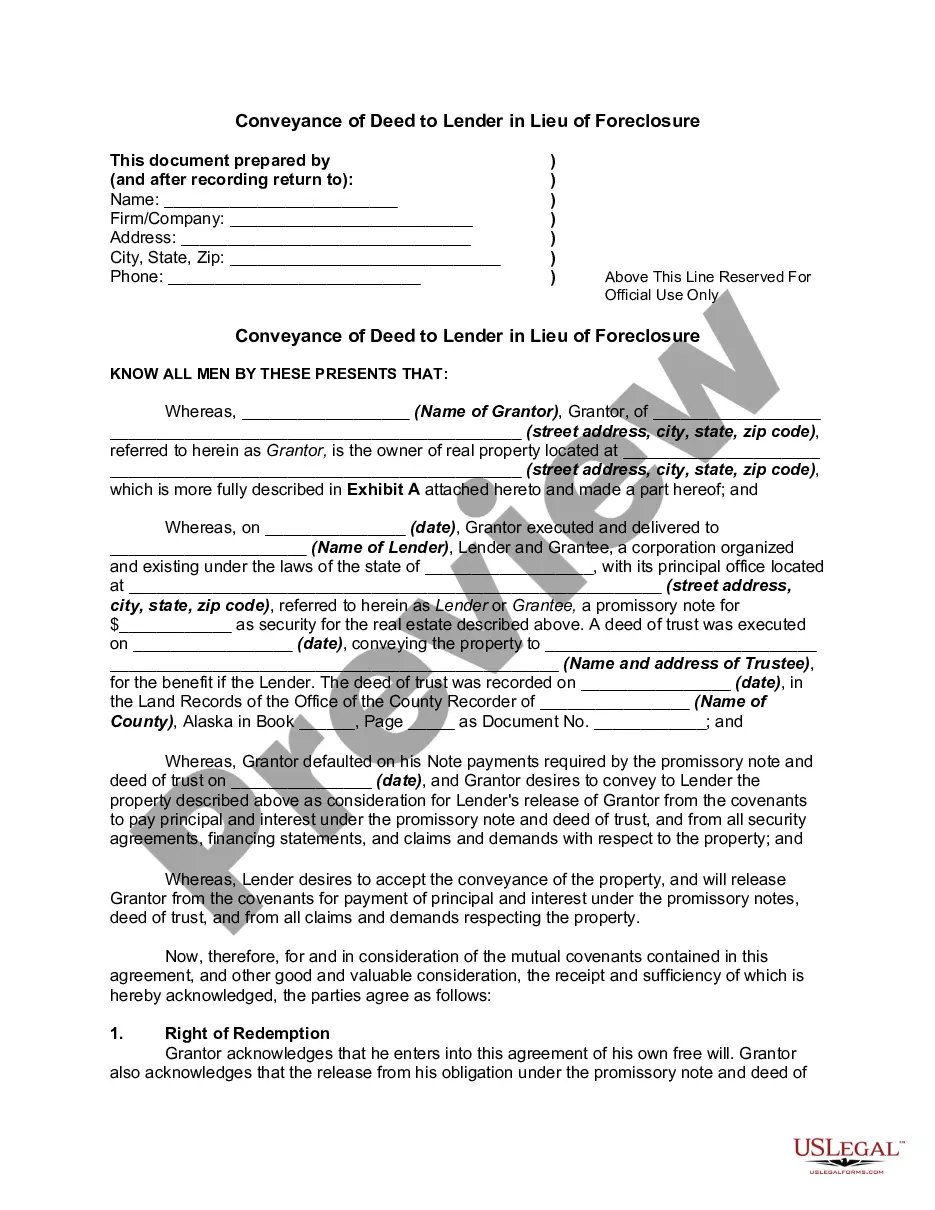

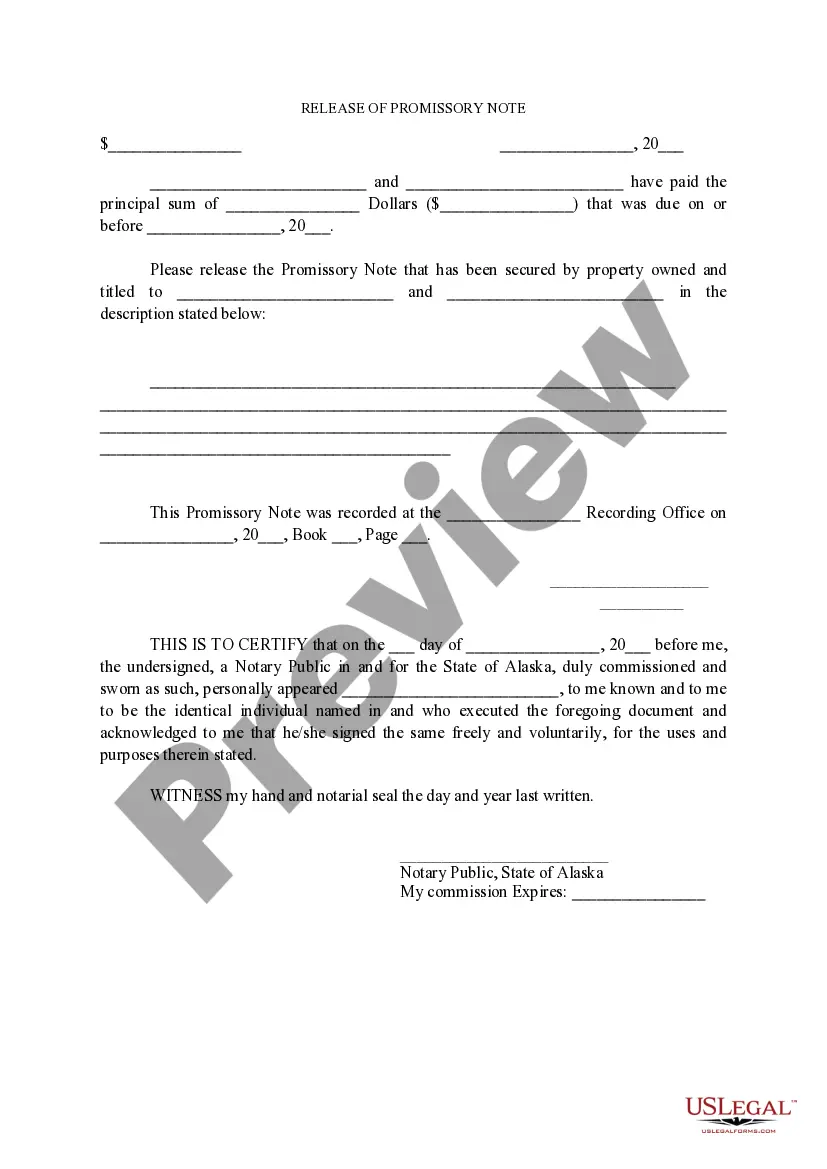

Alaska Release of Promissory Note

Description

How to fill out Alaska Release Of Promissory Note?

Utilize US Legal Forms to acquire a printable Alaska Release of Promissory Note. Our court-acceptable forms are composed and frequently refreshed by experienced attorneys.

Ours is the most comprehensive Forms library online and offers affordable and precise templates for individuals and lawyers, as well as small to medium-sized businesses.

