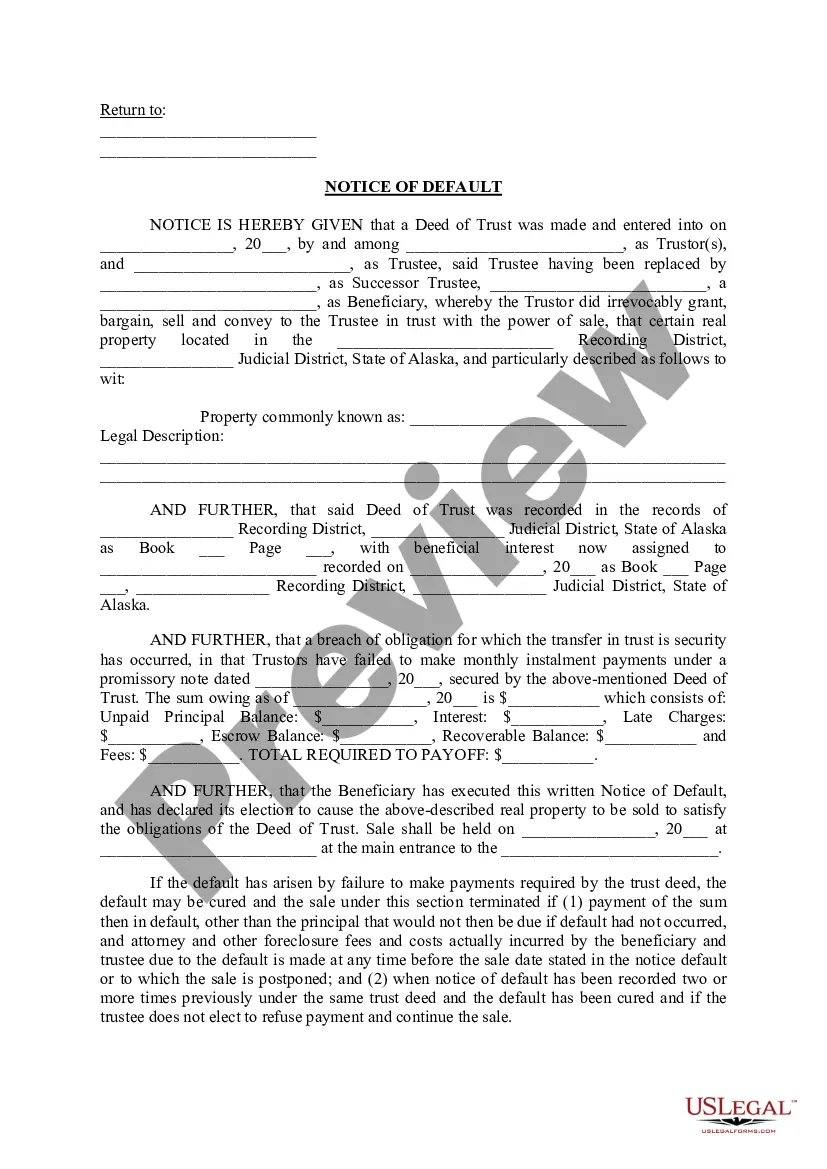

Alaska Notice of Default

Description

How to fill out Alaska Notice Of Default?

Utilize US Legal Forms to procure a printable Alaska Notice of Default.

Our legally acceptable forms are created and consistently refreshed by experienced attorneys.

