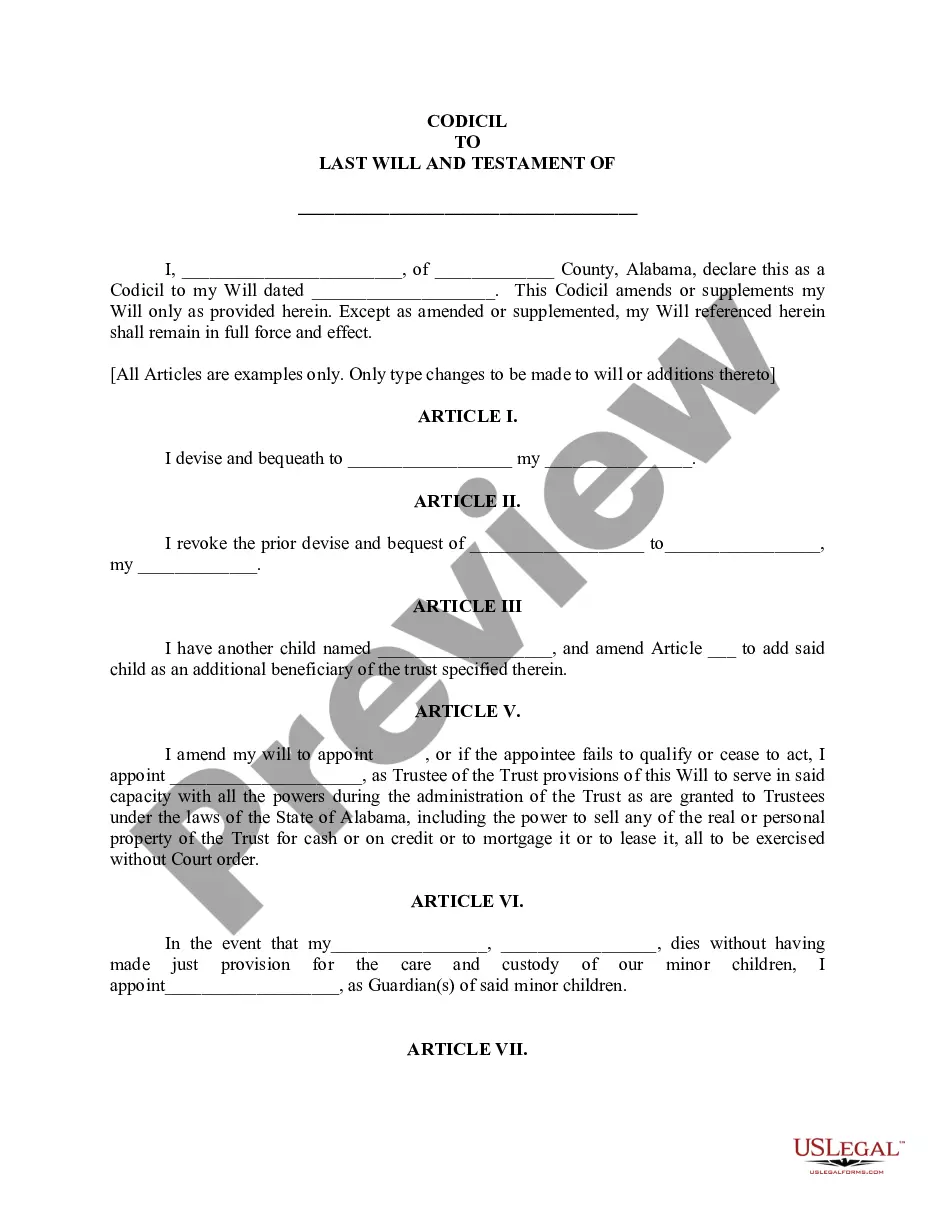

Alaska How to Calculate Child Support Under Civil Rule 90.3 is a set of guidelines used to determine the amount of child support that should be paid by a noncustodial parent in the state of Alaska. The rule is based on a set of statutory factors that are intended to ensure that the child is provided with a reasonable standard of living and that the noncustodial parent pays their fair share of the cost. The calculation of child support is based on the income of both parents, the number of children, and the parenting arrangement. There are two types of Alaska How to Calculate Child Support Under Civil Rule 90.3: the Flat Percentage Rule and the Income Shares Model. The Flat Percentage Rule divides the noncustodial parent’s monthly income by the total monthly family income and then multiplies that fraction by the total family expenses. The Income Shares Model is a more complex method that takes into account the income of both parents, the number of children, and the parenting arrangement. Both methods are used to determine the amount of child support that should be paid by the noncustodial parent.

