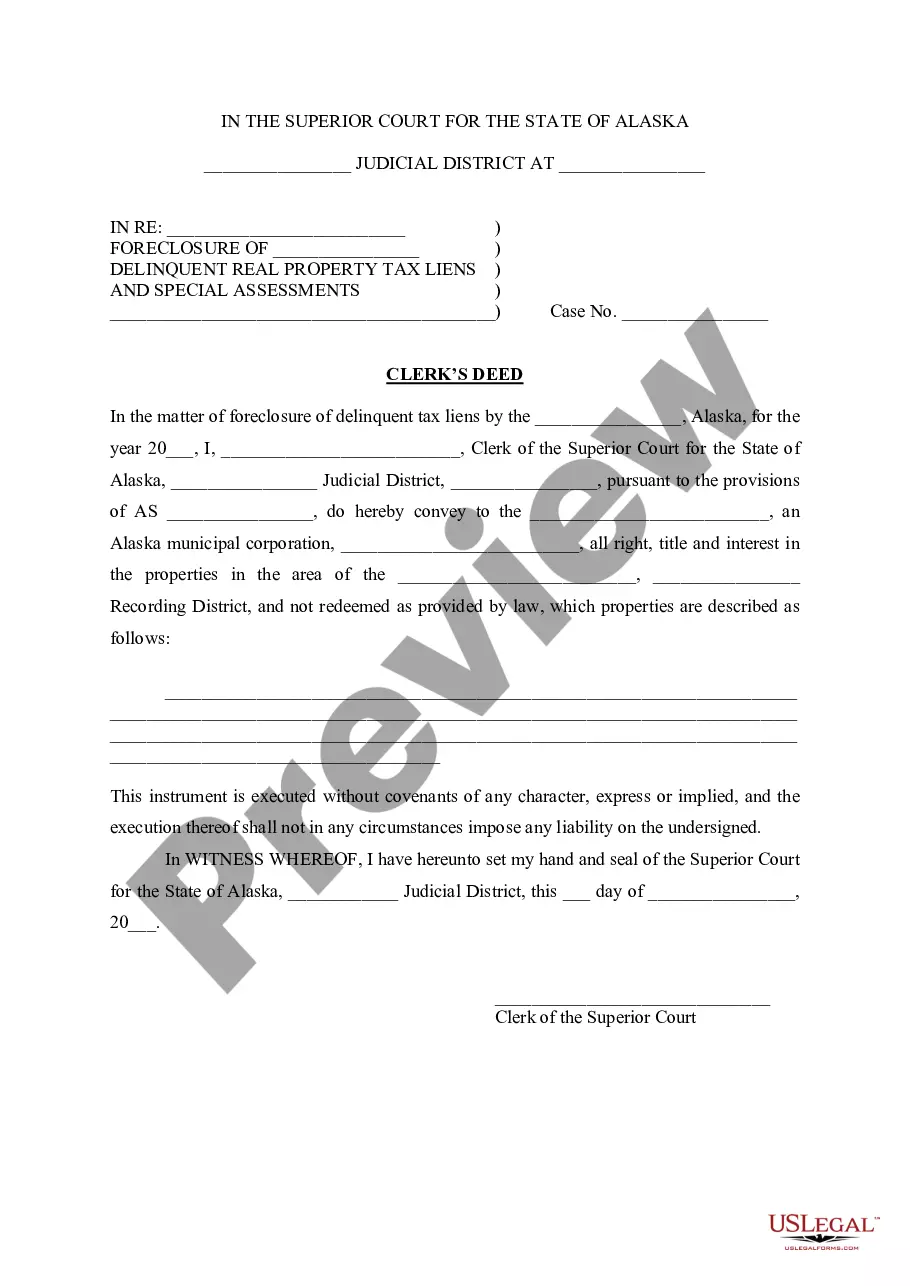

Alaska Clerk's Deed - Foreclosure of Property for Delinquent Tax Lien

Description Does Alaska Have Property Tax

How to fill out Alaska Clerk's Deed - Foreclosure Of Property For Delinquent Tax Lien?

Employing Alaska Clerk's Deed - Foreclosure of Property for Unpaid Tax Lien examples crafted by seasoned attorneys provides you the chance to evade stress when completing paperwork.

