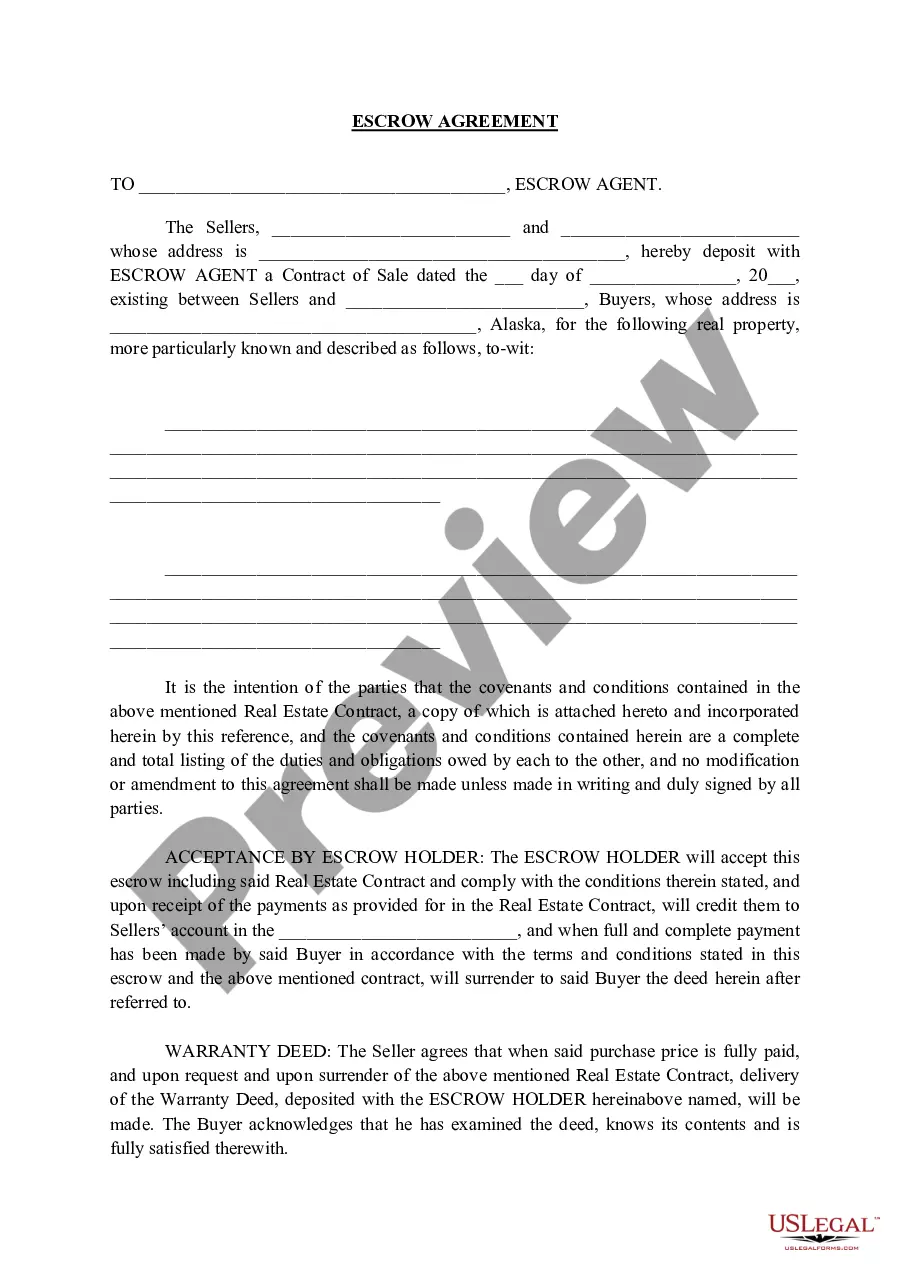

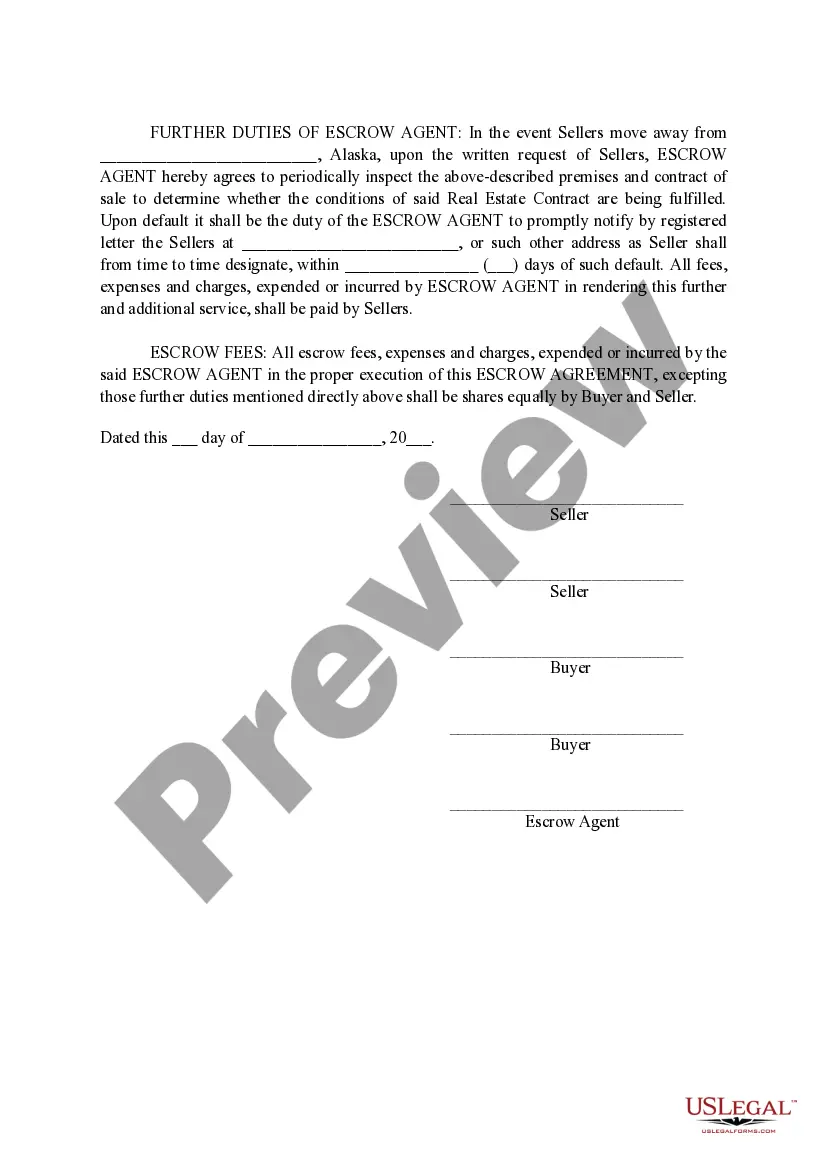

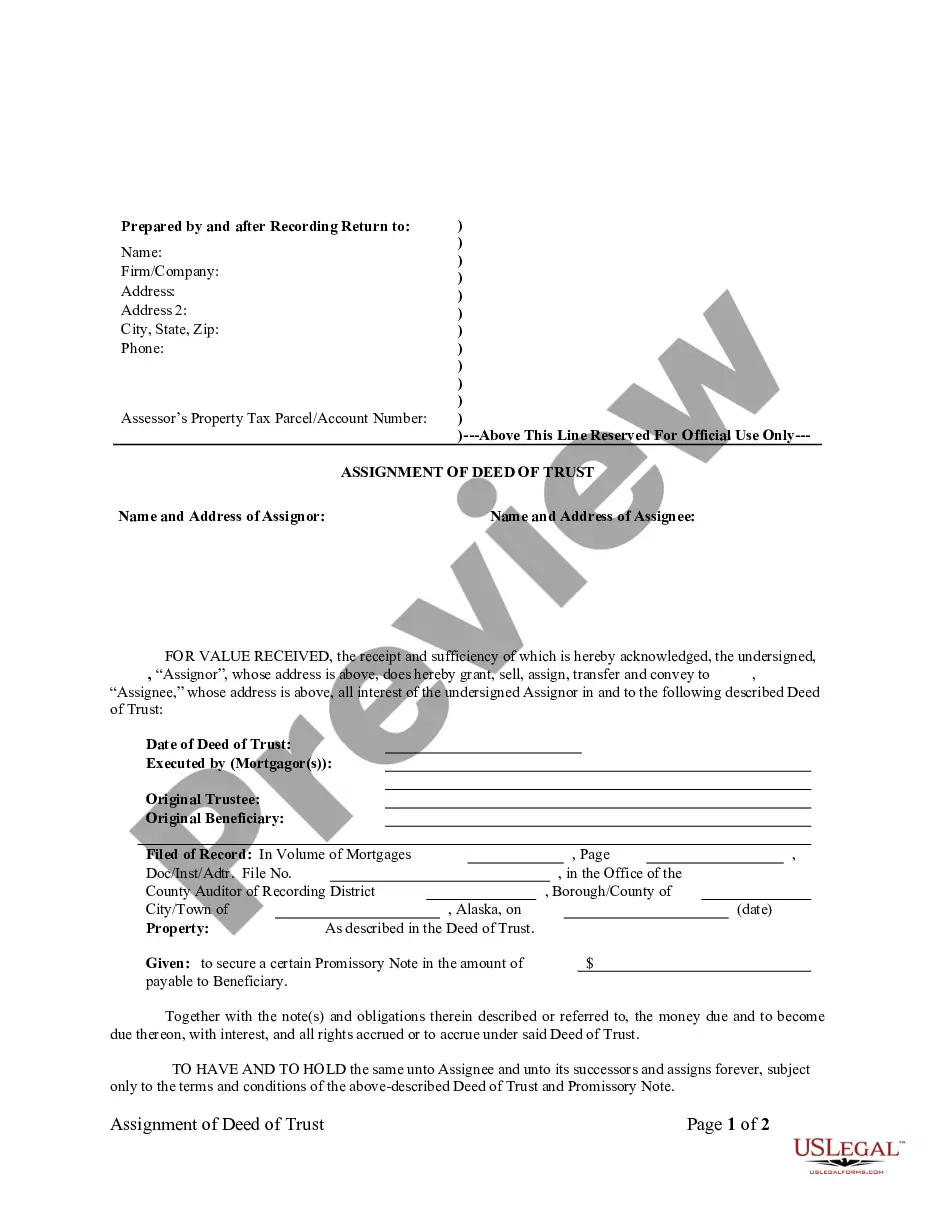

Alaska Escrow Agreement

Description What Is An Escrow Agreement

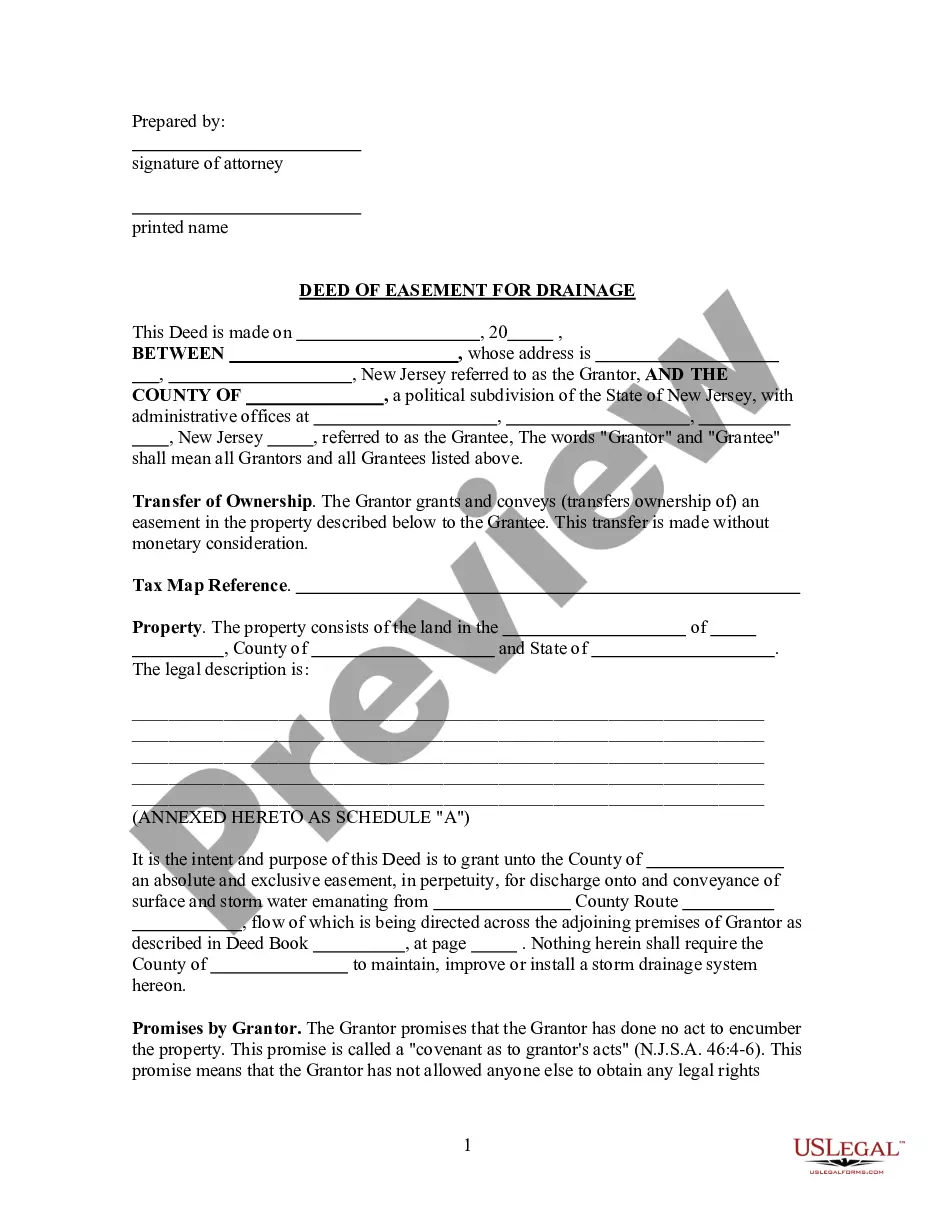

How to fill out Alaska Escrow Agreement?

Utilize US Legal Forms to secure a printable Alaska Escrow Agreement.

Our court-acceptable forms are composed and frequently refreshed by experienced attorneys.

Ours is the most comprehensive Forms library available online and offers budget-friendly and precise templates for individuals, legal experts, and small to medium-sized businesses.

Select Buy Now if it is the document you require.

- The documents are sorted into state-specific categories and some can be previewed prior to downloading.

- To access samples, users must hold a subscription and Log In/">Log In to their account.

- Click Download adjacent to any form you wish and locate it in My documents.