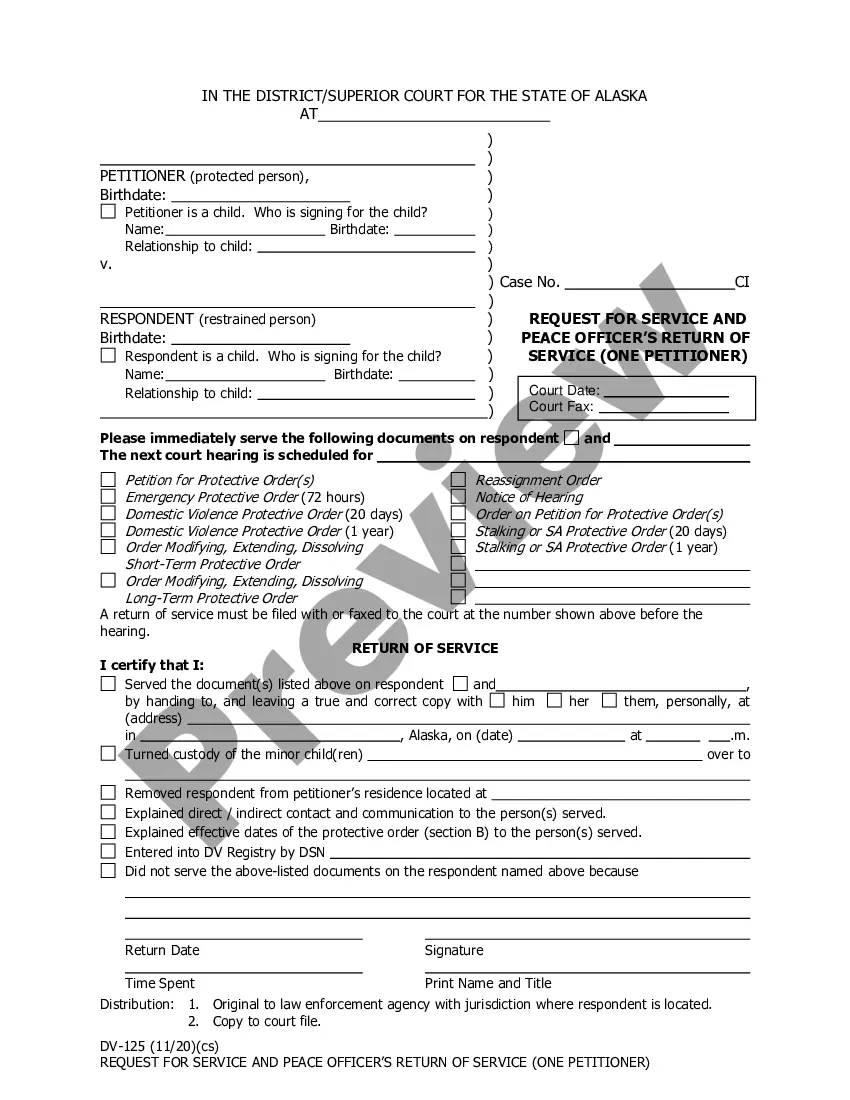

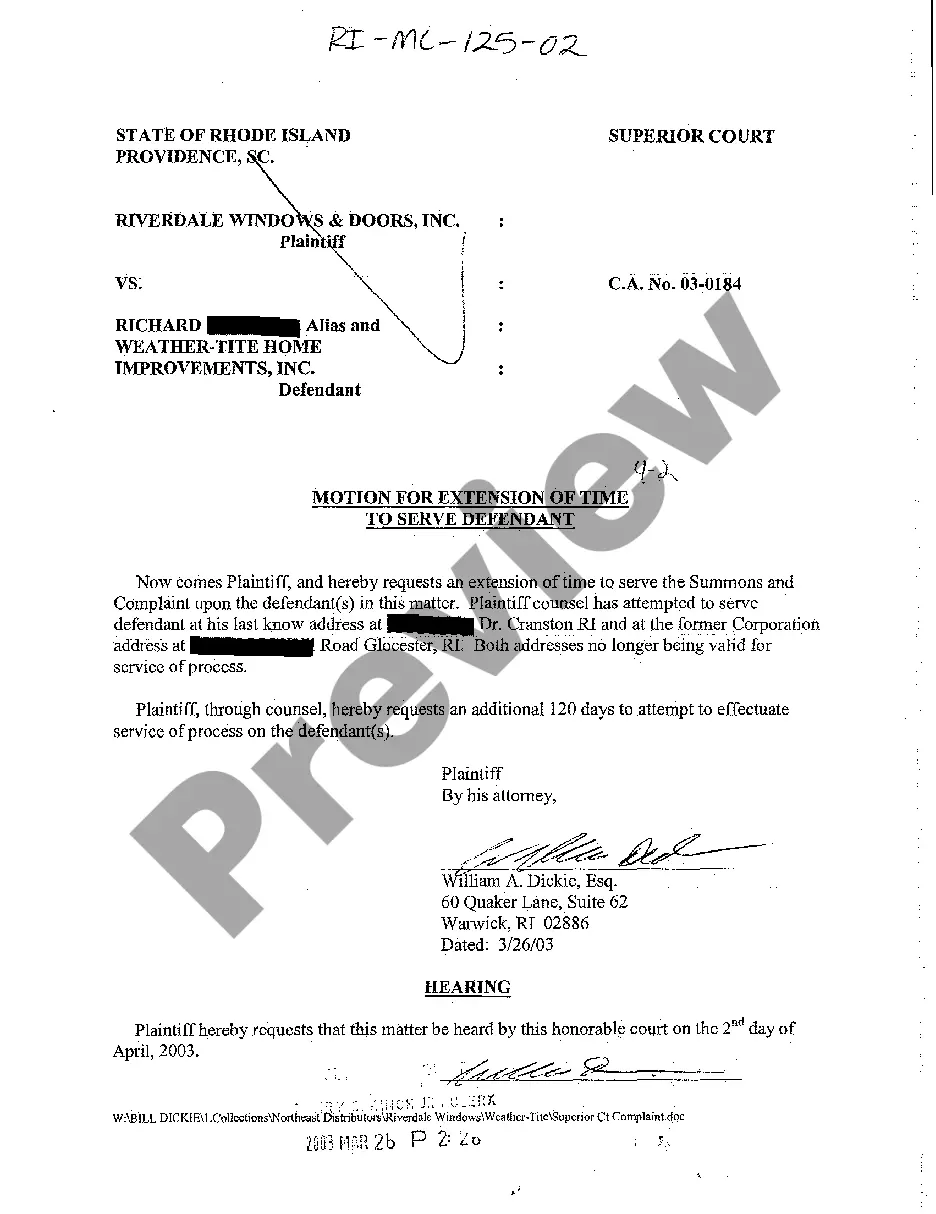

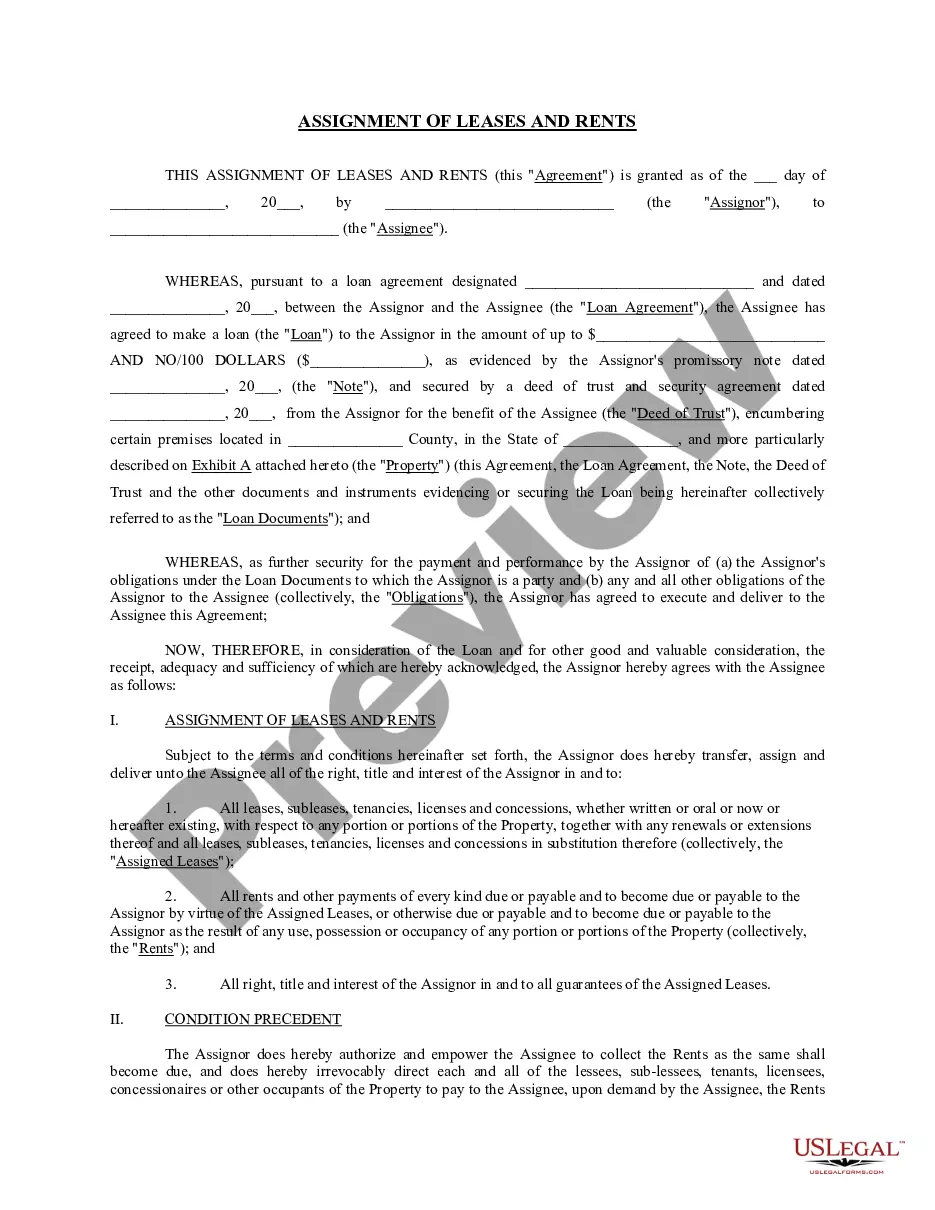

The documents are sorted into state-specific categories, and some of them may be previewed before downloading.

Create your account and make payment through PayPal or via credit card. Download the template to your device and feel free to reuse it numerous times. Use the Search field to find additional document templates. US Legal Forms offers a vast array of legal and tax templates and packages for both business and personal requirements, including the Alaska Release of Promissory Note. Over three million users have successfully utilized our platform. Choose your subscription plan and receive high-quality forms in just a few clicks.

- To download samples, users must have a subscription and Log In/">Log In to their account.

- Click Download next to any template you wish to retrieve and locate it in My documents.

- For individuals without a subscription, adhere to the following instructions to easily locate and download the Alaska Release of Promissory Note.

- Ensure you obtain the correct form concerning the state in which it is required.

- Examine the form by reviewing the description and utilizing the Preview option.

- Select Buy Now if it is the template you are looking for.

Form popularity

FAQ

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

Banks hold the majority of mortgage notes but it is possible for individuals and companies to also buy and hold notes.Individual people do buy promissory notes but it is wise to go with an established company who has the experience, knowledge and funds to buy notes.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.