Simply download the template from our site, complete it, and seek a legal expert to validate it.

This can assist you in saving significantly more time and money than hiring legal advice to create a document tailored to your needs would.

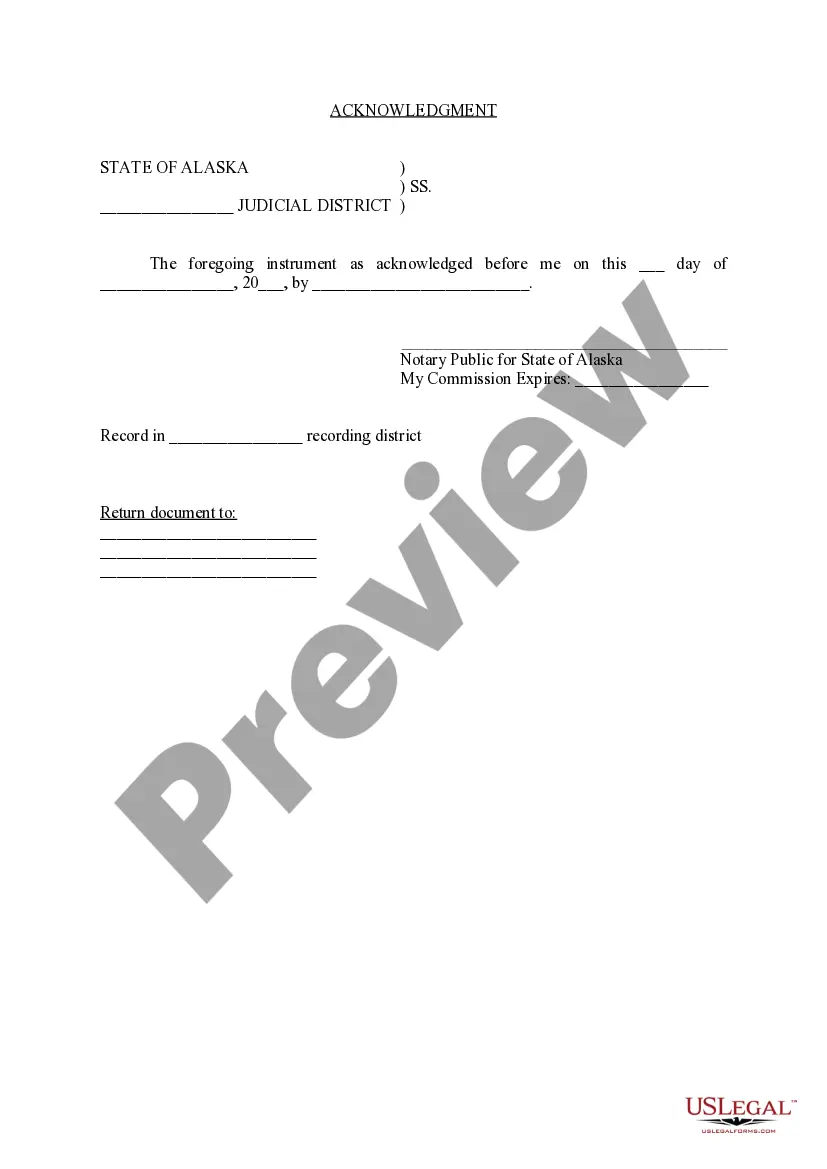

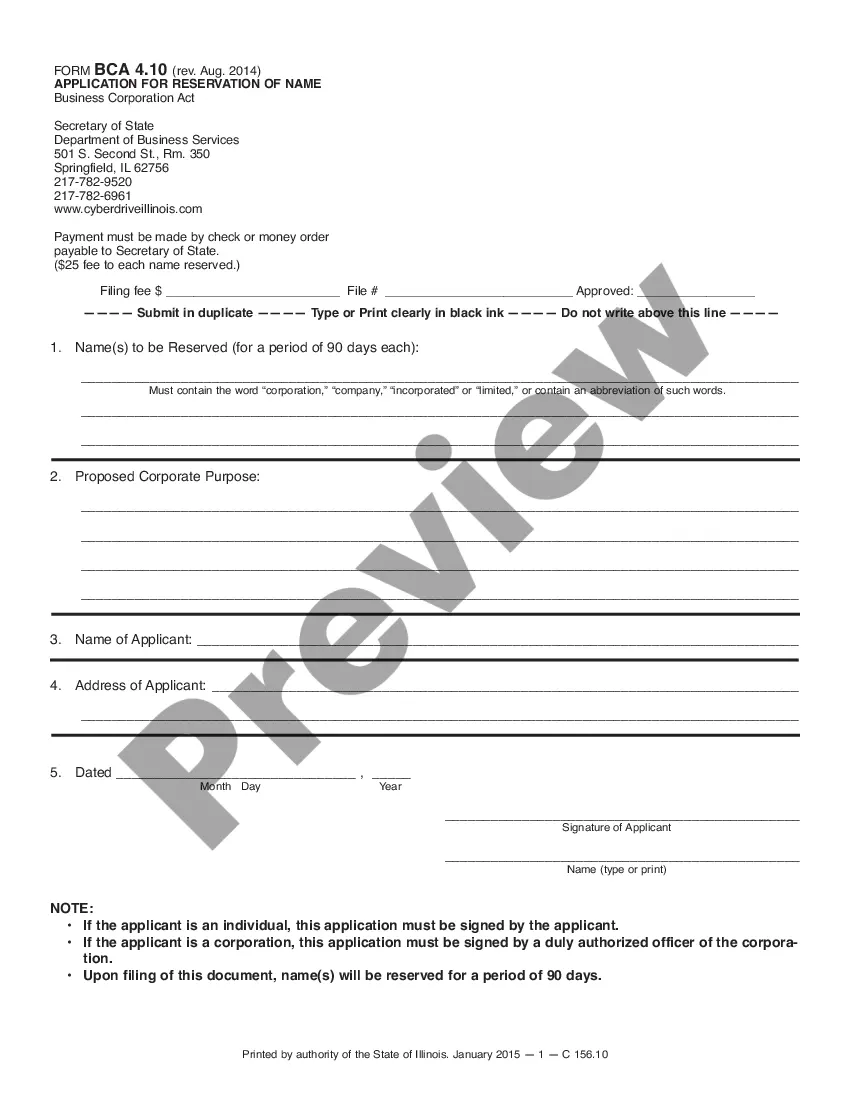

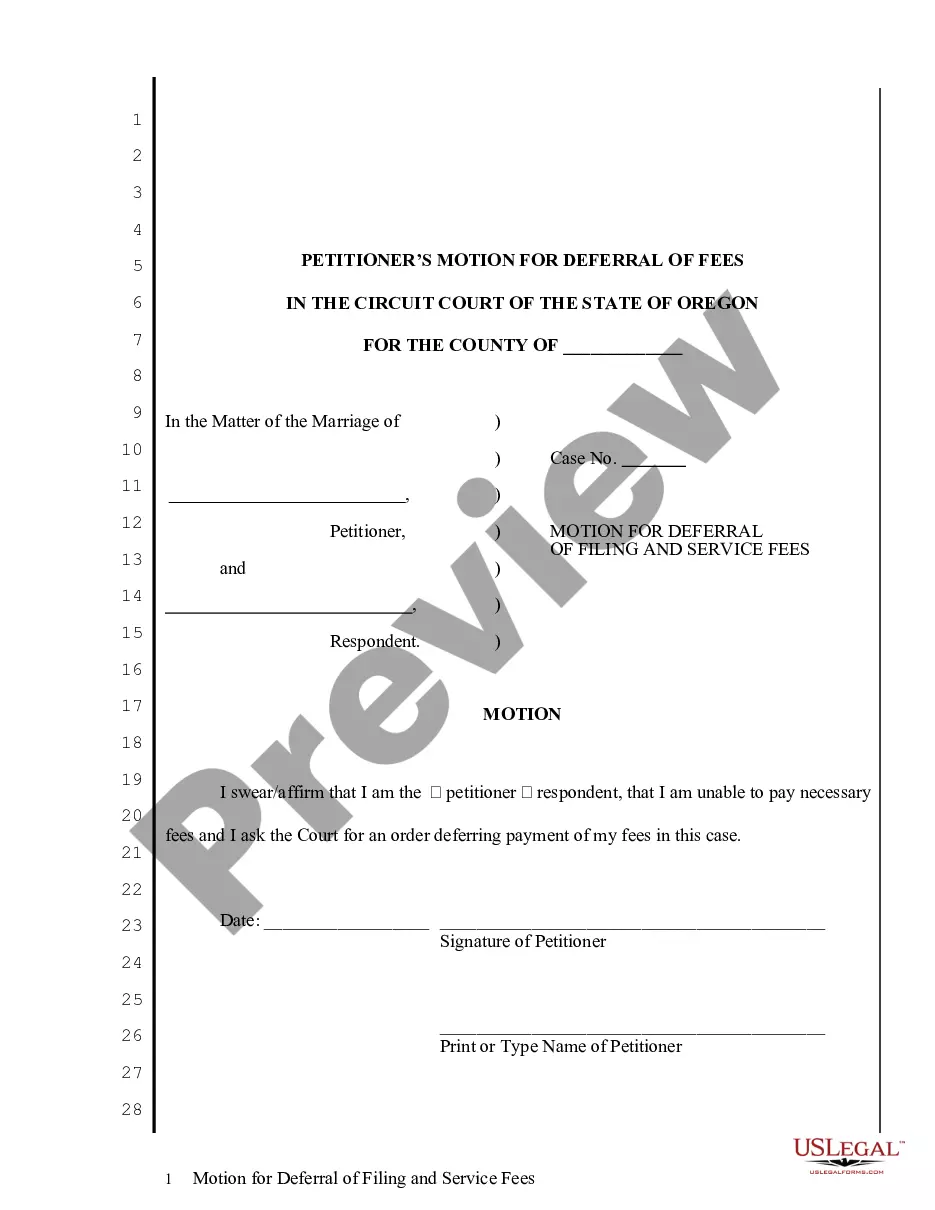

Utilize the Preview functionality and read the description (if present) to ascertain whether you require this specific template and if so, just click Buy Now. Find another example using the Search field if necessary. Choose a subscription that suits your needs. Start with your credit card or PayPal. Select a file format and download your document. Once you have completed all the steps mentioned above, you will be able to finish, print, and sign the Alaska Clerk's Deed - Foreclosure of Property for Unpaid Tax Lien template. Remember to recheck all entered details for accuracy before submitting or mailing it. Minimize the time spent on completing documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In/">Log In to your account and revisit the sample page.

- Locate the Download button next to the template you are reviewing.

