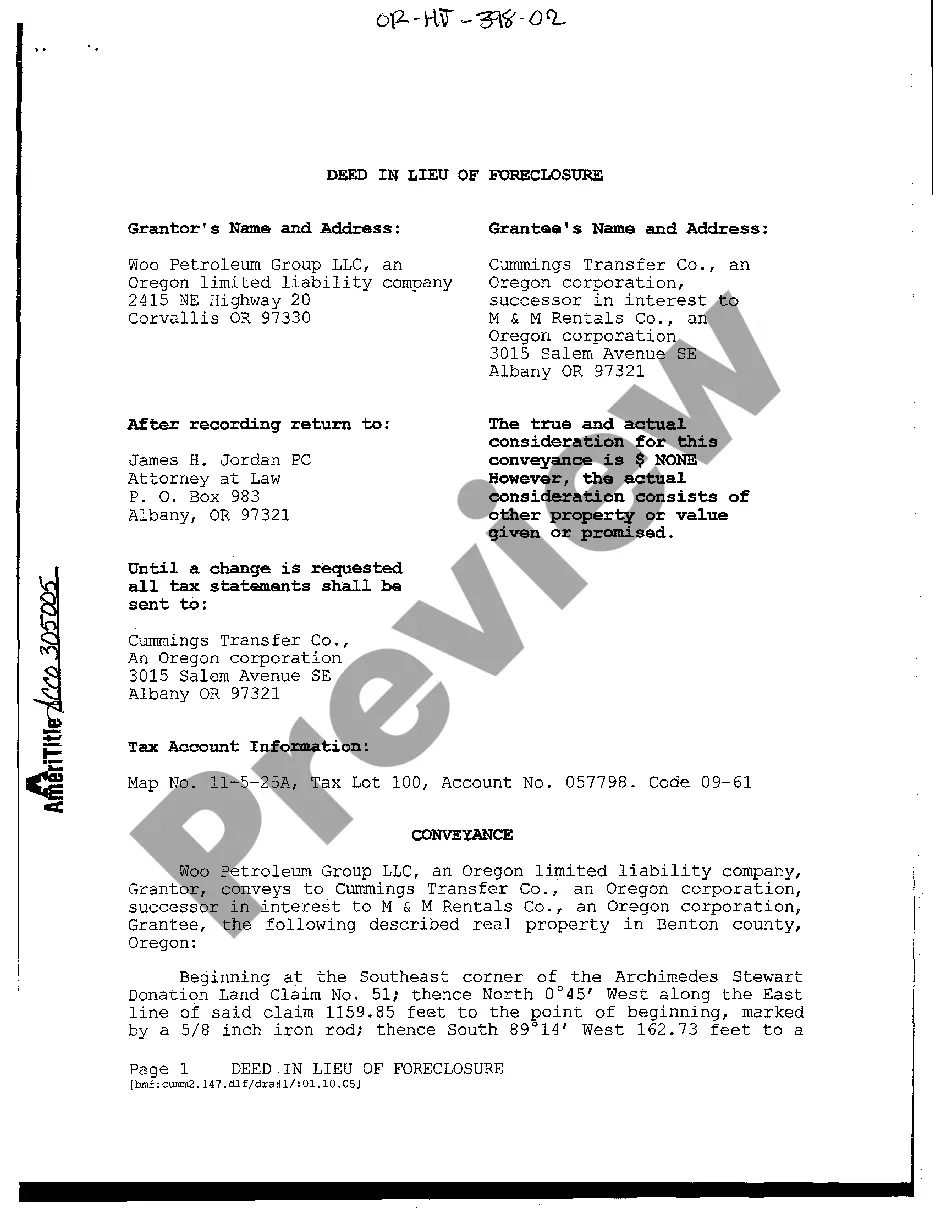

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Alaska Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Alaska Non-Foreign Affidavit Under IRC 1445?

Employing the Alaska Non-Foreign Affidavit Under IRC 1445 samples provided by skilled attorneys enables you to steer clear of complications when submitting paperwork.

Simply acquire the sample from our website, complete it, and request a lawyer to review it.

This approach will conserve you significantly more time and effort than attempting to find a lawyer to create a document from scratch for you.

After completing all aforementioned steps, you’ll be able to finalize, print, and sign the Alaska Non-Foreign Affidavit Under IRC 1445 template. Remember to thoroughly check all entered information for accuracy before submission or mailing. Reduce the time spent on document preparation with US Legal Forms!

- If you already possess a US Legal Forms subscription, simply Log In/">Log In to your account and navigate back to the form section.

- Locate the Download button adjacent to the template you are reviewing.

- Once you download a file, all your preserved examples will be accessible in the My documents section.

- If you lack a subscription, don't worry. Just adhere to the steps below to register for your account online, obtain, and finalize your Alaska Non-Foreign Affidavit Under IRC 1445 template.

- Verify and ensure that you’re obtaining the correct state-specific document.

- Utilize the Preview function and examine the description (if available) to assess if this particular sample is needed, and if so, click Buy Now.

Form popularity

FAQ

The address of the property being transferred (or sold) The seller or transferor's information: Full name. Telephone number. Address. Social Security Number, Federal Employer Identification Number, or California Corporation Number.

Rather, A buyer or other transferee of a U.S. real property interest, and a corporation, qualified investment entity, or fiduciary that is required to withhold tax, must file TIP Form 8288 to report and transmit the amount withheld. If two or more persons are joint transferees, each is obligated to withhold.

The IRS defines a foreign person as a nonresident alien individual, a foreign corporation not treated as a domestic corporation, or a foreign partnership, trust, or estate. A seller who is a U.S. citizen or a U.S. permanent resident (green card holder) is generally exempt from FIRPTA withholding.

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

FIRPTA withholding is required to be submitted to the IRS within 20 days of the closing together with IRS Form 8288, U.S. Withholding Tax Return for Disposition by Foreign Persons of U.S. Real Property Interests, and Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate. Under FIRPTA, if you buy U.S. real estate from a foreign person, you may be required to withhold 10% of the amount realized from the sale. The amount realized is normally the purchase price.