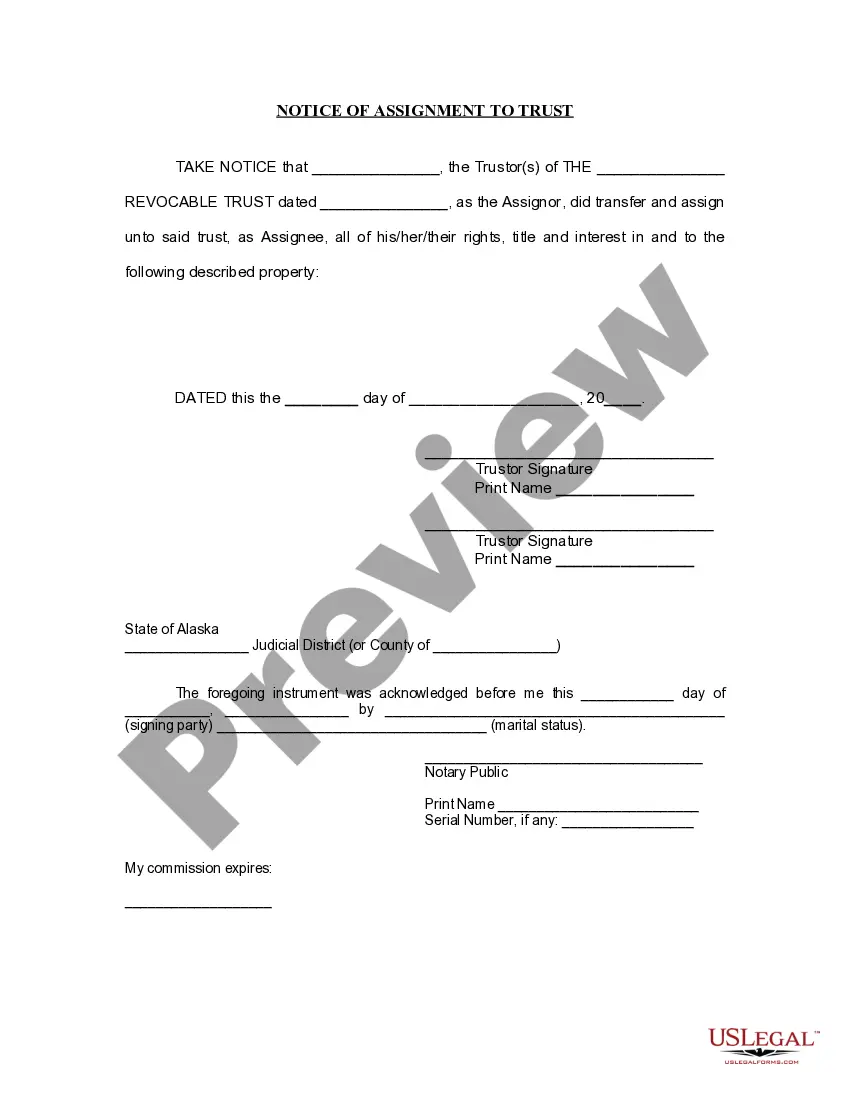

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Alaska Notice of Assignment to Living Trust

Description

How to fill out Alaska Notice Of Assignment To Living Trust?

Utilizing Alaska Notice of Assignment to Living Trust samples crafted by skilled attorneys allows you to avoid complications when filling out documentation.

Simply download the template from our site, complete it, and have an attorney verify it for you.

By doing this, you will conserve significantly more time and energy than seeking legal advice to create a document entirely from the ground up according to your specifications.

Don’t forget to verify all entered information for accuracy before submitting or mailing it. Reduce the time you spend on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and return to the form webpage.

- Locate the Download button next to the templates you’re reviewing.

- Upon downloading a document, you will find all of your stored samples under the My documents tab.

- If you lack a subscription, that’s not an issue.

- Just follow the instructions below to create an account online, obtain, and finalize your Alaska Notice of Assignment to Living Trust template.

- Double-check and confirm that you’re downloading the appropriate state-specific document.

Form popularity

FAQ

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.