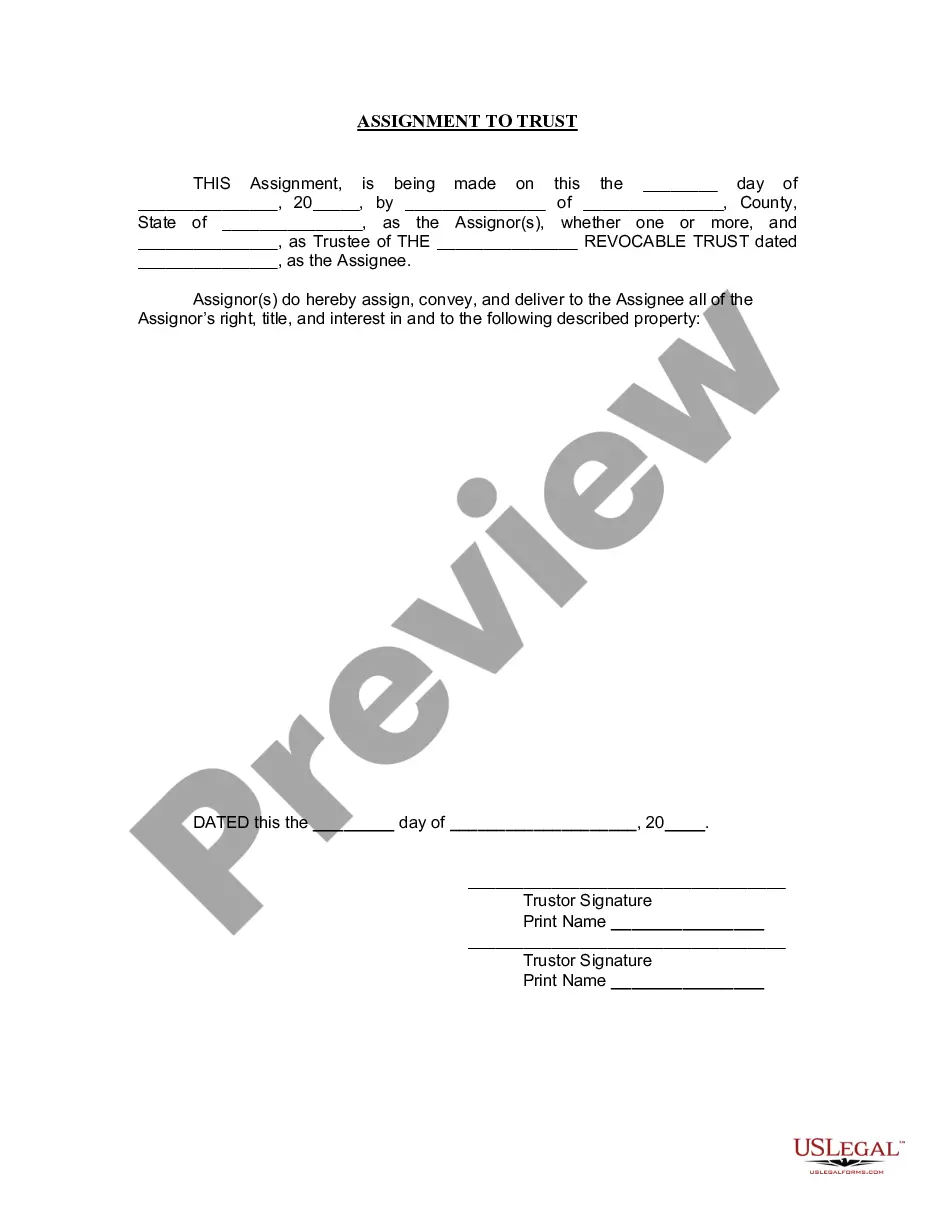

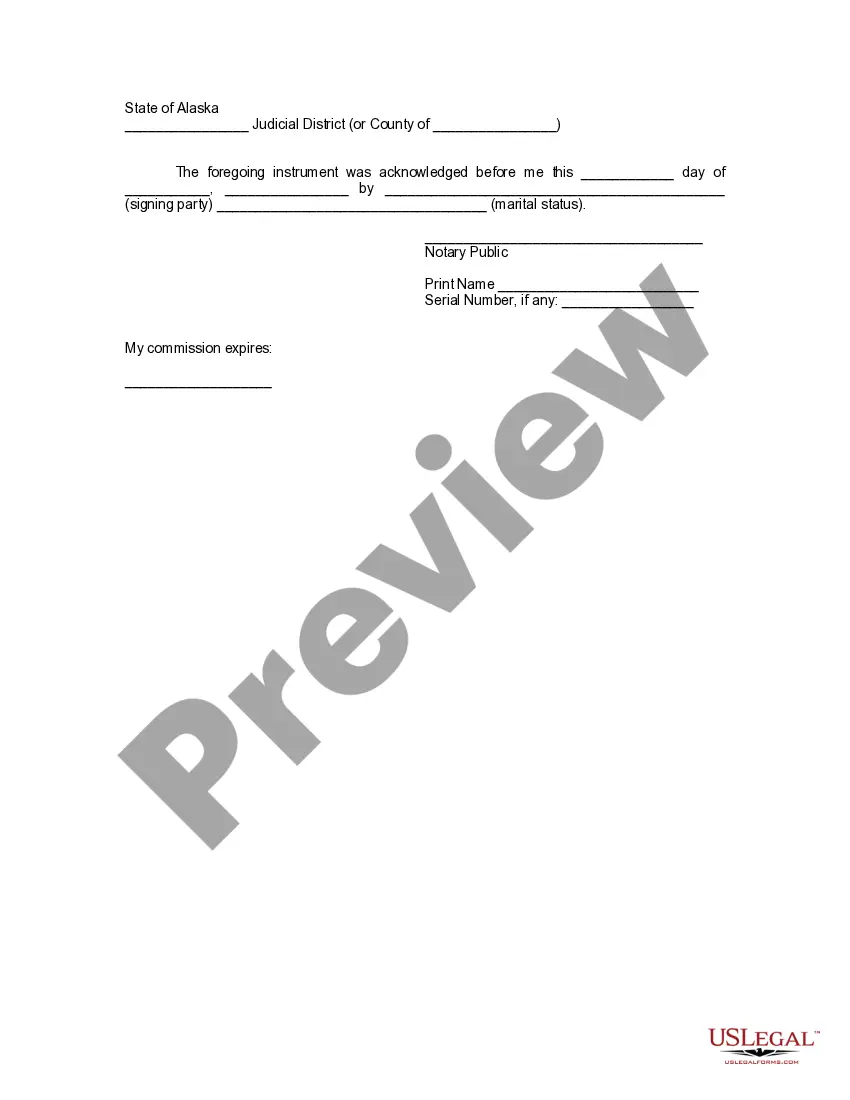

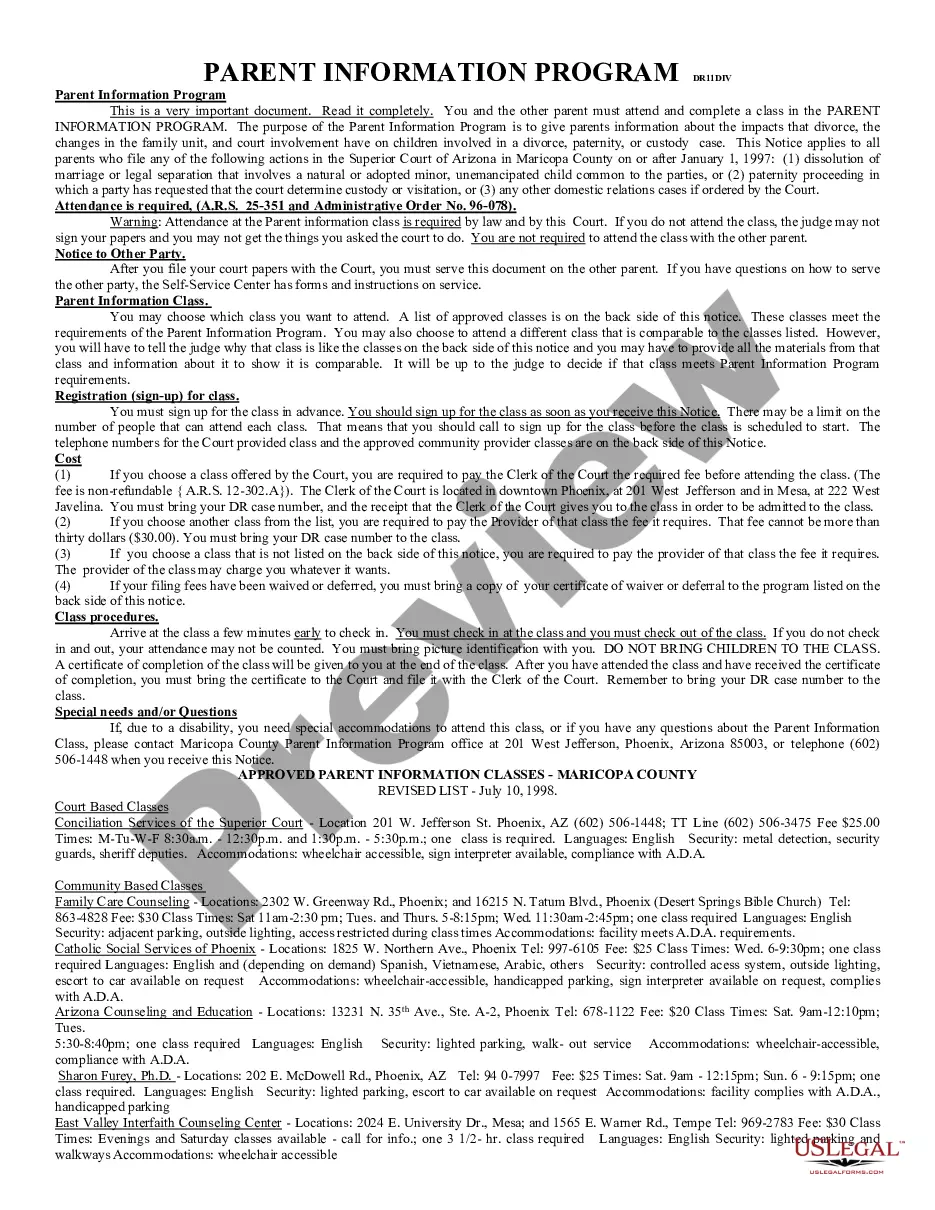

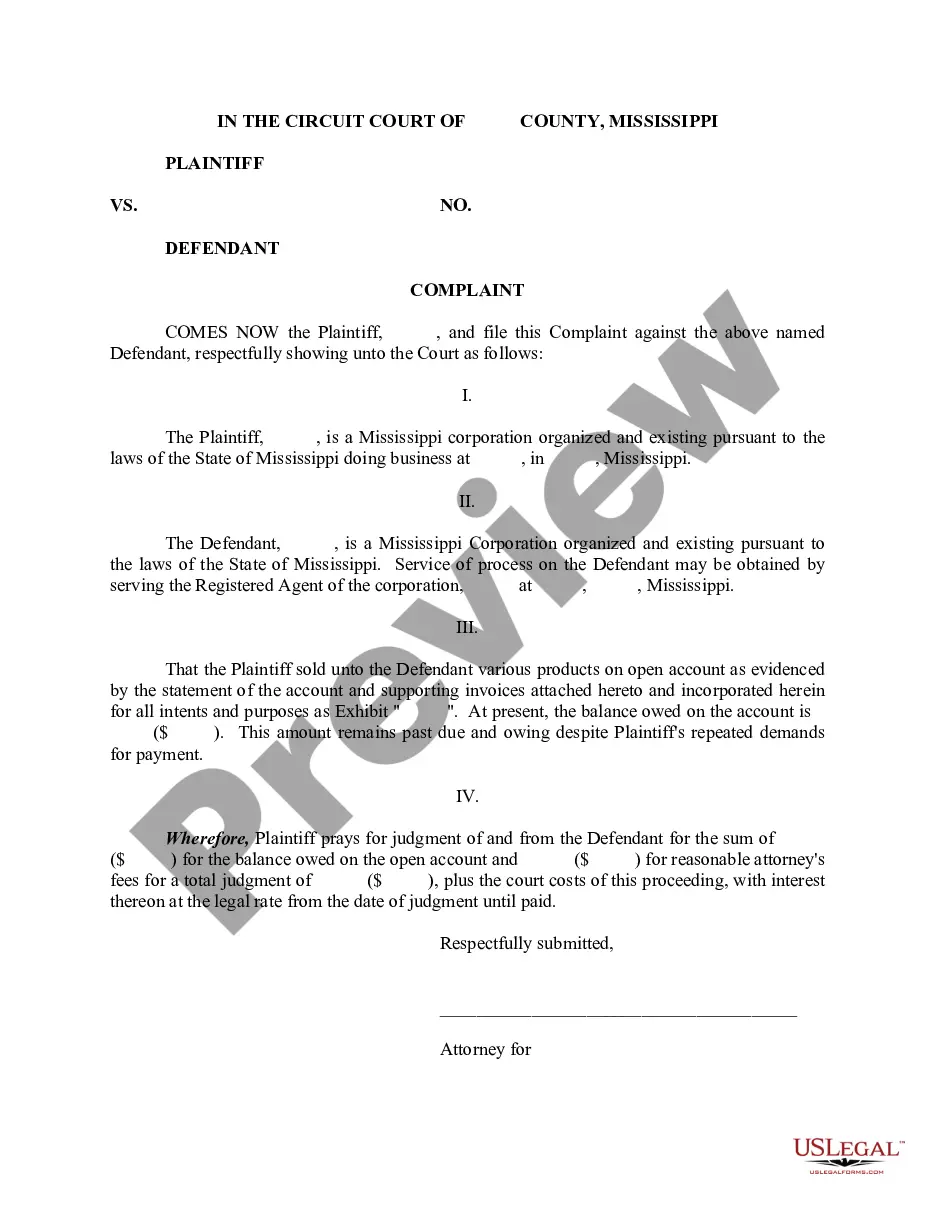

This Assignment to Living Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Alaska Assignment to Living Trust

Description Alaska Assignment Editable

How to fill out Assignment Trust Form?

Leveraging Alaska Assignment to Living Trust templates crafted by skilled lawyers allows you to steer clear of complications when filing documents.

Simply download the template from our site, complete it, and request an attorney to validate it.

This approach can save you significantly more time and effort compared to searching for a lawyer to create a file from the beginning for you would.

