The dissolution of a corporation package contains all forms to dissolve a corporation in Alaska, step by step instructions, addresses, transmittal letters, and other information.

Alaska Dissolution Package to Dissolve Corporation

Description Ak Packet Dissolve

How to fill out Alaska Dissolution Editable?

Among a multitude of complimentary and paid templates accessible online, you cannot be certain of their trustworthiness.

For instance, who produced them or if they possess the necessary expertise to handle what you require them for.

Always stay calm and use US Legal Forms! Discover the Alaska Dissolution Package to Dissolve Corporation templates crafted by expert attorneys and avoid the expensive and lengthy ordeal of seeking a lawyer and subsequently paying them to draft a document that you can obtain on your own.

Select a pricing plan and create an account. Complete the payment for the subscription with your credit/debit card or Paypal. Download the document in the required format. Once you have registered and purchased your subscription, you can utilize your Alaska Dissolution Package to Dissolve Corporation as frequently as needed or for as long as it remains relevant in your location. Edit it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you already have a subscription, Log In/">Log In to your account and locate the Download button alongside the form you are looking for.

- You will also have access to your previously downloaded templates in the My documents section.

- If you are using our site for the first time, adhere to the guidelines listed below to acquire your Alaska Dissolution Package to Dissolve Corporation promptly.

- Verify that the document you see is valid for your location.