- After acquiring a document, you will find all your downloaded samples in the My documents section.

- In case you lack a subscription, that’s not an issue.

- Simply adhere to the instructions below to register for your account online, obtain, and fill out your Alaska Clerk's Deed - Foreclosure of Property for Unpaid Tax Lien template.

- Verify and ensure you are downloading the accurate state-specific form.

Form popularity

FAQ

Tax deed sales must eliminate any community association liens and debts acquired prior to the tax deed. Tax deed sales must reduce any code enforcement liens to hard costs if the tax deed investor timely addresses such liens and underlying issues after purchasing the tax deed.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes.The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure. If there are any excess proceeds after the foreclosure sale, the IRS may seek to recover that money and apply it to the outstanding debt.

If all attempts to collect on the delinquent taxes have been exhausted and the redemption period expires, the lien holder can initiate a judicial foreclosure proceeding against the property itself. The court then orders a foreclosure auction be held to collect the money to satisfy the unpaid tax lien.

Normally, because property tax liens are superior to all other liens, their foreclosure eliminates all junior liens, including those for mortgages. Occasionally, buyers of tax-foreclosed properties have discovered that the property actually carries a surviving mortgage lien.

In cases where the mortgage lender recorded its lien (the mortgage) before the IRS records a Notice of Federal Tax Lien, the mortgage has priority. This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure.

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

The answer is, it depends. For homeowners who would like to keep their homes (by redeeming the mortgage during the 6 month redemption period) they must pay property taxes as well as any interest and costs as well as the balance of the loan. In that case, the answer is simple the homeowner is responsible.

The biggest difference between a tax deed sale and the foreclosure sale has to do with due diligence by the buyer.The buyer is also liable for homeowner or condominium association fees after the tax deed is issued by the Clerk of Court.