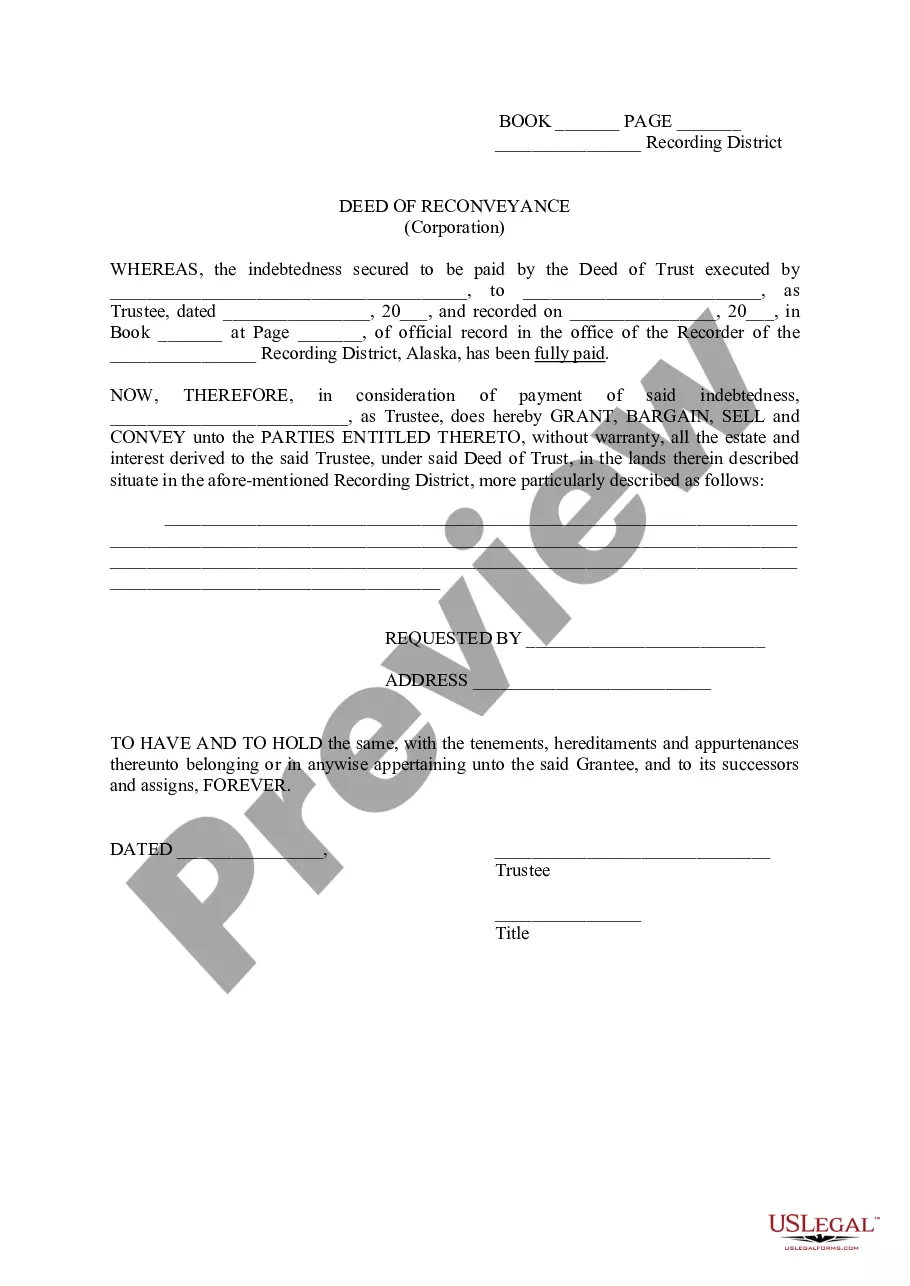

Alaska Deed of Reconveyance (Corporation)

Description Deed Of Reconveyance Form

How to fill out Alaska Deed Of Reconveyance (Corporation)?

Utilizing Alaska Deed of Reconveyance (Corporation) samples created by skilled attorneys allows you to prevent hassles while filling out documents.

Simply download the template from our website, complete it, and seek legal advice to confirm it.

This choice can help you conserve considerably more time and expenses than trying to find a lawyer to create a file from scratch for you would.

- If you possess a US Legal Forms subscription, just Log In to your account and navigate back to the form page.

- Locate the Download button next to the templates you are reviewing.

- After downloading a document, your stored samples will be found in the My documents section.

- When you lack a subscription, it's not a major issue.

- Simply adhere to the detailed instructions below to register for your online account, obtain, and fill out your Alaska Deed of Reconveyance (Corporation) template.

- Double-check to ensure you are downloading the correct state-specific form.

What Does Reconveyance Mean Form popularity

Letter Of Reconveyance Other Form Names

FAQ

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

How do you file a Deed of Reconveyance? A Deed of Reconveyance should be filed with your local county recorder or recorder of deeds once it has been signed by a notary public (such as an attorney). Once the document has been filed, the debt that was registered to the property will be considered paid off.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

Reconveyance Fee Definition The reconveyance fee the seller pays will be enough to cover the charges for recording the mortgage and deed, and those costs can vary. Generally, you can expect to pay between $50 and $65. If you want to know the exact amount you'll be charged at closing, you can ask your real estate agent.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.

A deed of reconveyance refers to a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage is paid off. It is used to clear the deed of trust from the title to the property.