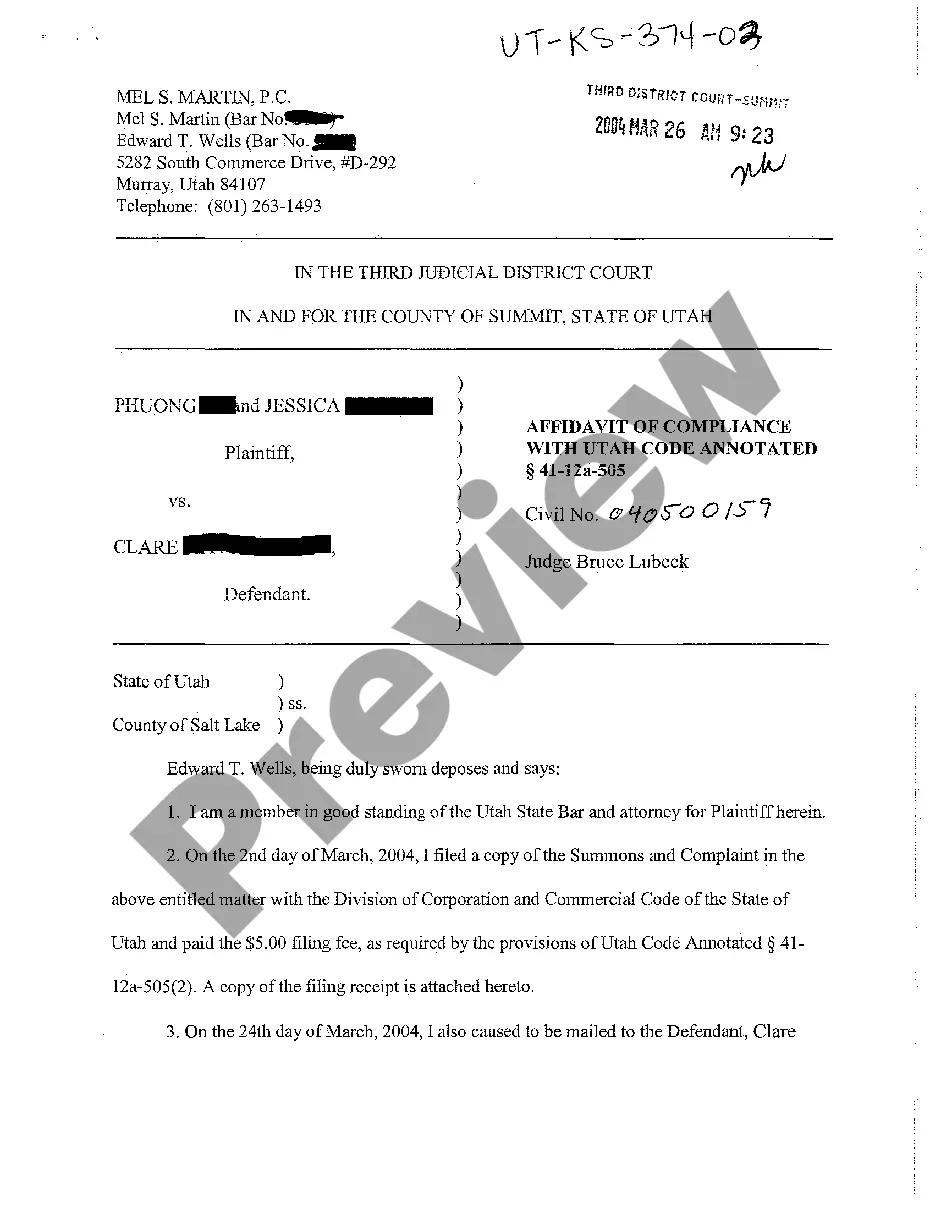

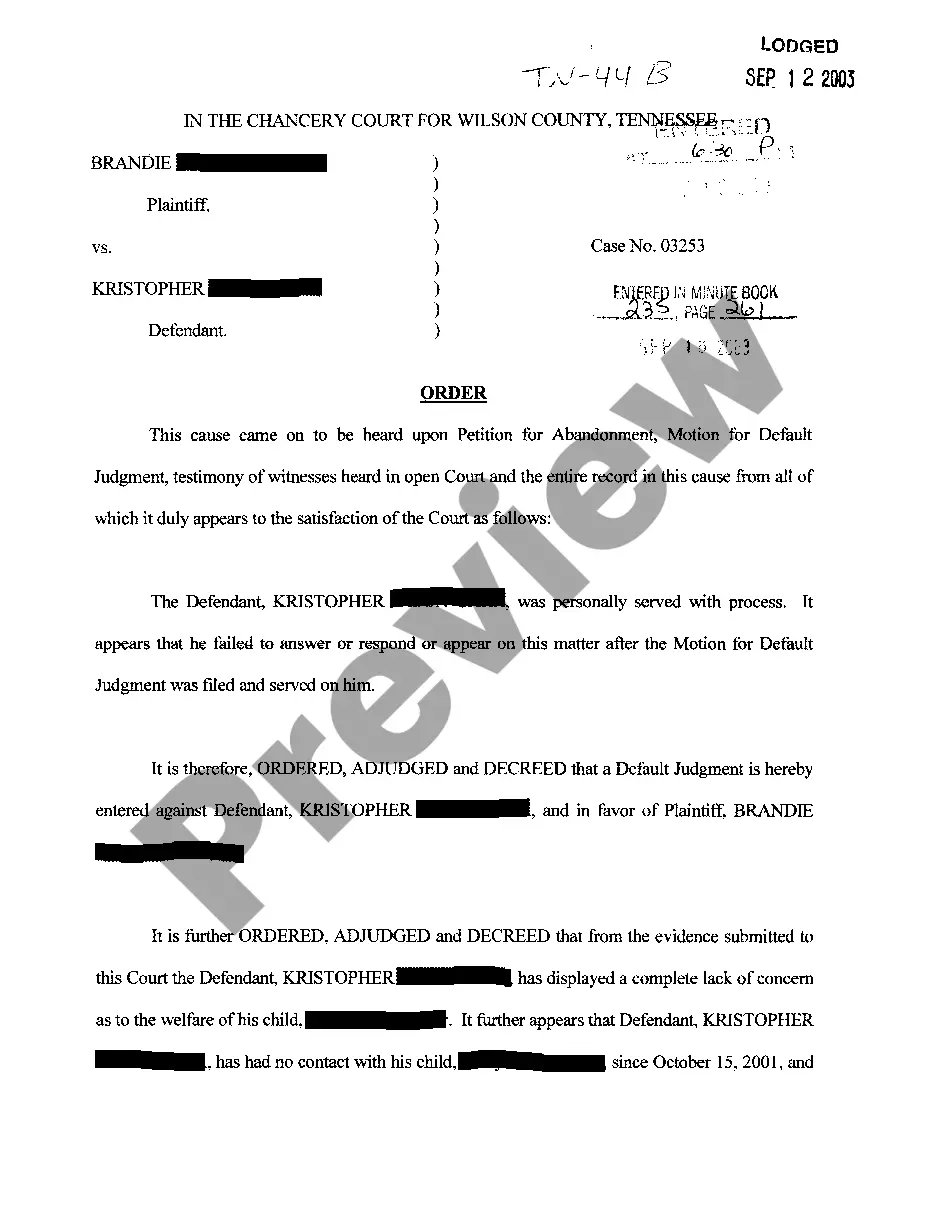

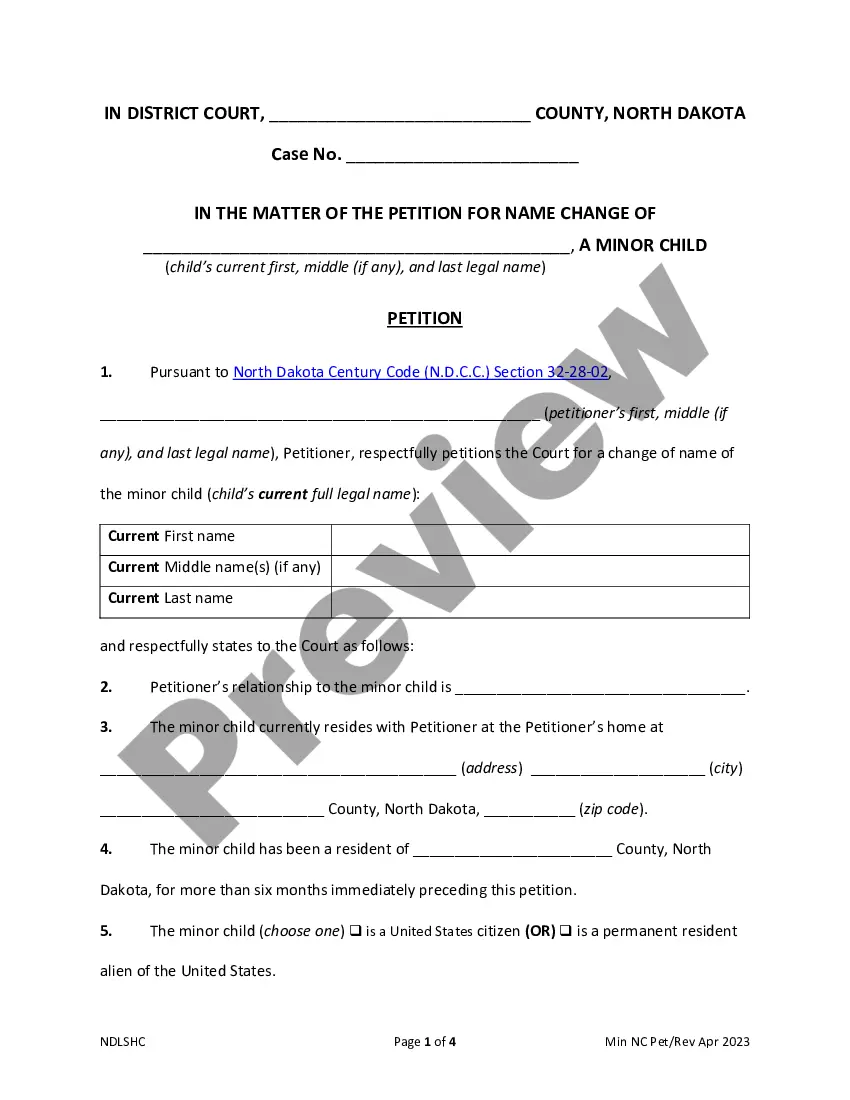

- Review the file by examining the details through the Preview function.

- Click Buy Now to initiate the ordering process or find another template using the Search feature located in the header.

Alaska Dissolution Corporation Form popularity

Alaska Package Dissolve Other Form Names

Ak Dissolution Packet FAQ

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority. Reinstatement is the action taken that restores an administratively dissolved business entity's rights, powers, and authority.

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.