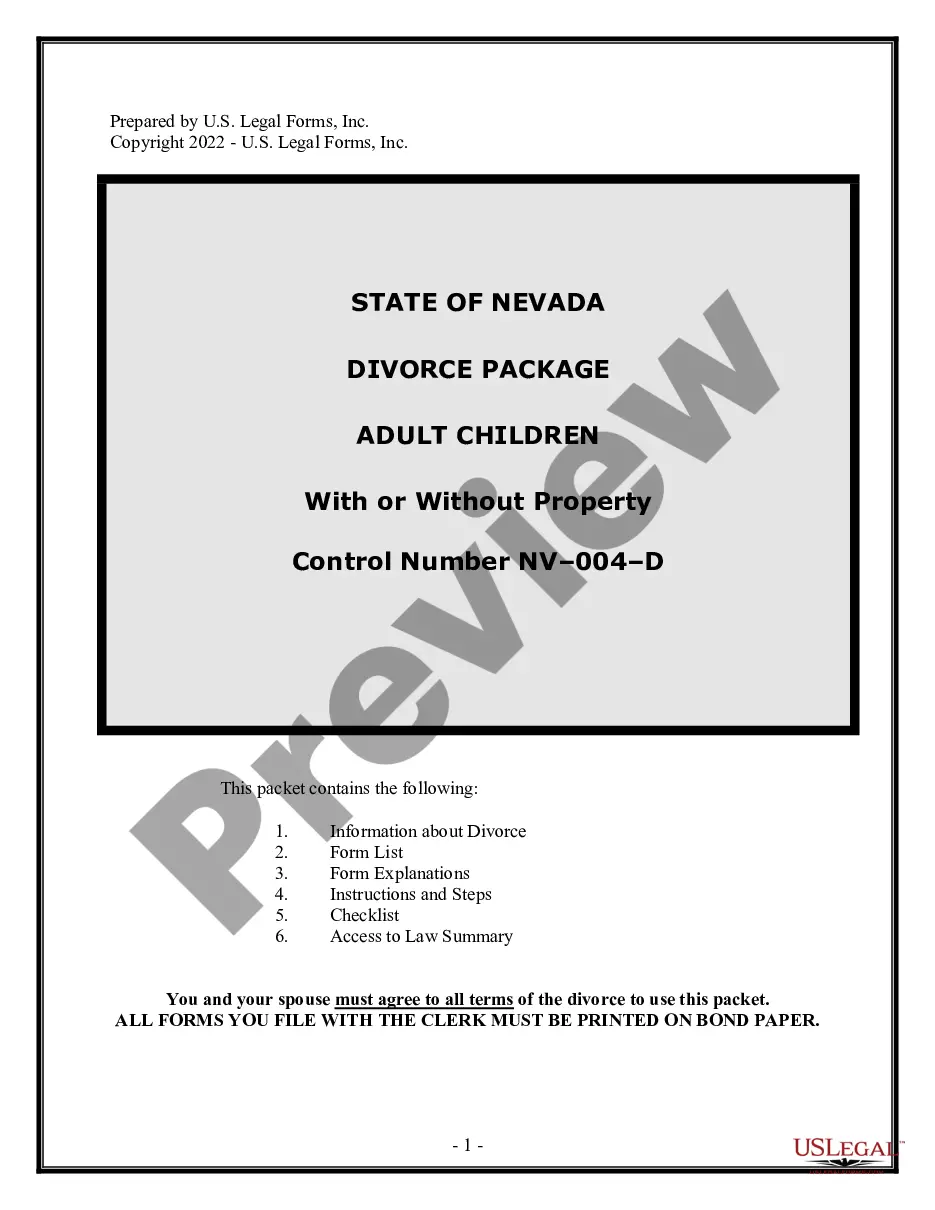

Utilize the Preview feature and examine the description (if available) to determine if you need this specific sample, and if so, simply click Buy Now. Find another document using the Search field if necessary. Select a subscription that suits your needs. Begin with your credit card or PayPal. Choose a file format and download your document. After completing all of the above steps, you’ll be able to finalize, print, and sign the Alaska Assignment to Living Trust sample. Remember to verify all entered details for accuracy before submitting or sending it out. Reduce the time spent on document creation with US Legal Forms!

- If you already possess a US Legal Forms subscription, just Log In/">Log In to your account and return to the form webpage.

- Locate the Download button near the template you are reviewing.

- Shortly after downloading a file, you can find your saved samples in the My documents section.

- If you do not hold a subscription, that’s not an issue.

- Simply adhere to the step-by-step instructions below to register for your account online, acquire, and complete your Alaska Assignment to Living Trust template.

- Double-check and ensure that you’re downloading the appropriate state-specific form.

Ak Assignment Form popularity

Alaska Living Form Other Form Names

Ak Living Trust FAQ

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

If you have a revocable living trust, it should still be valid in your new state, or in any state for that matter. The main consideration with your trust when you move is to make sure it is funded with all of the assets you want to pass directly to a beneficiary.

Trusts are transferrable from state to state, but it always makes sense to have your estate plan reviewed when you move.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

Due to these different definitions, it is possible for a trust to fall within more than one state resident trust definition and be subject to state income taxes in multiple states. It is also possible for a trust to not be a resident trust of any state and thereby avoid paying any state income taxes.

If your will and revocable trusts were properly executed in accordance with the laws of one state, they are usually valid in other states.Your heirs might need to rely on the laws of another state to establish the validity of your will and trusts, and opinions from attorneys in two separate states may be required.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Out-of-State Trustees The successor trustee does not have to live in the same state as you do.But for transfers of property such as securities and bank accounts, it usually won't make much difference where the successor trustee lives.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.