- For users lacking a subscription, refer to the guidelines below for swiftly finding and downloading the Alaska Escrow Agreement.

- Ensure you obtain the correct template regarding the required state.

- Examine the form by viewing the description and utilizing the Preview option.

Form popularity

FAQ

Close of escrow and your closing date could be the same day if the seller is there for your closing. However, it could be a different day altogether.Escrow is closed. However, you could close on your mortgage and take possession of the title, deed and keys from the escrow agent on a completely separate day.

Buyers stand to lose their earnest money if they jump ship on a real estate transaction.But, if a buyer decides to cancel the contract for a reason not covered by a contract contingency, earnest money is generally forfeited to the seller.

Upon the close of escrow, the earnest money deposit is applied to the balance of the down payment.That doesn't mean you can't get your deposit back or lose it, if you aren't careful. From the time you put up the deposit until you close escrow, a lot can happen.

Does the Seller Ever Keep the Earnest Money? Yes, the seller has the right to keep the money under certain circumstances. If the buyer decides to cancel the sale without a valid reason or doesn't stick to an agreed timeline, the seller gets to keep the money.

Escrow Account Refunds Lenders are required to return borrowers' escrow account funds to them once their loan accounts are closed.Generally, lenders closing out their borrowers' mortgage loans must refund any escrow account balances within 20 business days, but refunds don't always occur.

Funds in Escrow Earnest money is refundable, but you might receive a partial refund or no refund under certain circumstances.Buyers must ensure that they understand the circumstances under which they forfeit the earnest money deposit before entering into a purchase agreement.

Escrow For Securing the Purchase of a Home Once the real estate deal closes, and you sign all the necessary paperwork and mortgage documents, the earnest money from this escrow account is released. Usually, buyers get the money back and apply it to their down payment and mortgage closing costs.

Don't make any new major purchases that could affect your debt-to-income ratio. Don't apply, co-sign or add any new credit. Don't quit your job or change jobs. Don't change banks. Don't open new credit accounts. Don't close or consolidate credit card accounts without advice from your lender.

You pay escrow to seal the deal after a property owner accepts your offer. While these funds show the seller you're serious about purchasing the dwelling, if you can't close the loan, you could lose your escrow money.