Alaska Small Estate Affidavit for Summary Administration of Estates

Description

How to fill out Alaska Small Estate Affidavit For Summary Administration Of Estates?

Utilizing Alaska Small Estate Affidavit for Summary Administration of Estates templates developed by experienced attorneys allows you to evade complications when submitting paperwork. Simply download the form from our site, complete it, and request a lawyer to review it. This approach can conserve you considerably more time and energy than searching for an attorney to craft a document from the ground up to meet your requirements would.

If you already possess a US Legal Forms subscription, just Log In/">Log In to your account and return to the form webpage. Locate the Download button next to the templates you’re examining. Shortly after downloading a document, you can access all of your saved samples in the My documents tab.

When you lack a subscription, that's not a significant issue. Just adhere to the instructions below to register for an account online, obtain, and fill out your Alaska Small Estate Affidavit for Summary Administration of Estates template.

Once you’ve completed all the aforementioned steps, you will be able to fill out, print, and sign the Alaska Small Estate Affidavit for Summary Administration of Estates template. Be sure to double-check all entered information for accuracy before submitting it or dispatching it. Reduce the time spent on completing paperwork with US Legal Forms!

- Verify and ensure that you’re downloading the correct state-specific form.

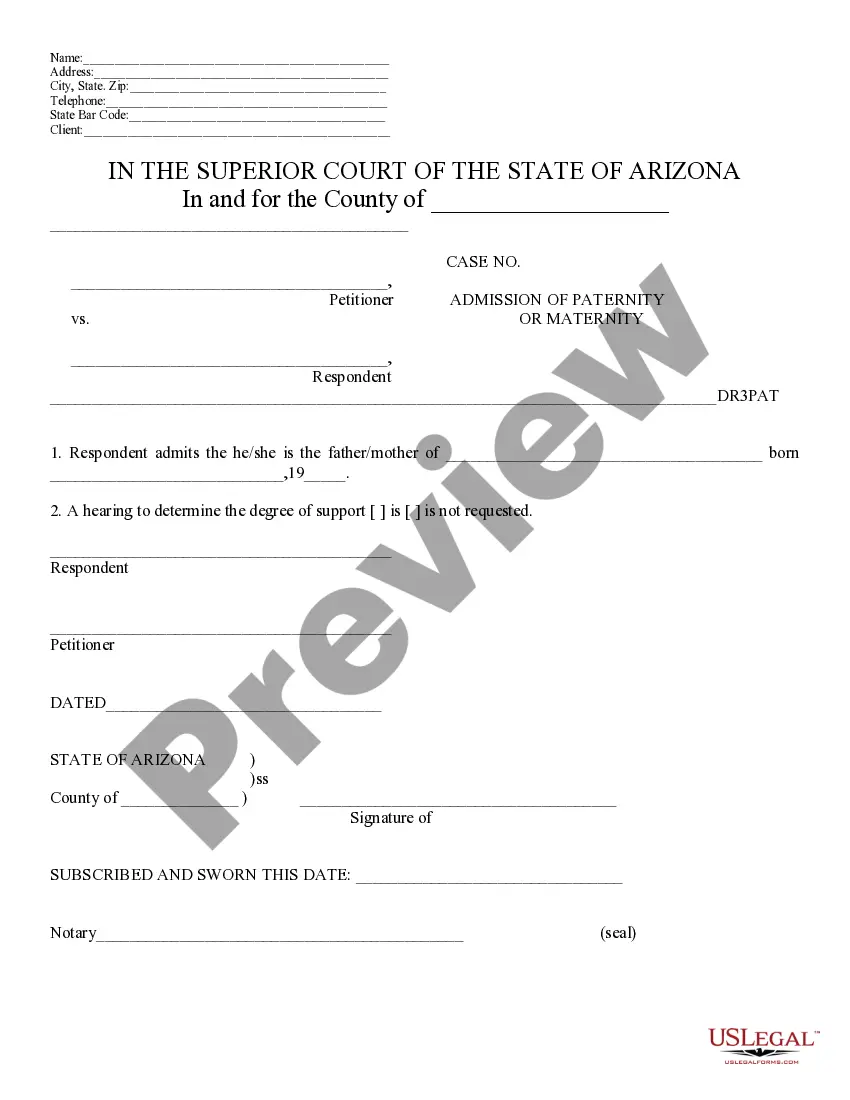

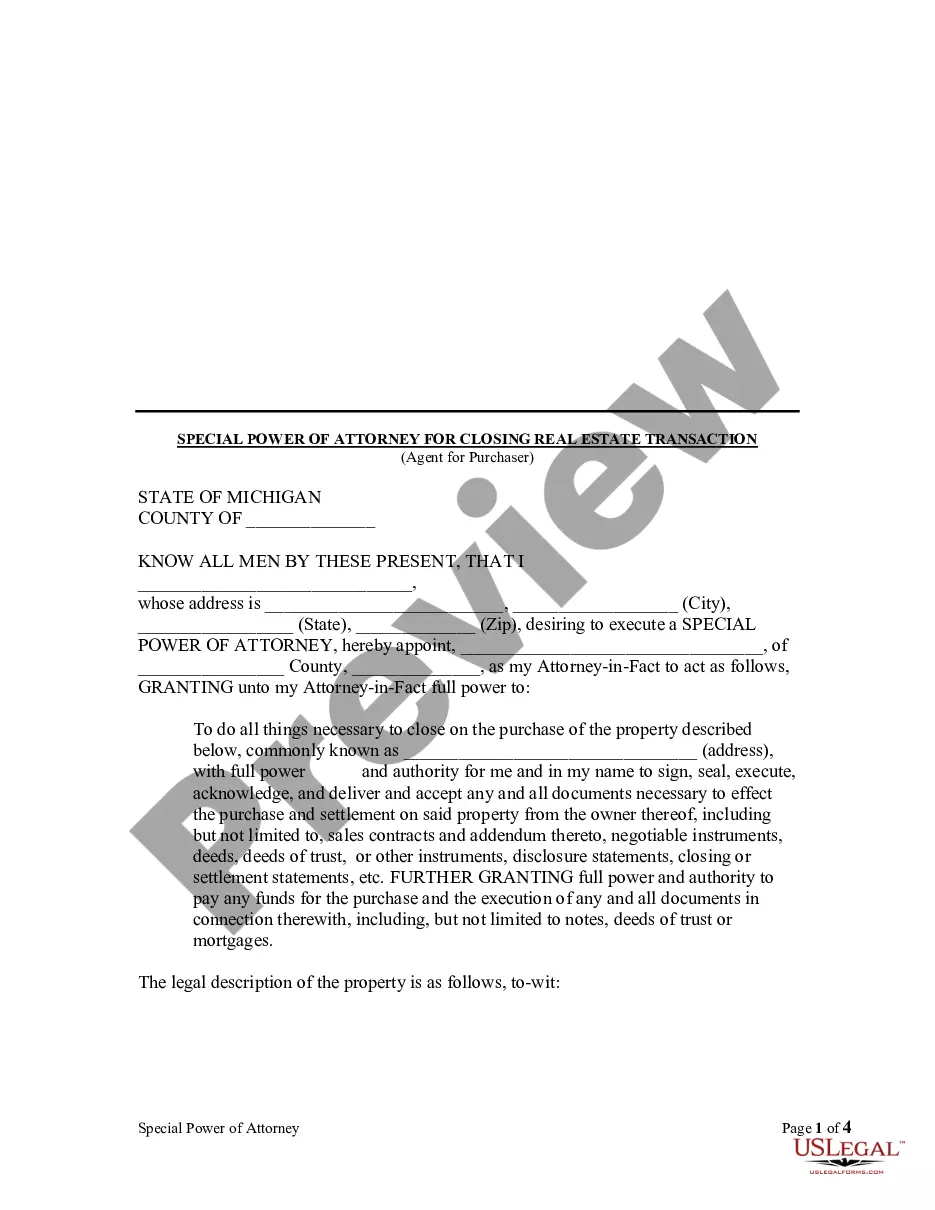

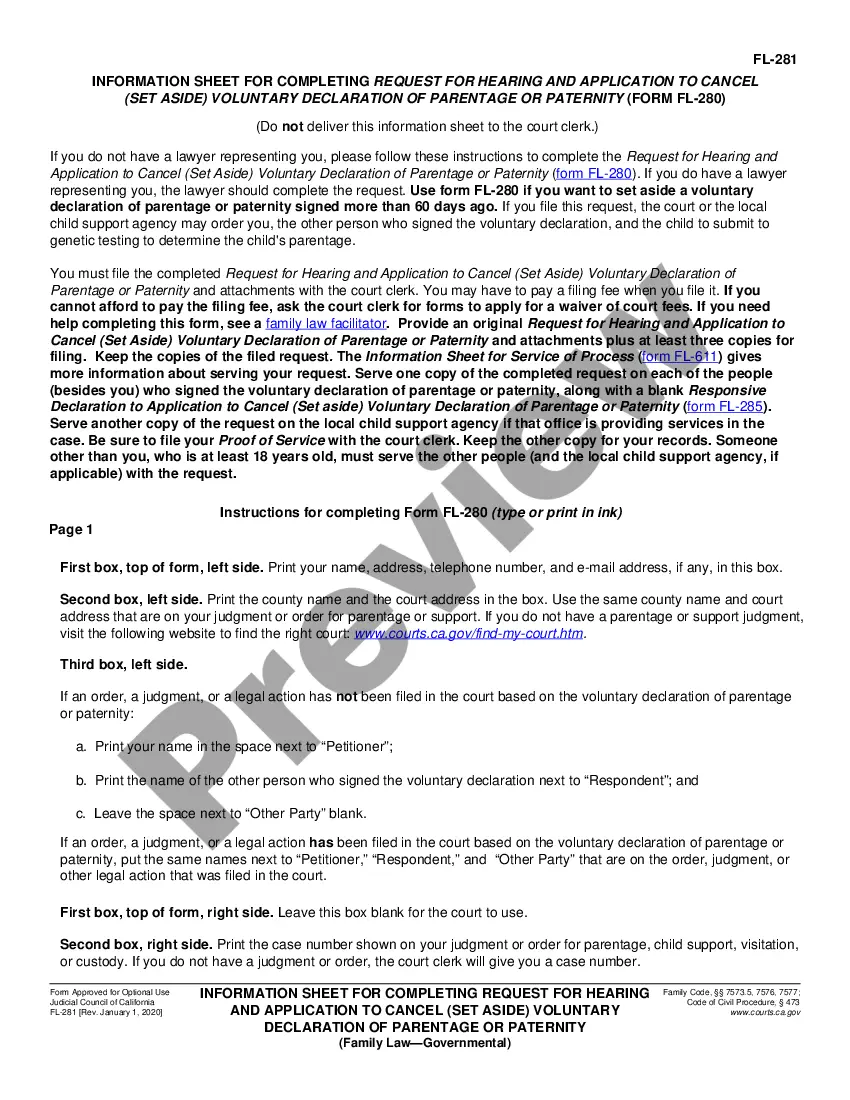

- Utilize the Preview feature and review the description (if available) to ascertain whether you require this particular example and if you do, click Buy Now.

- Search for another file using the Search field if necessary.

- Choose a subscription that meets your requirements.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.