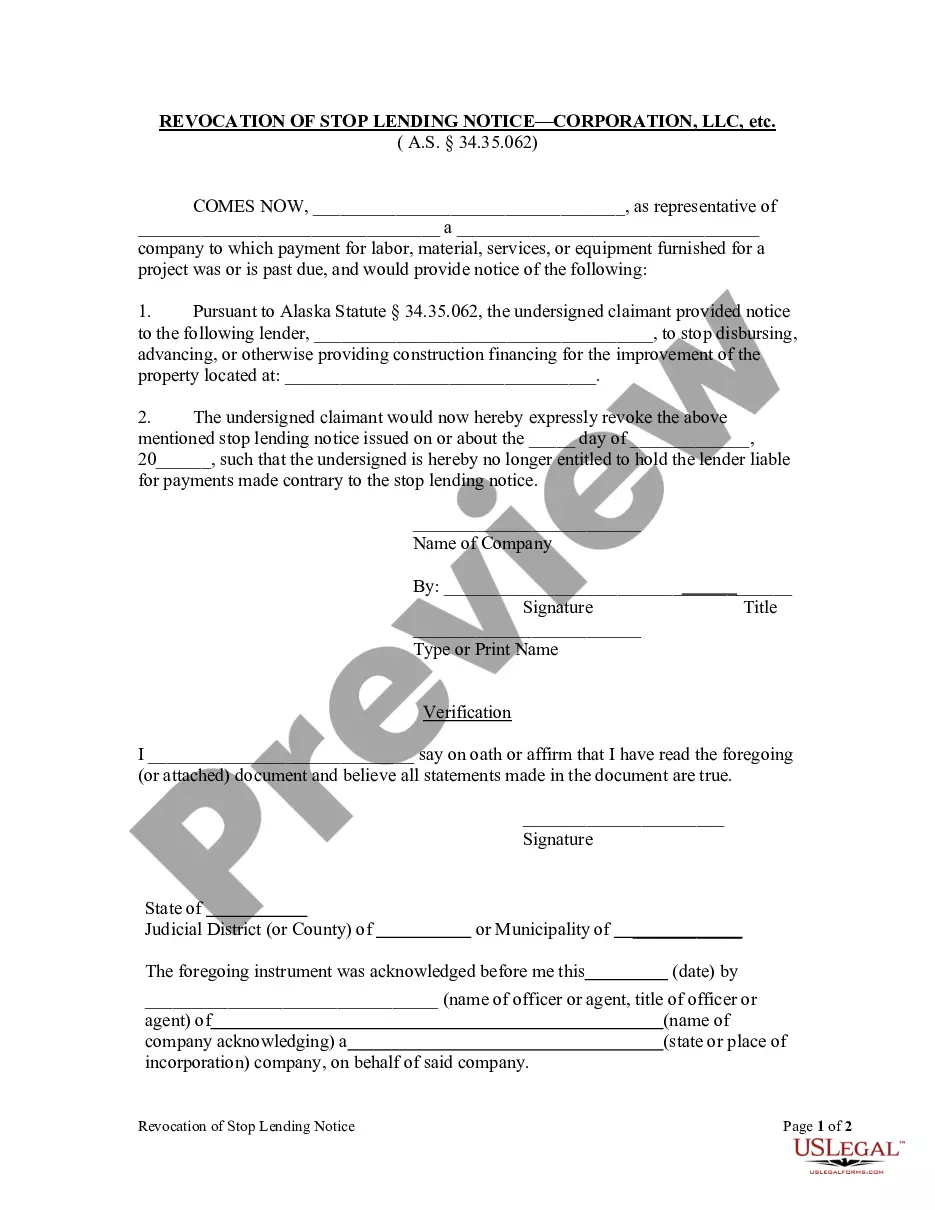

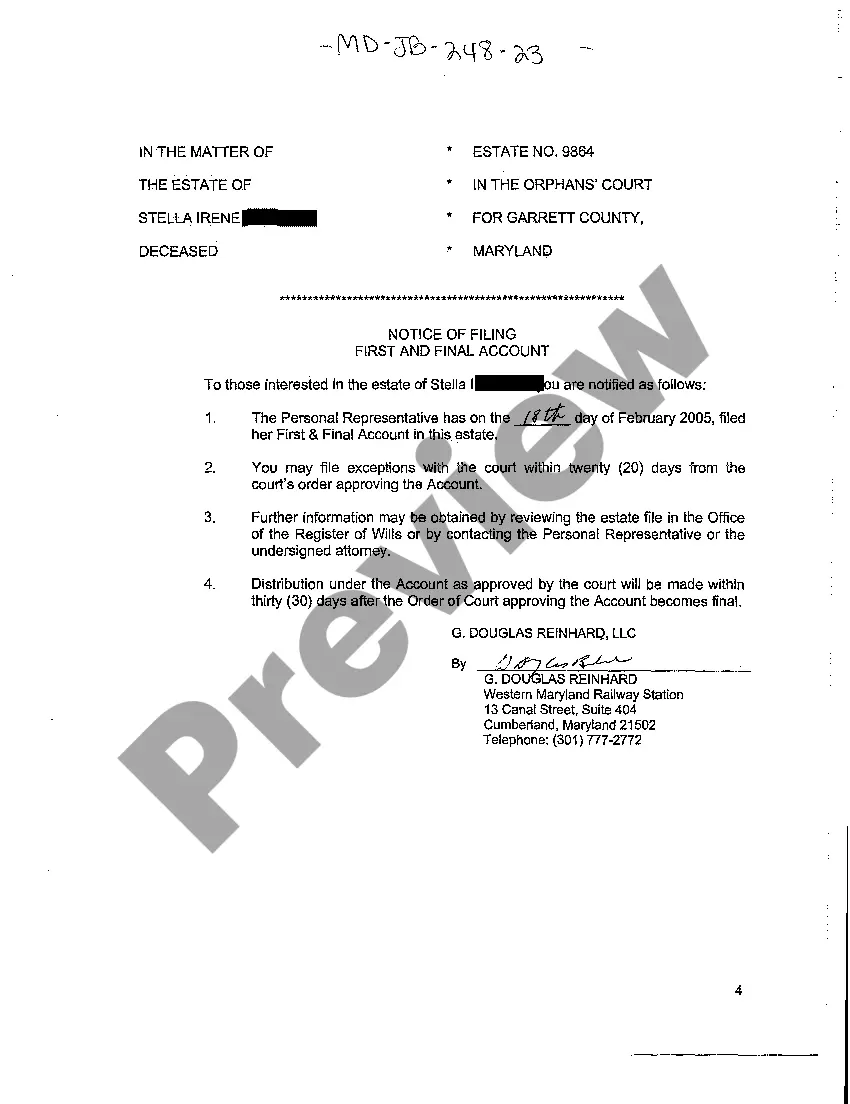

Ours is the most comprehensive catalog of forms available online, providing economical and precise templates for individuals, lawyers, and small to medium-sized businesses.

US Legal Forms presents a wide variety of legal and tax templates and bundles for both business and personal requirements, including the Alaska Notice of Default. More than three million users have successfully utilized our platform. Choose your subscription plan and acquire high-quality documents in just a few moments.

- Ensure you select the correct form pertaining to the required state.

- Examine the document by reading the summary and utilizing the Preview option.

- Click Buy Now if it is the template you require.

- Create your account and complete payment through PayPal or credit/debit card.

- Download the form to your device and you can reuse it as many times as needed.

- Use the Search bar if you wish to locate an alternative document template.

Form popularity

FAQ

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.