Alaska How to Calculate Child Support Under Civil Rule 90.3

Description

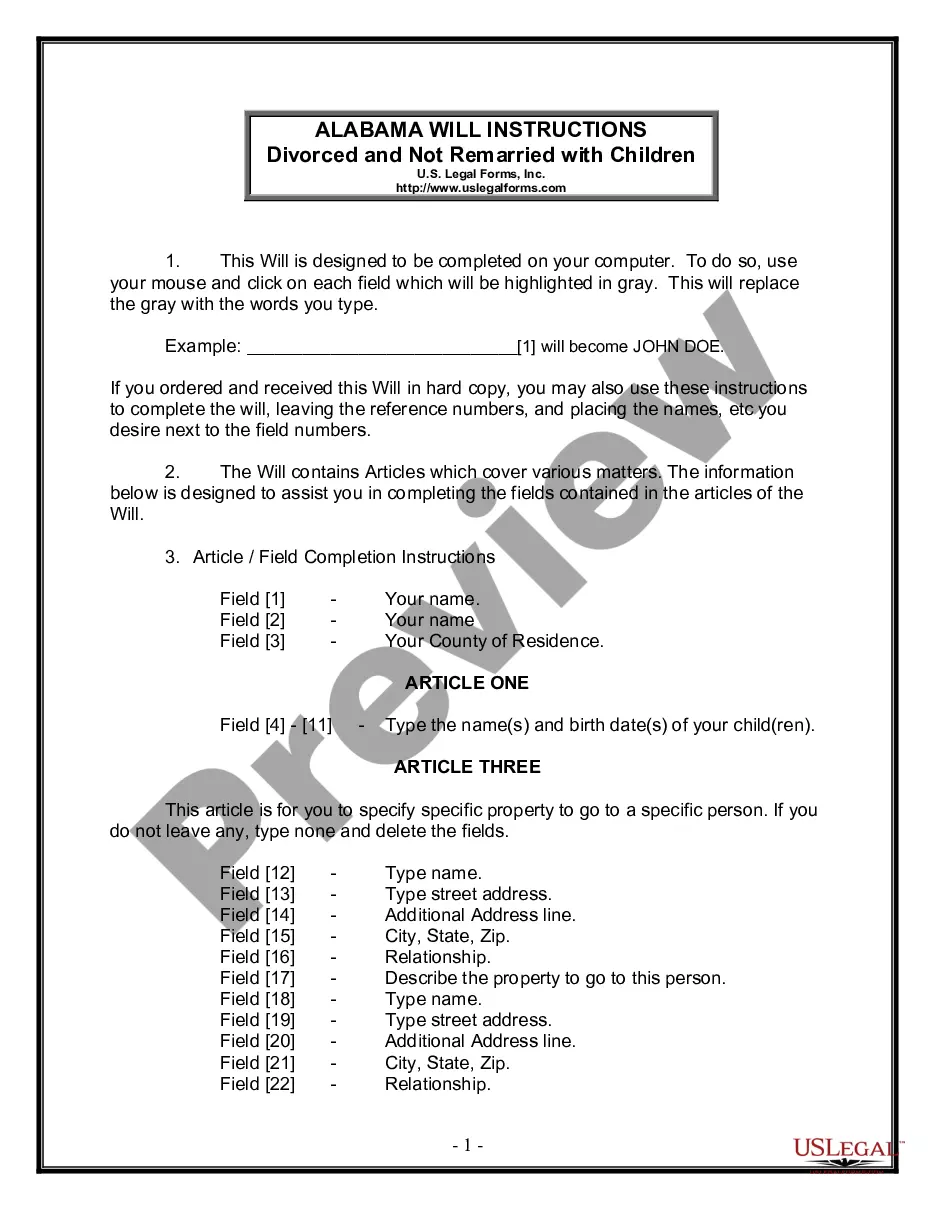

How to fill out Alaska How To Calculate Child Support Under Civil Rule 90.3?

Handling legal paperwork necessitates vigilance, precision, and utilizing correctly-prepared forms. US Legal Forms has been assisting individuals across the country in this regard for 25 years, ensuring that when you select your Alaska How to Calculate Child Support Under Civil Rule 90.3 template from our platform, it adheres to federal and state policies.

Utilizing our platform is straightforward and quick. To obtain the required document, simply create an account with an active subscription. Here’s a brief guide for you to locate your Alaska How to Calculate Child Support Under Civil Rule 90.3 in a matter of minutes.

All forms are designed for multiple uses, such as the Alaska How to Calculate Child Support Under Civil Rule 90.3 featured on this page. Should you require them again in the future, you can complete them without additional payment—just access the My documents section in your profile and fill out your document whenever necessary. Experience US Legal Forms and efficiently manage your business and personal documentation while ensuring full legal compliance!

- Ensure to thoroughly examine the content of the form and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for another formal template if the one you accessed does not meet your needs or state guidelines (the option for that is located at the top page corner).

- Sign in to your account and download the Alaska How to Calculate Child Support Under Civil Rule 90.3 in your preferred format. If it’s your initial experience with our service, click Purchase now to proceed.

- Create an account, choose your subscription option, and complete the payment using your credit card or PayPal account.

- Select the format in which you wish to save your form and click Download. Print the document or upload it to a professional PDF editor for electronic preparation.