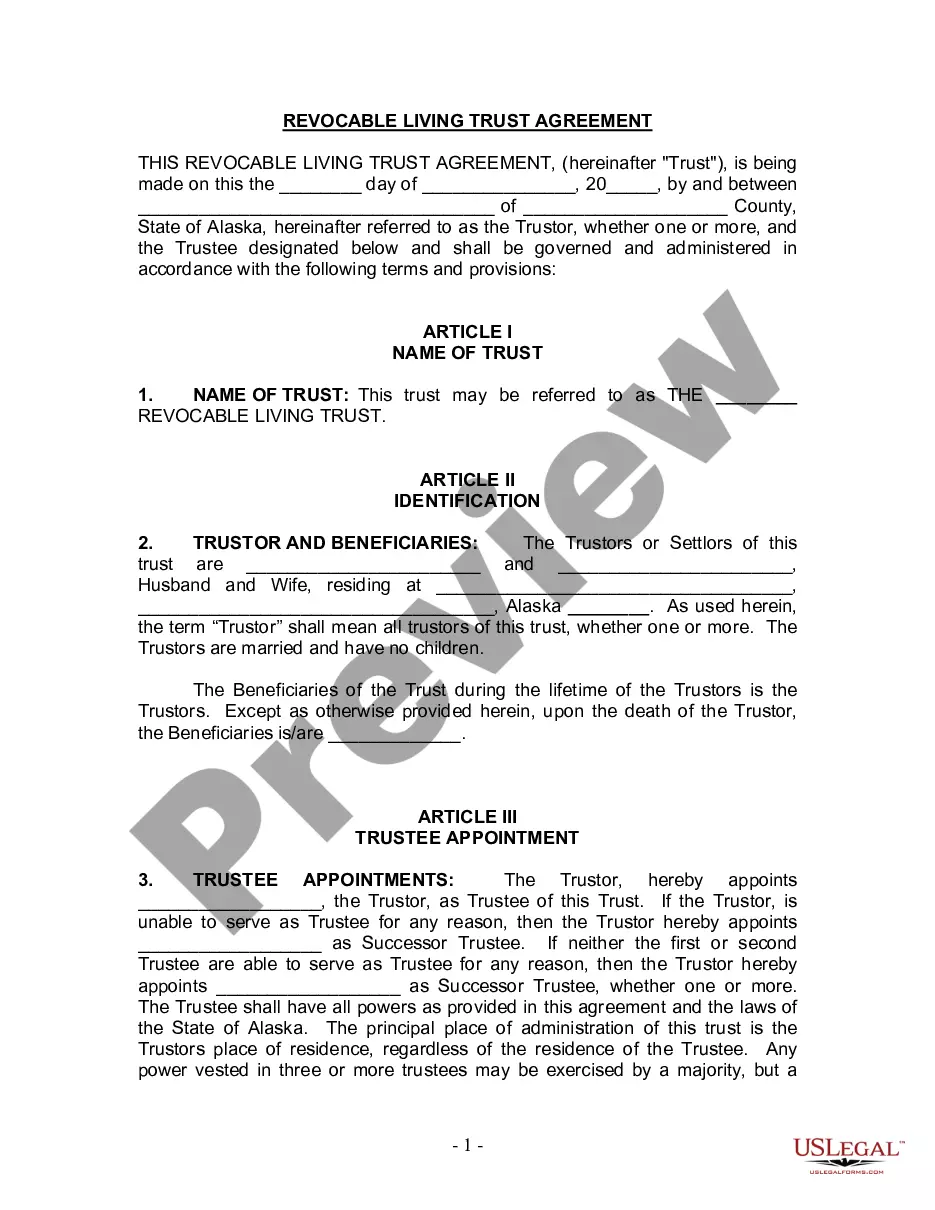

This Living Trust form is a living trust prepared for your State. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Alaska Living Trust for Husband and Wife with No Children

