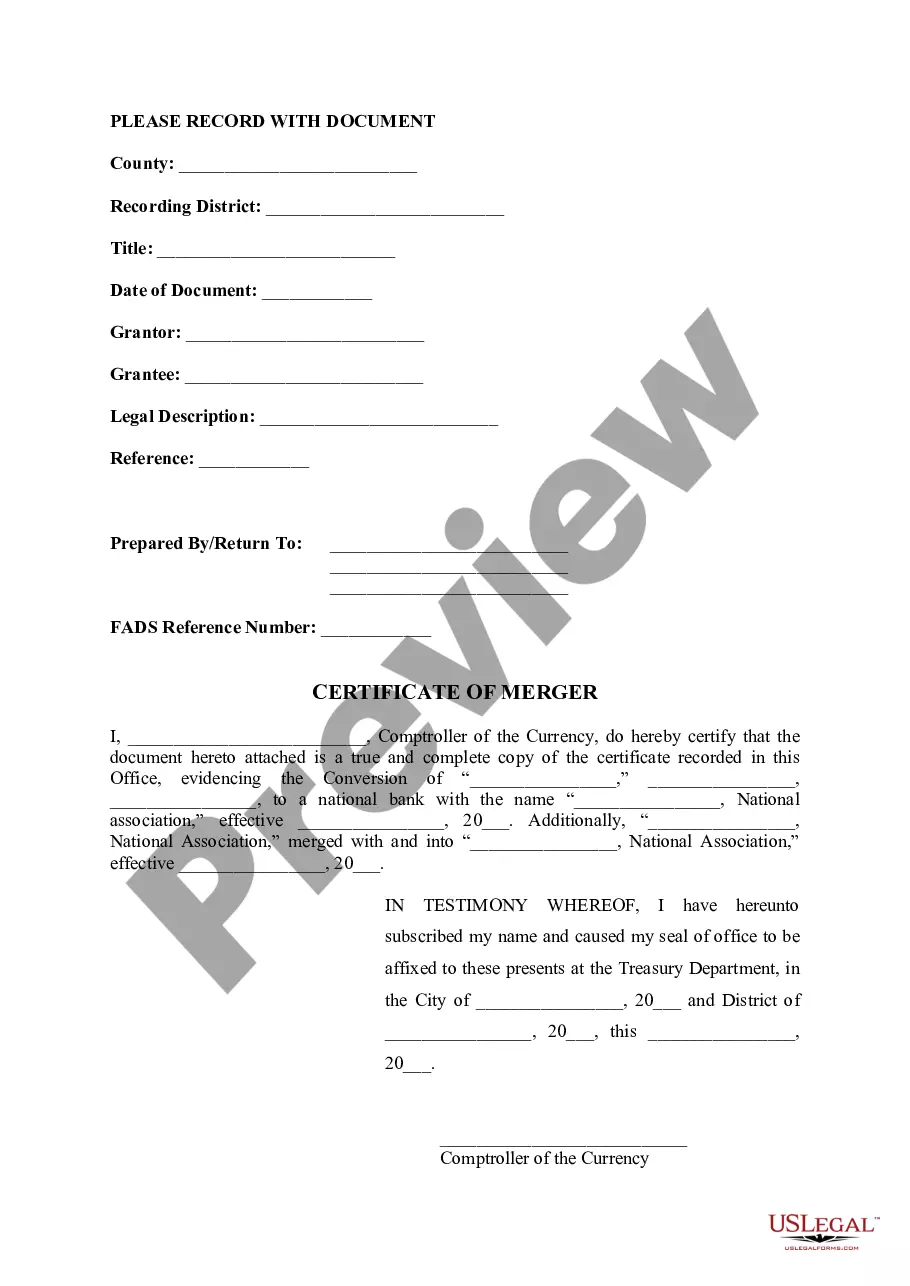

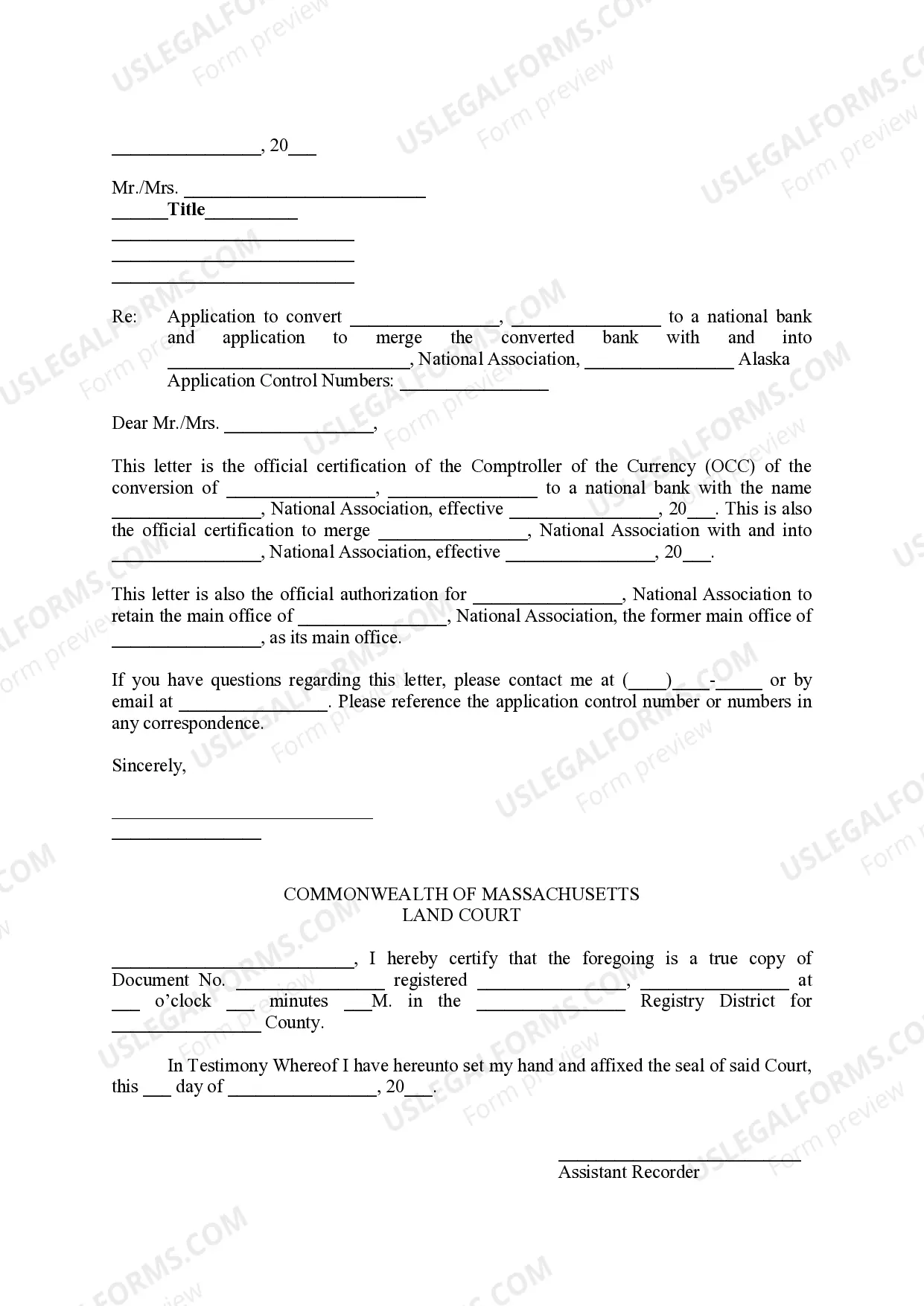

Alaska Certificate of Merger

Description

How to fill out Alaska Certificate Of Merger?

Employing Alaska Certificate of Merger templates designed by professional attorneys allows you to steer clear of complications when filling out forms.

Simply acquire the template from our site, complete it, and have a legal expert validate it.

This can save you significantly more time and expenses than having a lawyer create a document entirely from the ground up to meet your specifications.

After completing all of the aforementioned steps, you'll be able to finalize, print, and sign the Alaska Certificate of Merger form. Remember to verify all entered information for accuracy before submitting or dispatching it. Reduce the time spent on document preparation with US Legal Forms!

- If you currently possess a US Legal Forms subscription, just Log In/">Log In to your profile and return to the sample page.

- Locate the Download button adjacent to the templates you are reviewing.

- After downloading a document, you can find all of your saved files in the My documents section.

- If you don’t have a subscription, that’s not a major issue.

- Just follow the steps below to register for your online account, acquire, and fill out your Alaska Certificate of Merger template.

- Ensure that you are downloading the correct form specific to your state.

Form popularity

FAQ

Business License Section: 020, you must obtain a business license. Apply to the State of Alaska Business License Section for a business license. Note: The business license application will ask for the Alaska entity number (from Step 2, if applicable) and professional license number (from Step 1, if applicable).

Renew Online. If it has been 9 months or less since your business license expired then you may renew online and immediately print your renewed business license. Renew Hardcopy (Form 08-4617) New Online. New Hardcopy (Form 08-4181)

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

Apply hardcopy (via in-person, fax, or U.S. Mail) by submitting Business License: NEW Application (form 08-4181) along with the appropriate fees. Do not email payments or filings. For security reasons, do not email filings, payment, or other confidential information.

Alaska LLCs must file a Biennial Report Every LLC in Alaska is required to file a Biennial Report every 2 years. The purpose of the Biennial Report is to keep your LLC's contact information up to date with the state.

No. The requirement to obtain an Alaska Business License is based on business activity; it is not based upon whether you have a physical presence or physical location in the State of Alaska.020(a) a business license is required for the privilege of engaging in a business in the State of Alaska. Per AS 43.70.

Register your corporation/entity with the State of Alaska Corporations Section to receive an Alaska entity number . All forms are located on our Forms and Fees page. Once on that page, scroll down to your specific entity type and click on the appropriate form.

The filing fee is $100 for Alaska LLCs, $200 for foreign LLCs. The Initial Report and Biennial Report must include: the LLCs name and the state or country where it is organized.