Description

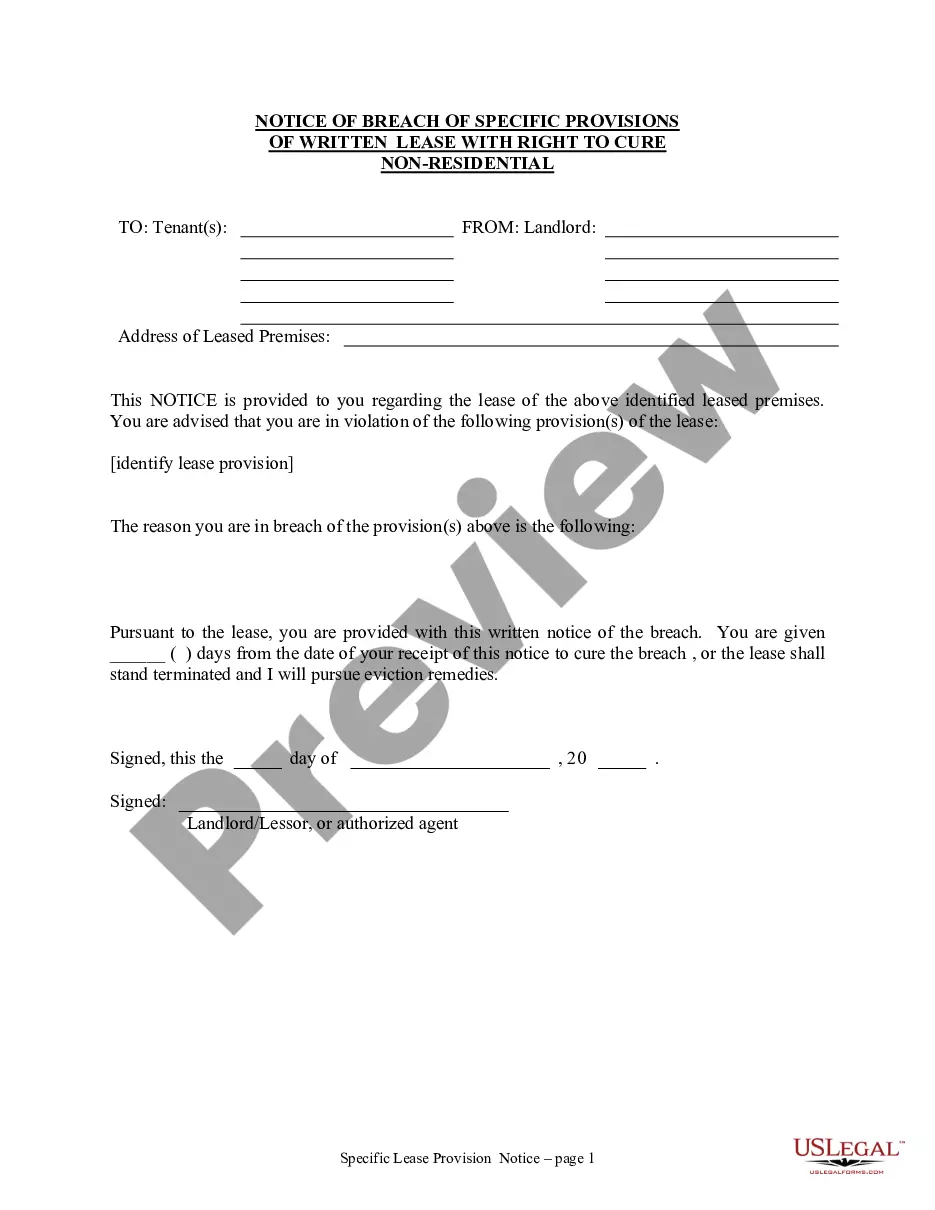

How to fill out Alaska Living Trust For Husband And Wife With No Children?

Utilizing an Alaska Living Trust for Spouses without Children templates crafted by proficient attorneys provides you the opportunity to sidestep difficulties when filling out paperwork.

Simply download the template from our site, complete it, and request a lawyer to confirm it.

This approach can assist you in conserving significantly more time and expenses than asking a lawyer to draft a document from the beginning for you.

Utilize the Preview feature and read the description (if available) to determine if you need this specific sample and if so, click Buy Now. Seek out another template using the Search field if necessary. Choose a subscription that suits your needs. Get started with your credit card or PayPal. Pick a file format and download your document. Once you’ve completed all the steps above, you will be able to fill out, print, and sign the Alaska Living Trust for Spouses without Children template. Make sure to double-check all entered information for accuracy before submitting or sending it out. Reduce the time spent on filling out documents with US Legal Forms!

- If you’ve already purchased a US Legal Forms subscription, just Log In to your account and navigate back to the form page.

- Locate the Download button next to the template you are reviewing.

- After downloading a document, your saved samples can be found in the My documents section.

- If you do not have a subscription, that’s not an issue.

- Simply adhere to the instructions below to register for an account online, obtain, and finalize your Alaska Living Trust for Spouses without Children template.

- Verify and make certain that you’re acquiring the correct state-specific form.

Form popularity

FAQ

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

If you die without a valid will, your state's intestacy laws determine the distribution of probate assets. Some states' laws provide that a surviving spouse automatically inherits all of the assets whether or not the couple had children together.

Joint tenancy with right of survivorship. Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Tenancy by the entirety. Community property with right of survivorship.

In Alaska, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

An Alaska Trust is an irrevocable trust which allows the grantor to transfer assets to his trust and to be a beneficiary to whom the trustee can distribute trust property. If the trust is not obligated to distribute trust assets to the grantor/beneficiary, the assets will not be subject to his or her creditors' claims.